Record Russell 2000 Earnings Expected

Stocks Barely Move

Monday was another record setting day for stocks. The Dow had its 5th record close and the S&P 500 stayed above 2,500 closing up 0.15%. The new trend is that the Russell 2000 is outperforming the large cap indexes. The Russell 2000 was up 0.65% on Monday and is up 6.2% in the past month. It’s now just 9 points off its all-time high. The bears who were claiming this divergence was a problem last month have moved on to worrying about market breadth. My viewpoint on this is that there will always be some issues with the internals of the market. Focusing on a small issue like minor changes in breadth is missing the big picture.

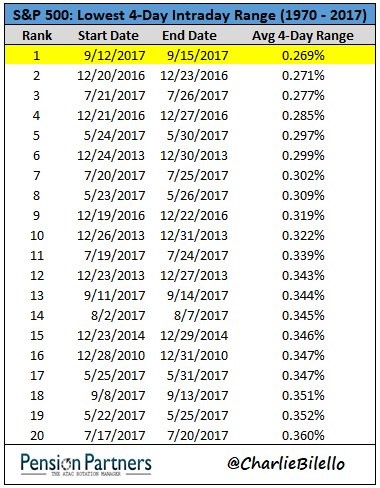

In a previous article, I showed a chart which had the 4-day intraday range of the market since 1970. The table below does a better job of showing the stats. As you can see, the average 4-day range is the smallest ever. 15 of the 20 top 4-day streaks have occurred in 2016 or 2017. All of these top 20 streaks have occurred in this bull market. This is the calmest bull market ever and this year has been the calmest of this bull market. This trend probably won’t continue, but it’s enjoyable while it lasts. There has now been 217 trading days since the last 3% pullback. That’s 24 days less than the longest streak ever. There’s no catalyst that I can see which stands in the way of this record. The average VIX has fallen to 11.01 for the month as the market ignores the storm related bad economic data.

(Click on image to enlarge)

Excessive Small Cap Optimism?

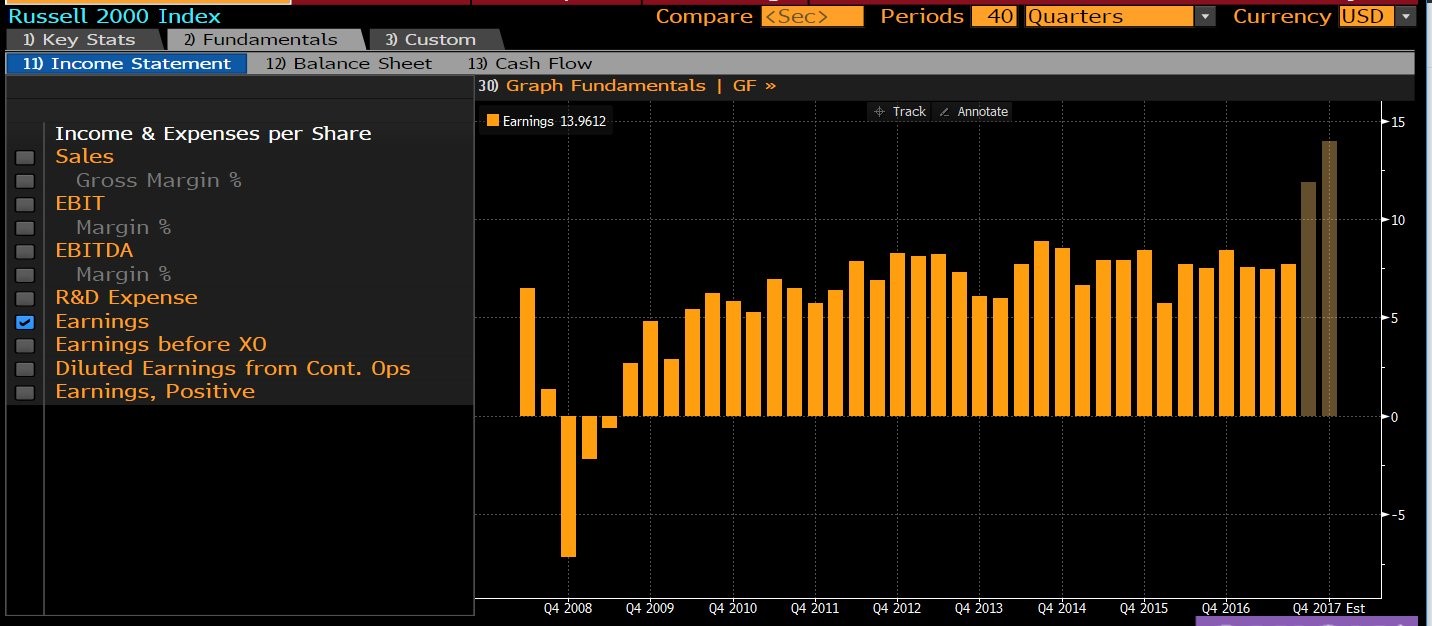

In the previous article, I reviewed the high level of optimism in S&P 500 earnings expectations for Q4 and 2018. The chart below shows that potentially excessive optimism also exists for Russell 2000 firms. This optimism may be what is driving the index higher lately. As you can see, the next two quarters of earnings are expected to be far higher than what we’ve seen this recovery which has had stagnant earnings for the past few years. Russell 2000 earnings can often be manipulated depending if you want to include the money losing companies of which there are many. With the optimism coming from small businesses and the relatively strong economy besides the storm affected areas, it’s possible record earnings are reached. Even if that happens, these projections look too high.

(Click on image to enlarge)

Small Businesses Worry About Little

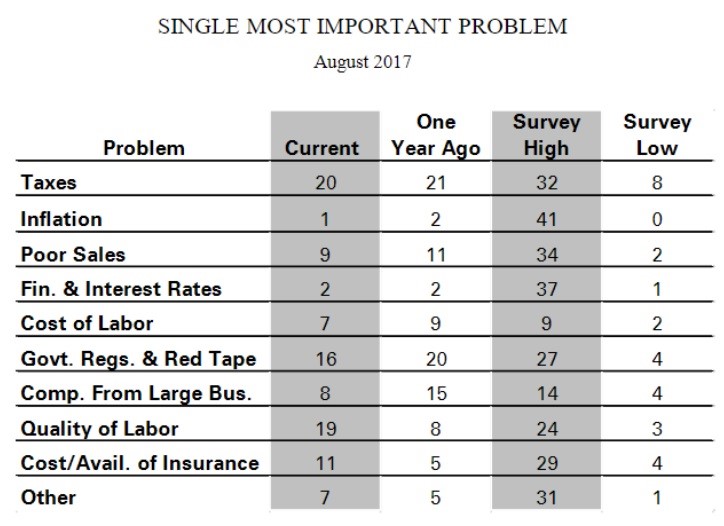

As I mentioned, small businesses have expressed optimism in the last NFIB report. Let’s look at the last survey which I haven’t yet discussed in previous articles. The table below shows the top problems small businesses face. Taxes aren’t considered as big of a threat as they once were, but obviously everyone would like to pay lower taxes. Regulations have become less of an issue. It will be interesting to see if that issue further drops under President Trump’s tenure; deregulation is what drove optimism from small businesses after he was elected. The fastest growing threat is quality of labor possibly because of the tight slack in the labor market. On the other hand, cost of labor isn’t a huge threat which means either only certain areas of the economy don’t have enough workers or there’s a skills gap. The skills gap means wages can’t be raised to find new workers because there simply isn’t enough workers to be hired. The labor market isn’t completely fluid. What I mean by this is if you have employment opportunities available and raise the wages paid, it doesn’t mean you will necessarily find a bunch of workers because skills need to be acquired by those who don’t have them. You can also see the two drivers of optimism this cycle in plain view: cheap financing and low inflation. Changes in those factors are what would catalyze economic weakness.

(Click on image to enlarge)

Tech Earnings Drive Market

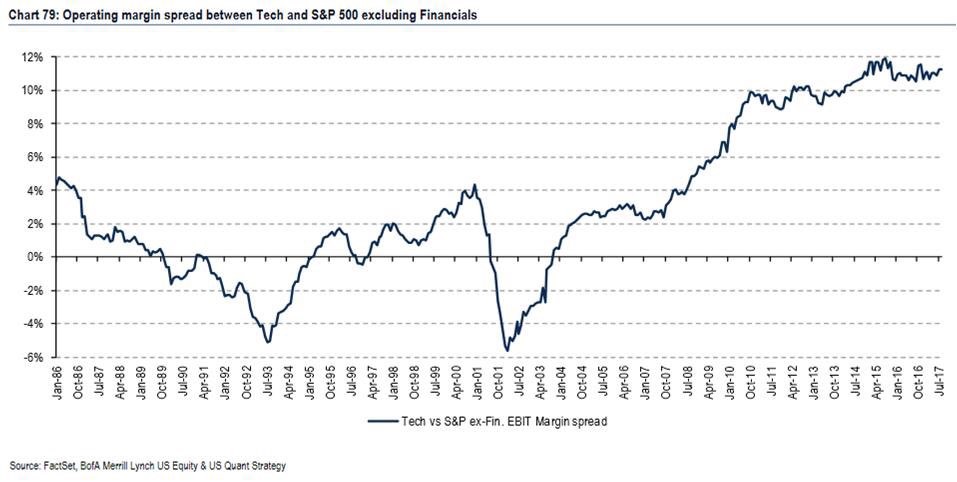

As I have mentioned previously, technology is the sector that makes the S&P 500 look cheaper than it is. Technology is also what is driving record S&P 500 margins. That’s why I say that even though the big tech names don’t have more of an impact on the market than any other big names have had historically, they are still important because of the earnings they provide. The chart below shows this reliance on tech in a new way. As you can see, the operating margin spread for tech versus the S&P 500 excluding financials is historically high. It has been relatively high for the past few years. This is a tough comparison because technology firms of the 1980s looked nothing like the tech firms of today. There’s no question tech stocks are important to market; the question is whether this new normal will continue or if it’s temporary. There certainly doesn’t seem to be a catalyst for Microsoft, Alphabet, and others to see margin declines. The only negative catalyst I see is regulatory issues in Europe as countries crack down on what are considered monopolistic tactics.

(Click on image to enlarge)

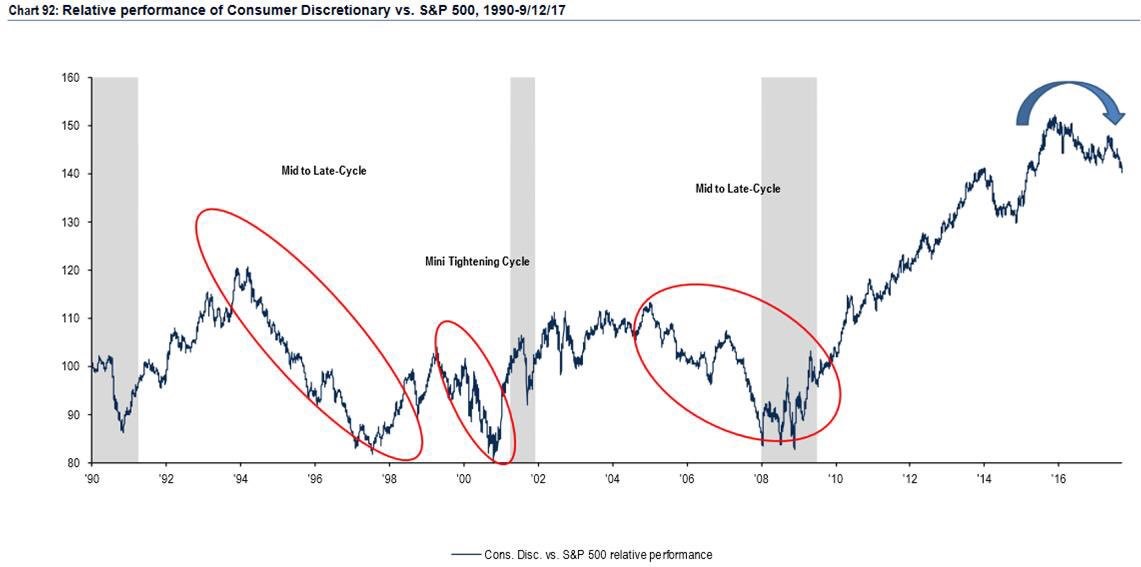

While technology firms have changed over the past few decades, consumer discretionary hasn’t. The chart below compares consumer discretionary performance compared to the S&P 500. As you can see, consumer discretionary has outperformed the S&P 500 more than the prior two cycles. Just to be clear, I don’t agree with the bearish notion the arrow at the top right purports. The downward movement has been small. As I said earlier, small changes to internals don’t mean much because there’s always going to be one sector outperforming for a multitude of reasons.

(Click on image to enlarge)

Conclusion

One of the reasons for the stock market having such a great performance is technology. The Nasdaq is up 19.91% year to date. More importantly, operating margins for tech have been historically high. The biggest catalyst for a change in this trend or an acceleration of this trend will be the release of the iPhone 8/8 Plus later this week and the iPhone X in November. We have seen the devices and some reviews, but sales results are still unknown.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more