Record Crush And Strong Exports, But Market Eyes Trade And US Acres

Market Analysis

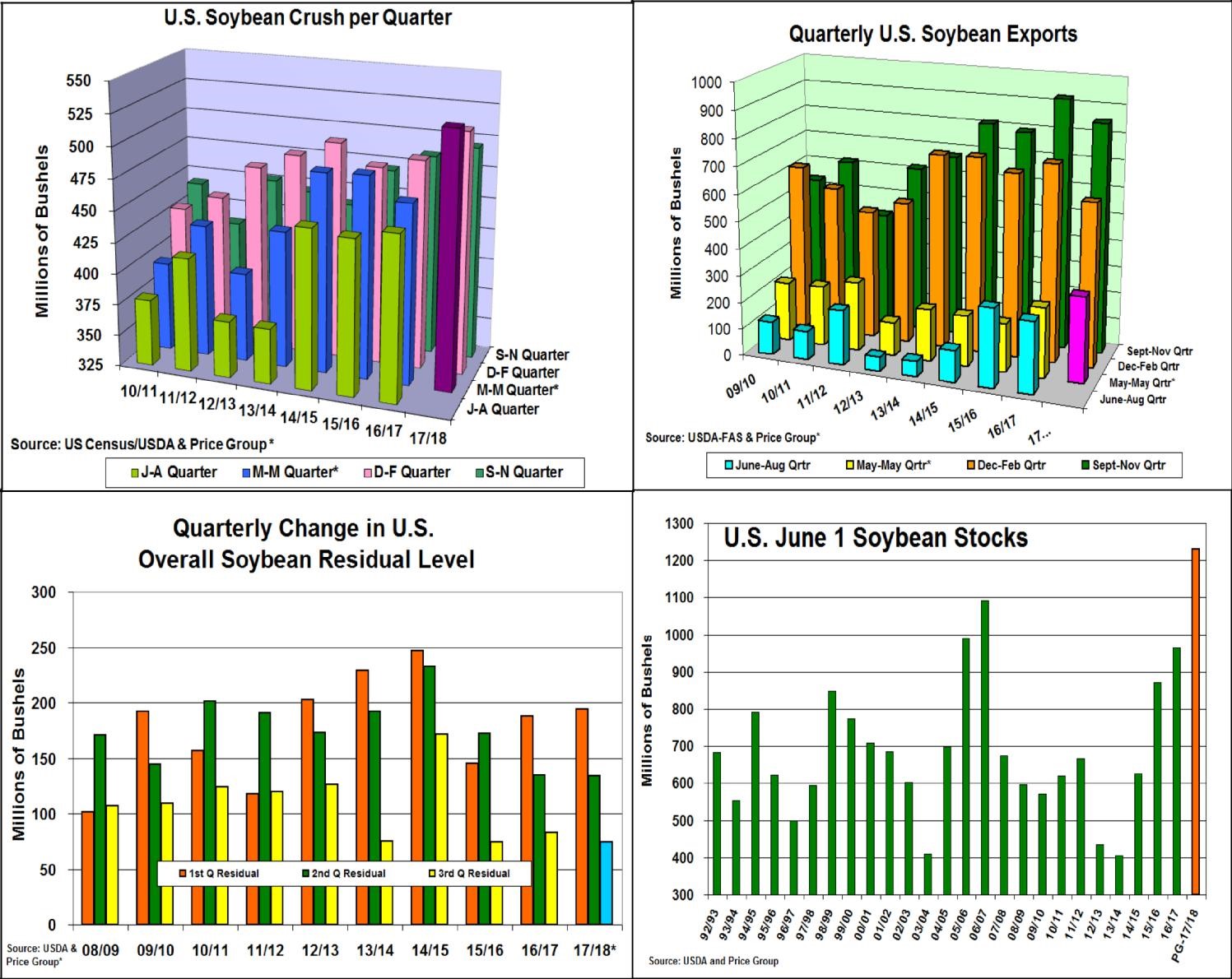

This year’s record US soybean crushing pace has continued this past quarter as declining Argentine output has switched world meal demand to the US.

The USDA up-ping - its Brazilian soybean estimate & our ongoing trade tensions with China - has prompted the Ag Department to leave the US export outlook unchanged this month. This year’s demand paces, the US/China trade conflict and the ultimate size of the US soybean crop (area and yield) will all be factors in 2018/19’s world soybean price.

May’s US (NOPA) processing pace posted another record 163.6 million bu. pace last week. This will likely advance this year’s 3rd quarter soybean crush to 526.2 million bu., a new quarterly record & the third consecutive quarterly record for US processing this year. Overall, this year’s crushing pace through the first three-quarters of 2017/18 will be near 1.537 billion bu. or 91 million larger than last year. To reach the USDA’s recently increased crush forecast, this summer’s processing pace needs to be 478 million bu. vs. 2017’s 455 million level. Given current US livestock & poultry numbers, this appears to be an achievable domestic demand pace.

After a strong first half, Brazilian competition reduced US export shipments by about 200 million. This spring’s 315 million bu in exports was an unexpected surprise during our trade tensions with China. Current export sales are near the USDA’s 2.065 billion forecast, but 290 million bu. remain unshipped. With China supposedly controlling about 100 million of this amount, this is huge unknown in the bean market - the final 12 weeks of the crop year.

2017/18’s 1st half residual disappearance has followed last year’s pattern. Supplies in export transit & commercial seed beans moving from producers to seed dealers to planting outside of marketing channels has us expecting a 71 million bu. residual this quarter. This puts our June 1 stocks at 1.23 billion bu., highest in 11 years.

(Click on image to enlarge)

What’s Ahead

The upcoming June 29 soybean stocks report will show strong processing demand and lower exports than last year. However, any movement in the US/Chinese trade talks or surprises in the July 29 acre-age report will likely influence bean prices more. With no yield impacting weather until August, use any 30-50 centrally on trade talks resuming to sell final your final 10% of old-crop soybean supplies.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more