Qualcomm, Inc. Shares Slide Amid Bearish Analyst Views

Semiconductor company Qualcomm, Inc. (NASDAQ: QCOM) dropped 2% in trading on June 29 after five-star analyst Richard Whittington of Drexel Hamilton downgraded his rating on the stock from Hold to Sell due to increasing competition in the semiconductor sector. Qualcomm shares are currently down approximately 14% year-to-date.

This is the second time the analyst downgraded his rating on Qualcomm. Back in January, he downgraded his rating from Buy to Hold, writing that “process and competitive questions reduce visibility.”

The semiconductor space has become increasingly crowded with other big names like Micron Technology, Intel, and Samsung. All of these companies have been struggling with the price fluctuation of DRAM chips as a result of the decreasing popularity in personal computers.

Whittington, who cut his price target from $60 to $55, believes Qualcomm customers like Apple and Samsung will request a price break for its semiconductor chips, which could negatively impact the company’s September earnings. Correspondingly, he cut “forward estimates beginning Sep. 2015 FQ4 to reflect lower gross margins as Qualcomm fights to retain sockets and market presence.”

Earlier this year, Qualcomm shares fell after news broke that Samsung Electronics opted out of using the company’s applications processor in its new Galaxy S6 smartphone due to issues with the “Snapdragon 810” part overheating during Samsung tests.

Now there has been talk that Samsung will develop inroads in processors which will directly compete with Qualcomm. In Whittington’s opinion, “Samsung is turning up the heat on Intel and Qualcomm in a quest for domination well beyond memory.”

Richard Whittington currently has an overall success rate of 79% recommending stocks and a +21.1% average return per recommendation. He has rated Qualcomm four times total, earning a 67% success rate recommending the stock and a +6.4% average return per recommendation.

Five-star analyst Chris Caso of Susquehanna also has a bearish sentiment on Qualcomm, giving the stock a Neutral rating on June 24. The analyst attributes his rating to the company’s production challenges in the first half of the year.

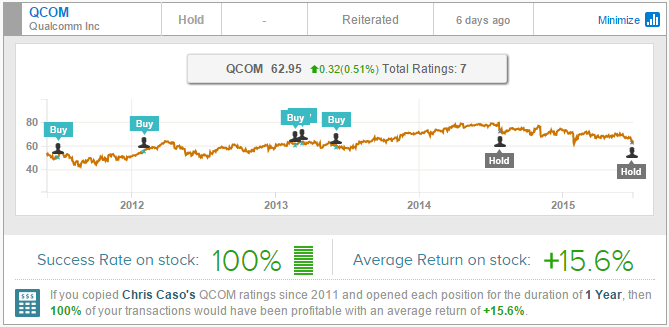

Overall, Chris Caso has a 74% success rate recommending stocks and a +18.9% average return per recommendation. He has rated Qualcomm a total of seven times, earning a 100% success rate recommending the stock and a +15.6% average return per recommendation.

Additionally, Qualcomm has recently been hit with investor pressure to spin off its chip business in order to intensify competition within the semiconductor industry and create more shareholder value. However, Qualcomm assured investors on June 30 that the company has no plans of giving into the pressure.

Executive Chairman Paul Jacobs noted, “We’ve had that discussion for a long time, many years the board has looked at it but we still think the synergies of having the businesses together outweighs the dissynergies.”

Out of 14 analysts polled by TipRanks, nine are bullish on Qualcomm, one is bearish, and four are neutral. The 12-month average price target for Qualcomm is $78.80, marking a potential upside of 25.84% from where the stock is currently trading.

Disclosure: To see more, visit more