Portable Device Accessory Manufacturer ZAGG Defies Market Hiccup

--If the Market Zigs, You Need to Zagg

We have been watching a market sell off today, with high flying indices cutting gains. As of right now, the Dow and SP500 are back to being flat for the year. Investors remain skittish thanks to good news about the US economy and the US dollar. The economy added 295,000 jobs in March, a huge beat of the estimate for 240,00 made by analysts. With these numbers, the US unemployment rate is now at a level (5.5%) traditionally considered "full employment" by the Fed.

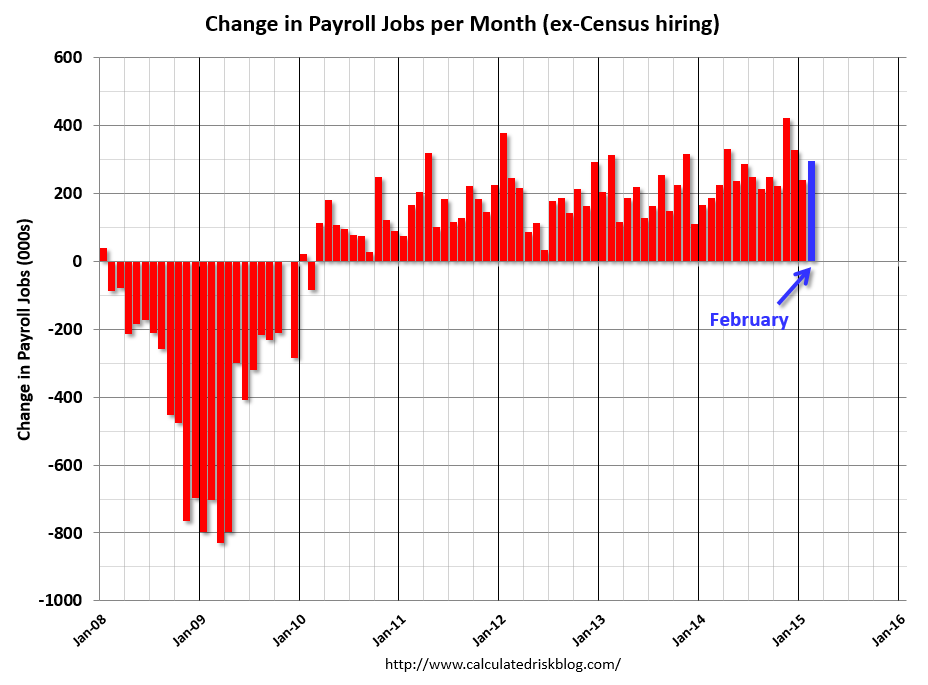

Job Creation Under the Obama Adminstration has been Impressive in the Wake of the Bush Crash

In the recent past, that is a strong signal of an impending rate hike. However, analysts remain unsure as to whether new Fed chair Janet Yellen will cut off growth at this point because while the traditional measure of unemployment is now reads "full employment," other data sets show continued weakness in the job market, no real pressure on wages has appeared, the economy still appears deflationary, etc.

The strong dollar, also driven in part by anticipation of a rate hike-as well as the further easing by European and some Asian banks, is also a bad sign for trade and thus the overall economy and may limit the appetite for equities as international investors pile into dollars in search of better yields.

We remain skeptical that Yellen will hike rates in June for the above-mentioned reasons. There simply is no inflationary pressure right now--crude oil at or below $50 is a big indicator there. The labor picture has been so bad in the recovery from the 2008 financial crisis we think we still have some room to run before a rate hike becomes imperative. We would hope that workers would finally gain some ground in an economy and system which has for far too long favored one part of the Fed mandate--controlling inflation--at the expense of the other--fostering full employment.

US income inequality at levels last seen in the late 1920s cannot be sustained if all agree that the key to a successful and modern industrial democracy is a thriving middle class. It seems as though even the worst employers--places like Wal-Mart-- are beginning to realize this fact. Let's hope Yellen puts her thumb on the scale in the direction of workers so that they might benefit from the improved economy before the next recession.

Nevertheless, all speculation about the Fed aside, the market is always "right." So, at times like these it is always instructive to see which stocks continue to perform under pressure. One stock we are watching right now is ZAGG Inc. (ZAGG). ZAGG Inc. designs, manufactures and distributes protective clear coverings and accessories for consumer electronic and hand-held devices, worldwide. ZAGG's flagship brand, the invisibleSHIELD, is a protective, high-tech patented film covering, designed for iPods, laptops, cell phones, digital cameras, PDAs, watch faces, GPS systems, gaming devices and other items. The patent-pending invisibleSHIELD application is the first scratch protection solution of its kind on the market, and has sold over one million units. Currently, ZAGG offers over 2,500 precision pre-cut designs with a lifetime replacement warranty through online channels, resellers, college bookstores, Mac stores and mall kiosks. The company continues to increase its product lines to offer additional electronic accessories to its tech-savvy customer base, as well as an expanded array of invisibleSHIELD products for other industries.

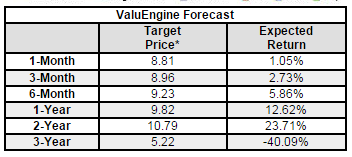

ZAGG was a selection for our ValuEngine Small Cap Newsletter this month and it is currently bucking the trend and is up @23% since our latest rebalance--while the Russell 2000 Index is down @1%. ZAGG posted a nice beat for Q4 at the end of last month with earnings of $0.49/share vs analysts expectations of $0.38/share. That was a 53% increase year-over-year. In response, many analysts upgraded their recommendations. Our models made another savvy pick with this company.

ValuEngine continues its STRONG BUY recommendation on ZAGG INC for 2015-03-09. Based on the information we have gathered and our resulting research, we feel that ZAGG INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

Below is today's data on ZAGG:

|

Valuation & Rankings |

|||

|

Valuation |

n/a |

Valuation Rank(?) |

|

|

1-M Forecast Return |

1.05% |

1-M Forecast Return Rank |

|

|

12-M Return |

92.92% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.33 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

21.56% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

65.03% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

8.15% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

0.26 |

Size Rank |

|

|

Trailing P/E Ratio |

16.15 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

14.93 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.98 |

PEG Ratio Rank |

|

|

Price/Sales |

1.01 |

Price/Sales Rank(?) |

|

|

Market/Book |

3.04 |

Market/Book Rank(?) |

|

|

Beta |

2.00 |

Beta Rank |

|

|

Alpha |

0.33 |

Alpha Rank |

|

Disclosure: None