Perhaps The 'Dow Jones' Should Now Be Called The 'Goldman Sachs' Industrial Average - Here's Why

U.S. stocks have had quite a rally in the last month, but in the large-cap space, the clear leader has been the Dow Jones Industrial Average (DJIA). While much of the strength in the DJIA has been chalked up to the index being full of old-line industrial stocks that stand to benefit from a Trump victory, practically all of the outperformance can be summed up in two words - Goldman Sachs (NYSE:GS ).

the Dow Jones Industrial Average (DJIA). While much of the strength in the DJIA has been chalked up to the index being full of old-line industrial stocks that stand to benefit from a Trump victory, practically all of the outperformance can be summed up in two words - Goldman Sachs (NYSE:GS ).

Written by Bespoke Investment Group

Because the DJIA is price weighted, stocks in the index with the highest share prices have the highest weighting, while stocks with the lowest share prices have the lowest weighting... This is a ridiculous method of weighting an index, but the DJIA has withstood the test of time, so who are we to argue. Plus, it's not like we haven't seen other methods of weighting over the years that weren't just as peculiar.

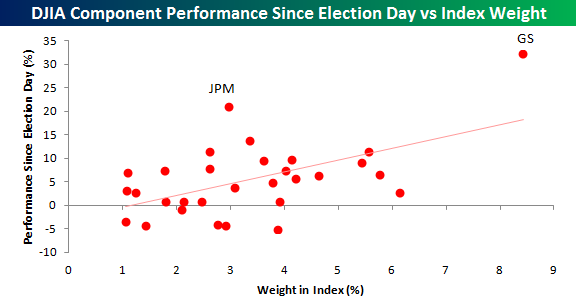

The table below lists each of the DJIA's current components sorted by their current weighting in the index along with their performance since election day and how many points each stock has contributed to the DJIA's overall gain since election day.

- At the top of the list is GS, which has an 8.4% weighting in the index.

- Not only is Goldman the most heavily weighted stock in the Dow, but it is also far and away the best performing stock in the index since election day. In fact, of the 1,282 points that the DJIA has added in the last month, Goldman accounts for 408 of those points, or 32% of the gain.

- The next biggest contributor since election day - UnitedHealth (NYSE:UNH) - has only added 112 Dow points.

- Without Goldman, instead of being up 7% since election day, the DJIA would be up less than 5%.

Looking at the current weightings of the index, the DJIA is looking increasingly top heavy.

- Not only does Goldman by itself account for over 8% of the index, but the top five stocks in the index account for a staggering 31% of the index.

- At the other end of the spectrum, major U.S. stocks which are among the largest in terms of market cap have weightings of less than 2%. Take General Electric (NYSE:GE), for example. While it is one of the ten largest U.S. companies in market value, its weighting in the Dow is barely 1%. Put another way, the stock could go to zero and it would have less of an impact on the Dow than a 15% drop in Goldman.

(Click on image to enlarge)

Like Goldman, which is both the most heavily weighted stock in the DJIA and the top performer, a little bit of a trend has developed where the higher-priced stocks in the index have been among the index's best performers, while the lower-priced stocks have underperformed.

- Of the six stocks in the index that have traded lower since the election, five are in the bottom half of the index in terms of share price (and therefore weighting).

...What are the ramifications of all this? While there's a good chance that there's nothing to worry about regarding the index's top heavy-ness, it has created a situation where a lot of the DJIA's 'eggs' are in a limited number of baskets.

- The only way to alleviate this situation would be through a combination massive underperformance of the index's high-priced stocks along with major outperformance of the index's low-priced stocks, or through stock splits.

- In the case of those top five stocks, which currently account for at least 5% of the index by themselves and nearly a third of the entire DJIA combined, if each of them issued a 2-1 split, their combined weighting would fall to 18.6%. Furthermore, none of the five would have a weighting in the index above 5%, while the most heavily weighted stock in the index would be Home Depot (NYSE:HD ) at 5.5%.

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more