Out Of Gear

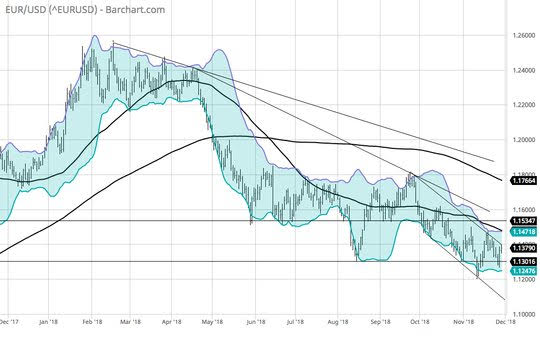

Approaching neutral doesn’t mean easy nor does it provide real traction when going uphill. Fed hike expectations for 2019 moved from risk of 3 to 1. Lessons from driving a stick-shift remain in play today as markets continue to digest the turnabout from FOMC Powell on the pace of rate hikes for 2019. If the Fed sees neutral at 2.5% rather than 3.5%, then the rest of the world will have less of a gap to get to normal. The USD should be the frontline of figuring this all out and the drop in the dollar yesterday, stalls today. FX isn’t where the fear trade resides, rather it’s all about equities and the upcoming US Trump and China Xi Saturday dinner. There was a host of important economic data overnight with Japan retail sales better, Australian Capex outlook better, Eurozone economic sentiment better than feared with business climate rising, while flash CPI reading in Spain and Germany were lower allowing ECB flexibility while German unemployment fell to new record lows. Also good bounces in retail sales in Spain and France help push the story that growth in Europe is back to normal rather than diving off the cliff. There was negatives in Sweden and Swiss 3Q GDP misses, and all isn’t well in China where bond defaults hit new record. Markets are uneasy, climbing a wall of worry with the help of Jay Powell. The pushing back of rate hike speeds doesn’t make the incline of trade and other political worries less important but for now, we wait for the data, the FOMC minutes and the next headline to get back into gear. The EUR has become the new leader for risk watching – with its bounce back yesterday looking for a gear to grind up to 1.15 again. The reality is that the EUR remains in a downtrend and bounces to 1.1475 or 1.1550 are going to be sold.Perhaps that is the foreshadowing for the global equity market up 5% in the last 2 days as it faces the G20 and more data.

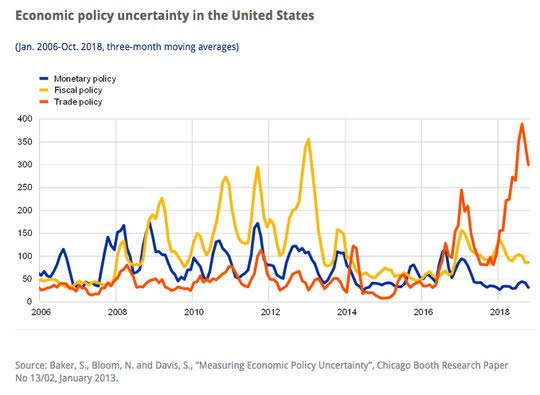

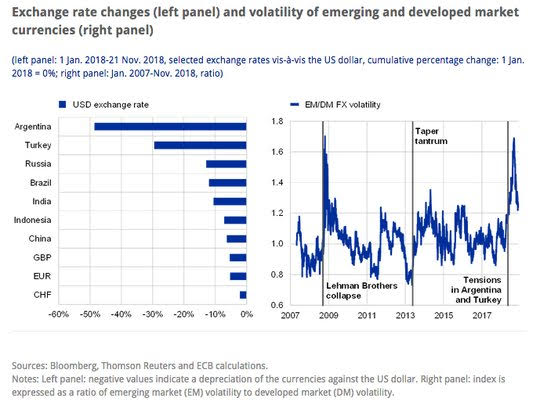

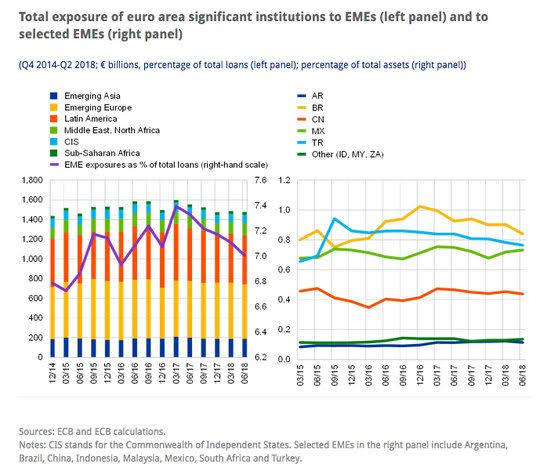

Question for the Day: Is the ECB too sanguine on stability? The ECB financial stability report released today notes that the environment has become more challenging. Solid economic growth continues to support financial stability. However, stress in emerging market economies, concerns about sovereign debt sustainability and rising political uncertainty all pose challenges.

The key stress points for emerging markets were identified as US rates and rising trade tensions. This is the central question for today as threats of US auto tariffs are balanced against FOMC Powell’s walk back of more rate hikes. The key for the understanding the ECB and its willingness to normalize in 2019 will be watching how EM, UK and Italy risks play out against the back drop of US policy fears.

The point that the ECB makes about EM exposures being limited to the EU banking world looks important today but one that will surely be questioned should another emerging market rout occur into 2019.

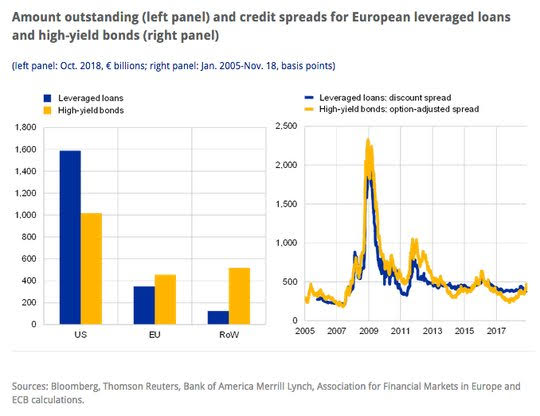

The other area that matters to 2019 is the leveraged loan market – which continues to grow and shows signs of overvaluation. This is the place where the non-bank world clashes with the banking one and where the ECB control of such via macro prudential controls needs more EU wide reform and support.

What Happened?

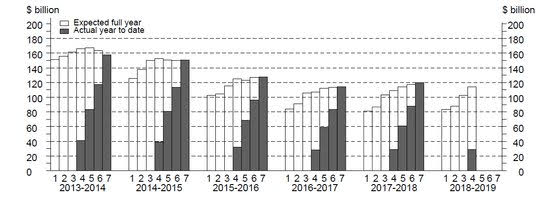

- Australia 3Q private capital expenditure -0.5% q/q, +0.1% y/y– weaker than +1% gain expected, while 4th estimate for 2018-2019 now 4.4% to A$114.099mn up from A$102bn previously and better than A$108.5bn expected. In 3Q, capital expenditure on building and structures fell 2.8% q/q dragging down the headline, but plant, equipment and machinery rose 2.2%.

- Japan October retail sales rise up 1.2% m/m, 3.5% y/y after 2.2% y/y – better than 2.6% y/y expected – best in 10-months. Sales grew at a faster pace for fuel (14.7% from 13.2%), medicine & toiletry stores (6.2% from 0.1%). Also, sales of motor vehicles rebounded a sharp 6.6% from down 0.1% in Sep. In contrast, sales of general merchandise declined further (1.6% from 1.3%).

- BOJ Masai: Highlights global economy uncertainty, but upbeat prices nudging towards 2% CPI target."As such, the best approach would be to sustain the current ultra-loose monetary policy ... so the positive momentum is not disrupted," she said.

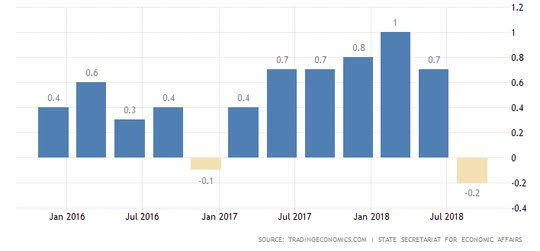

- Swiss 3Q GDP -0.2%q/q, 2.4% y/y after +0.7% q/q, +3.5% y/y– weaker than the 0.4% q/q, 3% y/y expected. Both industrial and services contracted with weaker spending from domestic demand and foreign trade noted.

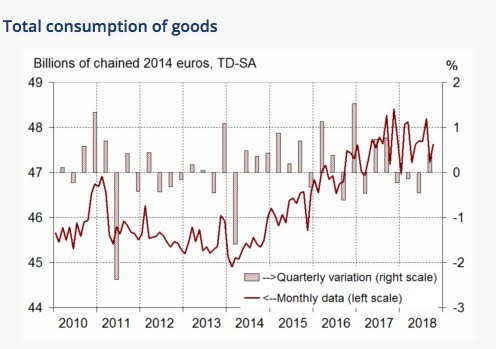

- French October consumer spending bounces +0.8% m/m after -2% m/m - better than +0.4% m/m expected. September revised lower from -1.7% m/m. Gains were led by food up 0.9% and manufactured goods up 0.8%. Energy rebounded to up 0.7% after -1.2% m/m.

- French 3Q GDP unrevised at up 0.4% q/q from 0.2% q/q – as expected. Household spending up 0.4% from -0.2% q/q, government spending 0.2% from 0.3% q/q. Inventories dragged 0.3% q/q after +0.2% q/q while foreign trade supported up 0.2% after -0.2% q/q.

- Spanish November flash HICP 1.7% y/y after 2.3% - less than the 2.1% y/y expected. Drops in electricity and fuel were highlighted base effects. The national CPI also was -0.1% m/m, 1.7% y/y down from 2.3% y/y as well.

- Spanish October retail sales up 0.9% m/m, +1.8% y/y after -0.2% m/m, -0.4% y/y – better than -1% y/y expected. September revised from -0.9% y/y. Non-food products rose 2.7% m/m and service station sales -1.7% m/m. Ex fuel sales were up 1.8% m/m.

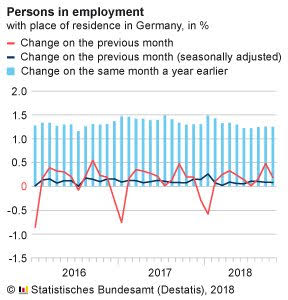

- German November unemployment drops 16,000 after 12,000 – better than 10,000 expected– pushing rate to new record lows at 5% from 5.1%. Total unemployment is 2.276mn while employment rose 1.2% y/y to 45.1mn.

- German November flash CPI from States imply up 0.1% m/m, 2.2% y/y – after 2.4% y/y – less than the 0.2% m/m, 2.3% y/y expected.

- BW up 0.3% m/m, 2.7% y/y from 2.8% y/y

- NRW up 0.3% m/m, 2.4% y/y from 2.4% y/y

- Hesse up 0.3% m/m, 2.1% y/y from 2.2% y/y

- Brandenburg off 0.1% m/m, 1.8% y/y from 2.3% y/y

- Bavaria up 0.3% m/m, 2.7% y/y from 2.8% y/y

- Saxony off 0.1% m/m, 2.1% y/y from 2.5% y/y

- UK October consumer credit rose GBP0.9bn after G0.852bn – as expected. However, the mortgage approvals jumped to 67,000 from 65,730 much more than the 64.550 expected– most since January.

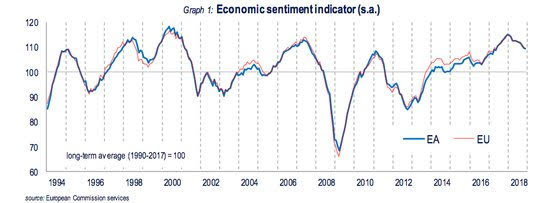

- Eurozone November economic sentiment lower to 109.5 from 109.7 – better than 109.0 expected.By sector, industry rose to 3.4 from 3.0, services were flat at 13.3, consumer fell to -3.9 from -2.7, retail trade rose to -0.6 from -0.8 and construction flat at 7.9. The business climate rose to 1.09 from 1.01 – better than the 0.96 dip expected. Production past and future expectations rose but export orders and finished products fell.

Market Recap:

Equities: The US S&P 500 futures are off 0.3% after jumping 2.3% yesterday. The Stoxx Europe 600 is up 0.4% - best in 2 weeks – while the MSCI Asia Pacific rose 0.7% - best in 3 weeks – despite China losses.

- Japan Nikkei up 0.39% to 22,262.60

- Korea Kospi up 0.28% to 2,114.10

- Hong Kong Hang Seng off 0.87% to 26,461.03

- China Shanghai Composite off 1.32% to 2,567.44

- Australia ASX up 0.61% to 5,835.70

- India NSE50 up 1.21% to 10,858.70

- UK FTSE so far up 0.5% to 7,038

- German DAX so far up 0.1% to 11,312

- French CAC40 so far up 0.5% to 5,008

- Italian FTSE so far off 0.05% to 19,108

Fixed Income: The US bond move on Powell led global markets overnight. The drop in core EU notable but real story is in periphery where a good Italian auction helped even with negative budget headlines. UK Gilt 10Y yields off 3.5bps to 1.34% with Brexit still the only discussion. The German Bunds off 2bps to 0.33%, French OATs off 1.8bps to 0.71% while Italy off 2bps to 3.23%, Spain off 3bps to 1.505%, Portugal off 3.5bp so 1.827% and Greece off 6.5bps ot 4.235%.

- Italy sold E2.25bn of 10Y 2.8% BTPs at 3.24% with 1.41 cover – better than 3.269% expected and down from 3.36% previously – Sold E2bn of 5Y 2.45% BTP at 2.35% with 1.34 cover. Italy also sold E641.1mn of 8Y FRN at 2.31% with 1.96 cover – previously 2.32%.

- US Bonds extend rally, bull flattening– 2Y off 1.4bps to 2.795%, 5Y off 3.2bps to 2.835%, 10Y off 4bps to 3.019%, 30Y off 3.7bps to 3.309%.

- Japan JGBs rally tracking US move, curve flatter after weak 2Y sale. MOF sold Y1.747trn of 2Y at -0.134% with 4.66 cover – down from 5.31 previously. 2Y off 0.4bps to -0.149%, 5Y off 1.6bps to -0.116%, 10Y off 1.6bps to 0.073%, 30Y off 1.4bps to 0.804%.

- Australian bonds rally with US– 3Y off 1.3bps to 2.02%, 10Y off 2bps to 2.598%.

- China PBOC skips open market operations again, leaves liquidity neutral. Domestic defaults now top CNY100bn this year – all in private sector. Government Bonds rally sharply with 2Y off 8.1bps to 2.67%, 5Y off 3.9bps to 3.12%, 10Y off 4.2bps to 3.35%.

Foreign Exchange: The US dollar index up 0.05% to 96.82 with 96.62-97.00 range. In EM, USD mostly lower – EMEA: ZAR up 1% to 13.63, TRY up 1.45% to 5.145, RUB up 1.05% to 66.36; ASIA: TWD up 0.25% to 30.82, KRW up 0.65% to 1119.50 and INR up 1.1% to 69.85.

- EUR: 1.1375 up 0.1%. Range 1.1349-1.1398 with focus on 1.14 as pivot for higher with 1.15-1.17 in play. In EM

- JPY: 113.30 off 0.3% Range 113.21-113.68 with EUR/JPY 129.95 off 0.2% - risk on but 114 still matters so 112 lingers as a risk.

- GBP: 1.2765 off 0.45%. Range 1.2756-1.2850 with EUR/GBP .8915 up 0.55% - all about Brexit risks still.

- AUD: .7335 up 0.35%. Range .7295-.7336 with USD not A$ the story – Capex weaker – but markets focus on crosses. NZD .6870 flat.

- CAD: 1.3280 flat. Range 1.3254-1.3313 with focus on oil vs. US rates vs. BOC and data 1.3250-1.3325 keys.

- CHF: .9955 up 0.15%. Range .9918-.9966 with EUR/CHF 1.1325 up 0.25% - GDP negative shock keeps .99 floor intact – cross in play.

- CNY: 6.9353 fixed 0.21% stronger from 6.95, up 0.15% to 6.9445 on the day, range 6.9331-6.9507 - notable that Swift saw global payments in CNY for October drop to 1.7% from 1.89%.

Commodities: Oil up, Gold up, Copper up 0.65% to $2.8510, China iron ore fell 1%.

- Oil: $50.89 up 1.2%.Range $49.41-$51.04 with focus on G20/OPEC and USD – break of $50 washed out positions - $59-$62 consolidation expected. Brent $59.36 up 1% with $58-$62 same.

- Gold: $1227.50 up 0.5%.Range $1221-$1229 with focus on $1225 base building for $1237 breakout. Silver flat at $14.33 with $14.50 key. Platinum flat at $825.30 and Palladium off 0.2% to $1183.50.

Economic Calendar:

- 0830 am US Oct personal spending 0.4%p 0.4%e / income 0.2%p 0.4%e / PCE index 0.2%p 0.2%e

- 0830 am US weekly jobless claims 224k p 219ke

- 0830 am Canada 3Q current account deficit C$15.88bn p C$15.5bn e

- 1000 am US Oct pending home sales 0.5%p 0.5%e

- 0200 pm US FOMC minutes

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.