Our Disruptive Economy

In its early days Microsoft took more risks than a pirate; now they take less risk than an insurance company.

- Anonymous quote in the Harvard Business Review

Dave McClure says be done with it. Just die.

“All dinosaurs gonna die,” he declares.

Dave heads 500 Startups, one of the most recognizable investment firms around.

The dinosaurs he’s referring to are the companies populating the S&P 500. He thinks they’re “big and dumb.” Most don’t get that “software is eating the world.”

They will be “disrupted and destroyed” by legacy-seeking startup missiles, says McClure.

His argument is a bit over the top. But McClure is no dummy. He also gives it intellectual punch by discussing “asymmetric outcomes,” the “power law” of returns, and Clayton Christensen‘s 1997 book The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail.

Christensen called the anticipation of future needs “disruptive innovation.”

Now, Christensen didn’t invent the phenomenon. Since the invention of the wheel, technology has always been a disruptive force. But he was among the first to associate it with startups and entrepreneurial success.

Since Christensen’s book, the two ideas of disruption and innovation have become increasingly linked in the entrepreneurial community of Silicon Valley.

These days, it’s almost impossible to get away from the word “disruption.” I constantly hear it from founders – “We’re disrupting XXX industry.” And I read about industries “ripe for disruption” all the time.

And now the word is being used to make highly ambitious claims that every industry, market and legacy company is susceptible to disruption.

These claims raise a host of questions, from “Are companies really dumber or are they more rigid/afraid to innovate?” to “Is all innovation disruptive?”

But the one question that interests me the most is this: Are startups the only agents of disruption?

If so, where does that leave companies like Amazon or Google? They’re not startups anymore. So are they by default “big and dumb”? They’d certainly refute that characterization.

Or how about the “Chimps and Monkeys” (I talk about them in this article – “Gorillas Not the Only Big Game“) and more niche companies – like the “Uber for X” startups – that follow the big disruptors into a market?

Your Margin Is My Opportunity

What’s the opposite of “self-fulfilling prophecy”? Whatever it is, that’s what Christensen’s book has done.

Amazon CEO Jeff Bezos says, “Your margin is my opportunity.” Amazon passes its profit along to its customers.

JPMorgan CEO Jamie Dimon says, “Rest assured, we analyze all of our competitors in excruciating detail – so we can learn what they are doing and develop our own strategies accordingly.”

And then there’s Google. Its founders – Larry Page and Sergey Brin – just reorganized the company this week. In his letter announcing the major shift, Page said that he and Brin “will rigorously handle capital allocation and work to make sure each business is executing well.”

Both have embraced innovation. Google is leading the way in several exciting technologies. Artificial intelligence. Driverless cars. Drones.

What are the chances that Bezos, Dimon, Page and Brin have read Christensen’s book?

I’d say about 99%.

It’s also why some of the most successful corporations are becoming active startup investors. Companies like Comcast (Comcast Ventures), Intel (Intel Capital) and Qualcomm (Qualcomm Ventures). Google has two venture arms: Google Ventures and Google Capital.

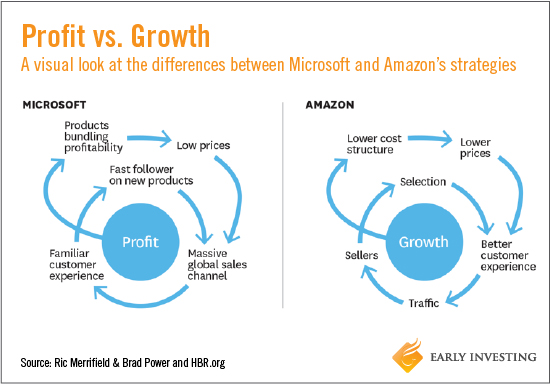

Microsoft (Profit) vs. Amazon (Growth)

Paul Graham – co-founder of Y Combinator – says this about Microsoft…

“Microsoft cast a shadow over the software world for almost 20 years starting in the late ’80s… But it’s gone now. I can sense that. No one is even afraid of Microsoft anymore. They still make a lot of money… But they’re not dangerous.”

He made this observation back in 2007!

While busy focusing on new versions of Windows to defend Microsoft’s core revenue-producing offerings, CEO Ballmer missed several big opportunities in search, social media and phones.

On the other hand, Amazon still thinks of itself as a startup. It is incredibly open to creating new things… growing its customers and improving their experience… and increasing the range of products it sells.

Profit isn’t a primary, secondary or tertiary objective. It’s completely avoided.

It was Microsoft that fell into the Christensen-predicted trap of chasing profits and missing the investment in innovation it needed to maintain its market dominance.

The two models are quite different…

Anything Wrong With This Picture?

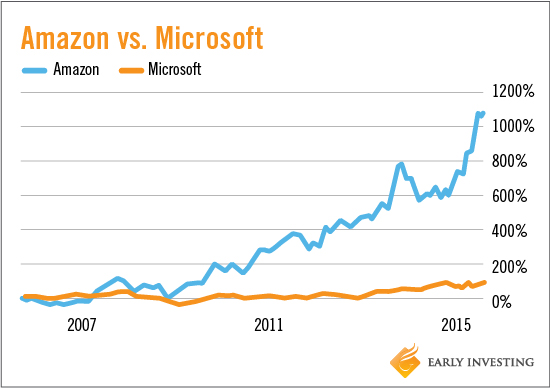

Is Amazon really the clear winner? And Microsoft the old-school loser, despite its ample profits?

To wit: Microsoft is a $376 billion company with annual profits of over $12 billion. Amazon has a cap of $250 billion with no profits (reporting a slight loss for the last 12 months).

Which do investors prefer?

It’s no contest. Amazon’s model wins out…

In the last 10 years, Amazon’s price has gone up over 1,000% compared to Microsoft’s modest 83% growth.

Do profits really count for so little and break-even revenue growth so much?

It’s not that simple.

Microsoft knows how to make money (as Graham says) but is lost in the weeds. Its growth model is broken with no way to fix it.

Tell me, when is the last time Microsoft did something that excited you?

Amazon doesn’t always get it right (sales of its Fire TV haven’t taken off), but it breeds confidence among investors. It knows how to attack new markets (Amazon Web Services). And it excels at multiplying its product lines.

I don’t expect that to change, as long as Bezos is in charge.

Under his leadership, Amazon has mastered both sides of the equation. It disrupts other companies’ markets while protecting its own from disruption.

In the banking sector, there is no equivalent to Amazon’s sheer size paired with a startup’s mentality. But America’s big banks understand that innovation is afoot.

JPMorgan CEO Jamie Dimon says banks need to be aware that “Silicon Valley is coming for banking.”

Oh, they know. The six major banks – Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo – have made strategic investments in 30 financial tech companies since 2009.

In my next post I’ll discuss how disruption is upending Wall Street and how Wall Street is fighting back.

Invest early and well,

Andrew Gordon