Options Opportunity Portfolio – 2016 Preview

What a crazy year 2015 was!

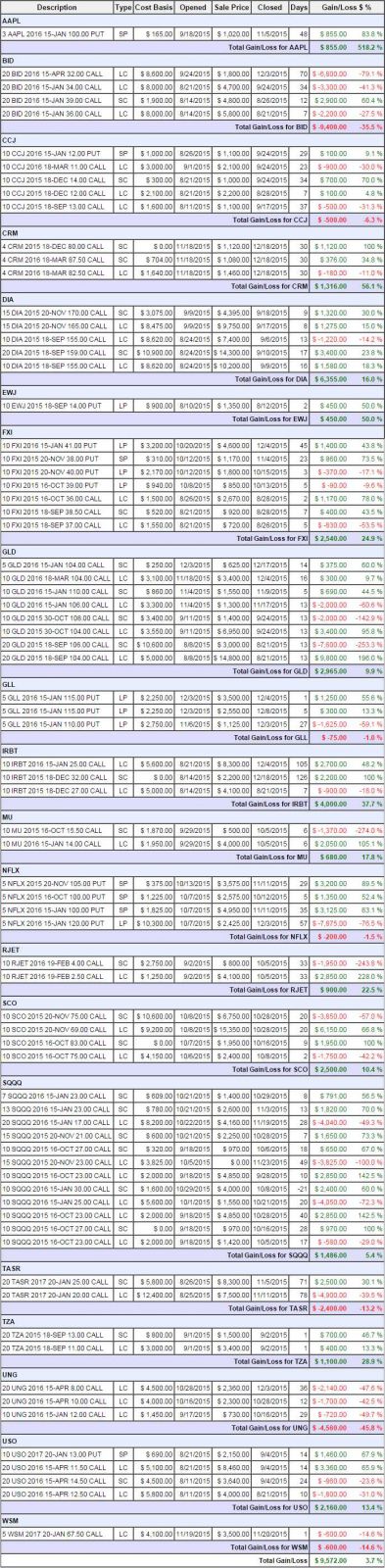

We began tracking this new virtual portfolio back in August and, in less than 4 months, we closed 80 option positions on 20 stocks (or ETFs) so pretty active in the beginning. At one point we were up 20% but the net gain on the positions we've closed ended up at just $9,572 or +9.5% from our $100,000 opening balance.

Since that pace was more hectic than we had intended and the market was very choppy, we moved towards longer-term investments which have the downside of being "expensive" to set up – in that the portfolio will tend to reflect the worst-case scenario for buying or selling options based on the bid/ask spread – no matter how unrealistic the pricing is. This is, however, something options players need to learn to understand when they are looking at their positions – and we'll discuss that in detail as we examine each of our open positions:

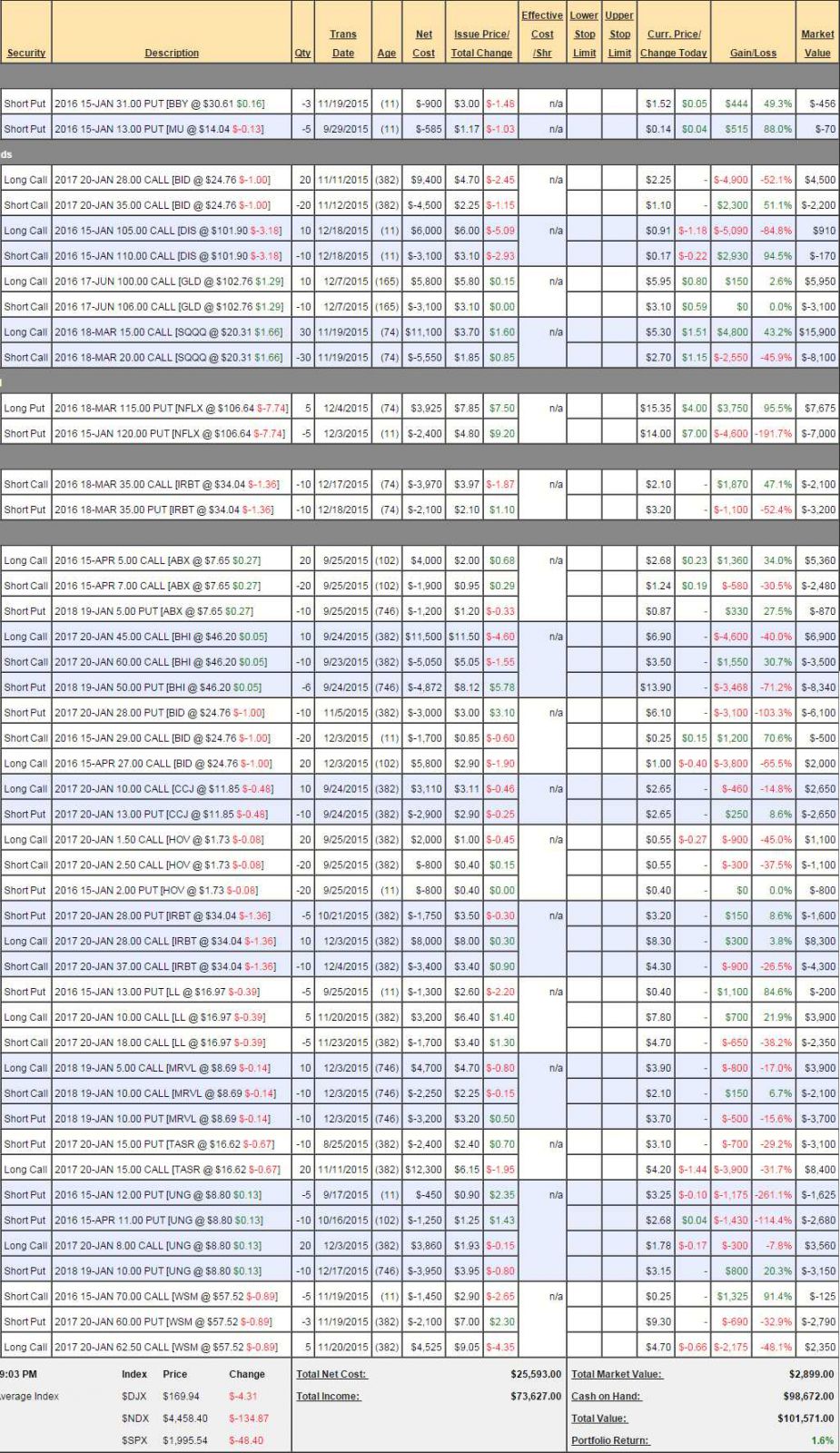

Notice first that we have $98,672 worth of cash on hand. We started with $100,000 and, using just $1,328 of our original cash, we now control a substantial amount of positions. On the margin side, we are using $48,700 out of $200,000 of ordinary margin (not Portfolio Margin, which would be much more) and, generally, we don't want to use more than 1/2 of our margin – saving the rest for emergencies.

At this stage in the process, we're not so much concerned with the BALANCE of the positions as we are to whether or not they are on or off track for their goals. Options trades can swing wildly in value as premiums fluctuate as well as the price of the underlying security – your job as an options trader is to understand the VALUE of your options so you can identify which ones are misPRICED and learn to take advantage of the differences.

- BBY – If BBY is over $31 on Jan 15th, the short puts expire worthless and we make the whole $900. As it stands, we're about 1/2 up and on track to make $450 more.

- Since we liked this trade, let's sell 5 March $30 puts for $2 ($1,000) as our next BBY play.

It should be noted, of course, that the prices shown by the broker's balance sheet are NOT the prices you can currently sell these puts for. The broker shows you the ASK price for a put you would have to buy back and would show you the BID price for the same put if you were selling it. In this case, ToS says the Bid on the BBY Jan $31 puts is $1.43 and the Ask is $1.50 yet our balance is even worse at $1.52.

It only matters when you actually go to sell it but NEVER accept the market price your broker shows you – it can end up costing you a fortune. We do our Live Webinars Tuesdays at 1pm – that's a very good time to ask questions regarding entering and exiting positions as we can demonstrate more easily.

- MU – Hopefully will safely expire worthless and we'll collect the last $70 dure to us on what should be a 100% winner ($585).

- BID – This has been a very painful position where we've already absorbed $10,000 worth of losses. We're waiting on Jan earnings but it may be April before we see real improvement. Meanwhile, it should cost just $2 to roll the Jan $28 calls ($2.50) to the Jan $23 calls ($4.50), so let's do that for no more than $2.20. On the $23/35 bull call spread, the max pay-off is $24,000 and we're in for $14,300 so about $10,000 upside at $35 with a break-even at $30.

- DIS – We were way too early on this one but our plan was to roll to a more aggressive position if the spread failed so we're going to sell the Jan $105 calls ($1.10) and roll them to the July $100 calls ($9.25) and sell the July $110 calls ($4.45) and sell 10 of the 2017 $85 puts for $4.50 so a net overall credit of 0.30 for all our hard work. That leaves us in the now $10 spread for net $2.60 with a $7,400 upside potential at $110 in July.

- GLD – This one is right on track for our $6,000 goal, which would be up $3,300 (122%) if GLD is over $106 in July (roughly $1,100 on gold).

- SQQQ – Is our primary hedge for the portfolio. This one is a great example of how bad your balance sheet can look compared to the actual position. SQQQ is at $20.10 so this spread is 100% in the money and, if it expired today, it would be worth $15,000. HOWEVER, the broker is showing us just net $7,800 in value – about half. Still, we KNOW that if the Nasdaq doesn't go higher, then we'll gain that last $7,200 in PRICE by March expirations (18th) so we effectively have a $7,200 guarantee that our long Nasdaq positions won't lose money for 90 days.

- NONETHELESS – I am going to call for taking the money and running on the March $15 calls ($5.44 at the moment) and that will put $16,320 in our pocket and leave us aggressively long on the Nasdaq. Most likely we will cover with a new spread but, for now, I want to play for the bounce.

- NFLX – This one is miles in the money but our $2,500 potential win is only showing $675 at the moment – pathetic! Of course, if you tried to buy the spread for net $1.35 it would never fill – that's just the awful quote we're getting from the broker. Not much to do but sit and wait on this one though getting more bullish on the Nasdaq with SQQQ helps us lock in our profits ont this trade because, if the Nasdaq doesn't come back, then this trade likely drops $1,825 in our laps.

- IRBT – We got very aggressive on this one and took a hit today but still in the green and still like this trade for our Stock of the Century – especially as there's still 85 years left to play.

- ABX – Another one that is 100% in the money towards our $4,000 maximum pay-out but broker shows us net $2,010 on the spread. So, a very nice $1,990 left to gain and all ABX has to do is hold $7 (this is another bullish bet on gold, of course)

- BHI – They are being bought by HAL for 1.12 shares of HAL + $19 in cash. HAL is now at $34.11 so that's $38.20 + $19 = $57, which would make our spread net $12,000 and currently our broker says they'll CHARGE us $4,940 to close it out. That is a RIDICULOUS mispricing but I very much doubt you can even come close to buying that spread for a $4,000 credit and, if you can – I'd buy MORE! If HAL holds $34 and if the deal goes through, we're good for about +$17,000 on this one!

And remember – we're doing all this using just $1,328 of our original cash!

- BID – The short Jan calls should expire worthless, so $500 to pick up there. We're going to consolidate with the above spread by rolling April $27 calls ($1.10) to the same Jan $23 calls ($4.67 now).

- CCJ – At $12 the spread is $1,000 in the money but shows net $0 in value per our friendly broker. To be fair, it's only about $600 in reality and I love this one as a new spread with $2,400 upside potential (400%) at $13 (up 8%) in a year. Our premise is new plants in China and the restarting of Japanese reactors will push uranium demand back to normal(ish) over the next 2 years.

- HOV – We will have to roll those Jan $2 puts so let's do that now. They are 0.30 and we can roll to the 2017 $2 puts at 0.65 so +0.35 for the same position is nice. As to the spread, I'm fine with the target and our broker shows us (impossibly) that we are losing on both legs at the same time. The actual net of the $1.50/2.50 spread is about 0.40, we're being shown 0.00 and we paid 0.60 so a big difference of opinion on the value of that spread. I'm not inclined, however, to put more money in as the economy isn't that great.

- IRBT – Again? Told you I liked them. This one is $6 in the money ($6,000) yet our broker says net $2,400 so we have $3,600 more to gain if IRBT holds $34 and up to $3,000 more than that at $37. Nice, boring trade where we wait to get paid.

- LL – Slowly but surely coming around. We have a nice, low target of $18 and we're on track for that and a $4,000 return on our $200 cash investment (see why we still have so much cash?). Those short puts are sure to expire worthless so let's sell 5 of the 2017 $13 puts for $2.90 ($1,450) as it's nice to get paid now in exchange for promising to buy a stock for 25% off next year, right?

- MRVL – This one is $3,690 in the money but showing us net -$1,900 so we'll get a +$5,590 bump in our portfolio if MRVL can get over $10 in 24 months (up 14%). I still like this as a new trade if you can get the pricing.

- TASR – Taser is only our Stock of the Decade and this drop to $17 is your chance to join us on the way to $30. I like this trade as it stands and, if TASR goes lower, we'll be happy to get more aggressive.

- UNG – Our Trade of the Year for 2016! Here we aggressively sold puts around the naked long calls because UNG was just stupidly cheap at $7 and already at $8.80 and we're showing a loss because of our too-early entry on the Jan and Apr puts. We will be rolling them but no changes at the moment.

WSM – The short Jan calls will expire worthless so let's use the $2.90 we collected to roll the 2017 $62.50 calls ($5.35) down to the $55 calls ($8.50) and we can sell 5 Feb $60 calls for $1.35 ($675) to pick up some more cash while we wait.

What a great bunch of positions! We certainly have the potential to make our $60,000 goal (+60%) if all goes well and we have plenty of cash on the side in case it doesn't. We'll make more fun earnings trades as those results begin to come in but, now that we have 4 months under our belts – let us know what kind of trade ideas you are looking for and we'll try to find some.

more