Oil Pauses Ahead Of Next OPEC Meeting

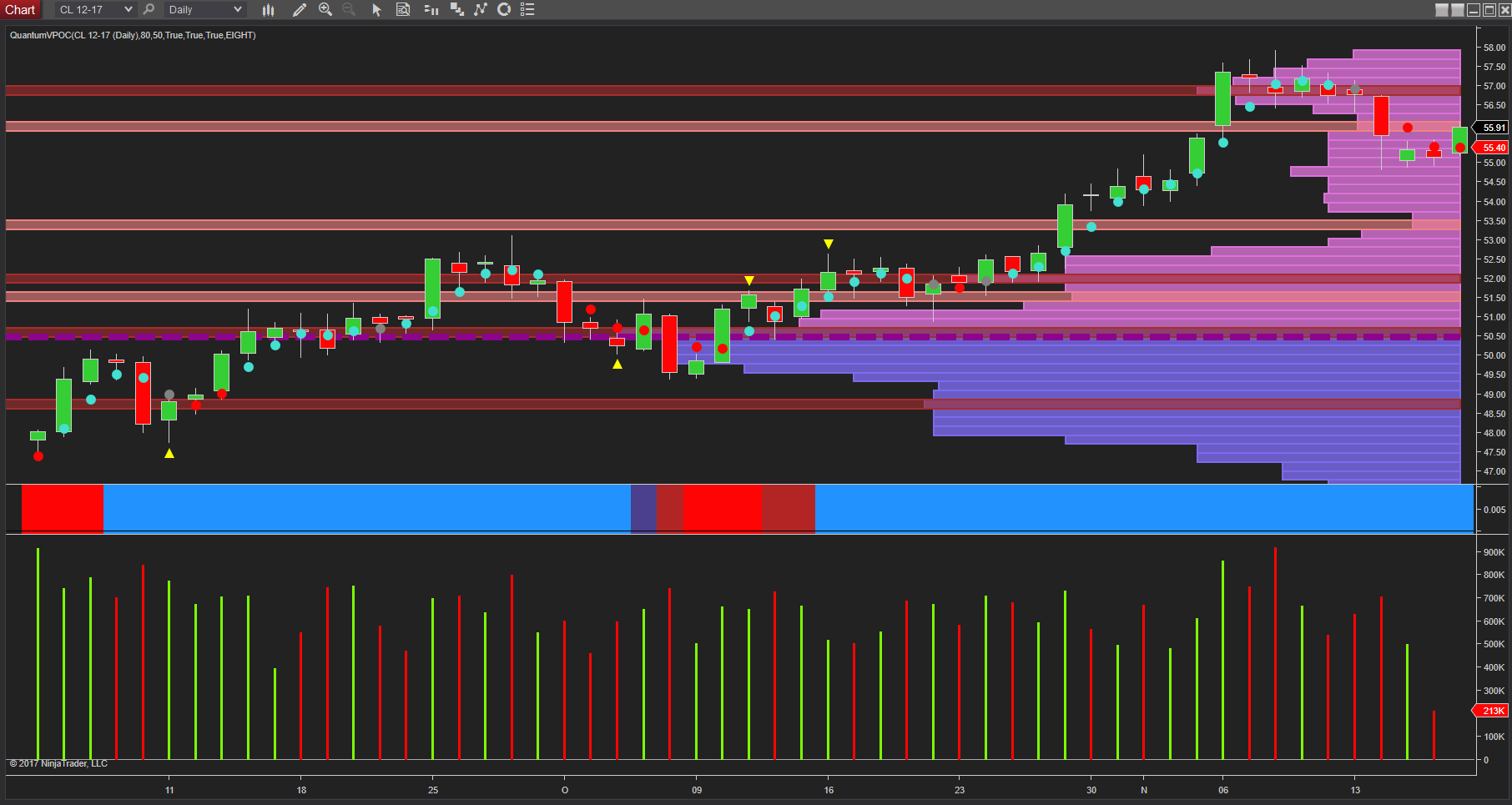

(Click on image to enlarge)

Oversupply in the oil market continues to dominate the longer term picture, and despite the recent rally in crude oil, statements from Saudi Arabia’s energy minister have reinforced this picture, with his comments that the market is likely to remain oversupplied until March 2018. This comes ahead of the next OPEC meeting scheduled for the end of November when it is expected caps on supply will be extended into the new year.Khalid al-Falih told the conference in Bonn that ” we need to recognize that by the end of March 2018 we’re not going to be at the level we want to be which is the five-year average, and that means an extension of some sort’. He then went on to say..’we have gone over 50% in reducing excess inventories but that means we still have some excessive inventories that we need to drain. We don’t want any spikes in price that shock the market. We don’t want any price movements that are unhealthy for demand. In his summary comments, he then said …’the November 30 meeting will be an important milestone to announce the way forward. My preference is to give clarity to the market and announce on November 3th what we are going to do’.

As such this meeting is likely to set the tone for oil prices into 2018, and provided all the targets and agreements are maintained and supply does indeed return to demand driven forces, oil should continue to rise in the longer term and much in line with the recent bullish sentiment.

From a technical perspective the recent rally in the early part of November was supported by rising volume and rising prices on the daily oil chart, with this move then coming to a halt on the 8th November, as heavy selling by the big operators coupled with a deep wick to the upper body of the candle, sent a strong signal of short-term weakness with the market duly selling off early this week and driving the price down to $55 per barrel once again. However note the price action and volume of Tuesday, with the big operators then buying, and coupled with very low volume yesterday as selling pressure eased, with the price then recovering in early trading today. Longer term the outlook for oil remains bullish as the November 30 meeting looms ahead, and should then $57.50 region of resistance be taken out on good volume, then $60 per barrel is the next target late in 2017 or early in 2018.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more