Oil Down 4%, Dollar Hits 6 Month High

Oil Crashes On Friday

The stock market sold-off modestly on Friday as the S&P 500 was down 0.24% and the Nasdaq was up 0.13%. The oil market was hit hard as WTI oil fell 4% to $67.88. This was based on reports that OPEC and non-OPEC nations could increase supply. That was WTI’s worst day since July 2017; oil is down 7% since its 3 year high which had a $72 handle. The American frackers will alter their production and won’t face the same issues as 2016 because breakeven costs have declined. However, all oil stocks will decline because of lower future profits. For example, EOG stock was down 1.83% and is down 7.6% since Monday’s close. That’s coming off an all-time high for the name which is impressive considering oil was much higher in 2014.

The XLE energy sector was down 2.6% on Friday and is down 5.49% since Monday’s close. The stock market would have looked like the Nasdaq if it wasn’t for this correction in oil prices. This correction in oil prices is what I was looking for earlier this year. I was wrong because I was too early. However, one of the thesis points which is helping drive oil lower still applies. Namely, the speculative short position in the WTI futures market as a percentage of open interest is the lowest in 12 years. Every trader and his/her mother was long oil. It only took a rumor that production increases could be coming to cause oil to fall 7%. The reason to be bearish is obvious now that the decline occurred. It will be up to the supply and demand fundamentals to drive future prices now that the speculative rally has popped.

The energy sector was a catalyst for the strong industrial production report in April, so this decline could limit that if it lasts longer. Obviously, a few days of weakness is meaningless, but if it becomes a trend, it will be impactful to the June report. If energy were to decline, it would help the consumer and lower nominal inflation. Since the Fed just pulled back on rate hikes, this is coming at a great time.

Dollar Up Fed Rate Hike Percentage Down

The dollar was up 0.51%. This is the highest point since November 2017. This is making all the dollar bears sweat as they claimed the dollar goes through 3-5 year cycles; they said it was in the 2nd year of a bear cycle. The technically critical level the dollar faces is the $95 handle. If it gets above that, it will be at the highest level since July 2017. This increase will crimp S&P 500 profits. A rising dollar isn’t great news for big cap stocks, but it is great for the small caps.

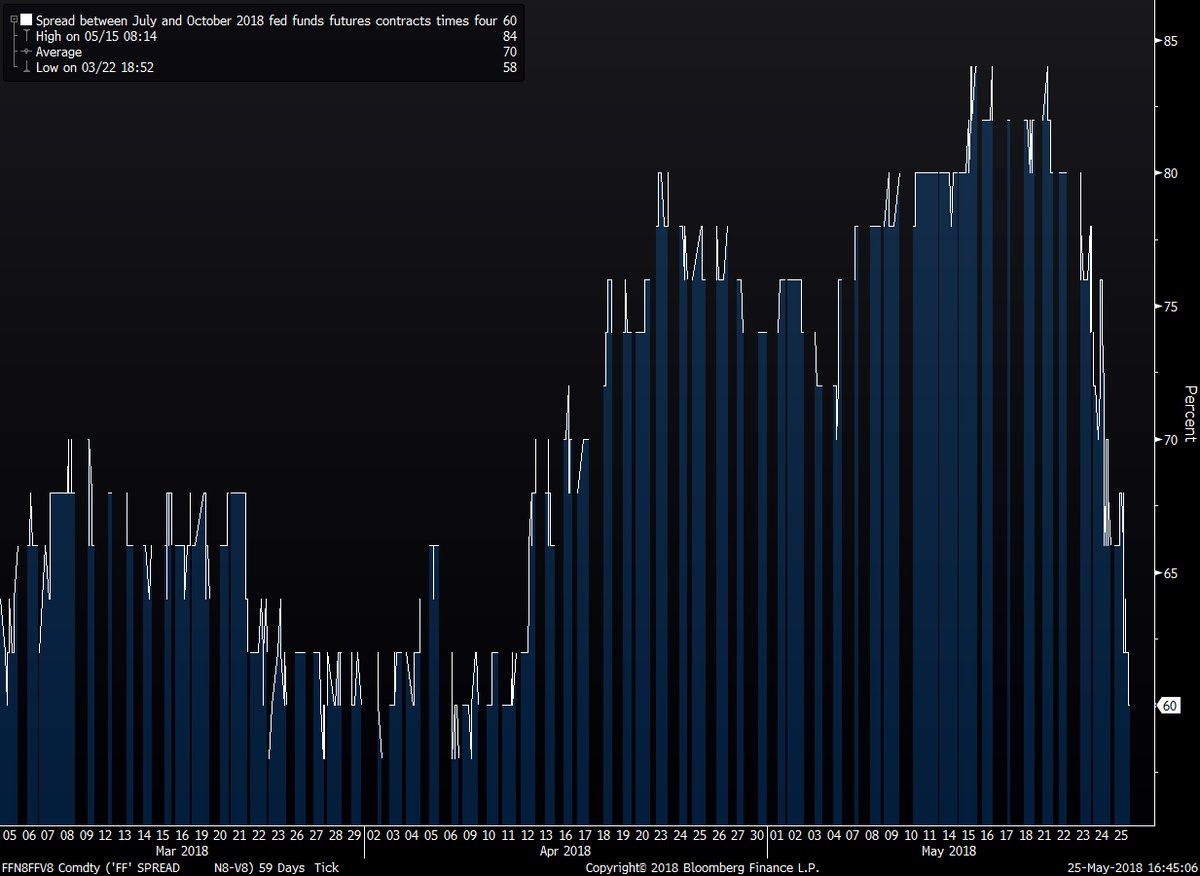

Even after the Fed pulled back on rate hikes, the dollar is still rallying. The Fed might consider being even more dovish in its next meeting. The dollar could be rallying because of improved economic performance which is reasonable, but it’s amazing to see such a rally given the chart below. As you can see, the odds for a September rate hike quickly have gone from about 85% to 60%. It went from a lock to a tossup. Even with a strong economy, the Fed can’t get too far out ahead of the other advanced economy central banks. The Fed wants a stable dollar, not one that gets above $100.

(Click on image to enlarge)

Treasury Yields Crater

It’s surprising to see treasury yields falling with the dollar rallying. Both were going up earlier in the year because of economic optimism. The recent dovishness from the Fed has caused the 2 year yield to crater while the dollar stays high. Oil prices falling is bad news for the inflation story which is one reason yields are falling. The CRB commodities ETF is down 1.5% in the past 2 days. That being said, the principle reason yields had been rising this year is because of improved growth. Improved inflation was only a secondary reason for rising rates which is what makes this recent decline so shocking.

Even though oil fell 4% on Friday, the action in the 10 year bond yield was the most important market movement on the day. The 10 year yield was down 4.57 basis points to 2.93%. That’s an 18 basis point drop from the close on May 17th. This is supporting the possibility I have floated in earlier articles which is that the May 17th high was historic. It’s too early to tell, but that could have been the high of the cycle. The 2 year yield fell 3.23 basis points to 2.48%. I think 2 year bond traders see that the Fed is in a tough situation on rate hikes. Even though the economy is strong, rate hikes could be limited because the dollar is spiking and emerging markets are cratering. The latest difference between the 2 yields is 46 basis points. Surprisingly, the yield curve isn’t looking terrible after this rally in the 10 year bond.

North Korea Is Back In The Headlines

In a previous article, I mentioned that the North Korea headlines wouldn’t go away after the June summit was cancelled. Amazingly, just a day after the summit was cancelled, President Trump said it might happen again after he had a productive discussion with the North Korean leaders. The decision to cancel the meeting could have been a negotiating ploy to get North Korea to budge on a certain issue. We will know in the next 2 weeks if the summit will occur again or if the cancellation will be permanent. It’s good news for the two countries to be talking. I think the best trade on this situation is to buy stocks if the meeting is back on and jitters cause stocks to decline right before it occurs. If the meeting occurs, it will go well because these issues are all worked out before the actual meeting. That’s why we’re seeing such vociferous negotiations happen this week.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more