October 2018 Asset Class Performance Snapshot

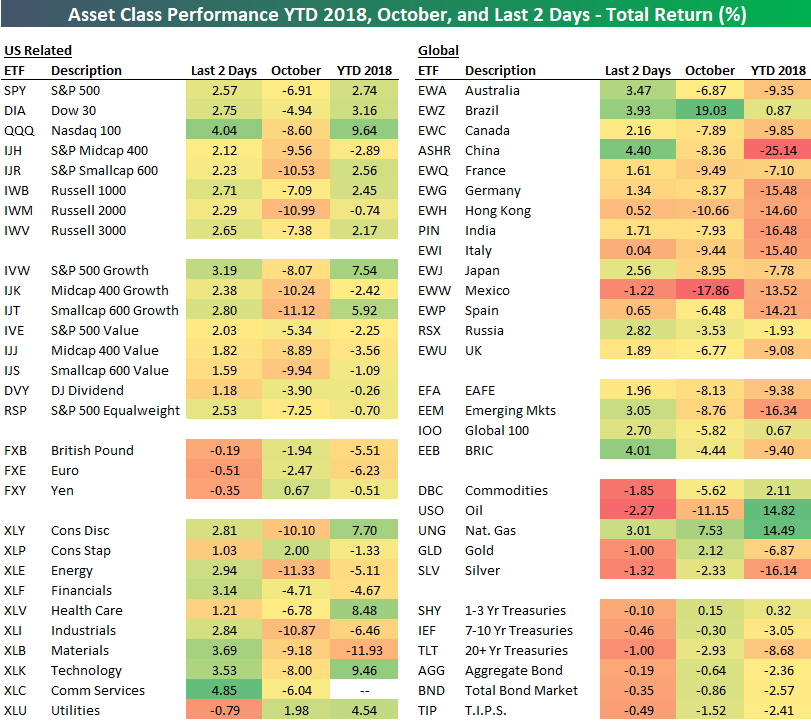

Below is our asset class performance matrix highlighting the total return of various ETFs across asset classes during the month of October. We also include YTD total return as well as the percentage change over the final two trading days of October.

While the last two days of October were extremely strong for equities, major US index ETFs still finished October down 5-10% across the board. The most pain was felt in small caps which still fell 10%+ on the month even after 2% gains over the last two days. Looking at sectors, Consumer Discretionary, Industrials, and Energy were all down 10%+ in October, while Utilities and Consumer Staples actually finished up 2%.

Outside of the US, Brazil was the big winner with an October gain of 19.03%, while Mexico was the big loser with a decline of 17.86%. While China was down 8% on the month, it saw a massive gain of 4.4% over the month’s final two trading days.

Commodities overall were down in October, but both natural gas and gold were up on the month. Fixed income ETFs were down in October as well.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more