NZD/USD Weekly Price Outlook: Kiwi Rally Runs Into Resistance

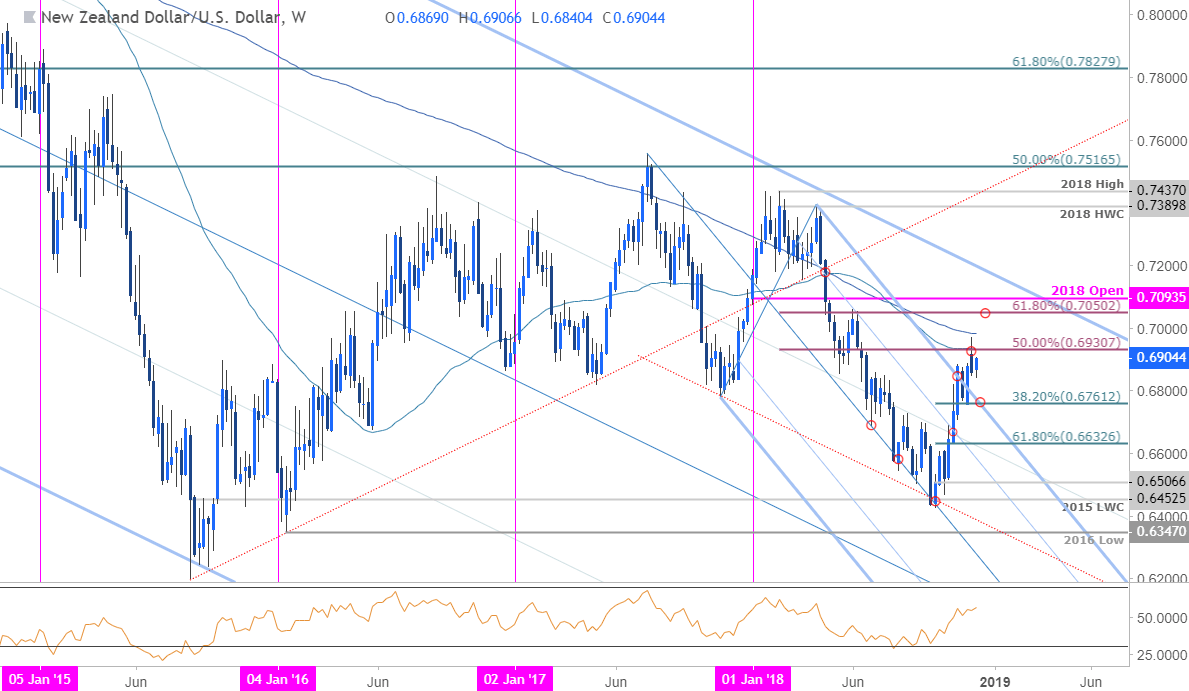

NZD/USD WEEKLY PRICE CHART

(Click on image to enlarge)

Notes: In last month’s NZD/USD Weekly Technical Outlook we noted that Kiwi was testing multi-year pitchfork resistance around 6811/54 and, “a topside breach / close above this formation would suggest a more significant low is in place with such scenario targeting the 50% retracement / 52-week moving average at 6930/32.” Price registered at a high at 6969 last week before reversing sharply with weekly RSI struggling just below the 60-threshold.

Initial resistance remains steady at 6930 and is backed closely by the 200-week moving average at ~6980s – a breach / close above is needed to keep the long-bias viable with such a scenario targeting subsequent topside objectives at the 61.8% retracement at 7050 and the yearly open at 7094. Confluence weekly support rests at 6761 with broader bullish invalidation at now raised to 6632.

Bottom line: The breakout in NZD/USD has responded to initial resistance at 6930 and while the immediate risk remains for a pullback off these levels, the medium-term outlook remains constructive while above 6761. From a trading standpoint, we’ll favor fading weakness while above former slope resistance targeting a breakout towards yearly open resistance.

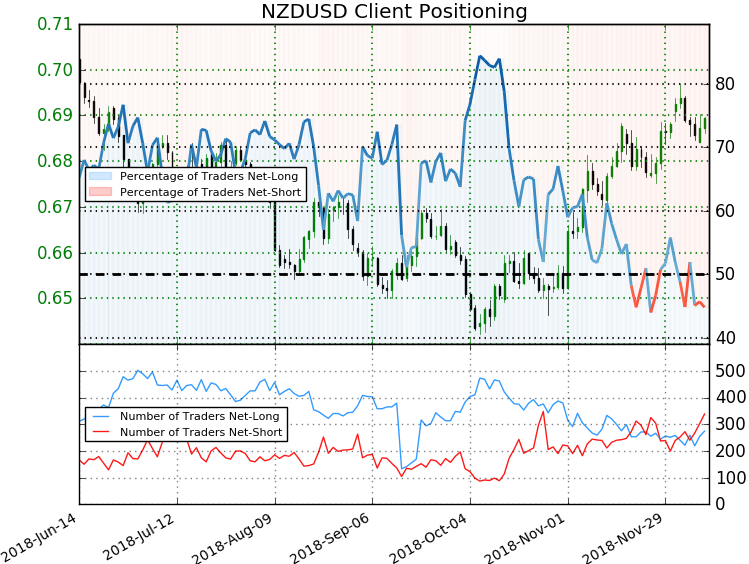

NZD/USD TRADER SENTIMENT

- A summary of IG Client Sentiment shows traders are net-short NZD/USD - the ratio stands at -1.23 (44.8% of traders are long) – weak bullish reading.

- Long positions are 12.8% higher than yesterday and 3.0% higher from last week

- Short positions are 17.4% higher than yesterday and 37.4% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Traders are further net-short than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias from a sentiment standpoint.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more