Now Is The Summer Of Our Content

( with apologies to William Shakespeare)

As the summer comes to an end, the financial markets are gripped by contentment and satisfaction. The U.S. stock markets reached historic highs without much fanfare, grinding higher with relative ease. Long term interest rates remain low and, especially in the EU countries, rates continue to drop into negative territory. Governments and corporations have no difficulty in raising new debt throughout the developed world. In the United States, the unemployment rate hovers around the full employment level of 4-5% and inflation remains relatively subdued in the 1.5% range. There is a general feeling of stability and contentment. Maybe this is just the normal feeling that occurs in summer. Nothing must disturb our holiday enjoyment.

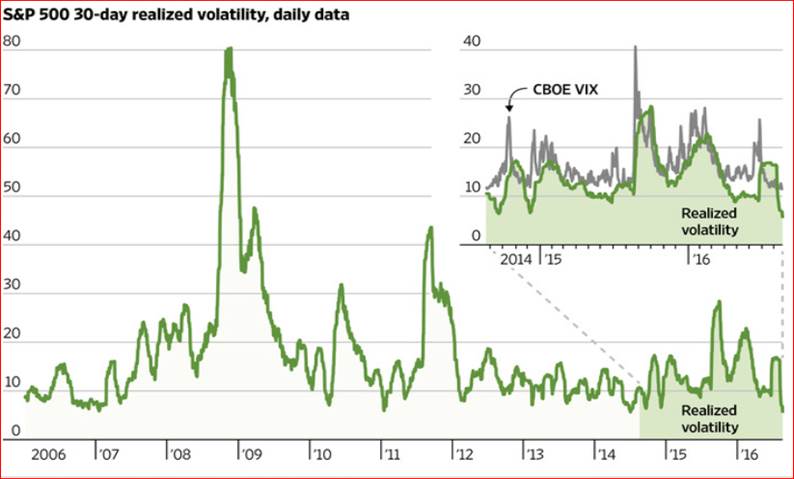

There are several ways to measure this degree of “contentment”. Chart 1 maps the VIX index, one of the most popular measures of stability. The VIX is often referred to as a `fear index` which is not entirely accurate. Instead the VIX is a measure of the market`s expected volatility in either direction.

Chart 1 Changes in VIX index, Aug 2015-Aug 2016

(Click on image to enlarge)

(Click on image to enlarge)

Market participants will place bets in the form of options on the direction and speed that the stock market will move over a given time period. They will pay premiums --- on calls or puts--- depending on how much volatility they expect--- on the upside or downside. When investors assume that neither significant downside risk nor significant upside potential will prevail, the VIX is quite low. Today readings are 11-13 percent, a range reserved only for periods of calm in the markets.

This complacency extends into the fixed income markets as well, especially in the corporate bond market. A glaring example is the narrowing of spreads between high yield (HY) corporates ( Chart 2) . In the early part of the year, HY bonds traded 850 bps over Treasuries. Today the spread has dramatically fallen to under 550 bps. Investors feel very confident that default rates will be low, that medium to long term interest rates will continue at historic lows and with the possible exception of the energy sector, the corporate market will remain healthy.

Chart 2 High - Yield Bond Spreads, Sept 2015- Aug 2016

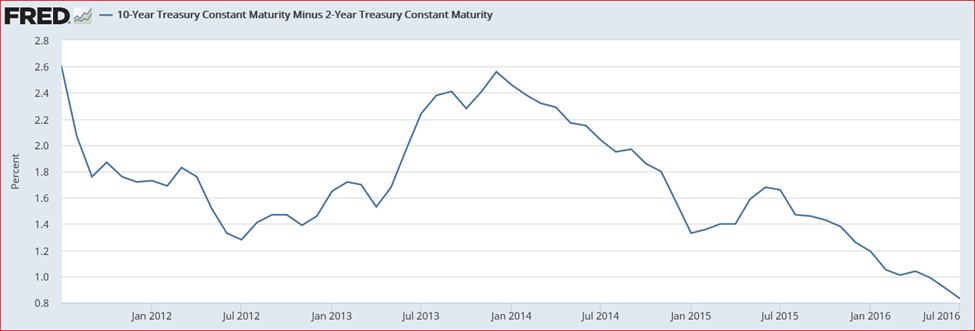

Adding further comfort to investors is the perception that the Federal Reserve (FOMC) will maintain easy monetary conditions. Despite recent statements by senior Fed officials---- William Dudley and Stanley Fischer---that conditions are ripe for another upward movement in short term rates, the markets have generally shrugged off this concern. In fact, the flattening of the yield curve--- the difference between the 2yr and 10 yr rates----suggests that investors are getting very comfortable with duration risk and are prepared to move out further along thecurve in order earn higher returns (more on this later). Is this degree of complacency warranted?

Chart 3 2yr-10yr Treasury Bond Spread, 2012-2016

(Click on image to enlarge)

The late Hyman Minsky famously coined the expression that “stability creates its own instability”. Simply put, over time as the economy exhibits stability and relative prosperity, there is a great temptation to assume more debt. Minsky argued that the stability encourages the adoption of more debt and at some point that debt becomes overwhelming and asset prices fall and the economy sinks badly. Certainly, this was the case during the 2000-2007 period. Many now understand what happened in 2008 as a “Minsky Moment”.

I do not believe that we are about to experience another Minsky Moment---- the conditions do not appear to be that ominous that a major financial crisis is in the making. However, the reader should be aware that there are some conditions that challenge this contentment in the market place.

Such as:

- Expectations for growth in the second half of this year are too optimistic; with the first half registering a meagre 1 percent; there is no evidence that a rate of 2-2.5% is likely for the balance of the year; this a wish, not a defensible forecast;

- The low interest rate environment is putting a lot of pressure on the consumer to forego purchases now in the interest of saving more for retirement; worldwide, the savings rates are just too high and without a strong consumer overall growth will be a struggle;

- The U.S. nominal growth over the past four years has almost halved from 4.3 percent to 2.4 percent; inflation has declined in a similar rapid rate and is below the 2 percent Fed target; again, expectations are too high regarding income growth this year and next;

- The flattening of the yield curve, while comforting for investors dealing with duration risk, signifies that the bond market is not anticipating neither significant nominal growth nor inflation over the next decade; this will put a lot of pressure on pension funds to seek higher returns from risky assets;

- Corporations have piled on considerable debt to boost dividends, buyback shares and maintain operations (especially in the energy sector); using debt in this fashion retards the growth in business investment and hence in overall national income.

In sum, these are not rosy conditions that are conducive to kicking back and being content with the world. Meaningful economic growth is not assured; profitability will continue to be harder to maintain; and current debt levels, especially in the corporate sector, poise significant systemic risks.

Disclosure: None.