November Crop Report: Larger Than Expected US Corn & Soybeans Crops Press Prices

Market Analysis

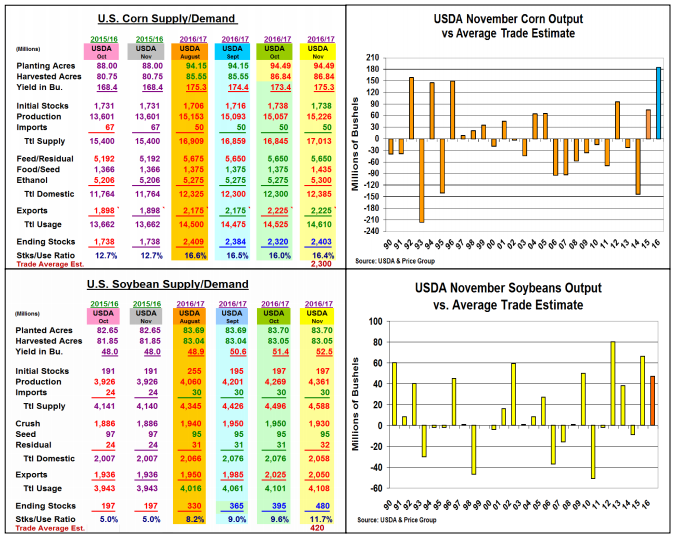

The USDA threw a curveball on its November’s crop report when they boosted both their corn and soybean US average yields above the trade’s expectations. Instead of a slight drop in corn’s yield, their latest update projected the national yield at 175.3 bu., up 1.9 bu. from October. Nov’s US bean yield forecast was also 0.5 bu. above expectations at 52.5 bu on this week’s report.

In corn, this month’s highly unusual 185 million bu. rise over the trade’s average estimate (highest in 27 years and only the third higher level in 11 years) prompted a quick sell-off in this feedgrain. Overall, 2016/17 crop size is a record 15.226 billion. This year’s extended fall (late freeze) was behind the NC region’s higher yields while dryness hit the SC/SE clipping yields. States from Houston to Detroit experienced unchanged yields vs. October. Interestingly, stronger industrial (ethanol and food) demand level reduced this grain’s ending stock revision to just 83 million bu. increase to 2.403 billion this month.

In soybeans, a 0.6 bu rise in the US yield trend was expected given the strong country reports heard this past month, but November’s crop increased another 47 million bu. to 4.361 billion bu. (also a record). Interestingly, this rise joined 3 other years with higher output in the past 5 years, but 2016’s crop rise was below 2015 and 2012 increases. Overall, this year’s 14% yield increase is the largest yearly rise since 1994. This year’s late freeze across the northern US also helped boost yields in this region from last month while the SC & SE regions were impacted by drought like corn this month. As expected, the USDA did increase November’s bean export by 25 million to 2.05 billion because of strong shipments and sales, but they also shaved 20 million off of our US crush because sluggish meal export sales and more DDGs staying in the US because of China’s decision to announce anti-dumping measures on imports this fall.

What’s Ahead

Given this year’s hefty export sales and the need to push a high percentage of these supplies through our US barge/river system before its early December close, both corn & soybean prices could remain buoyant despite the USDA’s higher crops. However, producers still need to utilize prices near recent highs (Dec $3.55-60 & Jan $10.20-30) as selling opportunity to cover early winter cash needs.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more