Northstar Is Far From An Intelligent REIT Alternative

Warren Buffett famously said, "Never invest in a business you don't understand." That's one reason that I have never hit the BUY button for Northstar Realty Finance (NYSE:NRF). I'm sure that the New York-based REIT is a sound business, but the complex structure seems to provide less transparency, often distorting the true value of the company.

I'll admit I'm not an expert when it comes to understanding NRF, especially the various components of the REIT - from SPEs, VIEs, PEs, CDOs, CMOs, and CMBS (I provide explanations for these terms in my newsletter) - it gets downright perplexing.

However, I am intrigued with NRF and its diversified commercial real estate portfolio with 82% of total assets invested in real estate (and 74% is invested in direct real estate investments). In 2015, the company generated 70% of total revenue from real estate and substantially all assets are invested in and revenues are generated from real estate (excluding the European Portfolio).

Another famous line from Warren Buffett,

One of the things we try very hard to do at Berkshire, is to stay within what I call our circle of competence.

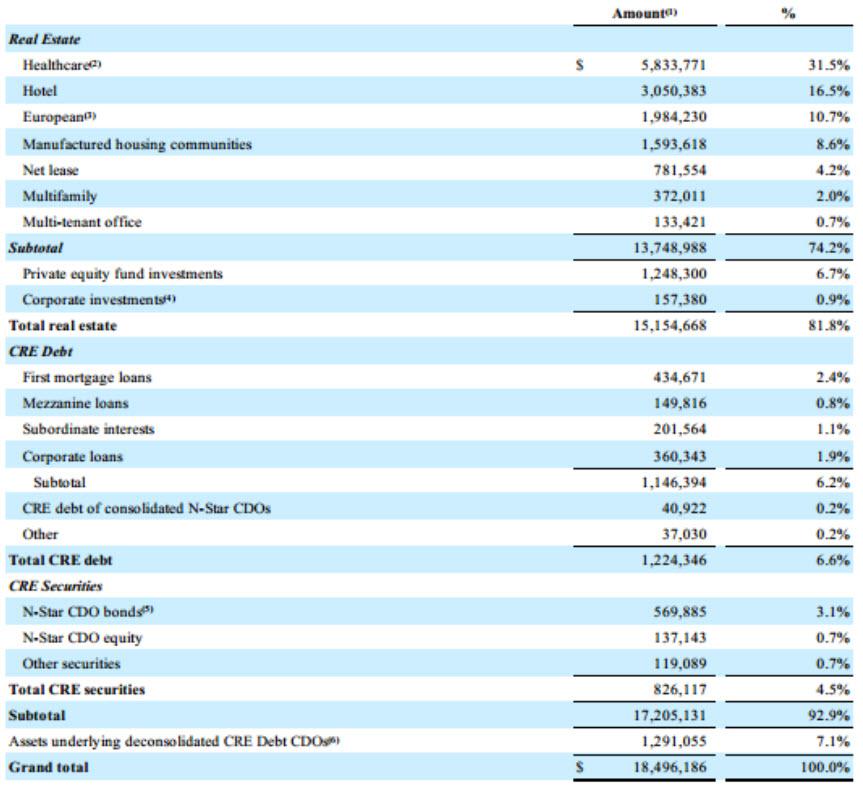

NRF is a seemingly complicated platform that invests in multiple asset classes across commercial real estate (or CRE). The following table presents NRF's investments as of December 31, 2014, adjusted acquisitions and commitments to purchase real estate through February 24, 2015:

Click on picture to enlarge

On February 26, 2015, NRF announced that its board had approved a plan to spin-off the European real estate business into a newly formed publicly traded REIT, Northstar Realty Europe Corp. (NRE) expected to be listed on the New York Stock Exchange and potentially in Europe. European Spin (NRE) is expected to be completed in the second half of 2015.

As part of NRF's real estate strategy, the REIT explores a variety of real estate investments, both directly and through joint ventures, in order to purchase real estate bolstered by attractive returns.

I consider NRF somewhat of an "incubator" of sorts in which the company provides capital for a diverse platform utilizing equity and non-recourse (non mark-to-market financing available through commercial mortgage-backed securities), CMBS, and agency financing markets.

As I examine NRF as a potential investment, I ask myself whether I would want to own an "incubator" or a REIT that invests in a "circle of competence." It's true that Warren Buffett's Berkshire Hathaway (NYSE:BRK-A) (NYSE:BRK-B) is merely a collection of differentiated businesses that all enjoy "circle of competence" attributes (but each of his businesses also have dedicated management).

So why wouldn't NRF qualify as a similar Berkshire conglomerate that owns a variety of real estate sectors - each demonstrating a uniquely positioned value thesis?

External Management Doesn't Excite Me

NRF is externally managed and the company has engaged Northstar Asset Management Group Inc. (NYSE:NSAM) to provide asset management and other services pursuant to a long-term management agreement and other ancillary agreements. Last year, NSAM spun-off from NRF.

The ability for NRF to achieve investment objectives and to make distributions to stockholders will depend in substantial part upon the performance of NSAM and its ability to provide asset management and other services.

NRF pays NSAM an annual base management fee regardless of the performance of the portfolio. Consequently, NRF is required to pay NSAM significant base management fees in a particular quarter despite experiencing a net loss or a decline in the value of its portfolio during that quarter.

Also NSAM has the ability to earn incentive fees each quarter based on NRF's cash available for distribution (or CAD) which may create an incentive for NSAM to invest in assets with higher yield potential, which are generally riskier or more speculative, or sell an asset prematurely for a gain and pay down borrowings, in an effort to increase its short-term net income and thereby increase the incentive fees to which it is entitled.

The compensation payable to NSAM will increase as a result of future issuances of equity securities, even if the issuances are dilutive to existing stockholders. NRF's base management fee to NSAM is equal to 1.5% per annum of the sum of (source 10-K):

• cumulative net proceeds of all future common equity and preferred equity issued by us;

• equity issued by us in exchange or conversion of exchangeable senior notes based on the stock price at the date of issuance;

• any other issuances by us of common equity, preferred equity or other forms of equity, including but not limited to limited partnership interests in an operating partnership (excluding equity-based compensation, but including issuances related to an acquisition, investment, joint venture or partnership); and

• our cumulative CAD in excess of cumulative distributions paid on our common stock, LTIP units or other equity awards beginning the first full calendar quarter after the spin-off.

Overview of Northstar's Real Estate

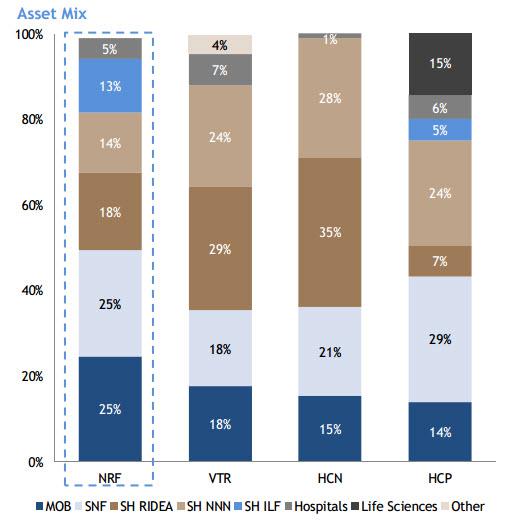

NRF's portfolio is primarily comprised of healthcare, hotel, manufactured housing communities, net lease, multifamily properties and international real estate, with a current focus on Europe. As of December 31, 2014, approximately 42% of NRF's real estate investments are concentrated in medical office buildings MOBs) and other healthcare-related facilities.

Following the completion of the acquisition of the Griffin-American Portfolio, NRF significantly increased its ownership of healthcare real estate properties in the portfolio.

NRF's Healthcare portfolio is being run by James F. Flaherty III who was previously the CEO of HCP, Inc. (NYSE:HCP). It's worth noting that if Flaherty were at HCP today he would be dealing with the difficulties associated with the HCR ManorCare exposure. It was Flaherty who negotiated the HCR deal and now current CEO, Lauralee Martin, is having to manage the risks (created by Flaherty). Here's a snapshot of the NRF Healthcare portfolio:

NRF's Healthcare portfolio should generate around $430 million in NOI in 2015. It's important to note that NRF outsources all of its asset management functions. That's a key differentiator when you consider the fact that peers like Healthcare Trust of America (NYSE:HTA) are almost 100% internalized (in its management services). In other words, I view NRF as an "asset aggregator" and not much of a "risk manager." Ask yourself what you are actually getting when you invest in NRF.

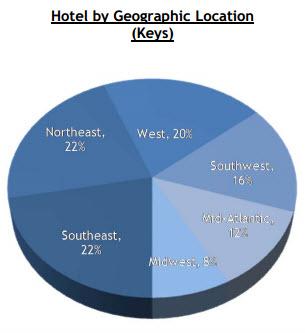

NRF's second largest exposure is in the Lodging sector. Recently, the company entered into an agreement to acquire a $170 million hotel portfolio consisting of nine upscale extended stay and premium branded select service hotels containing over 1,000 rooms located in New England markets, in New Hampshire and Massachusetts. These new investments should produce positive earnings in the months ahead from the seasonality in NRF's $3 billion hotel portfolio.

NRF currently relies upon Island to manage most of the hotels. For this reason, NRF is unable to directly implement strategic business decisions with respect to the daily operation and marketing of the hotels, such as decisions with respect to the setting of room rates, repositioning of a hotel, food and beverage pricing and certain similar matters.

As a result, NRF has limited recourse under its management agreements and the cash flow from the hotels may be affected adversely if managers fail to provide quality services and amenities or if they or their affiliates fail to maintain a quality brand name. Also, because NRF's management agreements are long-term agreements, they may not be able to terminate these agreements if the manager is not performing adequately.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more