Going Long Nickel

I have been hinting about going long nickel in several posts. I've now actually done it.

Undervaluation The ten-year graphs on this site forecast that nickel will double in real terms in ten years. That's a pretty good starting point. Nickel is the most undervalued metal I follow. BTW, there is a good reason for this. Back a few years ago, when China was frantically buying every metal in sight, Indonesia enacted an embargo on nickel ore exports. Their objective was to force local processing of the ore. Because many believed that Indonesia could not build the necessary processing facilities quickly enough, this created a panic in the market. Nickel went to absurdly high prices. This led to more production, and the typical commodity "cobweb" ensued. I think we are now at the opposite end of the cycle.

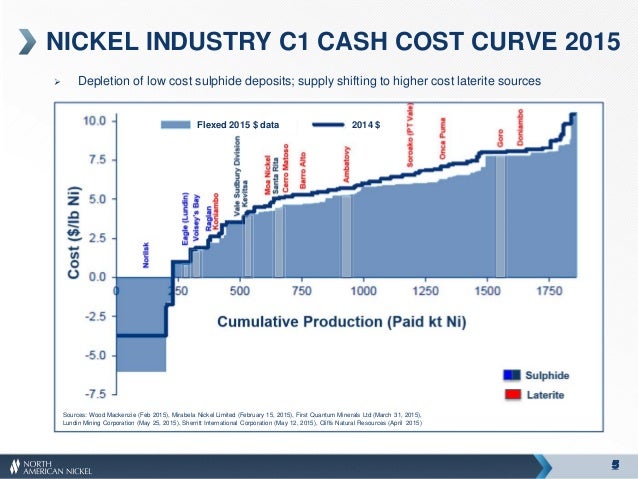

Nickel now sells for about $4 per lb. The graph below gives the cost curve. Most production is now losing money. BTW, the negative costs for Norislk (NILSY) is not an error. Norilsk produces so much coproduct metals that it more than covers their production costs. More on that later.

The fact that these miners are losing money does not mean they will shut down production immediately. Current prices may well cover their cash production costs. Also, some production is going to be subsidised. For example, France said last month that it would subsidise the nickel industry in New Caledonia, which had previously been expected to reduce production. Another issue is that the value of the Indonesian Rupiah has fallen by about half. This reduces the cost curve.

Nonetheless, the main thrust of this blog is to think strategically. All the above risks are short to intermediate term. In due time production will be shut down, and prices will rise. The remaining producers wind up doing very well. This is a three year trade.

So how to play this. Normally for longer term trades, I like to invest in the equity or debt of the lowest cost tradable producer. That would be Norilsk (Moscow: GMKN). For more on Norilsk's fundamentals, see this article by Metallum Research.

My numbers are slightly different from his, but only marginally. Also note that Norilsk also produces other metals, particularly copper and palladium. These revenues combined are actually larger than from nickel. I am a little bullish on palladium and a little bearish on copper.

In this case, however, I also bought LME nickel. The total return from this I estimate at 10% - 15% per year unlevered (I am unlevered). It's also easily tradable. More important, it does not have the Russian country risk. Now I personally feel that the Russian situation is not as bad as the market thinks, and its market is undervalued. But I could easily be wrong here. So keep that in mind if you follow me into Norilsk.

Disclosure: None.