Nasdaq Index Recovered Today

The Short-Term Trend

The Nasdaq Index recovered very nicely today, and the Small Cap Index is reaching up to new highs. It is hard to declare a downtrend with charts like this.

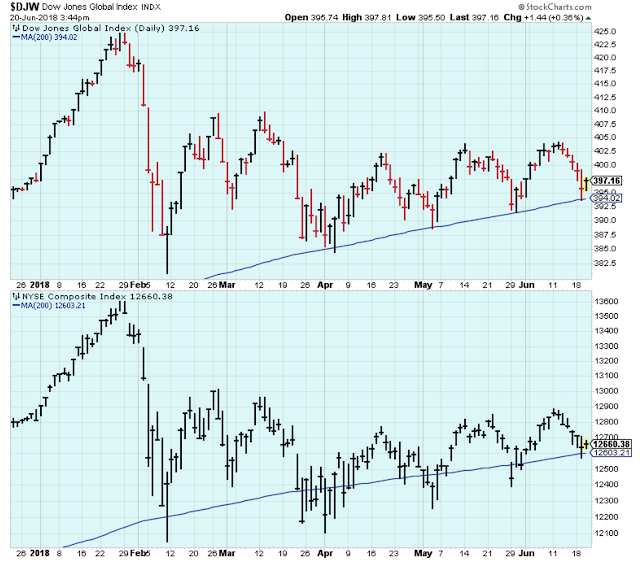

The chart above shows indexes at new highs, but the chart below shows indexes touching their 200-day moving averages. This does not look like an uptrend at all.

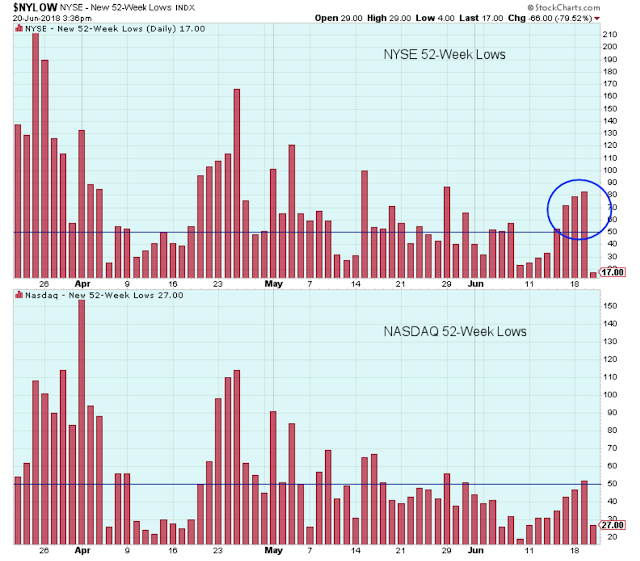

There have been too many new 52-week lows on the NYSE. It is a warning signal.

The Medium-Term Trend

I don't have much time, so I am just going to make a few comments with a few charts.

While this ETF trades above the neckline, it favors higher prices for the general market. If it falls below, then the level of caution is raised considerably.

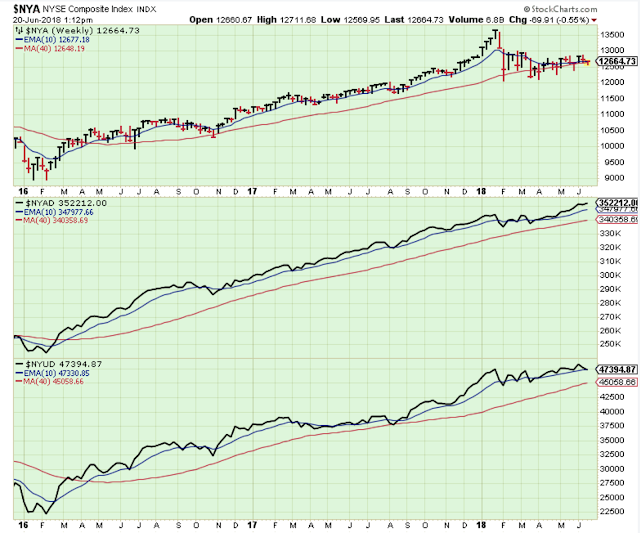

The NYSE advance/declines and up/down volume still look good.

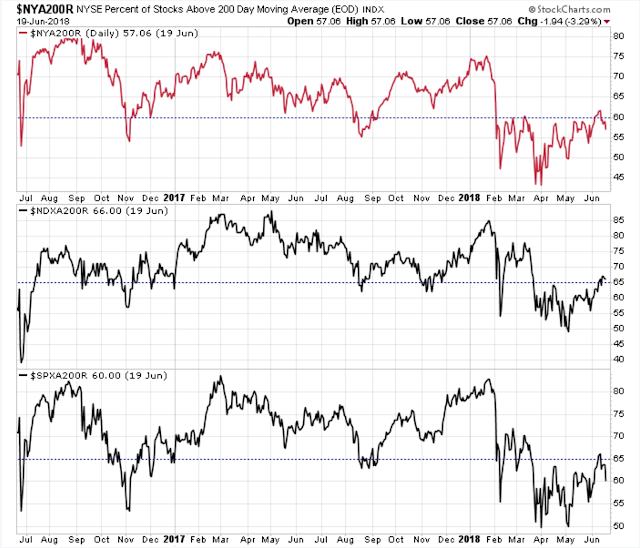

This chart is a concern. The number of trending stocks is well below where a bull would like it to be.

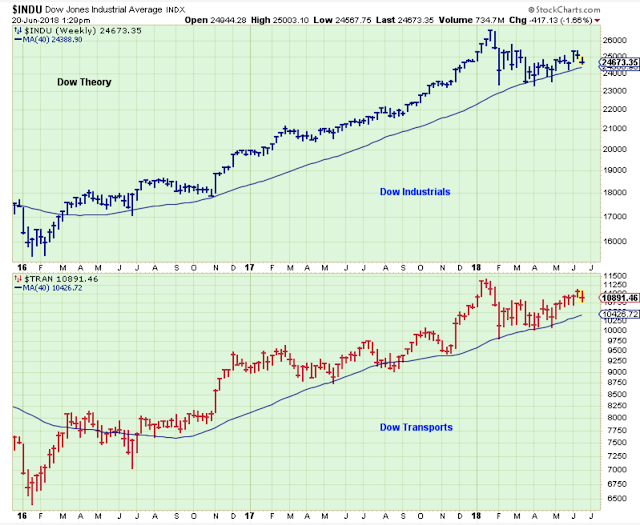

The old fashion Dow Theory still favors stocks going higher.

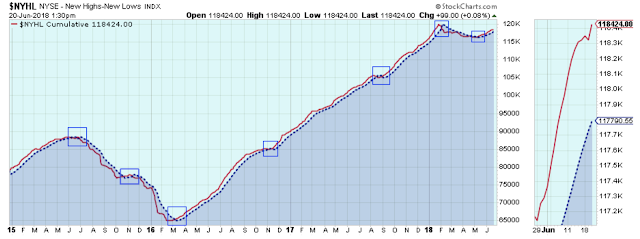

The trend for new highs/ new lows is still favorable.

Outlook Summary:

- The long-term outlook is cautious. Higher rates and Federal deficits.

- The medium-term trend is up as of May-10.

- The short-term trend is down as of Jun-19.

- The medium-term trend for bond prices is up as of Jun-19.

Investing Themes:

- Technology

- Medical Products

- Cyber Security

- Payment Processors

- Small and Micro Caps

- Gaming

Strategy:

- Buy large cap stocks and ETFs at the lows of the medium or short-term trends.

- Buy small cap growth stocks on break outs to new highs in the early stages of short-term up trends.

- Stop buying when the short-term trend is at the top of the range.

- Take partial profits when the uptrend starts to struggle at the highs.

- Never invest based on personal politics.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more