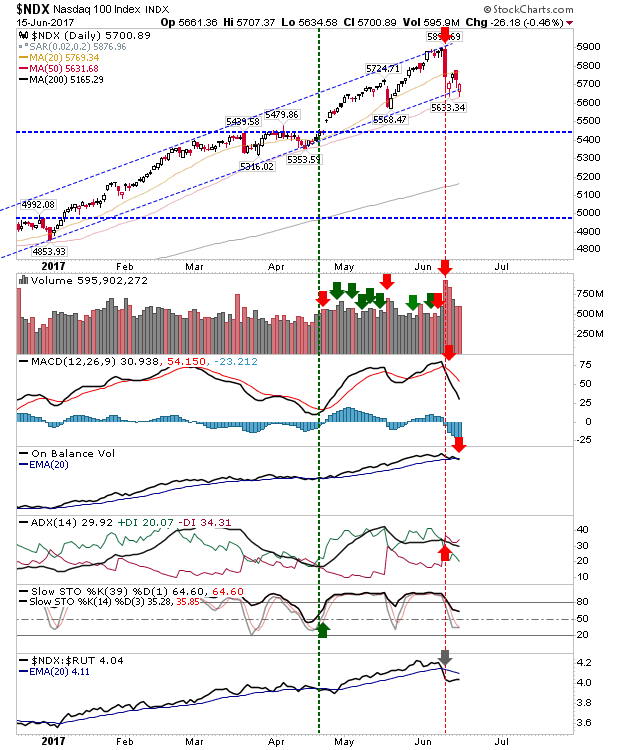

Nasdaq 100 At Support

It was a mixed day for markets. The day started with a gap down but bulls were able to make a respectable recovery to finish well yet still net down on the day.

The index best placed for a bounce on Friday is the Nasdaq 100. In addition to finishing on rising channel support the index has the 50-day MA to lean on too. Today's open started at the 50-day MA. Technicals do not offer much encouragement with a new 'sell' trigger in On-Balance-Volume to follow the existing 'sell' in the MACD.

The S&P continues to shape a trading range. Today's action did little to change that. The MACD saw a 'sell' trigger, but in itself doesn't mean much unless confirmed with a downside break of the trading range (illustrated in the chart below).

The Rusell 2000 lost ground against yesterday's 'bull trap' placing it back inside the consolidation. It did manage a decent finish, so watch for a challenge on the 'bull trap' which could catch many shorts out.

Momentum players still have the Dow Jones Index. Today's action did little damage to its breakout. Technicals for this index are still in good shape.

Shorts still have one avenue to work and that's the Semiconductor Index. Thursday's finish left the index below the sharply rising channel. A move back to tag this former support level could see shorts stir into action, but a move above 1,100 would negate this short position.

For tomorrow, momentum players still have the Dow Jones Index, support/demand traders can look to the Nasdaq 100, while shorts can look to the Semiconductor Index.