Morning Call -11/5/2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.50%) this morning are up +0.39% after the results of the mid-term elections showed Republicans won control of the U.S Senate in for the first time in 8 years, which is seen as business friendly. European stocks are up +1.48% as better-than-expected earnings results from Marks & Spencer Group Plc., UK's biggest clothing retailer, and from Hannover Re, the world's third-largest reinsurer by market value, boosted the overall market. The Russian ruble fell to a record low of 44.96 per dollar, but came off that low on signs that Russia's central bank may allow the currency to trade freely after the Bank of Russia said it was abandoning its predictable intervention policy to hamper "speculative strategies" against the currency. The Bank of Russia said it will spend only $350 million once a day in intervention and said it won't exclude additional interest rate increases in an attempt to shore up the ruble. Asian stocks closed mostly lower: Japan +0.44%, Hong Kong -0.63%, China -0.39%, Taiwan -0.30%, Australia -0.04%, Singapore +0.19%, South Korea -0.26%, India +0.20%. Commodity prices are mostly lower as the dollar strengthens. Dec crude oil (CLZ14 +0.04%) is down -0.05%. Dec gasoline (RBZ14 -0.51%) is down -0.38% at a 4-year low. Dec gold (GCZ14 -2.36%) is down -2.43% at a 4-1/2 year low. Dec copper (HGZ14 -1.21%) is down -1.49% at a 2-week low. Agriculture prices are weaker. The dollar index (DXY00 +0.61%) is up +0.62% at a 4-1/3 year high. EUR/USD (^EURUSD) is down -0.58%. USD/JPY (^USDJPY) is up +0.93% at a 6-3/4 year high as the yen fell after BOJ Governor Kuroda hinted the BOJ may further expand its stimulus measures when he said that he means business in ending what he calls a "deflationary mindset" in Japan and that there is "no limit for additional easing, including on bond purchases." Dec T-note prices (ZNZ14 -0.10%) are down -4 ticks.

Eurozone Sep retail sales fell -1.3% m/m, a bigger decline than expectations of -0.8% m/m and the largest drop in 2-1/3 years. On an annual basis, Sep retail sales rose +0.6% y/y, less than expectations of +1.4% y/y.

The Eurozone Oct Markit composite PMI was revised lower to 52.1 from the originally reported 52.2.

The German Oct Markit services PMI was revised lower to 54.4 from the originally reported 54.8, the slowest pace of expansion in 7 months.

The UK Oct Markit/CIPS services PMI fell -2.5 to 56.2, a bigger decline than expectations of -0.2 to 58.5 and the slowest pace of expansion in 17 months.

The UK Oct BRC shop price index fell -1.9% y/y, a steeper decline than expectations of -1.7% y/y and matched July's drop as the largest decrease since the data series began in 2006.

Japan Sep labor cash earnings rose +0.8% y/y, right on expectations, although Aug was revised lower to +0.9% y/y from the originally reported +1.4% y/y.

U.S. STOCK PREVIEW

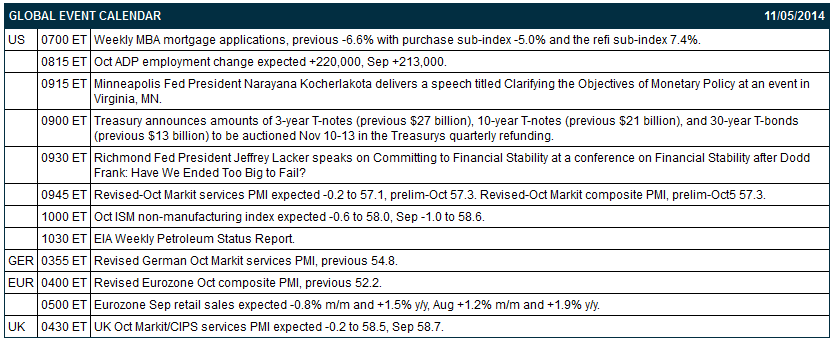

Today’s Oct ADP employment report is expected to show an increase of +220,000, strengthening a bit from the +213,000 rise seen in September. The market is expecting today’s Oct ISM non-manufacturing index to show a -0.6 point decline to 58.0, adding to the -1.0 point decline to 58.6 seen in September.

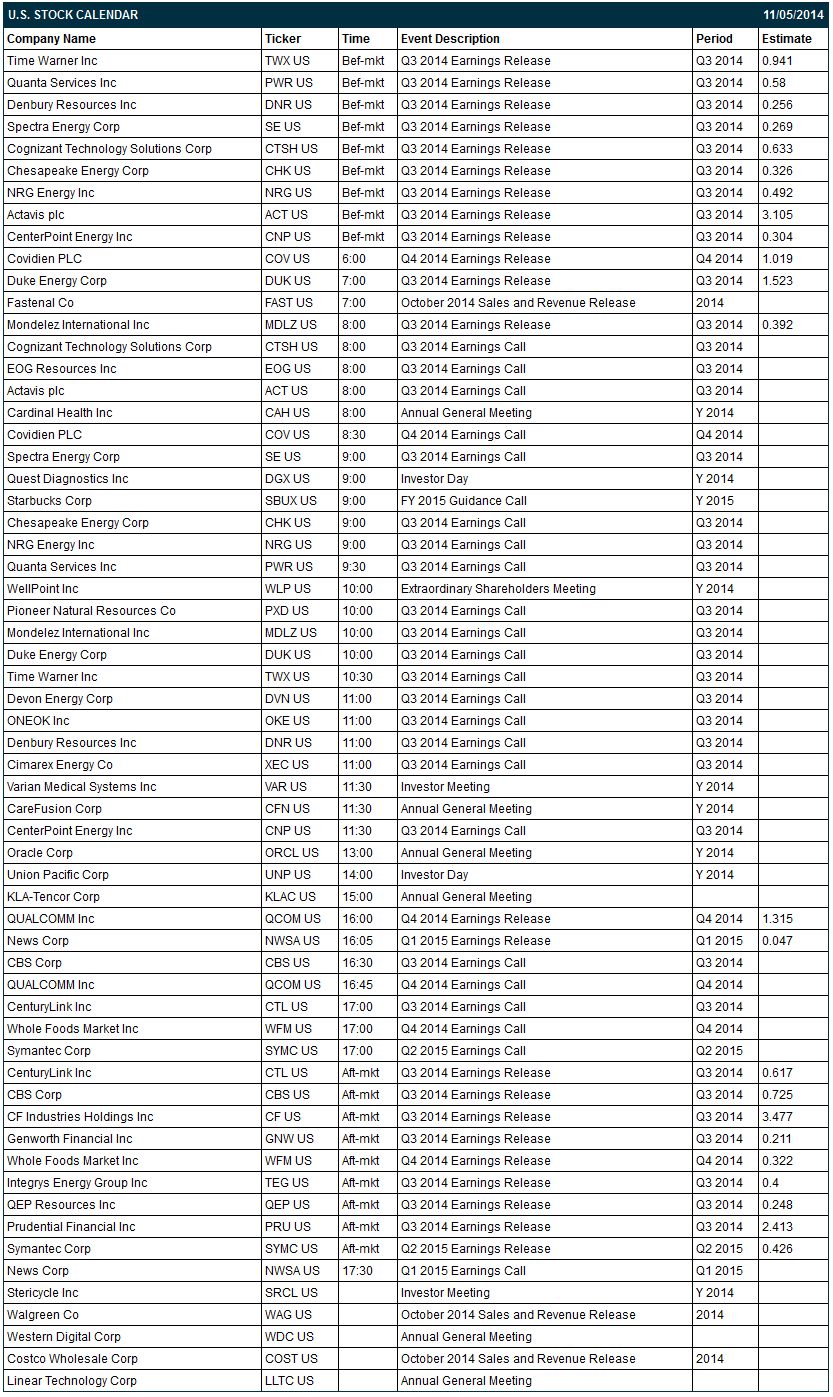

There are 23 of the S&P 500 companies that report earnings today with notable reports including: Time Warner (consensus $0.94), Duke Energy (1.52), News Corp (0.05), CBS Corp (0.73), Genworth Financial (0.21), Whole Foods (0.32), Prudential Financial (2.41), Symantec (0.43). Equity conferences this week include: Latin Markets Hedge Fund Americas Forum on Tue-Wed, Gabelli & Company Automotive Aftermarket Symposium on Tue, Raymond James Global Airline Transportation Conference on Thu, BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Time Warner (TWX -4.81%) reported Q3 EPS of $1.22, higher than consensus of 94 cents.

Covidien PLC (COV -0.42%) reported Q4 EPS of $1.15, better than consensus of $1.02.

EOG Resources (EOG -3.26%) rose over 5% in after-hours trading after it reported Q3 adjusted EPS of $1.31, higher than consensus of $1.30.

Papa John's (PZZA +0.97%) reported Q3 EPS of 39 cents, above consensus of 37 cents.

Levin Capital Strategies reported a 5.0% passive stake in Great Western (GWB -0.86%) .

Cimarex Energy (XEC -3.81%) reported Q3 adjusted EPS of $1.53, better than consensus of $1.51.

KAR Auction (KAR -0.79%) reported Q3 adjusted EPS of 40 cents, higher than consensus of 31 cents.

Team Health (TMH +0.23%) reported Q3 adjusted EPS of 60 cents, better than consensus of 59 cents.

Activision Blizzard (ATVI -1.72%) climbed over 3% in after-hours trading after it reported Q3 EPS of 23 cents, well above consensus of 13 cents, and then raised guidance on fiscal 2014 EPS to $1.35 from $1.29, higher than consensus of $1.33.

Intel (INTC +0.67%) fell over 1% in after-hours trading after it was downgraded to 'Underperform' from 'Market Perform' at Bernstein.

Pioneer Natural (PXD -3.84%) reported Q3 adjusted EPS of $1.35, higher than consensus of $1.26.

21st Century Fox (FOXA -2.97%) reported Q1 EPS of 48 cents, well above consensus of 36 cents.

Itron (ITRI -2.15%) reported Q3 EPS of 39 cents, better than consensus of 36 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.50%) this morning are up +7.75 points (+0.39%). The S&P 500 index on Tuesday closed lower: S&P 500 -0.28%, Dow Jones +0.10%, Nasdaq -0.317%. Bearish factors included (1) carry-over selling from a slide in European stocks after the European Commission said the recovery in the Eurozone is “not only subdued but also fragile” as it cut its Eurozone 2014 GDP forecast to +0.8% from a May forecast of +1.2%, (2) the -$43.0 billion U.S. Sep trade deficit, wider than expectations of a -$40.2 billion deficit, which may lead to Q3 GDP being revised lower, and (3) a slide in energy producers after crude oil tumbled to a 3-year low.

Dec 10-year T-notes (ZNZ14 -0.10%) this morning are down -4 ticks. Dec 10-year T-note futures prices on Tuesday closed slightly higher: TYZ4 +0.50, FVZ4 unch. Bullish factors included (1) speculation that the fall in crude oil prices to a 3-year low will reduce inflation expectations, (2) increased safe-haven demand for T-notes after stocks fell, and (3) positive carry-over from a rally in German bunds to a 2-week high after the EU cut its 2014 and 2015 Eurozone GDP and inflation forecasts.

The dollar index (DXY00 +0.61%) this morning is up +0.537 (+0.62%) at a 4-1/3 year high. EUR/USD (^EURUSD) is down -0.0073 (-0.58%). USD/JPY (^USDJPY) is up +1.06 (+0.93%) at a 6-3/4 year high. The dollar index on Tuesday closed lower. Closes: Dollar index -0.325 (-0.37%), EUR/USD +0.00647 (+0.52%), USD/JPY -0.441 (-0.39%). Negative factors included (1) weakness in USD/JPY as the fall in stock prices boosted safe-haven demand for the yen, and (2) strength in EUR/USD after Eurozone Sep producer prices unexpectedly rose, which reduced deflation concerns and dampened speculation the ECB will boost stimulus.

Dec WTI crude oil (CLZ14 +0.04%) this morning is down -4 cents (-0.05%) and Dec gasoline (RBZ14 -0.51%) is down -0.0079 (-0.38%) at a new 4-year low. Dec crude and Dec gasoline on Tuesday sold off with Dec crude at a 3-year low and Dec gasoline at a 4-year low. Closes: CLZ4 -1.59 (-2.02%), RBZ4 -0.0396 (-1.87%). Bearish factors included (1) Saudi Arabia’s cut in the price of crude oil that it sells to the U.S. in an attempt to preserve its share of OPEC output, (2) the European Commission’s cut in its Eurozone 2014 and 2015 GDP estimates, a sign of weaker fuel demand, and (3) expectations for Wednesday’s weekly EIA crude inventories to increase by +1.8 million bbl.

Disclosure: None