Morning Call For Wednesday, Nov. 15

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.44%) this morning are down -0.52% at a 2-week low and European stocks are down -0.78% at a 1-3/4 month low. Global stock markets moved lower as weakness in energy and mining stocks led losses in world bourses. Energy stocks declined with Dec WTI crude oil (CLZ17 -1.10%) down -1.17% after API data late Tuesday showed U.S. crude inventories rose +6.51 million bbl last week. Mining stocks moved lower after Dec COMEX copper (HGZ17 -0.54%) slid -0.65% to a 5-week low on the prospect of slower growth in China that will curb its demand for copper and other industrial metals. Asian stocks settled lower: Japan -1.57%, Hong Kong -1.03%, China -0.79%, Taiwan -0.53%, Australia -0.58%, Singapore -0.89%, South Korea -0.43%, India -0.55%. China's Shanghai Composite fell to a 1-week low and Japan's Nikkei Stock Index dropped to a 2-week low, led by losses in commodity producers and energy stocks. Japanese stocks were also under pressure after Japan Q3 GDP grew at a slower-than-expected pace.

The dollar index (DXY00 -0.31%) is down -0.30% at a 3-week low after Chicago Fed President Evans said we're facing "below-target inflation expectations." EUR/USD (^EURUSD) is up +0.38% at a 3-week high after ECB Governing Council member Hansson said the short-term economic risks in the Eurozone are to the upside. USD/JPY (^USDJPY) is down -0.65% at a 3-week low as the sell-off in global stocks boosted the safe-haven demand for the yen.

Dec 10-year T-note prices (ZNZ17 +0.25%) are up +11.5 ticks.

Chicago Fed President Evans said we're facing "below-target inflation expectations" and he is concerned "that persistent factors are holding down inflation, rather than idiosyncratic transitory ones." and that he has an "open mind" when it comes toward a decision in Dec on interest rates.

ECB Governing Council member Hansson said the short-term economic risks in the Eurozone are to the upside and the ECB is increasingly confident inflation will reach the levels consistent with our aim.

Japan Q3 GDP rose +1.4% (q/q annualized), weaker than expectations of +1.5% (q/q annualized). The Q3 deflator rose +0.1% y/y, right on expectations. Q3 private consumption fell -0.5% q/q, weaker than expectations of -0.4% q/q. Q3 business spending rose +0.2% q/q, weaker than expectations of +0.3% q/q.

U.S. STOCK PREVIEW

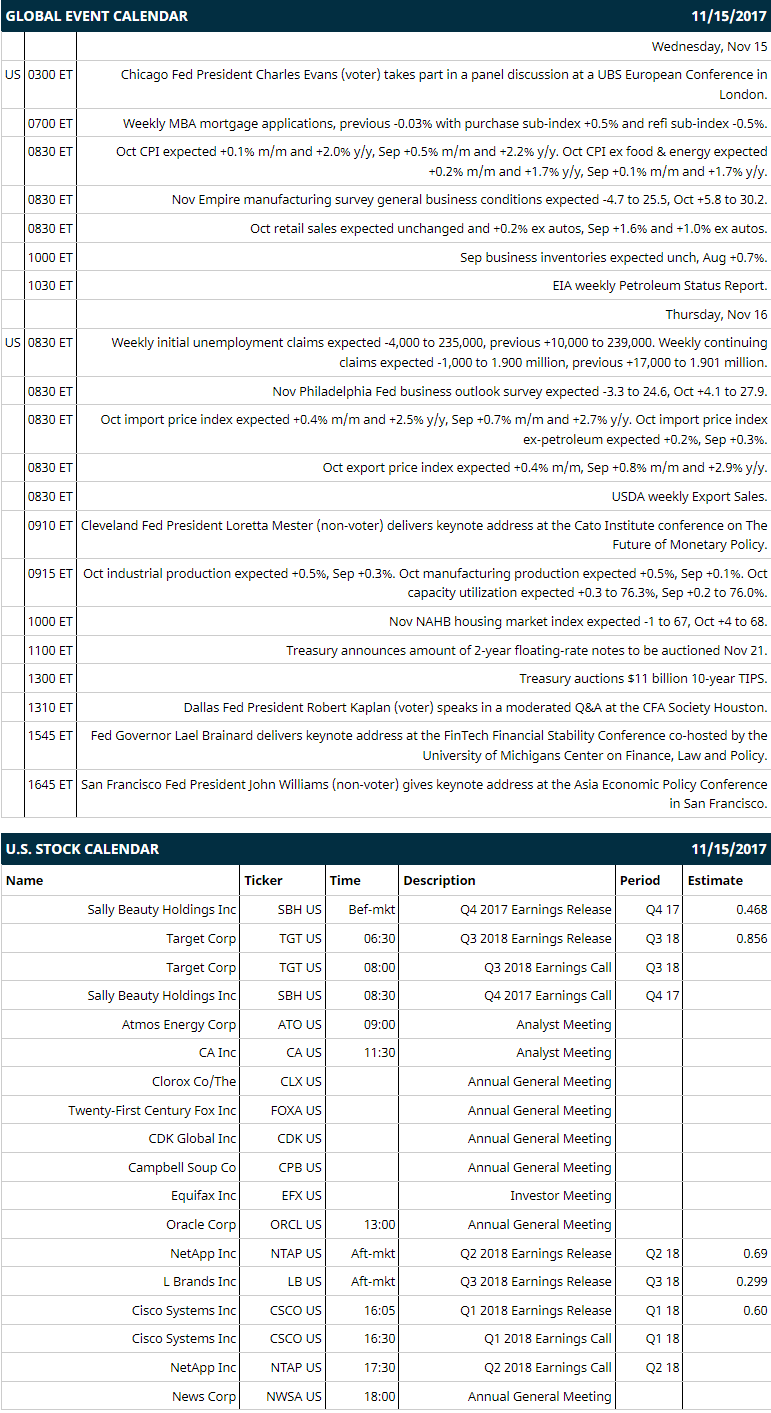

Key U.S. news today includes: (1) Chicago Fed President Charles Evans (voter) takes part in a panel discussion at a UBS European Conference in London, (2) weekly MBA mortgage applications (previous -0.03% with purchase sub-index +0.5% and refi sub-index -0.5%), (3) Oct CPI (expected +0.1% m/m and +2.0% y/y, Sep +0.5% m/m and +2.2% y/y) and Oct CPI ex food & energy (expected +0.2% m/m and +1.7% y/y, Sep +0.1% m/m and +1.7% y/y), (4) Nov Empire manufacturing index (expected -5.2 to 25.0, Oct +5.8 to 30.2), (5) Oct retail sales (expected unchanged and +0.2% ex autos, Sep +1.6% and +1.0% ex autos), (6) Sep business inventories (expected unch, Aug +0.7%), (7) EIA weekly Petroleum Status Report.

Notable Russell 2000 earnings reports today include: Cisco Systems (consensus $0.60), L Brands (0.30), NetApp (0.69), Target (0.86), Sally Beauty Holdings (0.47).

U.S. IPO's scheduled to price today: Arsanis Inc (ASNS), MPM Holdings (MPMQ).

Equity conferences during the remainder of this week: Bank of America Merrill Lynch Future of Financials Conference on Tue-Wed, Goldman Sachs Industrials Conference on Tue-Wed, Morgan Stanley Global Consumer & Retail Conference on Tue-Wed, Barclays Global Automotive Conference on Wed, MoffettNathanson Inaugural Software Forum on Wed, Morgan Stanley Global Chemicals and Agriculture Conference on Wed, UBS Industrial and Transportation Conference on Wed, Universal Companion Diagnostic Test Personalized Medicine Conference on Wed, Jefferies London Health Care Conference on Wed-Thu, Morgan Stanley European Technology, Media & Telecom Conference on Wed-Thu, Deutsche Bank Lithium Supply Chain and Energy Storage Conference on Thu, MKM Partners Entertainment, Travel & Technology Conference on Thu, Bank of America Merrill Lynch Global Energy Conference on Thu-Fri, Gabelli & Co Financial Services Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Acorda Therapeutics (ACOR +1.81%) plunged 32% in pre-market trading after it reported possible drug-related deaths in a Phase 3 study of its tozadenant for treatment of Parkinson's disease.

Tyson Foods (TSN +0.64%) was upgraded to 'Buy' from 'Hold at Argus Research.

Lam Research (LRCX -0.28%) gained over 2% in after-hours trading after it boosted its quarterly dividend to 50 cents a share from 45 cents, and then announced a $2 billion share buyback authorization.

Hewlett Packard Enterprise (HPE -1.56%) rose 1% in after-hours trading after holder Greenlight Capital boosted its stake in the company to 7.81 million shares from 3.36 million shares.

Applied Optoelectronics (AAOI -1.53%) climbed over 4% in after-hours trading after director of the company, Alan Moore, reported that he purchased 22,400 shares of the company stock at around $44.60 on Monday.

MACOM Technology Solutions Holdings (MTSI +0.11%) tumbled almost 13% in after-hours trading after it reported Q4 revenue of $166.4 million, weaker than consensus of $170.6 million, and then said it sees Q1 revenue of $130 million to $136 million, well below consensus of $171.1 million.

Genpact Ltd (G -0.13%) slid nearly 3% in after-hours trading after it announced a secondary offering of 10 million shares on behalf of selling holders.

Cargurus (CARG +0.91%) jumped over 11% in after-hours trading after it reported Q3 EPS of 2 cents, better than consensus of 0, and then said it sees Q4 EPS of 1 cent to 2 cents, the mid-point above consensus of 1 cent.

Beazer Homes USA (BZH +3.36%) rose over 4% in after-hours trading after it reported Q4 revenue of $673 million, higher than consensus of $640.3 million.

OM Asset Management Plc (OMAM -0.68%) lost 2% in after-hours trading after it announced a secondary offering of 6 million shares of its common stock.

SITO Mobile Ltd (SITO +2.33%) dropped 6% in after-hours trading after it reported a Q3 loss of -12 cents per share, wider than consensus of -5 cents per share loss.

Achillion Pharmaceuticals (ACHN -4.16%) fell 7% in after-hours trading after holder Johnson & Johnson Innovation said it intends to offer 18.4 million shares of ACHN, which constitutes its entire stake in the company.

SORL Auto Parts (SORL -4.01%) surged over 35% in after-hours trading after it reported Q3 revenue of $101.3 million, well above consensus of $63.8 million.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.44%) this morning are down -13.50 points (-0.52%) at a 2-week low. Tuesday's closes: S&P 500 -0.23%, Dow Jones -0.13%, Nasdaq -0.36%. The S&P 500 on Tuesday closed lower on concern a slowdown in Chinese growth will undercut global economic growth after China Oct industrial production rose +6.2% y/y, less than expectations of +6.3% y/y, and after China Oct retail sales rose +10.0% y/y, weaker than expectations of +10.5% y/y and the slowest pace of increase in a year. Weakness in energy stocks was another negative after crude oil prices fell -1.87% to a 1-week low.

Dec 10-year T-note prices (ZNZ17 +0.25%) this morning are up +11.5 ticks. Tuesday's closes: TYZ7 +3.50, FVZ7 +1.50. Dec 10-year T-notes recovered from a 2-week low and closed higher due to a slump in crude oil prices to a 1-week low, which undercut inflation expectations, and to a slide in stocks, which boosted the safe-haven demand for T-notes. A negative factor for T-notes was the +2.4% y/y increase in U.S. Oct core PPI, stronger than expectations of +2.2% y/y and the largest year-on-year increase in 5-1/2 years.

The dollar index (DXY00 -0.31%) this morning is down -0.282 (-0.30%) at a 3-week low. EUR/USD (^EURUSD) is up +0.0045 (+0.38%) at a 3-week high and USD/JPY (^USDJPY) is down -0.74 (-0.65%) at a 3-week low. Tuesday's closes: Dollar Index -0.663 (-0.70%), EUR/USD +0.0131 (+1.12%), USD/JPY -0.16 (-0.14%). The dollar index on Tuesday dropped to a 2-week low and closed lower due to strength in EUR/USD which rose to a 2-week high after German Q3 GDP rose more than expected and after the German Nov ZEW survey expectations of economic growth climbed to a 6-month high. Another negative for the dollar was a decline in the 10-year T-note yield, which lowered the dollar's interest rate differentials.

Dec crude oil (CLZ17 -1.10%) this morning is down -65 cents (-1.17%) and Dec gasoline (RBZ17 -1.53%) is -0.0291 (-1.65%). Tuesday's closes: Dec WTI crude -1.06 (-1.87%), Dec gasoline -0.0317 (-1.77%). Dec crude oil and gasoline on Tuesday fell to 1-week lows and closed lower after the IEA cut its global 2018 crude oil demand forecast by 200,000 bpd to 98.9 million bpd from a prior forecast of 99.1 million bpd. Gasoline prices were also pressured after the crack spread fell to a 3-week low, which may curb crude demand from refineries to refine crude into gasoline.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.20%) +2.4 (+0.19%), Dec silver (SIZ17 +0.33%) +0.047 (+0.28%) and Dec copper (HGZ17 -0.54%) -0.020 (-0.65%) at a 5-week low. Tuesday's closes: Dec gold +4.0 (+0.31%), Dec silver +0.026 (+0.15%), Dec copper -0.0515 (-1.65%). Metals on Tuesday settled mixed with Dec copper at a 5-week low. A fall in the dollar index to a 2-week low boosted gold and silver prices along with the stronger-than-expected U.S. Oct PPI, which boosted demand for gold as an inflation hedge. Copper prices fell on Chinese demand concerns after China Oct industrial production rose less than expected.

(Click on image to enlarge)

Disclosure: None.