Morning Call For Wednesday, August 23

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.23%) this morning are down -0.25% after President Trump last night at a rally in Arizona threatened to shut down the government over the Mexico border wall. The issue over funding for a border wall may become entangled with legislation to raise the federal government's debt limit, which needs to be raised by mid-Oct to avoid a default. Stocks also moved lower on global trade concerns when President Trump said he might terminate the North American Free Trade Agreement (NAFTA) at some point. The global trade concerns also weakened European stocks, which are down -0.12%, although losses were limited after stronger-than-expected Eurozone manufacturing data boosted confidence in the European economic outlook. Asian stocks settled mixed: Japan +.26%, Trading in Hong Kong was canceled due to Typhoon Hato, China -0.08%, Taiwan +0.14%, Australia -0.23%, Singapore -0.11%, South Korea +0.12%, India +0.88%. Chinese stocks closed lower and gains in Japanese stocks were capped on global trade concerns after President Trump threatened to end NAFTA.

The dollar index (DXY00 -0.24%) is down -0.15%. EUR/USD (^EURUSD) is up +0.18%. USD/JPY (^USDJPY) is down -0.15%.

Sep 10-year T-note prices (ZNU17 +0.02%) are unchanged.

The Eurozone Aug Markit manufacturing PMI unexpectedly rose +0.8 to 57.4, stronger than expectations of -0.3 to 56.3 and matched Jun as the fastest pace of expansion since the data series began in 2014.

U.S. STOCK PREVIEW

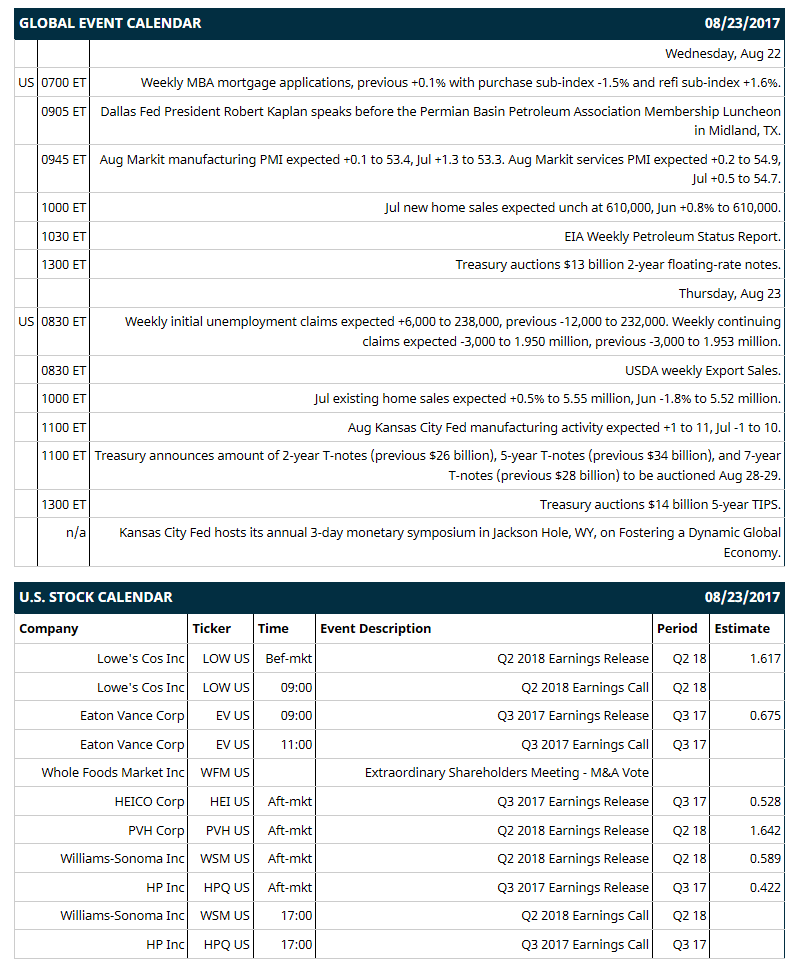

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +0.1% with purchase sub-index -1.5% and refi sub-index +1.6%), (2) Dallas Fed President Robert Kaplan speaks before the Permian Basin Petroleum Association Membership Luncheon in Midland, TX, (3) Aug Markit manufacturing PMI (expected +0.1 to 53.4, Jul +1.3 to 53.3) and Aug Markit services PMI (expected +0.2 to 54.9, Jul +0.5 to 54.7), (4) Jul new home sales (expected unch at 610,000, Jun +0.8% to 610,000), (5) Treasury auctions $13 billion 2-year floating-rate notes, (6) EIA Weekly Petroleum Status Report.

Notable Russell 1000 earnings reports today include: Lowe's (consensus $1.62), Eaton Vance (0.68), HEICO (0.53), PVH (1.64), Williams-Sonoma (0.59), HP (0.42).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: CFA Society of Minnesota Intellisight Conference on Tue-Wed, Healthcare Information & Management Systems Society Southeast Summit on Wed, Heikkinen Energy Conference on Wed, Raymond James SMID Cap Growth Conference on Wed, Southern California Investor Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Duluth Holdings (DLTH +6.55%) was downgraded to 'Market Perform' from 'Outperform' at Raymond James.

Baozun (BZUN -24.19%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Nordson (NDSN -10.89%) was upgraded to 'Buy' from 'Hold' at Gabelli & Co with a price target of $135.44

HP Inc. (HPQ +2.42%) was initiated with a 'Buy' at Loop Capital Markets with a 12-month target price of $23.

Rockwell Collins (COL +0.49%) was upgraded to 'Buy' from 'Hold' at Vertical Research Partners with a price target of $143.

Essent (ESNT +1.21% was upgraded to 'Outperform' from 'Market Perform' at Keefe, Bruyette & Woods with a price target of $44.

Ally Financial (ALLY +0.59%) rose 2% in after-hours trading after it said its bank subsidiary has been released from capital requirements tied to its application to the Federal Reserve System and will pay out a $2.9 billion dividend to Ally Financial in Q3.

Salesforce.com (CRM +1.30%) lost almost 2% in after-hours trading after it forecast Q3 deferred revenue growth of 18%-19% y/y, which implies billings of $1.95 billion at the midpoint, weaker than consensus of $2.17 billion.

Ultragenyx Pharmaceutical (RARE +3.41%) dropped 9% in after-hours trading after it said its Ace-ER Phase 3 did not meet the primary endpoint of demonstrating statistically significant difference in upper extremity muscle strength compared to a placebo in patients with GNE Myopathy.

Cree (CREE +2.04%) tumbled nearly 8% in after-hours trading after it reported Q4 adjusted gross margin of 28.0%, below consensus of 28.8%.

La-Z-Boy (LZB +0.32%) slumped over 14% in after-hours trading after it reported Q1 EPS of 24 cents, weaker than consensus of 29 cents.

21Vianet Group (VNET +0.66%) dropped 6% in after-hours trading after it reported Q2 net revenue fell -3.5% y/y to 878.7 million yuan, below the midpoint of a May estimate of Q2 revenue of 870 million yuan-910 million yuan.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.23%) this morning are down -6.25 points (-0.25%). Tuesday's closes: S&P 500 +0.99%, Dow Jones +0.90%, Nasdaq +1.50%. The S&P 500 on Tuesday closed sharply higher on speculation the Trump administration is gaining momentum in its efforts to pass tax reform legislation after Politico reported that Congressional lawmakers have found common ground on ways to pay for individual and corporate tax cuts. There was also strength in energy and mining stocks as crude oil prices rose +0.63% and copper prices climbed +0.22% to a new 2-3/4 year high.

Sep 10-year T-note prices (ZNU17 +0.02%) this morning are unch. Tuesday's closes: TYU7 -9.00, FVU7 -5.25. Sep 10-year T-notes on Tuesday closed lower on a report from Politico that said congressional leaders have made "significant strides" in shaping a tax overhaul, which may lead to more robust U.S. growth if implemented and prompt the Fed to keep raising interest rates. There was also reduced safe-haven demand with the rally in stocks.

The dollar index (DXY00 -0.24%) this morning is down -0.141 (-0.15%). EUR/USD (^EURUSD) is up +0.0021 (+0.18%) and USD/JPY (^USDJPY) is down -0.16 (-0.15%). Tuesday's closes: Dollar Index +0.450 (+0.48%), EUR/USD -0.0053 (-0.45%), USD/JPY +0.59 (+0.54%). The dollar index on Tuesday closed higher on weakness in EUR/USD after the German Aug ZEW survey expectations of economic growth fell more-than-expected to a 10-month low. The dollar also received a boost from the rise in 10-year T-note yields, which boosts the dollar's interest rate differentials.

Oct crude oil (CLV17 -0.31%) this morning is down -8 cents (-0.17%) and Oct gasoline (RBV17 -0.29%) is -0.0034 (-0.23%). Tuesday's closes: Oct WTI crude +0.30 (+0.63%), Oct gasoline +0.0054 (+0.36%). Oct crude oil and gasoline on Tuesday closed higher on news that Libya shut its Sharara oil field (the country's biggest) and on expectations for Wednesday's EIA crude inventories to fall by -3.5 million bbl.

Metals prices this morning are mostly higher with Dec gold (GCZ17 +0.27%) +1.8 (+0.14%), Sep silver (SIU17 +0.40%) +0.078 (+0.46%) and Sep copper (HGU17 +0.07%) unch. Tuesday's closes: Dec gold -5.7 (-0.44%), Sep silver -0.033 (-0.19%), Sep copper +0.0065 (+0.22%). Metals on Tuesday settled mixed with Sep copper at a new 2-3/4 nearest-futures high. Metals were boosted by a stronger dollar and the rally in stocks that curbed the safe-haven demand for precious metals. Copper closed higher on signs of tighter supplies after LME copper inventories fell -6,000 MT to a 1-1/2 month low of 255,700 MT.

(Click on image to enlarge)

Disclosure: None.