Morning Call For Tuesday, July 18

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.04%) this morning are down -0.03% after the U.S. Republican health care reform plan failed to secure enough votes to pass in the Senate, which reduces the prospects that the Trump administration will be able to pass any of its economic agenda. Also, weakness in European stocks is undercutting U.S. equities with European stocks down -0.59%, led by a 10% drop in Ericsson AB, after the company reported a Q2 net loss of -1 billion kroner from a profit of 1.59 billion kroner a year earlier. European stocks were also under pressure after the German Jul ZEW survey expectations of economic growth fell more than expected. Losses in U.S. stocks were limited as Netflix jumped 10% in pre-market trading after the company reported Q2 subscriber growth that well exceeded forecasts. Asian stocks settled mixed: Japan -0.59%, Hong Kong +0.21%, China +0.35%, Taiwan +0.23%, Australia -1.19%, Singapore +0.24%, South Korea +0.04%, India -1.13%. Chinese stocks erased early losses and closed higher as property stocks rallied after China Jun new home prices rose in 60 of 70 cities tracked by the government, up from 56 cities that rose in May. Japan's Nikkei Stock Index fell to a 1-week low as exporter stocks slid after the yen strengthened to a 1-week high against the dollar, which reduces the earnings prospects of exporters.

The dollar index (DXY00 -0.44%) is down -0.51% at a 10-1/4 month low as the failure by U.S. Republicans to pass their health care reform plan reduces expectations that they will be able to pass any of the Trump administration’s pro-growth policies. EUR/USD (^EURUSD) is up +0.71% at a 14-1/2 month high on speculation the ECB could signal its intent to scale back monetary stimulus when it meets Thursday. USD/JPY (^USDJPY) is down -0.50% at a 2-week low.

Sep 10-year T-note prices (ZNU17 +0.06%) are up +1.5 ticks.

The German Jul ZEW survey expectations of economic growth fell -1.1 to 17.5, weaker than expectations of -0.6 to 18.0.

UK Jun CPI was unch m/m and up +2.6% y/y, weaker than expectations of +0.2% m/m and +2.9% y/y. Jun core CPI rose +2.4% y/y, weaker than expectations of +2.6% y/y.

U.S. STOCK PREVIEW

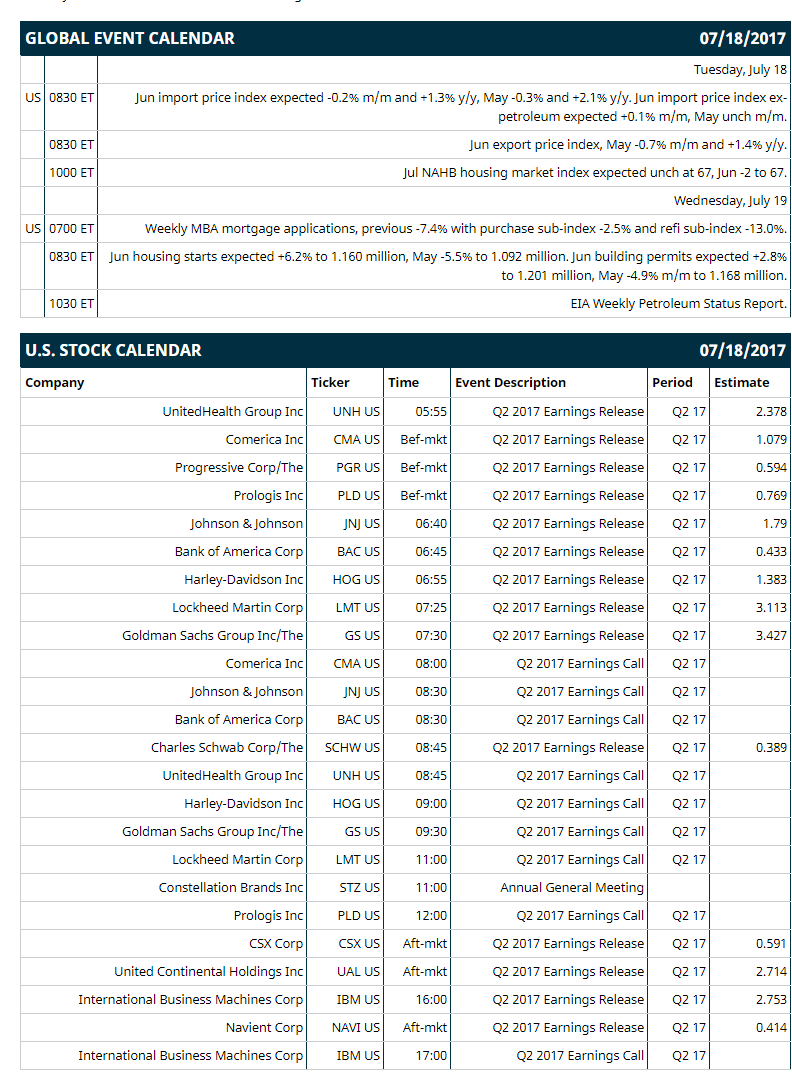

Key U.S. news today includes: (1) Jun import price index (expected -0.2% m/m and +1.3% y/y, May -0.3% and +2.1% y/y) and (2) Jul NAHB housing market index (expected unch at 67, Jun -2 to 67).

Notable S&P 500 earnings reports today include: Goldman Sachs (consensus $3.43), Bank of America (0.43), IBM (2.75), Navient (0.41), UnitedHealth Group (2.38), Johnson & Johnson (1.79), Harley-Davidson (1.38), Lockheed Martin (3.11), Charles Schwab (0.39).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Automatic Data Processing (ADP +0.35%) was downgraded to 'Equal-Weight' from 'Overweight' at Barclays.

Activision Blizzard (ATVI -0.41%) was initiated with a 'Buy' at Needham & Co. with a 12-month target price of $75.

Electronic Arts (EA +0.41%) was initiated with a 'Buy' at Needham & Co. with a 12-month target price of $130.

Autoliv (ALV -0.21%) was upgraded to 'Buy' from 'Neutral' at Mizuho Securities USA with a price target of $130.

Netflix (NFLX +0.36%) rallied over 10% in pre-market trading to a record high after it reported Q2 international streaming net adds of 4.14 million, above estimates of 2.63 million, and said it sees Q3 net streaming adds of 4.4 million, higher than consensus of 3.99 million.

AutoZone (AZO -0.52%) was downgraded to 'Underperform' from 'Peer Perform' with a 12-month target price of $429.

Rite Aid (RAD -0.86%) climbed 8% in after-hours trading after it said that adjustments from the Walgreens deal to adjusted EBITDA will result in pro-forma adjusted EBITDA for the year ended March 4, 2017, of $742.97 million

Allstate (ALL -0.63%) and Travelers (TRV +0.41%) were both downgraded to 'Sell' from 'Hold' at Edward Jones.

Select Comfort (SCSS +3.41%) dropped over 4% in after-hours trading after it reported Q2 net sales of $284.7 million, weaker than consensus of $300.1 million.

UnitedHealth Group (UNH -0.29%) gained almost 1% in after-hours trading after it said it extended its marketing agreement with AARP-branded Medicare plans through at least 2025.

Ethan Allen Interiors (ETH -0.49%) fell over 4% in after-hours trading after it said it sees preliminary full-year 2017 adjusted EPS of $1.44-$1.45, below consensus of $1.53.

Paratek Pharmaceuticals (PRTK +3.74%) rallied over 3% in after-hours trading after an all-oral formulation of its antibiotic omadacycline met all primary and secondary endpoints needed to support FDA and European approvals for use as a therapy for acute bacterial skin infections.

Annaly Capital Management (NLY -0.57%) lost nearly 3% in after-hours trading after it announced that it intends to offer 60 million shares of its common stock in a public offering.

Ring Energy (REI +3.30%) dropped 5% in after-hours trading after it announced that it intends to offer $50 million in shares of its common stock in an underwritten public offering.

Accuray (ARAY -2.08%) rose 4% in after-hours trading after it reported Q4 preliminary revenue of $111.5 million-$112 million, above consensus of $111.2 million.

Cymabay Therapeutics (CBAY +5.84%) slid 5% in after-hours trading after it announced that it intends to offer 10 million shares of its common stock in an underwritten public offering.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 -0.04%) this morning are down -0.75 points (-0.03%). Monday's closes: S&P 500 -0.01%, Dow Jones -0.04%, Nasdaq +0.03%. The S&P 500 on Monday closed little changed. Stocks were supported by the stronger-than-expected China Q2 GDP report of +6.9% y/y (vs expectations of +6.8%) and by strength in mining stocks after copper prices climbed +1.23% to a 3-1/4 month high. Stocks were undercut by the -10.0 point decline to 9.8 in the U.S. Jul Empire manufacturing index (weaker than expectations of -4.8 to 15.0) and by weakness in energy stocks as crude oil prices fell -1.20%.

Sep 10-year T-notes (ZNU17 +0.06%) this morning are up +1.5 ticks. Monday's closes: TYU7 +2.50, FVU7 +1.25. Sep 10-year T-notes on Monday closed slightly higher on carry-over support from a rally in German bunds and on the larger-than-expected decline in the U.S. Jul Empire manufacturing index. T-notes were undercut by an increase in inflation expectations after the 10-year T-note breakeven inflation rate rose to a 1-month high.

The dollar index (DXY00 -0.44%) this morning is down -0.484 (-0.51%) at a 10-1/4 month low. EUR/USD (^EURUSD) is up +0.0081 (+0.71%) at a 14-1/2 month high and USD/JPY (^USDJPY) is down -0.56 (-0.50%) at a 2-week low. Monday's closes: Dollar index -0.025 (-0.03%), EUR/USD +0.0008 (+0.07%), USD/JPY +0.10 (+0.09%). The dollar index on Monday posted a 10-month low and closed lower on strength in the Chinese yuan which rose to a 2-week high against the dollar after China Q2 GDP grew at a faster-than-expected +6.9% y/y pace. The dollar was also undercut by the weaker-than-expected U.S. Jul Empire manufacturing index. The dollar found support on the rise in the 10-year T-note breakeven inflation rate to a 1-month high, which was hawkish for Fed policy.

Aug WTI crude oil prices (CLQ17 +1.02%) this morning are up +19 cents (+0.41%) and Aug gasoline (RBQ17 +1.00%) is +0.0055 (+0.35%). Monday's closes: Aug crude -0.56 (-1.20%), Aug gasoline -0.0023 (-0.15%). Aug crude oil and gasoline on Monday closed lower on the drop in OPEC's compliance with its production cuts to 92% in Jun from 110% in May, and on on the rise in Libya crude production to a 4-year high of 1.1 million bpd. Crude oil prices were supported by the slump in the dollar index to a 10-month low and by the increase in the crack spread to a 2-3/4 month high, which may boost refinery demand for crude oil to refine into gasoline.

Disclosure: None.