Morning Call For Thursday, August 24

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.17%) this morning are up +0.07% and European stocks are up +0.45% before today's start to the 3-day annual conference in Jackson Hole, Wyoming for global central bankers. Speeches from Fed Chair Yellen and ECB President Drahi will be parsed for any hints of when the central banks may begin to unwind stimulus. Stock gains were limited as Oct WTI crude prices (CLV17 -0.48%) fell -0.62%, which undercut energy stocks. Asian stocks settled mixed: Japan -0.42%, Hong Kong +0.43%, China -0.49%, Taiwan +0.79%, Australia +0.14%, Singapore +0.37%, South Korea +0.33%, India +0.09%. Japan's Nikkei Stock Index tumbled to a new 3-1/2 month low as steelmakers retreated after Kyodo News and the Nikkei newspaper reported that Nippon Steel and Sumitomo Metal agreed on larger-than-expected price cuts with Toyota Motor, Japan's largest automaker.

The dollar index (DXY00 +0.16%) is up +0.16%. EUR/USD (^EURUSD) is down -0.12%. USD/JPY (^USDJPY) is up +0.26%.

Sep 10-year T-note prices (ZNU17 -0.11%) are down -4.5 ticks.

UK Aug CBI retailing reported sales fell -32 to -10, weaker than expectations of -8 to 14 and a 13-month low.

U.S. STOCK PREVIEW

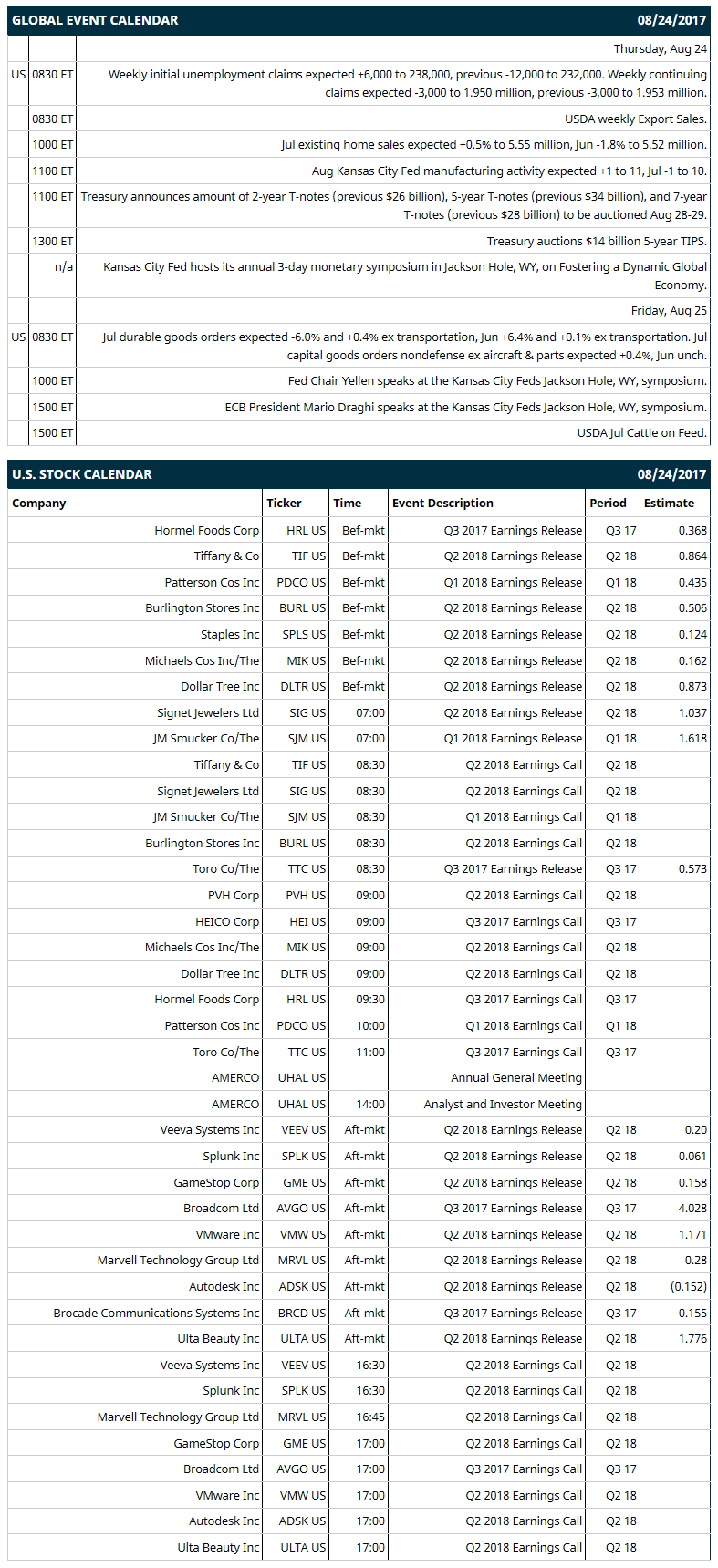

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +6,000 to 238,000, previous -12,000 to 232,000) and continuing claims (expected -3,000 to 1.950 million, previous -3,000 to 1.953 million), (2) Jul existing home sales (expected +0.5% to 5.55 million, Jun -1.8% to 5.52 million), (3) Aug Kansas City Fed manufacturing activity (expected +1 to 11, Jul -1 to 10), (4) Treasury auctions $14 billion 5-year TIPS, (5) Kansas City Fed hosts its annual 3-day monetary symposium in Jackson Hole, WY, on “Fostering a Dynamic Global Economy,” (6) USDA weekly Export Sales.

Notable Russell 1000 earnings reports today include: AutoDesk (consensus -$0.15), Splunk (0.06), Staples (0.12), Brocade Communications (0.16), GameStop (0.16), Michaels Cos (0.16), Veeva Systems (0.20), Marvell Technology (0.28), Hormel Foods (0.37), Patterson Cos (0.44), Burlington Stores (0.51), Toro (0.57), Tiffany (0.86), Dollar Tree (0.87), Signet Jewelers (1.04), VMware (1.17), JM Smucker (1.62), Ulta Beauty (1.78), Broadcom (4.03).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Southern California Investor Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Chipotle Mexican Grill (CMG -2.76%) was upgraded to 'Equal-Weight' from 'Underweight' at Stephens.

Hormel Foods (HRL -1.34%) may open lower this morning after it reported Q3 net sales of $2.21 billion, below consensus of $2.23 billion, and then cut its full-year EPS forecast to $1.54-$1.58 from a May estimate of $1.65-$1.71.

Heico (HEI -1.16%) reported Q3 net sales of $391.5 million, above consensus of $390.5 million, and then boosted its full-year net sales forecast to 9% to 11% from a prior estimate of +8% to +10%.

PVH Corp. (PVH -0.23%) climbed nearly 4% in after-hours trading after it reported Q2 adjusted EPS of $1.69, above consensus of $1.64, and then raised guidance on its view for full-year adjusted EPS to $7.60-$8.70 from a prior view of $7.40-$7.50, better than consensus of $7.48.

Williams-Sonoma (WSM +1.28%) jumped over 7% in after-hours trading after it reported Q2 comparable sales were up +2.8%, higher than consensus of +2.6%, and then said it sees Q3 revenue of $1.27 billion-$1.31 billion, stronger than consensus of $1.28 billion.

Global Blood Therapeutics (GBT unch) dropped 3% in after-hours trading after it filed an S-3 for a $125 million mixed shelf offering.

HP Inc. (HPQ -0.84%) lost over 1% in after-hours trading when it said it sees Q4 adjusted EPS of 42 cents-45 cents, the midpoint below consensus of 44 cents.

Raven Industries (RAVN -1.83%) reported Q2 revenue of $86.6 million, higher than consensus of $82 million

Tilly's (TLYS +10.09%) jumped 7% in after-hours trading after it reported Q2 adjusted EPS of 11 cents, well above consensus of 5 cents, and then said it sees Q3 EPS of 19 cents to 24 cents, higher than consensus of 17 cents.

Guess? (GES +0.89%) jumped over 10% in after-hours trading after it reported Q2 adjusted EPS of 19 cents, much better than consensus of 10 cents, and then raised its full-year adjusted EPS forecast to 52 cents-60 cents, higher than consensus of 41 cents.

China Cord Blood Corp (CO +1.46%) rallied 14% in after-hours trading after it said its Q1 gross margin increased to 80.0% from 78.4% and that new subscribers rose 22,523, up +35.4%.

Abercrombie & Fitch (ANF +5.03%) rose over 3% in after-hours trading on optimism that the company's Q2 earnings, to be released Thursday morning, will be better than expected.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.17%) this morning are up +1.75 points (+0.07%). Wednesday's closes: S&P 500 -0.35%, Dow Jones -0.40%, Nasdaq -0.37%. The S&P 500 on Wednesday closed lower on uncertainty caused by remarks from President Trump who said he could shut down the U.S. government in an effort to force funding for a border wall and that the U.S. may soon pull out of the North American Free Trade Agreement. Stocks were also undercut by the unexpected -9.4% drop in U.S. Jul new home sales to 571,000, weaker than expectations of unchanged at 610,000 and the fewest in 7 months.

Sep 10-year T-note prices (ZNU17 -0.11%) this morning are down -4.5 ticks. Wednesday's closes: TYU7 +11.50, FVU7 +5.75. Sep 10-year T-notes on Wednesday closed higher on the weaker-than-expected U.S. Jul new home sales and Aug Markit manufacturing PMI reports, and on the slide in stocks, which spurred some safe-haven demand into T-notes.

The dollar index (DXY00 +0.16%) this morning is up +0.145 (+0.16%). EUR/USD (^EURUSD) is down -0.0014 (-0.12%) and USD/JPY (^USDJPY) is up +0.28 (+0.26%). Wednesday's closes: Dollar Index -0.398 (-0.43%), EUR/USD +0.0045 (+0.38%), USD/JPY -0.53 (-0.48%). The dollar index on Wednesday closed lower on the weaker-than-expected Jul U.S. new home sales report and Aug Markit U.S. manufacturing PMI report. There was also strength in EUR/USD after the Eurozone Aug Markit manufacturing PMI and Eurozone Aug consumer confidence both rose more than expected.

Oct crude oil (CLV17 -0.48%)this morning is down -30 cents (-0.62%) and Oct gasoline (RBV17 +0.93%) is +0.0124 (+0.81%). Wednesday's closes: Oct WTI crude +0.58 (+1.21%), Oct gasoline +0.023 (+1.75%). Oct crude oil and gasoline on Wednesday closed higher on a weaker dollar and on the decline in U.S. crude inventories for an eighth week after EIA crude supplies fell -3.33 million bbl to a 1-1/2 year low. Gains were limited after U.S. crude production in the week of Aug 18 rose +0.3% to 9.528 million bpd, a 2-year high.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.29%) -3.1 (-0.24%), Sep silver (SIU17 -0.92%) -0.131 (-0.77%) and Sep copper (HGU17 +0.55%) +0.016 (+0.52%). Wednesday's closes: Dec gold +3.7 (+0.29%), Sep silver +0.064 (+0.38%), Sep copper -0.0065 (-0.22%). Metals on Wednesday settled mixed. Metals were supported by a weaker dollar and the decline in stocks, which boosted safe-haven demand for precious metals. Copper prices closed lower on global trade concerns after President Trump threatened to pull the U.S. out of NAFTA.

(Click on image to enlarge)

Disclosure: None.