Morning Call For October 28, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.18%) this morning are little changed as the market awaits this morning's U.S. Q3 GDP report, which is expected to improve to +2.5% from Q2's +1.4%. E-minis have been able to shake off negative overnight news that includes a -4% sell-off in Amazon on a disappointing holiday sales forecast and a -0.53% drop in European stocks. However, Alphabet is up +1% after better than expected earnings and revenue news.

The Euro Stoxx 50 index this morning is down -0.53% on disappointing earnings results and carry-over concerns about Thursday's sharp rise in the 10-year T-note yield to a new 5-month high. Anheuser-Busch InBev is down -4.5% this morning after the firm cut its revenue guidance. Novo Nordisk is down -13% after the company cut its long-term earnings growth target.

The Russian central bank today left its key rate unchanged at 10.0%, which was in line with market expectations. The Russian central bank in September pledged to leave its rates high at least through year-end in an attempt to curb inflation. The market consensus is for a rate cut in early 2017 if Russian inflation is contained and the ruble is stable.

Asian stock markets today closed mixed with downward pressure from Thursday's sell-off in U.S. stocks: Japan +0.63%, Hong Kong -0.77%, China Shanghai Composite -0.26%, Taiwan +0.08%, Australia -0.22%, Singapore -0.45%, South Korea -0.05%, India +0.09%, Turkey -0.52%.

Dec 10-year T-notes (ZNZ16 -0.08%) this morning are down -3 ticks on carry-over weakness from yesterday's rise in the 10-year breakeven inflation expectations rate to a 1-1/4 year high and on increased expectations for a Fed rate hike in December.

The dollar index (DXY00 -0.04%) is slightly lower by -0.03% this morning. EUR/USD (^EURUSD) is up +0.12% and USD/JPY (^USDJPY) is little changed. The dollar showed strength on Thursday on positive U.S. interest rate differentials with the 10-year T-note yield rising to a new 5-month high.

Commodity prices this morning are mildly lower by an average of -0.17%. Dec crude oil prices (CLZ16 -0.76%) this morning are mildly lower by -0.15 (-0.30%) as the market awaits the outcome of today's OPEC committee meeting set to discuss OPEC's production cut. Oil prices rallied on Thursday on Reuter's report that Saudi Arabia and its Gulf partners are willing to cut 4% from peak production. Metals prices are mixed this morning with Dec gold (GCZ16 -0.18%) down -2.5 (-0.20%), Dec silver (SIZ16 -0.14%) down -0.049 (-0.28%), and Dec copper (HGZ16 +0.39%) up +0.011 (+0.51%). Grains are narrowly mixed this morning with Dec corn down -1.00 (-0.28%), Nov beans up +1.00 (+0.10%), and Dec wheat down -0.25 (-0.06%). Softs this morning are mixed with March sugar down -0.12 (-0.53%), Dec coffee up +0.05 (+0.03%), Dec cocoa down -12 (-0.44%), and Dec cotton down -0.03 (-0.04%).

U.S. STOCK PREVIEW

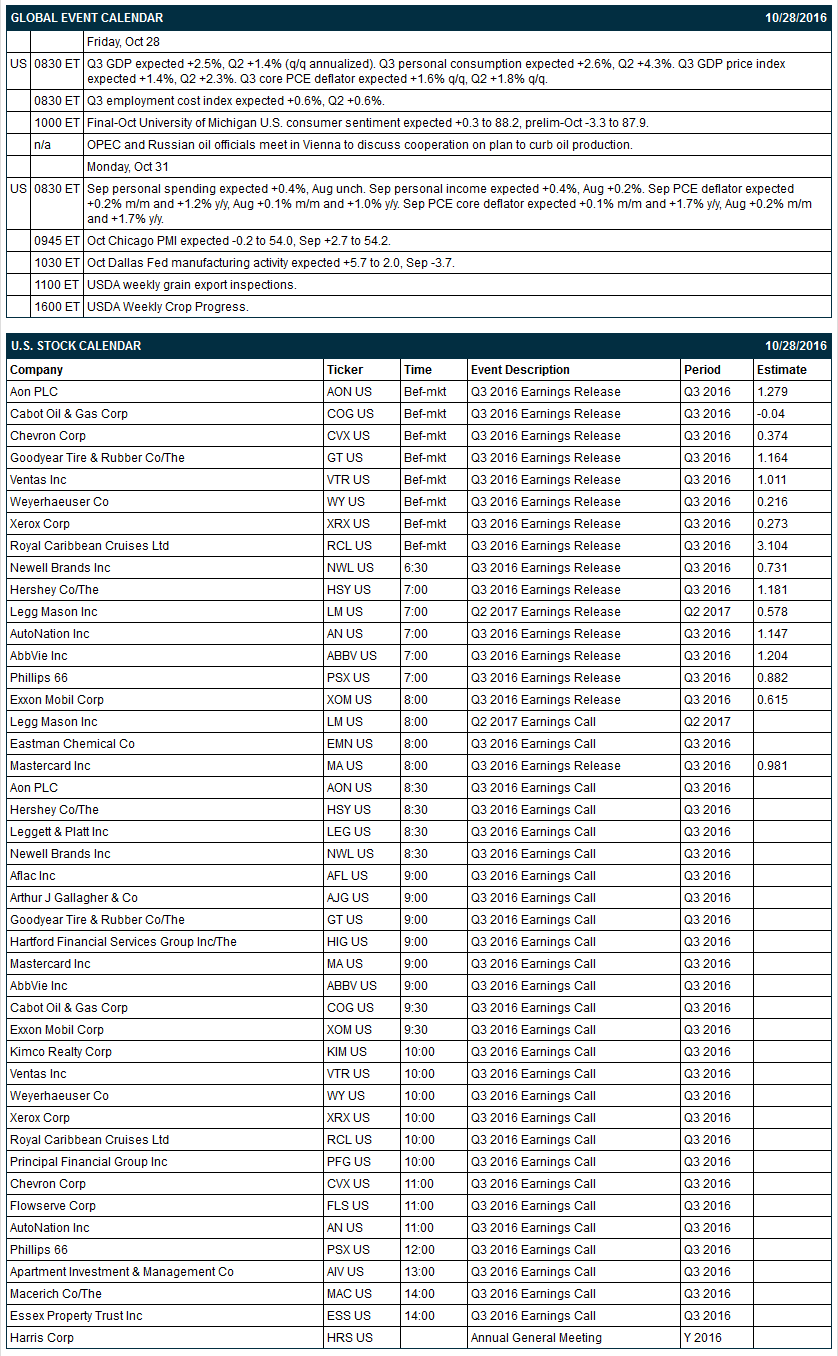

Key U.S. news today includes: (1) Q3 GDP (expected +2.5%, Q2 +1.4%), (2) Q3 employment cost index (expected +0.6%, Q2 +0.6%), (3) final-Oct University of Michigan U.S. consumer sentiment (expected +0.3 to 88.2, prelim-Oct -3.3 to 87.9), and (4) OPEC and Russian oil officials meet in Vienna to discuss cooperation on plan to curb oil production.

Notable S&P 500 earnings reports today include: MasterCard (consensus $0.98), Exxon (0.62), Phillips 66 (0.88), AbbVie (1.20), Chevron (0.37), Aon (1.28), Goodyear Tire & Rubber (1.16), among others.

U.S. IPO's scheduled to price today: none.

Equity conferences today include: none.

OVERNIGHT U.S. STOCK MOVERS

- Amazon.com (AMZN -0.51%) is down -4% in overnight trading after forecasting weak holiday sales that may produce an earnings miss.

- Alphabet (GOOG -0.47%) rallied +1.2% in after-hours trading after reporting a 20.2% rise in revenue and announcing a $7 billion buyback of its Class C stock.

- GE (GE -0.83%) is in talks to buy Baker Hughes (BHI), according to a Dow Jones report, which boosted BHI 17% in post-market trading. GE was down -1.3% after the report. However, GE officials later denied that it is discussing an outright purchase of BHI.

- Apple (AAPL -0.96%) raised the price of its Macs in the UK by 20% due to Brexit-induced sterling weakness.

- Expedia (EXPE +0.70%) rallied 1% in after-hours trading on positive revenue and bookings news.

- TripAdvisor (TRIP +0.16%) bookings to Cuba were cleared by the U.S. Treasury Department.

- Tesla (TSLA) and Solar City (SCTY +3.25%) will unveil their solar roof on Friday, according to Tesla CEO Elon Musk.

- VeriSign (VRSN +1.94%) rallied 4% in after-hours trading and beating revenue and earnings estimates.

- Decker Outdoor Corp (DECK -1.72%) rallied +0.8% in after-hours trading on an earnings beat.

- Cirrus Logic (CRUS -1.63%) rallied 6% in after-hours trading on positive earnings news.

- Hanesbrands (HBI -0.38%) rallied 4% in after-hours trading on positive earnings news.

MARKET COMMENTS

Dec E-mini S&Ps this morning are little changed and have shaken off this morning's -0.53% sell-off in European stocks. Thursday's closes: S&P 500 -0.30%, Dow Jones -0.16%, Nasdaq -0.65%. The S&P 500 on Thursday closed lower on the sharp rise in the 10-year T-note yield to a 5-month high and on the weaker-than-expected durable goods report. Stocks found underlying support on generally positive earnings news and some strength in energy producers after Dec crude oil prices recovered by +1.10%.

Dec 10-year T-notes this morning are down -3 ticks on carry-over weakness from Thursday's session. Thursday's closes: TYZ6 -13.50, FVZ6 -6.25. Dec 10-year T-notes on Thursday fell to a new 5-month low and closed lower on the rise in the 10-year breakeven inflation expectations rate to a new 1-1/4 year high of 1.75%. T-notes were also undercut by the recent strengthening of expectations for a December rate hike by the FOMC.

The dollar index is slightly lower by -0.03% this morning. EUR/USD this morning is up +0.12% and USD/JPY is little changed. Thursday's closes: Dollar index +0.259 (+0.26%), EUR/USD -0.0011 (-0.10%), USD/JPY +0.82 (+0.78%). The dollar index on Thursday closed higher on improved U.S. interest rate differentials as the 10-year T-note yield rose to a new 5-month high and as expectations grow for a rate hike by the FOMC in December.

Dec crude oil prices this morning are mildly lower by -0.15 (-0.30%) as the market awaits the outcome of today's OPEC committee meeting set to discuss OPEC's production cut. Dec gasoline prices this morning are down -0.0021 (-0.14%). Thursday's closes: Dec crude +0.54 (+1.10%), Dec gasoline +0.0065 (+0.44%). Dec crude oil and gasoline on Thursday closed moderately higher on a Reuters report that Saudi Arabia and its Gulf partners are willing to cut 4% from their peak oil output. Crude oil prices also found continued support from Wednesday's bullish weekly EIA report, which showed that U.S. crude oil inventories fell by -553,00 bbl to a 9-month low and that Cushing crude oil inventories fell by -1.337 million bbl to an 11-month low.

(Click on image to enlarge)

Disclosure: None.

Thanks for sharing