Morning Call For October 26, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 -0.41%) are down -0.37% and European stocks are down -0.76%. A 3% drop in Apple in pre-market trading is undercutting stocks after the company forecast uninspiring forward expectations. A -1.38% slide in crude oil prices (CLZ16 -1.62%) to a 2-week low is also pushing energy producing stocks lower after the API reported late yesterday that U.S. crude inventories rose +4.75 million bbl last week. European stocks were also pressured by an unexpected decline in German Nov GfK consumer confidence to a 6-month low. Asian stocks settled mostly lower: Japan +0.15%, Hong Kong -1.02%, China -0.50%, Taiwan -0.25%, Australia -1.53%, Singapore -0.89%, South Korea -1.18%, India -0.91. Japan's Nikkei Stock Index bucked the trend today and rallied up to a 5-3/4 month high after Tuesday's rally in USD/JPY to a 2-3/4 month high fueled gains in exporter stocks.

The dollar index (DXY00 -0.12%) is down -0.21%. EUR/USD (^EURUSD) is up +0.30%. USD/JPY (^USDJPY) is down -0.01%.

Dec 10-year T-note prices (ZNZ16 -0.13%) are down -4 ticks.

ECB Governing Council member Hanson said wage growth, which could boost price growth "remains rather modest in some regions" and "even looking at headline inflation developments, one can notice tendency for growth lately, but where some weakness can be seen is core inflation, where we can't yet see a very clear trend for improvement."

The German Nov GfK consumer confidence unexpectedly fell -0.3 to 9.7, weaker than expectations of no change at 10.0 and a 6-month low.

U.S. STOCK PREVIEW

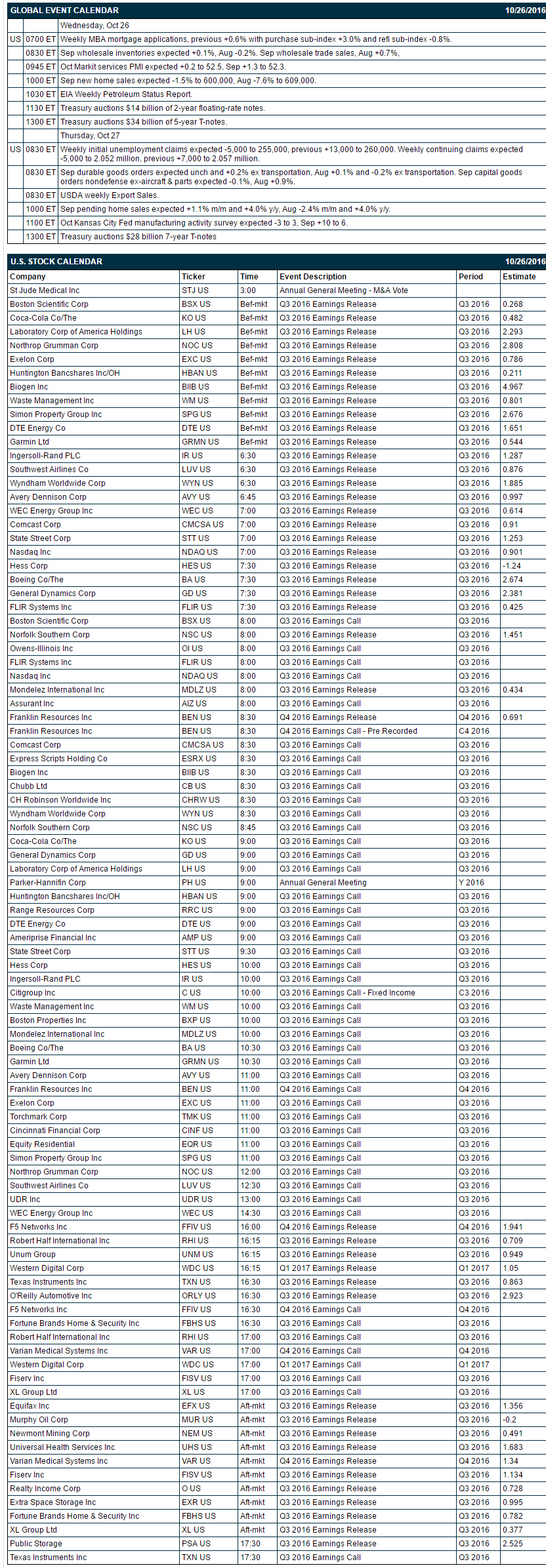

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +0.6% with purchase sub-index +3.0% and refi sub-index -0.8%), (2) Sep wholesale inventories (expected +0.1%, Aug -0.2%), (3) Oct Markit services PMI (expected +0.2 to 52.5, Sep +1.3 to 52.3), (4) Sep new home sales (expected -1.5% to 600,000, Aug -7.6% to 609,000), (5) the Treasury's auction of $14 billion of 2-year floating-rate notes and $34 billion of 5-year T-notes, and (6) EIA Weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Coca-Cola (consensus $0.48), Boeing (2.67), General Dynamics (2.38), Norfolk Southern (1.45), Biogen (4.97), Waste Management (0.80), Simon Property Group (2.68), Southwest Airlines (0.88), Comcast (0.91), State Street (1.25), Nasdaq (0.90), Newmont Mining (0.49), Public Storage (2.53).

U.S. IPO's scheduled to price today: GTY Technology Holdings (GTYHU), Myovant Sciences (MYOV).

Equity conferences this week include: Money20/20 Conference on Mon-Wed, American Cystic Fibrosis Conference on Thu, ARM TechCon on Thu.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL +0.51%) slid 3% in pre-market trading after it reported Q4 revenue of $46.9 billion, below consensus of $47 billion, and forecast Q1 gross margins of 38%-38.5%, weaker than consensus of 39%

Under Armour (UA -13.22%) was downgraded to 'Market Perform' from 'Outperform' at Cowen with a 12-month target price of $35.

Twitter (TWTR -4.27%) rose 3% in after-hours trading after Betaville reported that Disney is still interested in acquiring the company.

Akamai Technologies (AKAM +0.39%) climbed over 6% in after-hours trading after it reported Q3 adjusted EPS of 68 cents, higher than consensus of 61 cents.

Juniper Networks (JNPR +0.25%) rose 4% in after-hours trading after it reported Q3 adjusted EPS of 58 cents, higher than consensus of 52 cents/

Edwards Lifesciences (EW -2.86%) slumped over 12% in after-hours trading after it reported Q3 revenue of $739.4 million, less than consensus of $749.1 million, and said it sees Q4 sales of $750 million-$790 million, below consensus of $801.6 million.

Panera Bread (PNRA -2.04%) rose 5% in after-hours trading after it reported Q3 adjusted EPS of $1.37, higher than consensus of $1.34, and then raised its full-year adjusted EPS view to $6.67-$6.72 from a July 26 estimate of $6.60-$6.70.

NuVasive (NUVA -2.74%) tumbled 12% in after-hours trading after it cut its full-year revenue forecast to $952 million from a prior estimate of $962 million.

Express Scripts Holding (ESRX +0.39%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS of $1.74, above consensus of $1,73, and then raised the low end of its full-year adjusted EPS view to $6.36-$6.42 from a prior view of $6.33-$6.43.

CH Robinson Worldwide (CHRW +0.45%) declined over 3% in after-hours trading after it reported Q3 EPS of 90 cents, below consensus of 96 cents.

Owens-Illinois (OI -0.99%) rallied over 3% in after-hours trading after it raised the low end its full-year adjusted EPS view to $2.27-$2.32 from a July 27 view of $2.25-$2.35.

Pandora Media (P -4.84%) fell 5% in after-hours trading after it lowered guidance on full-year revenue to $1.354 billion-$1.366 billion from a prior view of $1.385 billion-$1.405 billion.

NCR Corp. (NCR -2.17%) rose over 3% in pre-market trading after it reported Q3 adjusted EPS of 87 cents, above consensus of 81 cents, and then raised its full-year adjusted EPS view to $2.97-$3.02 from a prior view of $2.90-$3.00.

Diplomat Pharmacy (DPLO -0.24%) dropped over 5% in after-hours trading after President Gary Kadlec and CFO Sean Whelan said they will both step down on Dec 31.

Gladstone Capital (GLAD -1.68%) slid over 3% in after-hours trading after it announced a common stock offering, although no size was given.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 -0.41%) this morning are down -8.00 points (-0.37%). Tuesday's closes: S&P 500 -0.38%, Dow Jones -0.30%, Nasdaq-0.38%. The S&P 500 on Tuesday closed lower on the -4.9 point decline in U.S. Oct consumer confidence to 98.6 (weaker than expectations of -2.6 to 101.5) and on negative earnings news after 3M cut the top end of its 2016 profit forecast, Caterpillar cut its sales forecast for this year and Whirlpool lowered its profit outlook. There was also weakness in energy producer stocks as the price of crude oil fell -2.41%.

Dec 10-year T-notes (ZNZ16 -0.13%) this morning are down -4 ticks. Tuesday's closes: TYZ6 -5.50, FVZ6 -3.25. Dec 10-year T-notes on Tuesday recovered from a 1-week low and closed unchanged. T-notes found underlying support from the larger-than-expected decline in U.S. Oct consumer confidence index and from increased safe-haven demand with the weakness in stocks. Stocks were undercut by slack demand for the Treasury's $26 billion 2-year auction that had a bid-to-cover ratio of 2.53, weaker than the 12-auction average of 2.86 and the weakest demand for a 2-year auction in 3 months.

The dollar index (DXY00 -0.12%) this morning is down -0.209 (-0.21%). EUR/USD (^EURUSD) is up +0.0033 (+0.30%). USD/JPY (^USDJPY) is down-0.01 (-0.01%). Tuesday's closes: Dollar index -0.037 (-0.04%), EUR/USD +0.0007 (+0.06%), USD/JPY +0.04 (+0.04%). The dollar index on Tuesday fell back from an 8-1/2 month high and closed lower on the weaker-than-expected U.S. Oct consumer confidence index. The dollar was also undercut by the rebound in EUR/USD from a 7-1/2 month low after the German Oct IFO business climate index showed an unexpectedly strong increase to a 2-1/2 year high.

Dec WTI crude oil (CLZ16 -1.62%) this morning is down -69 cents (-1.38%) at a 2-week low and Dec gasoline (RBZ16 -1.74%) is down -0.0246(-1.66%) at a 1-1/2 week low. Tuesday's closes: Dec crude -1.22 (-2.41%), Dec gasoline -0.0244 (-1.66%). Dec crude oil and gasoline on Tuesday closed lower on comments from a Russian OPEC envoy who said an oil production cut is not a suitable option for Russia, only a freeze of output at current levels. Crude oil prices were also undercut by expectations for Wednesday's EIA crude inventories to increase by +1.75 million bbl.

Disclosure: None.