Morning Call For October 25, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.06%) are up +0.06% at a 2-week high and European stocks are up +0.12% on signs of optimism in the global economic outlook. German business sentiment increased as the Oct IFO business climate rose more than expected to a 2-1/2 year high. That helped fuel a rally in mining stocks and raw-material producers as copper prices (HGZ16 +2.08%) climbed +2.17% to a 1-week high. Also, a +0.40% rally in crude oil prices (CLZ16 +0.51%) has given energy producing stocks a lift. Stock gains were limited as drug producers retreated, led by a nearly 3% decline in shares of Eli Lilly in pre-market trading, after it reported Q3 adjusted EPS of 88 cents, below consensus of 96 cents. Asian stocks settled mostly higher: Japan +0.76%, Hong Kong -0.17%, China +0.12%, Taiwan +0.68%, Australia +0.63%, Singapore -0.09%, South Korea -0.35%, India -0.31%. Japan's Nikkei Stock Index climbed to a 5-3/4 month high as exporter stocks rallied after USD/JPY rose to a 1-week high.

The dollar index (DXY00 -0.03%) is up +0.01. EUR/USD (^EURUSD) is down -0.04%. USD/JPY (^USDJPY)is up 0.36% at a 1-week high.

Dec 10-year T-note prices (ZNZ16 -0.17%) are down -7.5 ticks at a 1-week low.

The German Oct IFO business climate rose +1.0 to 110.5, stronger than expectations of +0.1 to 109.6 and the highest in 2-1/2 years.

U.S. STOCK PREVIEW

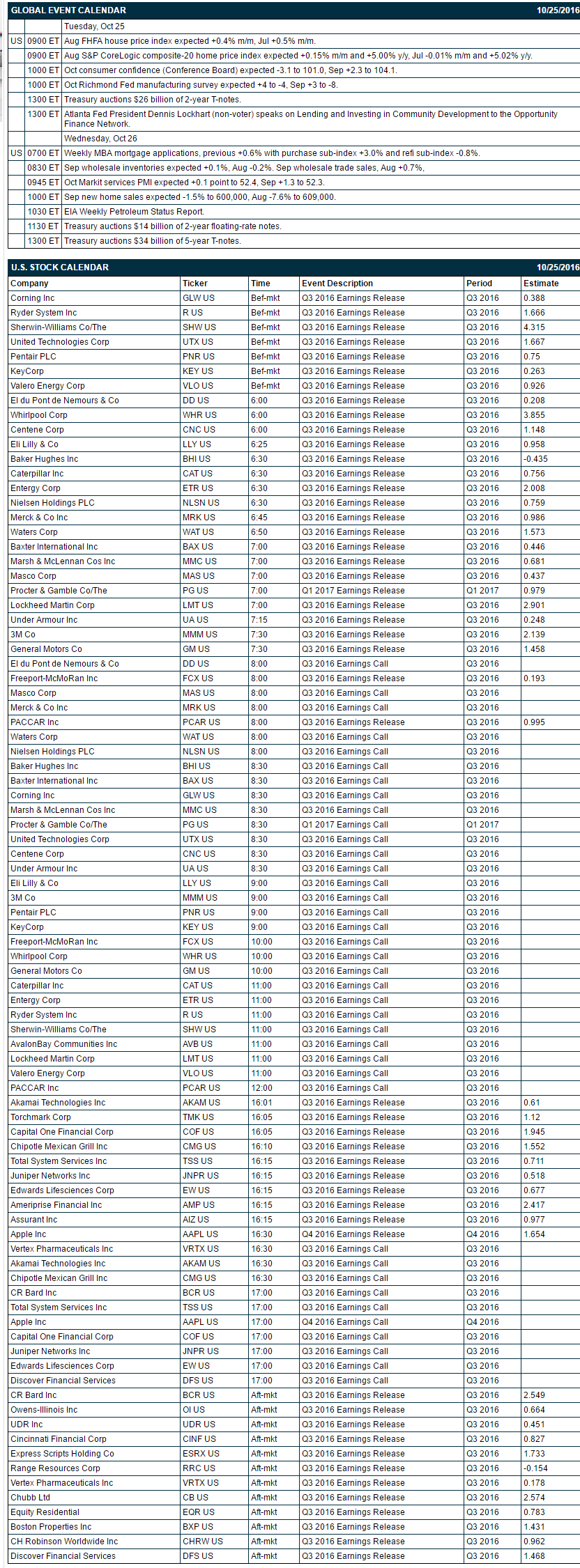

Key U.S. news today includes: (1) Aug FHFA house price index (expected +0.4% m/m, Jul +0.5% m/m), (2) Aug S&P CoreLogic composite-20 home price index (expected +0.15% m/m and +5.00% y/y, Jul -0.01% m/m and +5.02% y/y), (3) Oct consumer confidence from the Conference Board (expected -3.1 to 101.0, Sep +2.3 to 104.1), (4) Oct Richmond Fed manufacturing survey (expected +4 to -4, Sep +3 to -8), (5) Treasury auctions $26 billion of 2-year T-notes, and (6) Atlanta Fed President Dennis Lockhart (non-voter) speaks on “Lending and Investing in Community Development” to the Opportunity Finance Network.

Notable S&P 500 earnings reports today include: Apple (consensus $1.65), Procter & Gamble (0.98), Caterpillar (0.76), Corning (0.39), United Technologies (1.67), Keycorp (0.26), Valero (0.93), Du Pont (0.21), Whirlpool (3.86), Eli Lilly (0.96), Baker Hughes (-0.44), Entergy (2.01), Nielsen (0.76), Merck (0.99), Baxter (0.45), UnderArmour (0.25), 3M (2.14), GM (1.46), Capital One (1.95), Chipotle (1.55), Chubb (2.57), Discover Financial Services (1.47), and others.

U.S. IPO's scheduled to price today: Ra Pharmaceuticals (RARX).

Equity conferences this week include: Money20/20 Conference on Mon-Wed, American Cystic Fibrosis Conference on Thu, ARM TechCon on Thu.

OVERNIGHT U.S. STOCK MOVERS

Swift Transportations (SWFT +2.22%) gained 2% in after-hours trading after it reported Q3 adjusted EPS of 34 cents, higher than consensus of 32 cents.

Rambus (RMBS +3.18%) climbed 5% in after-hours trading after it reported Q3 adjusted EPS of 16 cents, above consensus of 13 cents, and said it sees Q4 revenue of $94 million-$98 million, higher than consensus of $894.4 million.

Eli Lilly (LLY -0.87%) dropped nearly 3% in pre-market trading after it reported Q3 adjusted EPS of 88 cents, weaker than consensus of 96 cents.

Visa (V +1.00%) lost nearly 1% in after-hours trading after it said it sees 2017 adjusted EPS growth of mid-teens on a nominal dollar basis, below estimates of 20% growth.

Sonic (SONC +1.85%) sank 10% in after-hours trading after it reported Q4 revenue of $162.1 million, below consensus of $167.2 million.

CoreLogic (CLGX +2.18%) rose nearly 3% in after-hours trading after it reported Q3 adjusted EPS of 73 cents, higher than consensus of 66 cents and boosted its stock buyback plan by 1 million shares.

Wabash National (WNC +0.83%) lost 6% in after-hours trading after it reported Q3 revenue of $464.3 million, weaker than consensus of $480.6 million.

Greenhill & Co. (GHL +1.51%) slipped over 1% in after-hours trading after it reported Q3 EPS of 41 cents, weaker than consensus of 42 cents.

Fiesta Restaurant Group (FRGI -0.55%) gained over 1% in after-hours trading after it said it will close 10 Pollo Tropical Locales and re-brand up to three locations as Taco Cabana.

ProAssurance (PRA +0.52%) slid 5% in after-hours trading after it said preliminary Q3 operating EPS will be between 43 cents-47 cents, weaker than consensus of 60 cents.

Allison Transmission Holdings (ALSN +0.40%) rose over 2% in after-hours trading after it reported Q3 EPS of 27 cents, higher than consensus of 24 cents.

Park National (PRK +0.75%) climbed nearly 3% in after-hours trading after it reported Q3 EPS of $1.78, well above consensus of $1.40.

New Mountain Finance (NMFC +1.02%) fell 3% in after-hours trading after it began an offering of 5 million shares of common stock.

SAExploration Holdings (SAEX -3.11%) catapulted over 40% in after-hours trading after it received $24.4 million of tax credit certificates from Alaska's Department of Revenue and was granted access to the remaining $15 million of funding available under its senior loan facility.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 +0.06%) this morning are up +1.25 points (+0.06%) at a 2-week high. Monday's closes: S&P 500 +0.47%, Dow Jones +0.43%, Nasdaq +1.20%. The S&P 500 on Monday rose to a 1-1/2 week high and closed higher on increased M&A activity after AT&T agreed to buy Time Warner for $85 billion and Rockwell Collins said it will purchase B/E Aerospace for $6.4 billion. In addition, the U.S. economic picture brightened a bit with the +1.7 point increase in the U.S. Oct Markit manufacturing PMI to 53.2, stronger than expectations of unch at 51.5 and the fastest pace of expansion in a year. Global stocks were boosted by news that the Eurozone Oct Markit manufacturing PMI expanded at its fastest pace in 2-1/2 years and that the Japan Oct Nikkei manufacturing PMI expanded at its fastest pace in 9 months.

Dec 10-year T-notes (ZNZ16 -0.17%) this morning are down -7.5 ticks at a 1-week low. Monday's closes: TYZ6 -5.50, FVZ6 -3.25. Dec T-notes on Monday closed lower on reduced safe-haven demand due to the rally in stocks and St. Louis Fed President Bullard's (voter) comment that the December FOMC meeting is "most likely" for an interest rate increase. T-notes were also undercut by the stronger-than-expected U.S. Oct Markit manufacturing PMI which expanded at its fastest pace in a year.

The dollar index (DXY00 -0.03%) this morning is up +0.010 (+0.01%). EUR/USD (^EURUSD) is down -0.0004 (-0.04%). USD/JPY (^USDJPY) is up +0.37 (+0.36%) at a 1-week high. Monday's closes: Dollar index +0.061 (+0.06%), EUR/USD -0.0002 (-0.02%), USD/JPY +0.38 (+0.37%). The dollar index on Monday climbed to an 8-1/2 month high and settled higher on comments from St. Louis Fed President Bullard's (voter) comment that the December FOMC meeting is "most likely" for an interest rate increase. The dollar was also boosted by weakness in the Chinese yuan which fell to a 6-year low against the dollar on speculation the PBOC will let yuan weaken in an attempt to revive Chinese exports.

Dec WTI crude oil (CLZ16 +0.51%) this morning is up +20 cents (+0.40%) and Dec gasoline (RBZ16 +0.36%) is up +0.0033 (+0.22%). Monday's closes: Dec crude -0.36 (-0.71%), Dec gasoline -0.0236 (-1.56%). Dec crude oil and gasoline prices on Monday closed lower on the rally in the dollar index to an 8-1/2 month high. There was also concern that an OPEC plan to curb production may be derailed after Iraq, OPEC's second biggest producer, said that it should be exempt from any planned output cuts. Crude oil prices were also undercut by expectations for Wednesday's EIA crude inventories to climb by +1.5 million bbl.

Disclosure: None.