Morning Call For October 20, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 -0.21%) are down -0.31% and European stocks are down -0.85% on reduced chances of additional easing from the ECB after the ECB's lending survey showed that credit standards on loans to companies eased for the sixth consecutive quarter. Also, weakness is IBM, which is down -4.5% in pre-market trading, is undercutting stocks after it lowered its full-year profit forecast after Q3 revenue missed estimates. Mining companies and raw-material stocks are lower as well after the price of copper (HGZ15 -0.30%) fell to a 1-week low. Asian stocks settled mixed: Japan +0.42%, Hong Kong -0.37%, China +1.14%, Taiwan +0.26%, Australia -0.65%, Singapore -0.18%, South Korea +0.43%, India -0.21%. China's Shanghai Composite rose to a 1-3/4 month high as a rally in small-cap stocks led the overall market higher on speculation the government will boost stimulus in the technology industry to offset the faltering industrial sector.

The dollar index (DXY00 -0.31%) is down -0.31%. EUR/USD (^EURUSD) is up +0.45%. USD/JPY (^USDJPY) is up +0.11%.

Dec T-note prices (ZNZ15 -0.15%) are down -6 ticks on negative carryover from a slide in German bund prices after strength in the ECB's Bank Lending Survey curbed speculation the ECB will expand QE.

The ECB said Q3 credit standards on loans to companies eased for the sixth consecutive quarter, according to the ECB's Bank Lending Survey. The survey showed 40% of banks said they used the extra liquidity from the ECB's QE program to lend to companies, while 14% increased mortgages and 36% expanded consumer credit and other loans to households.

U.S. STOCK PREVIEW

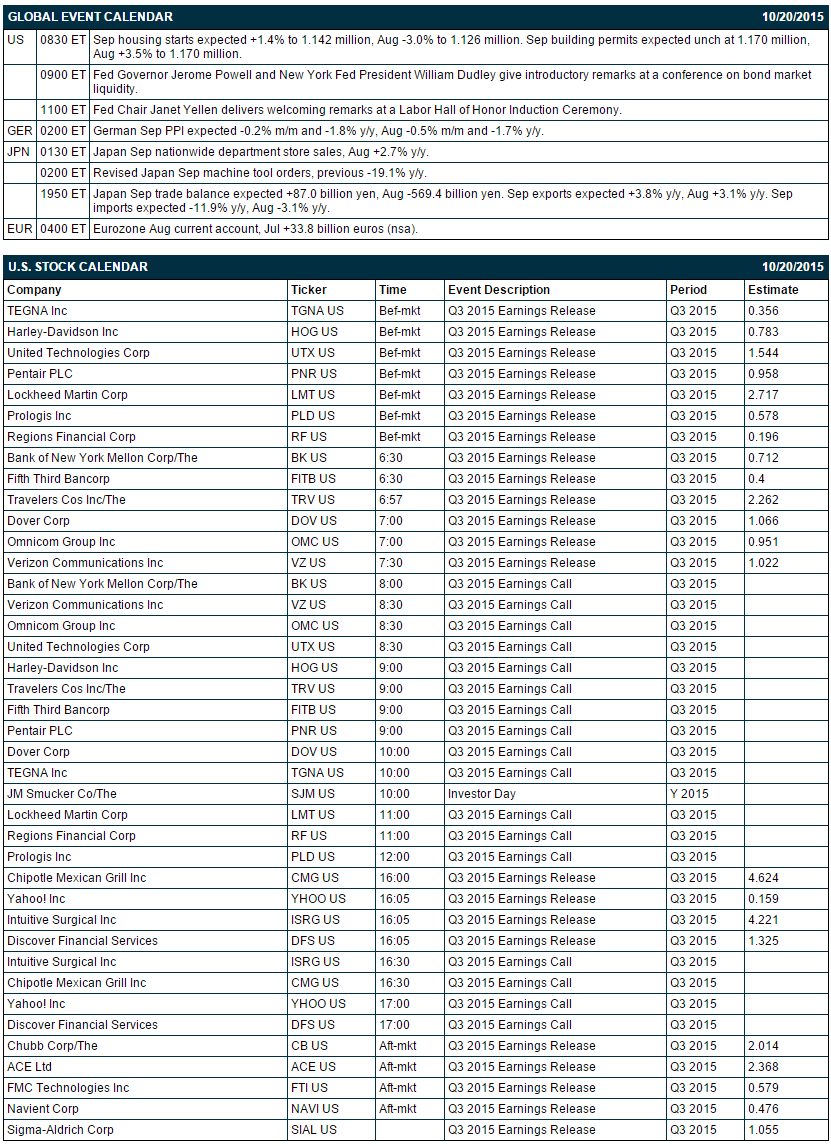

Key U.S. news today includes: (1) Sep housing starts (expected +1.4% to 1.142 million, Aug -3.0% to 1.126 million), (2) introductory remarks by Fed Governor Jerome Powell and New York Fed President William Dudley at a conference on bond market liquidity, and (3) Fed Chair Janet Yellen's welcoming remarks at a Labor Hall of Honor Induction Ceremony.

There are 22 of the S&P 500 companies that report earnings today with notable reports including: Yahoo (consensus $0.16), Bank of New York Mellon (0.71), Fifth Third Bancorp (0.40), Verizon (1.02), Chipotle (4.62), Discover Financial Services (1.33), Navient (0.48).

U.S. IPO's scheduled to price today: Ferrari (RACE).

Equity conferences today include: Private Wealth Latin America and The Caribbean Forum on Wed.

OVERNIGHT U.S. STOCK MOVERS

International Business Machines (IBM -0.78%) fell nearly 5% in pre-market trading after it reported Q3 adjusted EPS of $3.34, above consensus of $3.30, but then lowered guidance for fiscal 2015 EPS to $15.25, plus or minus 50 cents, below consensus of $15.68.

Fifth Third Bancorp (FITB +0.11%) reported Q3 EPS of 39 cents, below consensus of 40 cents.

Harley Davidson (HOG +1.16%) reported Q3 EPS of 69 cents, weaker than consensus of 78 cents.

The Travelers Cos. (TRV +0.40%) reported Q3 EPS of $2.93, higher than consensus of $2.26.

Omnicom Group (OMC +0.07%) reported Q3 EPS of 97 cents, better than consensus of 95 cents.

Wolverine World Wide (WWW -0.25%) reported Q3 EPS of 48 cents, right on consensus, but then lowered guidance on fiscal 2015 EPS to $144-$1.47 from a February estimate of $1.53-$1.60, below consensus of $1.47.

The Fresh Market (TFM +3.51%) was raised to 'Neutral' from 'Underperform' at Credit Suisse.

Hexcel (HXL +0.07%) fell over 4% in after-hours trading after it reported Q3 EPS of 55 cents, weaker than consensus of 59 cents, and then lowered guidance on fiscal 2015 EPS to $2.28-$2.34, below consensus of $2.43.

SanDisk (SNDK +2.90%) jumped over 8% in after-hours trading after people with knowledge of the matter said SanDisk is in advanced talks to sell itself to Western Digital Corp.

Ctrip.com (CTRIP) climbed nearly 2% in after-hours trading after Priceline Group raised its stake in the company to 12.63%.

Rambus (RMBS +0.87%) sank nearly 15% in after-hours trading after it reported Q3 EPS of 14 cents, right on consensus, but then lowered guidance on Q4 revenue to $71 million -$77 million, below consensus of $83.4 million.

Sonic Corp. (SONC +1.99%) rose 5% in after-hours trading after it reported Q4 EPS of 43 cents, better than consensus of 42 cents, and raised guidance for fiscal year 2016 EPS growth to 16% to 20% per share, higher than a previous outlook of 14% to 18% growth.

Flexatronic International (FLEX -0.80%) rose 6% in after-hours trading after it reported Q2 EPS of 27 cents, higher than consensus of 25 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 -0.21%) this morning are down -6.25 points (-0.31%). Monday's closes: S&P 500 +0.03%, Dow Jones +0.08%, Nasdaq +0.53%. The S&P 500 on Monday closed slightly higher on reduced Chinese economic concerns after the China Q3 GDP report of +6.9% y/y was slightly stronger than expectations of +6.8% y/y. In addition, the U.S. Oct NAHB housing market index showed a larger than-expected gain to a new 10-year high of 64. Meanwhile, bank stocks were undercut by disappointing earnings from Morgan Stanley and by weakness in energy producers after crude oil fell by over -3%.

Dec 10-year T-notes (ZNZ15 -0.15%) this morning are down -6 ticks. Monday's closes: TYZ5 -2.00, FVZ5 +1.00. Dec T-notes on Monday closed slightly lower on increased worries about a Fed tightening after the stronger-than-expected Chinese Q3 GDP of +6.9% and the larger-than-expected increase in the Oct NAHB housing market index to a 10-year high.

The dollar index (DXY00 -0.31%) this morning is down -0.293 (-0.31%). EUR/USD (^EURUSD) is up +0.0051 (+0.45%). USD/JPY (^USDJPY) is up +0.13 (+0.11%). Monday's closes: Dollar Index +0.388 (+0.41%), EUR/USD -0.0021 (-0.19%), USD/JPY +0.06 (+0.05%). The dollar index on Monday rose to a 1-week high and closed higher on the slightly increased chances for a Fed rate hike after the stronger-than-expected U.S. Oct NAHB housing market index report to a 10-year high. In addition, EUR/USD fell to a 1-week low on speculation that ECB President Draghi will consider expanding QE when the ECB meets on Thursday.

Dec crude oil (CLZ15 +0.19%) this morning is down -1 cent (-0.02%) and Dec gasoline (RBZ15 +0.31%) is down -0.0006 (-0.05%). Monday's closes: CLZ5 -1.44 (-3.02%), RBZ5 -0.0538 (-4.03%). Dec crude oil and gasoline prices on Monday closed lower with Dec gasoline at a 1-1/2 month low. Crude oil and gasoline prices were undercut by the rally in the dollar index to a 1-week high and the decline in Q3 China GDP to a 6-1/2 year low of +6.9% y/y. In addition, the market is expecting Wednesday's weekly EIA report to show a +500,000 bbl increase in Cushing crude oil inventories.

Disclosure:None.