Morning Call For October 10, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.40%) are up +0.35% and European stocks are up +0.34% on speculation that U.S. Presidential candidate Clinton will prevail following Sunday night’s second presidential debate between candidates Trump and Clinton. Market activity may be subdued today with cash Treasury trading closed in the U.S. today for the Columbus Day holiday. European stocks received a boost on signs of strength in the German economy, Europe's largest, after German Aug exports increased by the most in 6-1/4 years. Asian stocks settled mostly higher: Japan, Hong Kong and Taiwan closed for holiday, China +1.45%, Australia +0.15%, Singapore -0.17%%, South Korea +0.10%, India +0.08%. China's Shanghai Composite rallied to a 2-week high after markets there reopened following a week-long holiday. China's yuan tumbled to 6.7051 per dollar, the weakest in 6 years, on signs the PBOC will allow the yuan to weaken in the short-term. China's Sep foreign-exchange reserves fell to $3.17 trillion, less than expectations of$3.18 trillion, which fueled speculation the PBOC was selling dollars to support the yuan before a G-20 meeting in China last month.

The dollar index (DXY00 +0.14%) is up +0.11%. EUR/USD (^EURUSD) is down -0.29%. USD/JPY (^USDJPY) is up +0.42%.

Dec 10-year T-note prices (ZNZ16 -0.17%) are down -6.5 ticks.

Fed Vice Chair Fischer said the FOMC's interest rate decision in Sep was a "close call" and that policy makers chose to wait for more signs of progress on inflation and employment goals.

The German Aug trade balance was in surplus by +20.0 billion euros, wider than expectations of +19.5 billion euros. Aug exports rose +5.4% m/m, stronger than expectations of +2.2% m/m and the biggest monthly increase in 6-1/4 years. Aug imports rose +3.0% m/m, stronger than expectations of +0.7% m/m and the biggest increase in 1-3/4 years.

U.S. STOCK PREVIEW

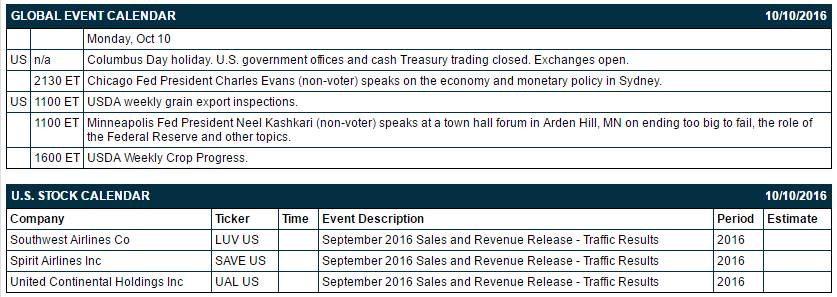

Key U.S. news today includes: (1) the Columbus Day holiday with U.S. government offices and cash Treasury trading closed but with exchanges open, (2) Chicago Fed President Charles Evans (non-voter) speaks on the economy and monetary policy in Sydney.

Russell 1000 companies that report earnings today: none.

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: European Society of Medical Oncology Meeting on Mon, Online Retail Logistics 2016 on Mon, Australia FIX Conference on Wed, Calgary Energy Roundtable Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Mylan (NV) jumped over 10% in pre-market trading after it agreed to a $465 million settlement with the U.S. Department of Justice and other government agencies to resolve questions about classification of EpiPen for the Medicaid Drug Rebate program.

Sherwin-Williams (SHW -1.94%) was upgraded to 'Buy' from 'Hold' at Argus Research.

Under Armour (UA -0.11%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo.

Mattel (MAT -1.44%) was upgraded to 'Buy' from 'Neutral' at MKM Partners with a 12-month target price of $36.

Twitter (TWTR -0.10%) dropped nearly 7% in pre-market trading after people familiar with the matter said top bidders have lost interest in bidding for Twitter.

American Eagle Outfitters (AEO +0.98%) was upgraded to 'Outperform' from 'Market Perform' at BMO Capital Markets with a target price of $21.

CVR Energy (CVI -1.48%) was upgraded to 'Neutral' from 'Underweight' at Piper Jaffray.

Oil-Dri Corp of America (ODC -0.61%) reported Q4 EPS of 72 cents versus 71 cents y/y with Q4 revenue of $64.91 million, down -0.4% y/y.

The WSJ reports that Viacom (VIA -0.92%) and CBS (CBS -1.76%) boards retained advisors to explore a merger.

Duke Energy (DUK -0.67%) rose over 3% in after-hours trading after it said it had restored power for 38,000 out of 200,000 customers who were out of power in Florida as of late Friday afternoon.

Twilio (TWLO -0.18%) lost 3% in after-hours trading after it said it plans to offer $400 million in shares in a secondary offering.

Inotek Pharmaceuticals (ITEK -2.06%) slumped over 10% in after-hours trading after the company said it informed Chief Science Officer, William McVicar, that his employment will be ending.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 +0.40%) this morning are up +7.50 points (+0.35%). Friday's closes: S&P 500 -0.33%, Dow Jones -0.15%, Nasdaq -0.19%. The S&P 500 on Friday closed lower on the U.S. Sep payroll report of +156,000, which was weaker than market expectations of +172,000 but was not seen as weak enough to dissuade the Fed from raising interest rates this year. There was also weakness in precious metals stocks after gold and silver prices fell to 4-month lows.

Dec 10-year T-notes (ZNZ16 -0.17%) this morning are down -6.5 ticks. Friday's closes: TYZ6 +3.50, FVZ6 +2.00. Dec 10-year T-notes on Friday recovered from a 4-1/4 month low and settled higher on the smaller-than-expected increase in U.S. Sep non-farm payrolls and the slide in stocks. T-notes were undercut by continued expectations for a Fed rate hike by year-end since the payroll report was probably not weak enough to dissuade the Fed from a rate hike in December.

The dollar index (DXY00 +0.14%) this morning is up +0.103 (+0.11%). EUR/USD (^EURUSD) is down -0.0032 (-0.29%). USD/JPY (^USDJPY) is up +0.43 (+0.42%). Friday's closes: Dollar index -0.133 (-0.14%), EUR/USD +0.0050 (+0.45%), USD/JPY -0.97 (-0.93%). The dollar index on Friday fell back from a 2-1/4 month high and closed lower on the weaker-than-expected U.S. Sep payroll report and the rebound in EUR/USD from a 1-3/4 month low after German Aug industrial production rose at the fastest pace in 7 months.

Nov WTI crude oil (CLX16 +0.66%) this morning is up +25 cents (+0.50%) and Nov gasoline (RBX16 +0.24%) is up +0.0040 (+0.27%). Friday's closes: Nov crude -0.63 (-1.25%), Nov gasoline -0.0201 (-1.34%). Nov crude oil and gasoline on Friday closed lower on comments from Russian Energy Minister Novak who said he doesn't see an accord on crude oil production cuts when he meets with OPEC during an energy conference in Turkey that starts Oct 9. Crude oil prices were also undercut by the Baker Hughes report showing that active U.S. oil wells rose by another 3 rigs to a 7-3/4 month high of 428 rigs.

Disclosure: None.