Morning Call For Nov. 17, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.28%) this morning are down -0.27% and European stocks are down -0.23% as world equity markets retreated on concern over global growth after Japan Q3 GDP unexpectedly contracted for a second quarter, a sign of recession. U.S. stocks recovered from their worst levels on increased M&A activity after Halliburton agreed to buy Baker Hughes in a cash/stock deal valued at $34.6 billion. Asian stocks closed mostly lower: Japan -2.96%, Hong Kong -1.21%, China -0.54%, Taiwan -1.10%, Australia -0.77%, Singapore -0.81%, South Korea +0.05%, India +0.47%. Chinese stocks were also undercut on banking concerns after data showed China Q3 non-performing loans rose to the most in 6 years. Commodity prices are mostly lower. Dec crude oil (CLZ14 -1.07%) is down -1.07%. Dec gasoline (RBZ14 -1.29%) is down -1.12%. Dec gold (GCZ14+0.29%) is up +0.24%. Dec copper (HGZ14 -0.59%) is down -0.48%. Agriculture prices are weaker. The dollar index (DXY00 +0.19%) is up +0.21%. EUR/USD (^EURUSD) is down -0.28%. USD/JPY (^USDJPY) is up +0.02% at a new 7-year high on speculation the BOJ may expand stimulus and the government may push back an increase in the national sales tax after data showed Japan entered into recession in Q3. Dec T-note prices (ZNZ14+0.11%) are up +3.5 ticks.

Japan Q3 GDP unexpectedly contracted for a second quarter as it fell -1.6% q/q annualized, weaker than expectations of +2.2% q/q annualized. The Q3 deflator rose +2.1% y/y, stronger than expectations of +1.9% y/y and the fastest pace of increase since the data series began in 1995.

China Q3 non-performing loans rose +10.4% q/q or 72.5 billion yuan ($11.8 billion) to 766.9 billion yuan ($125 billion), the most in 6 years.

UK Nov Rightmove house prices fell -1.7% m/m and rose +8.5% y/y. The +8.5% y/y increase is the largest annual gain in 6 months.

U.S. STOCK PREVIEW

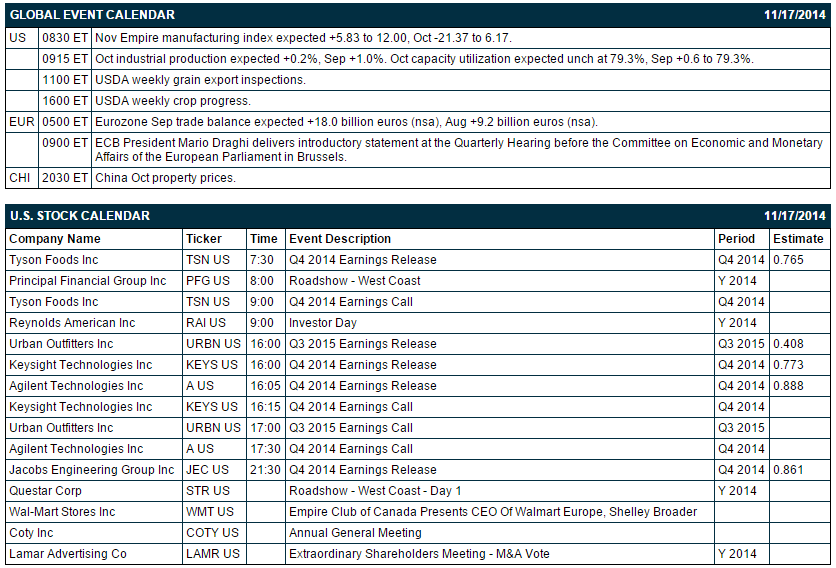

Today’s Oct industrial production report is expected to downshift to +0.2% from +1.0% in Sep due in part to slower U.S. auto production. today's Nov Empire manufacturing index is expected to show a +5.8 point increase to 12.0, recovering a bit after the -21.4 point plunge to 6.2 seen in October. There are 5 of the Russell 1000 companies report earnings today: Tyson Foods (consensus $0.77), Urban Outfitters (0.41), Keysight Technologies (0.77), Agilent (0.89), Jacobs Engineering Group (0.86).

Equity conferences today include: Bernstein Energy Efficiency Conference on Tue, FirstEnergys Energy Growth Conference on Tue, Morgan Stanley Global Consumer & Retail Conference on Tue-Wed, Stifel Healthcare Conference on Tue-Wed, UBS Global Technology Conference on Tue-Wed, Los Angeles Auto Show-Press & Trade Days on Tue-Thu, Citi Financial Technology Conference on Wed, Jefferies Global Healthcare Conference on Wed, World Internet Conference on Wed, Keefe, Bruyette, & Woods Securities Brokerage & Market Structure Conference on Wed, Vertical Research Partners Paper and Packaging Conference on Wed, Barclays Global Automotive Conference on Wed-Thu, Citigroup Global Financial Conference on Wed-Thu, Goldman Sachs Global Metals & Mining/Steel Conference on Thu, Wells Fargo Securities E-Cig Conference on Thu, Morgan Stanley European Technology, Media & Telecoms Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Tyson Foods (TSN -1.26%) reported Q4 adjusted EPS of 87 cents, better than consensus of 76 cents, although Q4 revenue of $10.11 billion was below consensus of $10.16 billion.

Baker Hughes (BHI +1.94%) jumped 18% in pre-market trading after it agrred to be acquired by Halliburton ({=HAL for $78.62 per share.

Procter & Gamble (PG -0.55%) was downgraded to 'Hold' from 'Buy' at Canaccord.

Bloomberg reports that Actavis (ACT +0.89%) is nearing a deal to acquire Allergan (AGN +1.24%) for $64 billion.

Marriott (MAR -0.17%) and Starwood (HOT -0.20%) were both downgraded to 'Neutral' from 'Buy' at UBS.

Phillips 66 (PSX +1.34%) was upgraded to 'Outperform' from 'Neutral' at Credit Suisse.

Nokia (NOK -4.84%) was downgraded to 'Underperform' from 'Market Perform' at Raymond James.

JD.com (JD -1.13%) reported a Q3 EPS loss of -2 cents, twice as much as consensus of a -1 cent loss.

Austin Ventures reported 14.9% stake in Upland Software (UPLD -0.09%) .

CJA Private Equity reported a 9.95% stake in Broadway Financial (BYFC +2.67%) .

Springowl Associates reported a 5.1% stake in Forestar Group (FOR -1.21%) .

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.28%) this morning are down -5.50 points (-0.27%). The S&P 500 index on Friday closed slightly higher: S&P 500 +0.02%, Dow Jones -0.10%, Nasdaq +0.27%. Bullish factors included (1) the stronger-than-expected U.S. Oct retail sales of +0.3% and +0.3% ex autos, better than expectations of +0.2% and +0.2% ex autos, and (2) the +2.5 point increase in the early-Nov U.S. consumer confidence index to 89.4, better than expectations of +0.6 to 87.5 and the highest in 7-1/3 years.

Dec 10-year T-notes (ZNZ14 +0.11%) this morning are up +3.5 ticks. Dec 10-year T-note futures prices on Friday closed higher: TYZ4 +6.50, FVZ4 +3.25. Bullish factors included (1) reduced inflation expectations after the Nov University of Michigan consumer confidence 1-year outlook for the inflation expectations sub-index fell to a 4-year low of +2.6%, and (2) short-covering by bond dealers following the Nov $66 billion quarterly refunding operation. Gains were limited after U.S. Oct retail sales and Nov University of Michigan consumer confidence came in stronger than expected.

The dollar index (DXY00 +0.19%) this morning is up +0.185 (+0.21%). EUR/USD (^EURUSD) is down -0.0035 (-0.28%). USD/JPY (^USDJPY) is up +0.02 (+0.02%) at a new 7-year high. The dollar index on Friday posted a 4-1/3 year high but then shed its gains and closed lower. Closes: Dollar index-0.149 (-0.17%), EUR/USD +0.00492 (+0.39%), USD/JPY +0.503 (+0.43%). A rally in EUR/USD to a 1-week high undercut the dollar after Eurozone Q3 GDP grew at a faster-than-expected pace. A bullish factor for the dollar was the rally in USD/JPY to a 7-year high on speculation Japanese Prime Minister Abe may announce a delay of a national sales tax increase and decide to dissolve parliament and call for snap elections, which would be yen-negative.

Dec WTI crude oil (CLZ14 -1.07%) this morning is down -81 cents (-1.07%) and Dec gasoline (RBZ14 -1.29%) is down -0.0228 (-1.12%). Dec crude and Dec gasoline on Friday rebounded from 4-year lows and closed higher. Closes: CLZ4 +1.61 (+2.17%), RBZ4 +0.0409 (+2.04%). Bullish factors included (1) a weaker dollar, (2) the larger-than-expected increase in both U.S. Oct retail sales and consumer confidence, and (3) the stronger-than-expected Eurozone Q3 GDP, which signals increased energy consumption and fuel demand.

Disclosure: None