Morning Call For Monday, June 5

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 -0.11%) this morning are down -0.09% as stock prices consolidate following Friday's rally to a new all-time high. European stocks are down -0.34% as a slide in copper prices undercuts mining stocks with Jul COMEX copper (HGN17 -1.09%) down -1.05%. Concern about this Thursday's vote in the UK is also weighing on equities on the chance that UK Prime Minister May will not receive an increased majority ahead of Brexit negotiations. Aug COMEX gold (GCQ17 +0.22%) is up +0.20% to a 6-week high on increased safe-haven demand before Thursday's UK election. Qatar's QE Stock Index tumbled 8% after Saudi Arabia, United Arab Emirates, Bahrain and Egypt cut diplomatic and economic ties to Qatar in an attempt to punish it for its ties with Iran and Iranian backed terrorist groups operating within Qatar. Asian stocks settled mostly lower: Japan -0.03%, Hong Kong -0.24%, China -0.45%, Taiwan +0.68%, Australia -0.57%, Singapore -0.05%, South Korea -0.16%, India +0.12%.

The dollar index (DXY00 +0.19%) is up +0.20%. EUR/USD (^EURUSD) is down -0.35%. USD/JPY (^USDJPY) is up +0.19%.

Sep 10-year T-note prices (ZNU17 -0.11%) are down -5 ticks.

The World Bank said it expects the global economy to grow +2.7% this year and +2.9% next year, unchanged from its January forecast, and said "global activity is firming broadly as expected."

U.S. STOCK PREVIEW

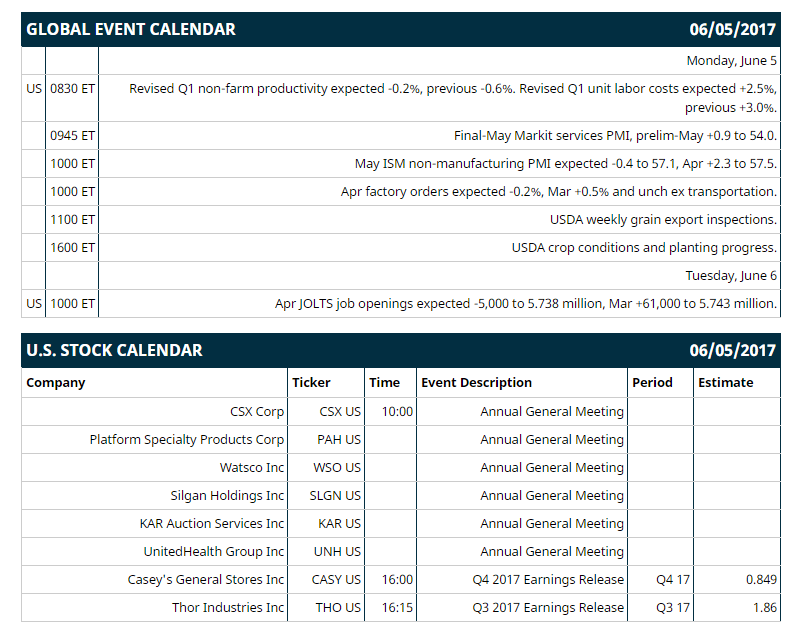

Key U.S. news today includes: (1) revised-Q1 non-farm productivity (expected -0.2%, previous -0.6%) and revised-Q1 unit labor costs (expected +2.5%, previous +3.0%), (2) final-May Markit services PMI (prelim-May +0.9 to 54.0), (3) May ISM non-manufacturing PMI (expected -0.4 to 57.1, Apr +2.3 to 57.5), (4) Apr factory orders (expected -0.2%, Mar +0.5% and unch ex transportation), (5) USDA weekly grain export inspections, (6) USDA crop conditions and planting progress.

Notable Russell 2000 earnings reports today include: Casey's General Stores (consensus $0.85), Thor Industries (1.86).

U.S. IPO's scheduled to price today: none.

Equity conferences: Susquehanna Auto Conference on Mon, American Society of Clinical Oncology Meeting on Mon-Tue, Bank of America Merrill Lynch Energy Credit Conference on Mon-Tue, Goldman Sachs Lodging, Gaming, Restaurant and Leisure Conference on Tue, Wells Fargo Financial Services Investors Forum on Tue, Stifel Technology Internet & Media Conference on Tue, Bank of America Merrill Lynch Global Technology Conference on Tue-Wed, NAREIT REITWeek Investor Forum on Tue-Wed, RBC Global Energy & Power Executive Conference on Tue-Wed, Stephens Spring Investment Conference on Tue-Wed, Robert W. Baird Global Consumer, Technology & Services Conference on Tue-Thu, Jefferies Global Health Care Conference on Tue-Fri, Deutsche Bank Global Industrials and Materials Summit on Wed-Thu, Sandler O'Neill Global Exchange and Brokerage Conference on Wed-Thu, Goldman Sachs European Financial Conference on Wed-Fri, Macquarie Group Ltd Canadian Energy Conference on Thu, Gabelli & Company Entertainment Conference on Thu, Citi Small and Mid Cap Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL +1.48%) was downgraded to 'Sector Weight' from 'Overweight' at Pacific Crest Securities.

Perrigo (PRGO -1.73%) was downgraded to 'Underperform' from 'Sector Perform' at RBC Capital Markets.

Navistar (NAV -2.09%) was upgraded to 'Outperform' from 'Neutral' at Baird with a price target of $33.

Skechers (SKX +0.72%) was upgraded to 'Positive' from 'Neutral' at Susquehanna with a price target of $32.

Yelp (YELP -0.14%) was upgraded to 'Buy' from 'Neutral' at Bank of America/Merrill Lynch with a price target of $37.

Veeva Systems (VEEV +2.82%) was downgraded to 'Equalweight' from 'Overweight' at Morgan Stanley.

Hilton Worldwide Holdings (HLT +1.16%) was rated a new 'Buy' at Argus Research with a price target of $80.

State Street (STT -0.17%) was upgraded to 'Buy' from 'Neutral' at UBS with a price target of $92.

NewLink Genetics (NLNK -1.25%) dropped over 8% in after-hours trading after it said a combination of its indoximod with chemotherapy failed to show a significant difference in a Phase 2 study.

Dynavax Technologies (DVAX +4.42%) surged 18% in after-hours trading after it said a combo of its SD-101 plus Merck's Keytruda resulted in a 100% response rate and 29% complete response in 7 melanoma patients and that SD 101 also helped shrink tumors in 42% of 12 patients who had previously failed PD-1 treatment.

MARKET COMMENTS

June E-mini S&Ps (ESM17 -0.11%) this morning are down -2.25 points (-0.09%). Friday's closes: S&P 500 +0.37%, Dow Jones +0.29%, Nasdaq +1.12%. The S&P 500 on Friday posted a new all-time high and closed higher on ideas the Fed might delay its third rate hike of the year after the weak payroll report of +138,000. Stocks were also boosted by the +14.50 tick rally in Sep 10-year T-notes and the unexpected -0.1 point decline in the U.S. May unemployment rate to a 16-year low of 4.3%, stronger than expectations of unchanged at 4.4%.

Sep 10-year T-notes (ZNU17 -0.11%) this morning are down -5 ticks. Friday's closes: TYU7 +14.50, FVU7 +7.25. Sep 10-year T-notes on Friday soared to a contract high and the 10-year T-note yield tumbled to a 6-3/4 month low. T-note prices were supported by the smaller-than-expected increase in U.S. May non-farm payrolls and reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 2-week low.

The dollar index (DXY00 +0.19%) this morning is up +0.194 (+0.20%). EUR/USD (^EURUSD) is down -0.0039 (-0.35%) and USD/JPY (^USDJPY) is up +0.21 (+0.19%). Friday's closes: Dollar index -0.483 (-0.50%), EUR/USD +0.0066 (+0.59%), USD/JPY -0.97 (-0.87%). The dollar index on Friday dropped to a 6-3/4 month low and closed lower on the weaker-than-expected U.S. May payroll report, which was dovish for Fed policy. The dollar was also undercut by the slide in the 10-year T-note yield to a 6-3/4 month low, which reduces the dollar's interest rate differentials.

Jul WTI crude oil prices (CLN17 -0.57%) this morning are down -26 cents (-0.55%) and July gasoline (RBN17 -0.80%) is -0.0142 (-0.90%). Friday's closes: Jul crude -0.70 (-1.45%), Jul gasoline -0.0243 (-1.52%). Jul crude oil and gasoline on Friday fell to 3-week lows and closed lower on concern about the continued rise in U.S. oil production after last Thursday's EIA data showed a +0.2% increase in U.S. crude production in the week of May 26 to a 2-year high of 9.342 million bpd. Oil prices were also undercut by news that OPEC production in May rose by +315,000 bpd to a 3-month high of 32.21 million bpd.

Disclosure: None.