Morning Call For Monday, July 10

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.02%) this morning are up +0.12% and European stocks are up +0.42%. Strength in technology stocks is leading the overall market higher with Advanced Micro Devices and Nvidia both up over 1% in pre-market trading. European stocks also received a boost on stronger-than-expected German May exports and stronger-than-expected Eurozone Jul Sentix investor confidence. Weakness in mining companies and energy stocks limited the upside in stock index with Aug COMEX gold (GCQ17 -0.16%) down -0.17% to a 3-3/4 month low and Aug WTI crude oil (CLQ17 -0.99%) down -1.18% to a 1-week low. Asian stocks settled mostly higher: Japan +0.76%, Hong Kong +0.63%, China -0.17%, Taiwan -0.07%, Australia +0.37%, Singapore +0.54%, South Korea +0.26%, India +1.13%.

The dollar index (DXY00 +0.17%) is up +0.13%. EUR/USD (^EURUSD) is down -0.10%. USD/JPY (^USDJPY) is up +0.26% at a 1-3/4 month high on signs the BOJ may expand its yen-negative stimulus measures after BOJ Governor Kuroda said the BOJ will watch price momentum and adjust monetary policy as needed.

Sep 10-year T-note prices (ZNU17 +0.18%) are up +7.5 ticks.

China Jun CPI rose +1.5% y/y, unch from May and weaker than expectations of +1.6% y/y. Jun PPI rose +5.5% y/y, unch from May and right on expectations.

The Eurozone Jul Sentix investor confidence fell -0.1 to 28.3, stronger than expectations of -0.3 to 28.1.

The German May trade balance widened to a surplus of 22.0 billion euros, higher than expectations of 18.7 billion euros. May exports rose +1.4% m/m, stronger than expectations of +0.3%. May imports rose +1.2%, stronger than expectations of +0.3%.

U.S. STOCK PREVIEW

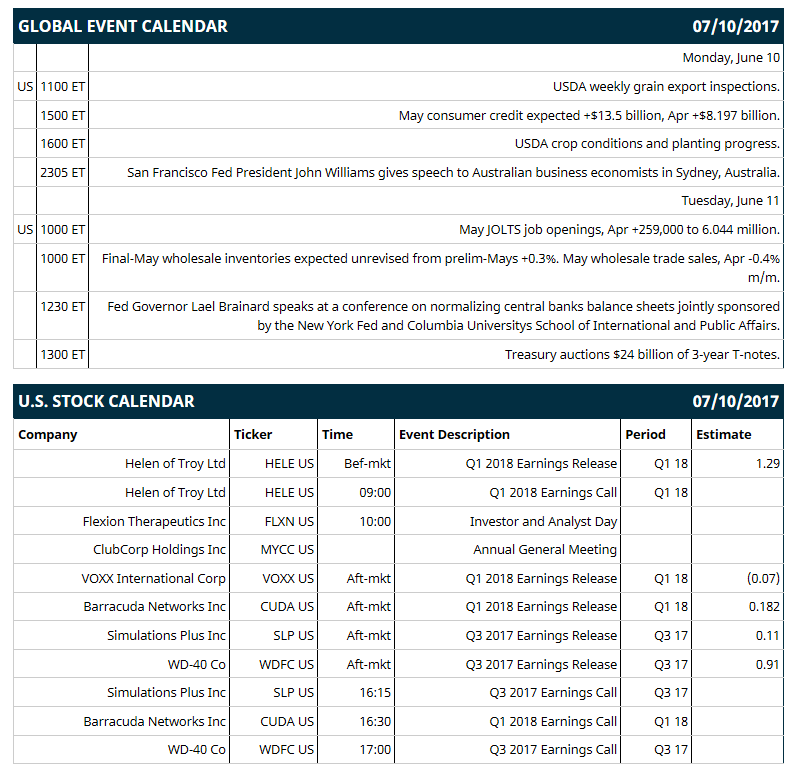

Key U.S. news today includes: (1) May consumer credit (expected +$13.5 billion, Apr +$8.197 billion), (2) San Francisco Fed President John Williams gives a speech to Australian business economists in Sydney, Australia, (3) USDA weekly grain export inspections, and (4) USDA crop conditions and planting progress.

Notable Russell 3000 earnings reports today include: Helen of Troy (consensus $1.29), WD-40 (0.91), Simulations Plus (0.11), Barracuda Networks (0.18), VOXX Intl (-0.07%).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: SEMICON West Conference on Tue.

OVERNIGHT U.S. STOCK MOVERS

Nvidia (NVDA +2.29%) is up over 1% in pre-market trading after Needham & Co. reiterated their 'Buy' rating on the stock with a price target of $200, saying the company's deal with Toyota will generate meaningful revenue over the next 24 months.

HP Inc. (HPQ +0.93%) was upgraded to 'Buy' from 'Neutral' at Mizuho Securities USA with a price target of $21.

Costco (COST -1.90%) was downgraded to 'Market Perform' from 'Outperform' at BMO Capital Markets.

Juniper Networks (JNPR +2.37%) was upgraded to 'Outperform' from 'Market Perform at BMO Capital Markets with a price target of $34.

PayPal (PYPL +0.94%) was upgraded to 'Outperform' from 'Market Perform' at Bernstein with a price target of $61,

Apartment Investment & Management (AIV -0.26%) was downgraded to 'Underperform' from 'Neutral' at Mizuho Securities USA.

Xilinx (XLNX +1.43%) was upgraded to 'Buy' from 'Hold' at Jeffries with a price target of $77.

Intel (INTC +0.74%) was downgraded to 'Underperform' from 'Hold' at Jeffries.

Five Below (FIVE -0.50%) was downgraded to 'Neutral' from 'Buy' at UBS.

Rockwell Collins (COL +0.91%) boosted its share buyback authorization by $200 million.

Lockheed Martin (LMT +1.51%) was awarded a $5.85 billion contract modification from the U.S. Department of Defense for 74 Joint Strike Fighter jets for fiscal 2017.

Depomed (DEPO +1.50%) slid nearly 1% in after-hours trading after Chief Medical Officer, Dr. Srinivas G. Rao, announced his resignation effective July 31.

LendingClub (LC +1.12%) lost nearly 1% in after-hours trading after the company cautioned holders of its stock against an unsolicited exchange offer from IEG Holdings.

USA Technologies (USAT +2.94%) filed to sell $40 million of its common stock in an underwritten public offering.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 +0.02%) this morning are up +3.00 points (+0.12%). Friday's closes: S&P 500 +0.64%, Dow Jones +0.44%, Nasdaq +1.05%. The S&P 500 on Friday closed higher on the +222,000 increase in U.S. Jun non-farm payrolls, stronger than expectations of +178,000. Stocks also found support on the Jun average hourly earnings report of +0.2% m/m and +2.5% y/y, weaker than expectations of +0.3% m/m and +2.6% y/y, which was dovish for Fed policy. Energy stocks declined after the price of crude oil fell -2.83%.

Sep 10-year T-notes (ZNU17 +0.18%) this morning are up +7.5 ticks. Friday's closes: TYU7 -4.50, FVU7 -2.00. Sep 10-year T-notes on Friday closed lower on the stronger-than-expected U.S. Jun payroll report of +222,000 (vs expectations of +178,000) and reduced safe-haven demand with the rally in stocks. There was also negative carry-over from the slide in German bund prices to a 17-1/2 month low.

The dollar index (DXY00 +0.17%) this morning is up +0.125 (+0.13%). EUR/USD (^EURUSD) is down -0.0011 (-0.10%) and USD/JPY (^USDJPY) is up +0.30 (+0.26%) at a fresh 1-3/4 month high. Friday's closes: Dollar index +0.206 (+0.22%), EUR/USD -0.0022 (-0.19%), USD/JPY +0.70 (+0.82%). The dollar index on Friday closed higher on the larger-than-expected increase in U.S. Jun non-farm payrolls and on a rally in USD/JPY to a 1-3/4 month high after the BOJ announced an unlimited debt-purchase operation to keep Japanese 10-year bond yields pegged near zero percent, which is negative for the yen's interest rate differentials.

Aug WTI crude oil prices (CLQ17 -0.99%) this morning are down -52 cents (-1.18%) to a 1-week low and Aug gasoline (RBQ17 -1.15%) is -0.0213 (-1.42%). Friday's closes: Aug crude -1.29 (-2.83%), Aug gasoline -0.0303 (-1.98%). Aug crude oil and gasoline on Friday fell to 1-week lows and closed lower. Crude oil prices were undercut by a stronger dollar and by signs that U.S. crude production will continue to increase after data from Baker Hughes showed U.S. active oil rigs in the week ended July 7 rose +7 to 763, the most in 2-1/4 years.

(Click on image to enlarge)

Disclosure: None.