Morning Call For Monday, January 29

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 -0.26%) this morning are down -0.23% as they retreated from a new record nearest-futures high in overnight trade after rising T-note yields undercut stock prices. The 10-year T-note yield jumped to a 3-3/4 year high of 2.72% ahead of President Trump's State of the Union address Tuesday night and the outcome of the 2-day FOMC meeting on Wednesday. European stocks are down -0.02% as rising European government bond yields weigh on stock prices. The 10-year German bund yield climbed to a 2-year high of 0.685% after ECB Governing Council member Knot said the ECB has to end the QE program as soon as possible. Trade concerns also pressured equity prices after the European Commission said the EU is "ready to react swiftly and appropriately" to any restrictive trade measures by the U.S. that affect the bloc. Asian stocks settled mixed: Japan -0.01%, Hong Kong -0.56%, China -0.99%, Taiwan +0.67%, Australia +0.42%, Singapore +0.28%, South Korea +0.80%, India +0.65%.

The dollar index (DXY00 +0.32%) is up +0.23%. EUR/USD (^EURUSD) is down -0.26% after ECB Executive Board member Praet said the ECB "still has a way to go before inflation is on track toward its goal." USD/JPY (^USDJPY) is up +0.09%.

Mar 10-year T-note prices (ZNH18 -0.37%) are down -11.5 ticks at a contract low and the 10-year T-note yield soared to a 3-3/4 year high of 2.72%.

ECB Governing Council member Knot said the QE program "has done what could realistically be expected of it" and the ECB has to end the program as soon as possible.

ECB Executive Board member Praet said an "ample degree of monetary accommodation is still needed" as "domestic price pressures remain subdued" and the ECB "still has a way to go before inflation is on track toward its goal."

The German Dec import price index of +0.3% m/m and +1.1% y/y was slightly stronger than expectations of +0.2% m/m and +1.1% y/y.

U.S. STOCK PREVIEW

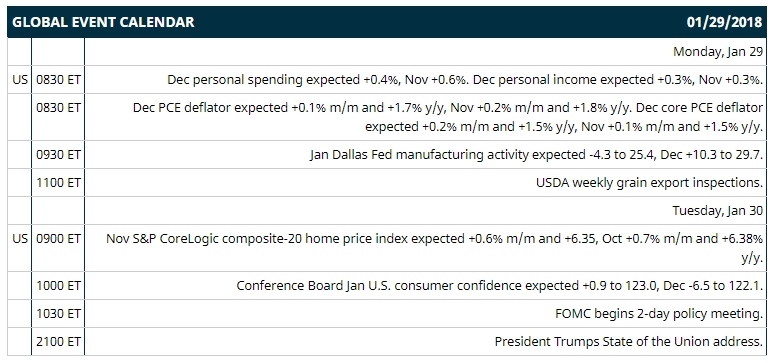

Key U.S. news today includes: (1) Dec personal spending (expected +0.4%, Nov +0.6%) and Dec personal income (expected +0.3%, Nov +0.3%), (2) Dec PCE deflator (expected +0.1% m/m and +1.7% y/y, Nov +0.2% m/m and +1.8% y/y) and Dec core PCE deflator (expected +0.2% m/m and +1.5% y/y, Nov +0.1% m/m and +1.5% y/y), (3) Jan Dallas Fed manufacturing activity (expected -4.3 to 25.4, Dec +10.3 to 29.7), (4) USDA weekly grain export inspections.

Notable S&P 500 earnings reports today include: Lockheed Martin (consensus $4.04), Dominion Energy (0.89), Affiliated Managers Group (4.53), Seagate Technology (1.40), Alexandria Real Estate Equities (1.54), Principal Financial Group (1.36).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Starbucks (SBUX -4.23%) was downgraded to 'Market Perform' from 'Outperform' at Bernstein.

CBS (CBS +1.23%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

Myriad Genetics (MYGN +0.20%) was rated a new 'Sell' at Goldman Sachs with a price target of $32.

Equinix (EQIX +0.55%) was upgraded to 'Buy' from 'Neutral' at UBS with a price target of $510.

Allergan (AGN -0.10%) was upgraded to 'Overweight' from 'Equal-Weight' at Barclays.

Keurig Green Mountain (GMCR -0.30%) said it will acquire Dr. Pepper Snapple (DPS -0.04%) for $103.75 a share.

Lowe's (LOW +0.96%) gained nearly 1% in after-hours trading after it announced a new $5 billion stock repurchase program in addition to the previous buyback program that had a remaining balance of $2.1 billion as of Nov 3.

Kroger (KR +2.05%) gained almost 1% in after-hours trading after CNBC reported Casey's General Stores is eyeing Kroger's convenience-store business.

Momo (MOMO +1.81%) gained over 1% in after-hours trading after it was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase with a price target of $40.

Karypharm Therapeutics (KPTI +4.07%) fell over 2% in after-hours trading after it failed to sell a $250 million mixed securities shelf offering.

National CineMedia (NCMI -0.30%) rose nearly 5% in after-hours trading after Standard General reported 16.9% in the company and said it seeks board representation.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 -0.26%) this morning are down -6.50 points (-0.23%). Friday's closes: S&P 500 +1.18%, Dow Jones +0.85%, Nasdaq +1.54%. The S&P 500 on Friday rallied to a new all-time high and closed higher on continued optimism about earnings with 80% of reporting SPX companies beating estimates. Stocks on Friday were also boosted by the U.S. Dec durable goods orders report of +2.9%, stronger than expectations of +0.8% and the biggest increase in 6 months. Stocks were undercut by the U.S. Q4 GDP report of +2.6% (q/q annualized), weaker than expectations of +3.0% (q/q annualized).

Mar 10-year T-note prices (ZNH18 -0.37%) this morning are down -11.5 ticks at a new contract low and the 10-year T-note climbed to a 3-3/4 year high of 2.72%. Friday's closes: TYH8 -12.00, FVH8 -7.75. Mar 10-year T-notes on Friday closed lower on negative carry-over from a slide in German 10-year bunds after ECB Executive Board member Coeure said we are starting to see wages and core inflation tick up in the Eurozone. T-notes were also undercut by the rally in the S&P 500 to a new record high, which curbs the safe-haven demand for T-notes.

The dollar index (DXY00 +0.32%) this morning is up +0.209 (+0.23%). EUR/USD (^EURUSD) is down -0.0032 (-0.26%) and USD/JPY (^USDJPY) is up +0.10 (+0.09%). Friday's closes: Dollar Index -0.324 (-0.361%), EUR/USD +0.0031 (+0.25%), USD/JPY -0.83 (-0.76%). The dollar index on Friday closed lower on the weaker-than-expected U.S. Q4 GDP report and on the plunge in USD/JPY to a 4-1/2 month low after BOJ Governor Kuroda said Japan is "finally close" to 2% inflation, which bolstered speculation the BOJ may be closer to ending QE.

Mar crude oil (CLH18 -0.64%) this morning is down -27 cents (-0.41%) and Mar gasoline (RBH18 -0.36%) is -0.0027(-0.14%). Friday's closes: Mar WTI crude +0.63 (+0.96%), Mar gasoline +0.0174 (+0.91%). Mar crude oil and gasoline on Friday closed higher on a weaker dollar and on carry-over support from Wednesday's EIA data that showed that crude inventories fell for a record tenth week down to a 2-3/4 year low.

Metals prices this morning are mixed with Feb gold (GCG18 -0.84%) -6.9 (-0.51%), Mar silver (SIH18 -1.04%) -0.121(-0.69%), and Mar copper (HGH18 +0.20%) +0.009 (+0.27%). Friday's closes: Feb gold -10.8 (-0.79%), Mar silver -0.174(-0.99%), Mar copper -0.0175 (-0.54%). Metals on Friday closed lower on the rally in the S&P 500 to a new record high, which reduces the safe-haven demand for precious metals, and on the weaker-than-expected U.S, Q4 GDP report of +2.6%, which was negative for industrial metals consumption. Copper prices were undercut by the +9,525 MT increase in LME copper inventories to a 4-1/4 month high of 309,125 MT.

Disclosure: None.