Morning Call For Monday, January 22

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 -0.06%) this morning are down -0.07% as the partial shutdown of the U.S. government begins for a third day. The Senate has a vote scheduled for 12pm Eastern time to sees if the impasse can be ended. European markets are up +0.16% at a 2-1/4 month high and EUR/USD moved higher on improved prospects for a coalition government in Germany after Chancellor Merkel's Christian Democratic Party and their Bavarian allies signaled they will put aside their differences and enter negotiations for a common policy platform for Germany. Increased M&A activity is giving stocks a lift after Celgene agreed to purchase Juno Therapeutics for about $9 billion or $87 a share in cash. Asian stocks settled mostly higher: Japan +0.03%, Hong Kong +0.43%, China +0.39%, Taiwan +0.72%, Australia -0.23%, Singapore +0.54%, South Korea -0.99%, India +0.81%. China's Shanghai Composite climbed to a fresh 2-year high on optimism the global economic recovery will continue.

The dollar index (DXY00 -0.09%) is down -0.14% as the partial shutdown of the U.S. government continues. EUR/USD (^EURUSD) is up +0.25% on optimism Chancellor Merkel's Christian Democrats will be able to form a coalition government. USD/JPY (^USDJPY) is down -0.01%.

Mar 10-year T-note prices (ZNH18 -0.09%) are down -2.5 ticks at a new contract low and the 10-year T-note yield touched a new 3-1/2 year high of 2.668% in overnight trade before falling back slightly.

San Francisco Fed President Williams said, "there is some potential the economy is going to outperform my forecast" and that there's a greater chance of economic performance prompting four rate hikes than a downturn that would force policymakers to pull back on expectations of three quarter-point bumps in 2018.

U.S. STOCK PREVIEW

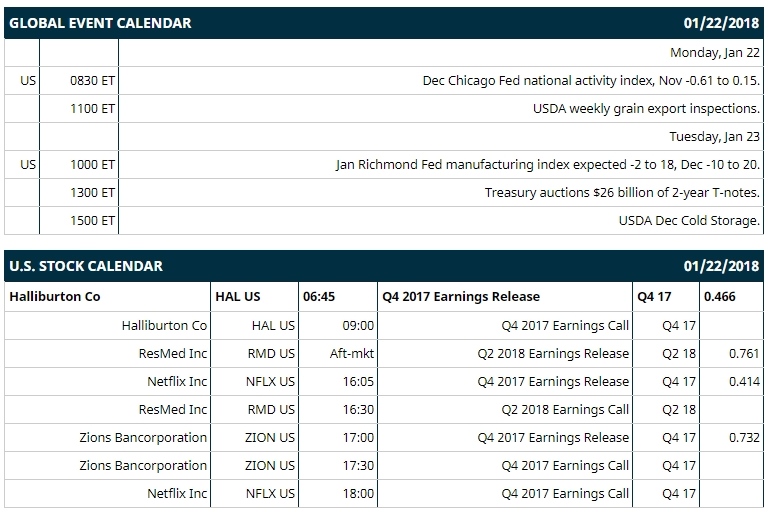

Key U.S. news today includes (1) Dec Chicago Fed national activity index (expected +0.07 to 0.22, Nov -0.61 to 0.15), (2) USDA weekly grain export inspections.

Notable Russell 1000 earnings reports today include: Halliburton (consensus $0.47), Netflix (0.41), Zions Bancoporation (0.73), ResMed (0.76).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Platts Utility Supply Chain Conference on Mon, U.S. Capital Advisors Midstream Corporate Access Day on Tue, National Business Aviation Association Regional Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL -0.45%) was downgraded to 'Neutral' from 'Overweight' at Atlantic Equities LLP.

Halliburton (HAL +1.24%) is up nearly 2% in pre-market trading after it was upgraded to 'Buy' from 'Neutral' at Guggenheim Securities.

Abbott Laboratories (ABT +0.41%) was downgraded to 'Neutral' from 'Buy' at BTIG LLC.

American Express (AXP -1.83%) was downgraded to 'Neutral' from 'Buy' at Guggenheim Securities.

Harley-Davidson (HOG +1.26%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $59.

Aflac (AFL +0.44%) was upgraded to 'Strong Buy' from 'Outperform' at Raymond James with a price target of $100.

Palo Alto Networks (PANW -0.38%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Juno Therapeutics ({=JUNO will move higher this morning after Celgene agreed to acquire the company for $87 a share, a 28% premium to Friday's closing price.

Celgene (CELG +0.91%) said investigational data showed results from its Abraxane regimen for patients with locally advanced pancreatic cancer were "encouraging."

Genmab A/S (GNMSF +1.46%) may get a boost this morning after said the U.S. FDA late Friday granted priority review for its Daratumumab in combination with bortezomib, melphalan, and prednisone for the treatment of patients with multiple myeloma ineligible for autologous stem cell transplant

Bunge Ltd (BG +11.37%) rose nearly 2% in after-hours trading on top of the 11% the stock rallied during Friday's session after people familiar with the matter said ADM made a takeover approach for Bunge.

Sanmina (SANM +1.43%) plunged 18% in after-hours trading after it reported preliminary Q1 adjusted EPS of 48 cents, well below consensus of 71 cents, and then said it sees Q2 adjusted EPS of 40 cents to 50 cents, weaker than consensus of 70 cents.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 -0.06%) this morning are down -2.00 points (-0.07%). Friday's closes: S&P 500 +0.44%, Dow Jones +0.21%, Nasdaq +0.34%. The S&P 500 on Friday moved up to a new record high and closed higher on signs the global economy is picking up steam after the German government raised its German 2018 GDP forecast to 2.3% from a prior forecast of 1.9%. There were also upbeat comments from Cleveland Fed President Mester who said the U.S. economy started 2018 with "positive momentum." Stocks were undercut by the prospects for a U.S. government shutdown and by the unexpected -1.5 point decline in the University of Michigan U.S. Jan consumer sentiment index to a 6-month low of 94.4 (weaker than expectations of +1.1 to 97.0).

Mar 10-year T-note prices (ZNH18 -0.09%) this morning are down -2.5 ticks at a fresh contract low. Friday's closes: TYH8 -5.50, FVH8 -3.75. Mar 10-year T-notes on Friday fell to a new contract low and the 10-year T-note yield rose to a 3-1/2 year high. T-note prices were undercut by strength in stocks, which reduced safe-haven demand for T-notes, and by hawkish comments from Cleveland Fed President Mester who said the U.S. economy started 2018 with "positive momentum" and "if the economy evolves as I anticipate, I believe further increases in interest rates will be appropriate this year and next."

The dollar index (DXY00 -0.09%) this morning is down -0.123 (-0.14%). EUR/USD (^EURUSD) is up +0.0030 (+0.25%) and USD/JPY (^USDJPY) is down -0.01 (-0.01%). Friday's closes: Dollar Index +0.074 (+0.08%), EUR/USD -0.0016 (-0.13%), USD/JPY -0.34 (-0.31%). The dollar index on Friday closed higher on the jump in the 10-year T-note yield to a 3-1/2 year high of 2.66%, which improved the dollar's interest rate differentials, and by comments from Cleveland Fed President Mester who said, "if the economy evolves as I anticipate, I believe further increases in interest rates will be appropriate this year and next."

Feb crude oil (CLG18 +0.05%) this morning is down -9 cents (-0.14%) and Feb gasoline (RBG18 +0.15%) is unch. Friday's closes: Feb WTI crude -0.58 (-0.91%), Feb gasoline -0.0199 (-1.06%). Feb crude oil and gasoline on Friday closed lower with Feb crude at a 1-week low. Crude oil prices were undercut by a stronger dollar and by the IEA's hike in its U.S. 2018 crude oil production estimate by 240,000 bpd to 1.35 million bbl and its comment that U.S. crude output is set for "explosive" growth this year.

Metals prices this morning are mixed with Feb gold (GCG18 -0.08%) -0.7 (-0.05%), Mar silver (SIH18 -0.01%) +0.04 (+0.02%), and Mar copper (HGH18 +0.69%) +0.025 (+0.77%). Friday's closes: Feb gold +5.9 (+0.44%), Mar silver -0.112(-1.23%), Mar copper -0.0115 (-0.36%). Metals on Friday settled mixed. Metals prices were undercut by strength in stocks which curbed the safe-haven demand for precious metals, and by increased copper supplies after LME copper inventories rose +6,175 MT to a 1-3/4 month high and weekly Shanghai copper inventories rose +8,804 MT to a 4-1/2 month high. Metals prices were boosted by increased safe-haven demand for precious metals on U.S. political risks due to the threat of a partial government shutdown on Friday night, and by fund-buying of gold as gold holdings in ETFs rose to a 4-1/2 year high of 2,241.22 MT on Thursday.

Disclosure: None.