Morning Call For May 5, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 +0.28%) are up +0.28% and European stocks are up +0.28% as a +2.83% jump in crude oil (CLM16 +2.74%) lifts energy producing stocks. Weakness in miners and raw-material producers kept equity gains in check as the price of copper (HGN16 -1.35%) slips -1.39% to a 2-week low. volume and market activity in Europe is light with Denmark, Finland, Sweden and Switzerland all closed for holidays. Gains in European stocks were limited as Turkey's ISE National 100 Stock Index slumped -1.46% to an 8-week low on expectations for Turkish Prime Minister Davutoglu to step down amid a power struggle with President Erdogan, which cloud's Turkey's economic prospects and threatens its membership talks with the EU. Asian stocks settled mixed: Japan and South Korea closed for holiday, Hong Kong -0.37%, China +0.22%, Taiwan -0.21%, Australia +0.15%, Singapore-0.19%, India +0.64%.

The dollar index (DXY00 +0.53%) is up +0.49%. EUR/USD (^EURUSD) is down -0.54%% after the ECB said in its monthly bulletin that it "will do everything within its mandate" to ensure that the low inflation environment does not become entrenched. USD/JPY (^USDJPY) is up +0.21%.

Jun T-note prices (ZNM16 -0.05%) are down -2 ticks.

In its monthly economic bulletin, the ECB said it is "crucial to ensure that the very low inflation environment does not become entrenched in second-round effects on wage and price setting." The ECB "will continue to monitor closely the evolution of the outlook for price stability and, if warranted to achieve its objective, will act by using all the instruments available within its mandate."

U.S. STOCK PREVIEW

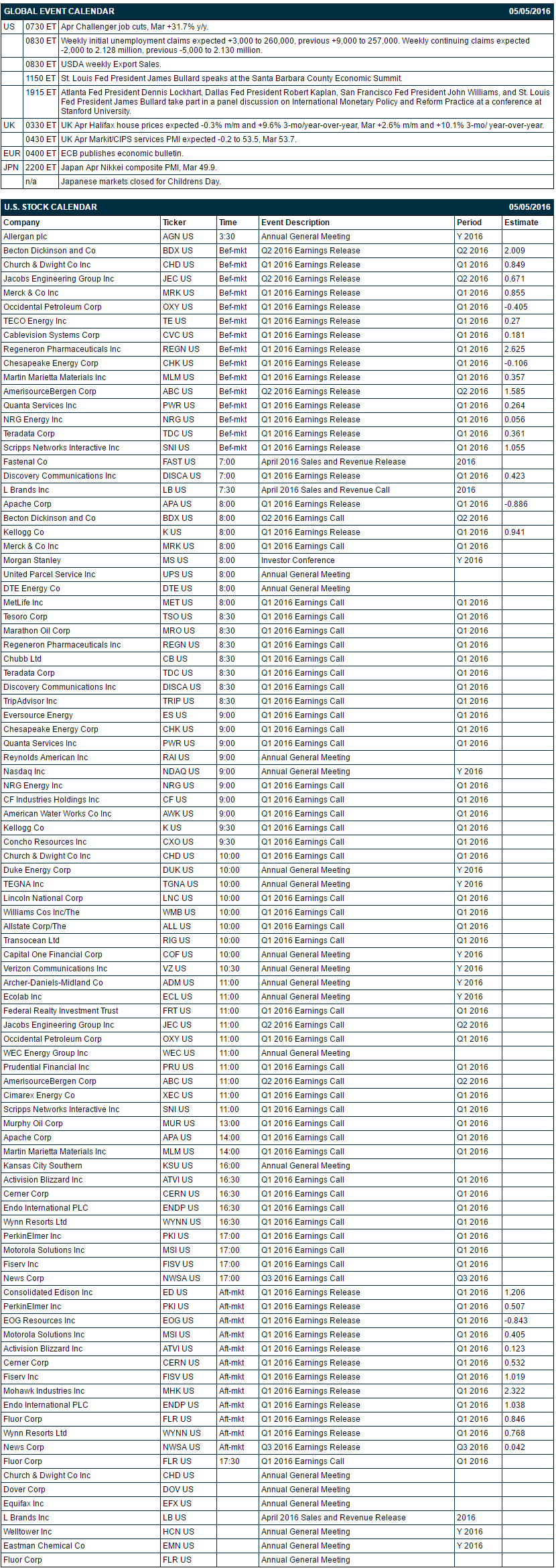

Key U.S. news today includes: (1) Apr Challenger job cuts (Mar +31.7% y/y), (2) weekly initial unemployment claims (expected +3,000 to 260,000, previous +9,000 to 257,000) and continuing claims (expected -2,000 to 2.128 million, previous -5,000 to 2.130 million), (3) St. Louis Fed President James Bullard speaks at the Santa Barbara County Economic Summit, and (4) Atlanta Fed President Dennis Lockhart, Dallas Fed President Robert Kaplan, San Francisco Fed President John Williams, and St. Louis Fed President James Bullard take part in a panel discussion on “International Monetary Policy and Reform Practice” at a conference at Stanford University.

There are 30 of the S&P 500 companies that report earnings today with notable reports including: Merck (0.86), Occidental Petroleum (-0.41), Chesapeake Energy (-0.11), Kellogg (0.94), Motorola Solutions (0.41), Fluor (0.85), Wynn Resorts (0.77), News Corp (0.04).

U.S. IPO's scheduled to price today: Cancer Prevention Pharmaceuticals (CPP), Oncobiologics (ONS), Spring Bank Pharmaceuticals (SBPH), Intellia Therapeutics (NTLA).

Equity conferences during the remainder of this week include: Deutsche Bank Health Care Conference on Wed-Thu, ACI Renewable & Bio-based Chemicals Summit on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Tesla (TSLA -4.20%) rose 5% in pre-market trading after it said it plans to deliver 80,000 to 90,000 new Model S and Model X vehicles this year and reach 500,000 vehicles by 2018, two years sooner than originally planned.

McKesson (MCK -1.87%) gained over 1% in after-hours trading after it reported Q4 adjusted EPS of $3.17, higher than consensus of $3.14.

Kraft Heinz (KHC +1.65%) jumped nearly 5% in after-hours trading after it reported Q1 adjusted EPS of 73 cents, well above consensus of 61 cents.

MetLife (MET -1.90%) fell nearly 3% in after-hours trading after it reported Q1 operating EPS of $1.20 with a 1 cent net tax benefit, weaker than consensus of $1.38.

Prudential Financial (PRU -1.55%) lost 3% in after-hours trading after it reported Q1 operating EPS of $2.18, below consensus of $2.37.

Whole Foods Market (WFM -0.83%) gained nearly 2% in after-hours trading after it reported Q2 EPS of 44 cents, better than consensus of 41 cents.

TripAdvisor (TRIP -4.10%) dropped over 3% in after-hours trading after it reported Q1 adjusted EPS of 32 cents, well below consensus of 46 cents.

Weight Watchers International (WTW -1.11%) surged 12% in after-hours trading after it raised guidance on full-year EPS to 80 cents-$1.05 from a February estimate of 70 cents-$1.00.

Relypsa (RLYP -19.17%) gained nearly 3% in after-hours trading after it reported a Q1 loss of -$1.26, a smaller loss than consensus of -$1.46.

CenturyLink (CTL +1.24%) slid nearly 4% in after-hours trading after it reported Q1 adjusted EPS of 46 cents, well below consensus of 68 cents.

TASER International (TASR -0.79%) rose over 4% in after-hours trading after it reported Q1 EPS of 6 cents, higher than consensus of 4 cents.

ARRIS International PLC (ARRS -0.13%) rallied over 8% in after-hours trading after it reported Q1 adjusted EPS of 47 cents, better than consensus of 40 cents and said it sees Q2 adjusted EPS of 65 cents-70 cents, well above consensus of 56 cents.

Qorvo (QRVO -1.18%) climbed 7% in after-hours trading after it said it sees Q1 adjusted EPS of $1.05, higher than consensus of 96 cents.

Fitbit (FIT -0.47%) tumbled over 10% in after-hours trading after it said its sees Q2 adjusted EPS of 8 cents-11 cents, below consensus of 26 cents and below the lowest estimate of 12 cents.

EP Energy (EPE +0.23%) jumped nearly 20% in after-hours trading after it reported Q1 adjusted EPS of 19 cents, well above consensus of 1 cent.

MARKET COMMENTS

June E-mini S&Ps (ESM16 +0.28%) this morning are up +5.75 points (+0.28%). Wednesday's closes: S&P 500 -0.59%, Dow Jones -0.56%, Nasdaq-0.68%. The S&P 500 on Wednesday tumbled to a 3-week low and closed lower on negative carryover from a sell-off in European stocks to a 3-week low after Eurozone Mar retail sales dropped -0.5% m/m, weaker than expectations of -0.1% m/m and the largest decline in 1-1/2 years. Stocks were also undercut by the +156,000 increase in the U.S. Apr ADP employment change, weaker than expectations of +195,000 and the smallest increase in 3 years. Stocks found some underlying support from the +1.1% rise in U.S. Mar factory orders (stronger than expectations of +0.6%) and the +1.2 points rise in the Apr ISM non-manufacturing index to 55.7 (stronger than expectations of +0.3 to 54).

June 10-year T-note prices (ZNM16 -0.05%) this morning are down -2 ticks. Wednesday's closes: TYM6 +4.50, FVM6 +2.75. Jun T-notes on Wednesday rose to a 2-week high and closed higher on increased safe-haven demand for T-notes after the S&P 500 dropped to a 3-week low. T-notes were also boosted by the weaker-than-expected Apr ADP employment report of only +156,000, the smallest increase in 3 years. T-notes were undercut by the stronger-than-expected Apr ISM non-manufacturing index report and Mar factory orders report.

The dollar index (DXY00 +0.53%) this morning is up +0.456 (+0.49%). EUR/USD (^EURUSD) is down -0.0062 (-0.54%). USD/JPY (^USDJPY) is up +0.23 (+0.21%). Wednesday's closes: Dollar Index +0.235 (+0.25%), EUR/USD -0.0009 (-0.08%), USD/JPY +0.41 (+0.38%). The dollar index on Wednesday closed higher on the stronger-than-expected U.S. Apr ISM non-manufacturing index report and Mar factory orders report and on weakness in EUR/USD after Eurozone Mar retail sales fell -0.5% m/m, the largest monthly decline in 1-1/2 years.

June WTI crude oil (CLM16 +2.74%) this morning is up +$1.24 a barrel (+2.83%). June gasoline (RBM16 +0.68%) is up +0.0126 (+0.85%). Wednesday's closes: CLM6 +0.13 (+0.30%), RBM6 -0.0234 (-1.55%). Jun crude oil and gasoline on Wednesday settled mixed with Jun gasoline at a 2-week low. Crude oil prices were undercut by the +2.78 million bbl increase in EIA crude inventories (higher than expectations of +750,000), and the unexpected +536,000 bbl increase in EIA gasoline supplies (more than expectations for a -250,000 bbl decline). Crude oil found support from the -1.3%drop in U.S. crude production in the week of Apr 29 to a 1-1/2 year low of 8.28 million bpd.

Disclosure: None.