Morning Call For May 19, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 -0.20%) are down -0.28% and European stocks are down -0.95% on negative carryover from yesterday's late afternoon slide in stocks after the Apr 26-27 FOMC meeting minutes suggested that Fed members may want to raise interest rates as soon as their June meeting. The possibility of a June rate hike by the Fed has boosted the dollar index to a 1-1/2 month high, which has undercut commodity prices with crude oil (CLM16 -1.87%) down -1.83% and gold (GCM16 -1.56%) down -1.53% at a 3-week low. The sell-off in commodities has dragged down energy and raw material producers as well as mining stocks. Asian stocks settled mostly lower: Japan +0.01%, Hong Kong -0.67%, China -0.02%, Taiwan -0.78%, Australia -0.61%, Singapore -1.33%, South Korea -0.33%, India -1.19%. Chinese stocks fell and the yuan tumbled to a 2-1/2 month low against the dollar on concern that rising U.S. interest rates may exacerbate Chinese capital outflows. Japan's Nikkei Stock Index bucked the trend of weaker global stocks and climbed to a 3-week high after a rally in USD/JPY to a 3-week high lifted Japanese exporter stocks on improved earnings prospects.

The dollar index (DXY00 +0.19%) is up +0.19% at a 1-1/2 month high. EUR/USD (^EURUSD) is down -0.12% at a 1-1/2 month low. USD/JPY (^USDJPY) is down -0.21% as it falls back from a 3-week high.

Jun T-note prices (ZNM16 +0.02%) are little changed, up +0.5 of a tick.

U.S. STOCK PREVIEW

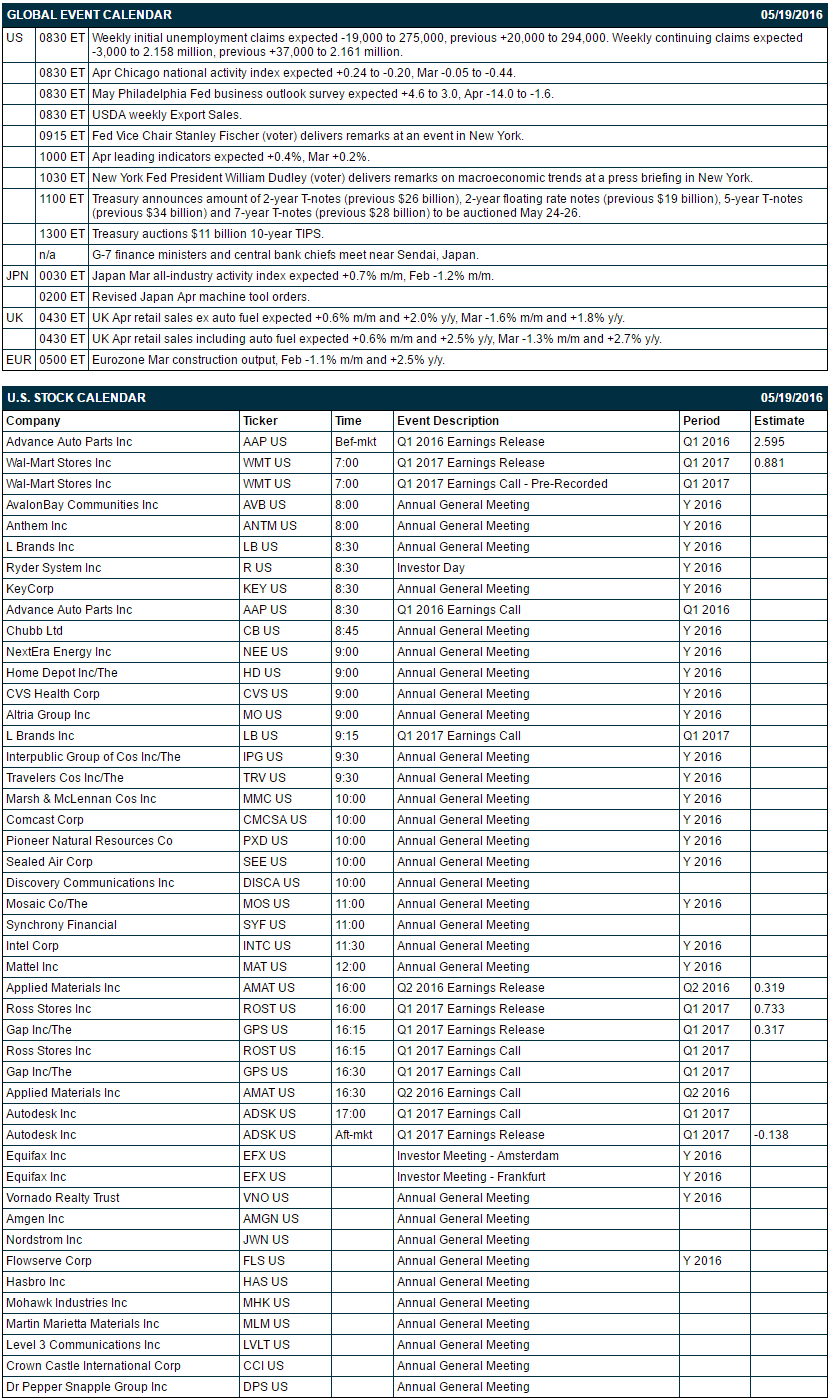

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -19,000 to 275,000, previous +20,000 to 294,000) and Weekly continuing claims (expected -3,000 to 2.158 million, previous +37,000 to 2.161 million), (2) Apr Chicago national activity index (expected +0.24 to -0.20, Mar -0.05 to -0.44), (3) May Philadelphia Fed business outlook index (expected +4.6 to 3.0, Apr -14.0 to -1.6), (4) Fed Vice Chair Stanley Fischer (voter) delivers remarks at an event in New York, (5) Apr leading indicators (expected +0.4%, Mar +0.2%), (6) New York Fed President William Dudley (voter) delivers remarks on macroeconomic trends at a press briefing in New York, (7) Treasury auctions $11 billion of 10-year TIPS, (8) G-7 finance ministers and central bank chiefs meet near Sendai, Japan, and (9) USDA weekly Export Sales.

There are 6 of the S&P 500 companies that report earnings today: Wal-Mart (consensus $0.88), Ross Stores (0.73), Gap (0.32), Advance Auto Parts (2.60), Applied Materials (0.32), Autodesk (-0.14).

U.S. IPO's scheduled to price today: CF Corp (CFCOU).

Equity conferences today: BMO Capital Markets Farm to Market Conference on Wed-Thu, Citi Car of the Future Symposium on Thu, ITG Global Industrials Conference on Thu, Needham Emerging Technology Conference Thu, Business Analytics Innovation Summit on Thu-Fri, Medical Affairs Summit on Fri.

OVERNIGHT U.S. STOCK MOVERS

L Brands (LB -2.43%) dropped over 5% in pre-market trading after it lowered guidance on full-year adjusted EPS to $3.60-$3.80 from a previous estimate of $3.90-$4.10.

Monsanto (MON -0.60%) jumped 8% in pre-market trading after it said it received an unsolicited acquisition offer from Bayer AG.

FMC Technologies (FTI -2.25%) climbed 3% in pre-market trading after it agreed to merge with Technip SA.

Cisco Systems (CSCO +0.26%) rallied over 6% in after-hours trading after it reported Q3 adjusted EPS of 57 cents, higher than consensus of 55 cents, and said it sees Q3 adjusted EPS of 59 cents-61 cents, above consensus of 58 cents.

LKQ Corp. (LKQ -0.59%) climbed over 1% in after-hours trading when it was announced that it will replace Airgas in the S&P 500 after the close of trading on Friday, May 20.

Medical Properties Trust (MPW -2.69%) rose over 3% in after-hours trading when it was announced that it will replace LKQ Corp. in the S&P Midcap 400.

Tesla Motors (TSLA +3.18%) fell over 3% in after-hours trading after it said started a $2 billion secondary stock offering.

Salesforce.com (CRM +1.43%) rallied nearly 6% in after-hours trading after it reported Q1 adjusted EPS of 24 cents, above consensus of 23 cents, and then raised guidance on fiscal 2017 adjusted EPS to $1-00-$1.02 from a prior view of 99 cents-$1.01.

Marathon Petroleum (MPC +1.86%) was rated a new 'Sell' at UBS.

Urban Outfitters (URBN -3.34%) rose nearly 4% in after-hours trading after it reported Q1 revenue of $762.6 million, higher than consensus of $758.9 million.

Flowers Foods (FLO -2.96%) slipped 2% in after-hours trading after it reported Q1 EPS of 28 cents, below consensus of 29 cents.

American Eagle Outfitters (AEO -3.39%) jumped over 13% in after-hours trading after it reported Q1 adjusted EPS of 22 cents, better than consensus of 18 cents.

ZIOPHARM Oncology (ZIOP +4.79%) jumped over 6% in after-hours trading after it said its gene therapy product Ad-RTS-hIL-12+veledimex showed "encouraging signs of immune activation" in a Phase 1 study of patients with recurrent of progressive brain cancer.

Repros Therapeutics (RPRX -3.15%) surged over 20% in after-hours trading after its dosage of Proellex met its primary endpoint in a Phase 2b study of women with severe menstrual bleeding due to uterine fibroids.

MARKET COMMENTS

June E-mini S&Ps (ESM16 -0.20%) this morning are down -5.75 points (-0.28%). Wednesday's closes: S&P 500 +0.02%, Dow Jones -0.02%, Nasdaq +0.36%. The S&P 500 recovered from a 1-1/2 week low and closed little changed. Stocks were undercut by the -1.27% drop in China's Shanghai Stock Index and by the Apr 26-27 FOMC meeting minutes showing that Fed members were open to a rate hike in June. Stocks were supported by strength in energy producer stocks after crude oil rallied to a 7-month high and by strength in technology stocks led by a +1% advance in Apple to a 2-week high.

June 10-year T-note prices (ZNM16 +0.02%) this morning are up +0.5 of a tick. Wednesday's closes: TYM6 1-1/32 points, FVM6 -20.00. Jun T-notes on Wednesday dropped to a 3-week low and closed lower on the Apr 26-27 FOMC meeting minutes showing that policy makers supported a rate hike in June if the economy warrants and on increased inflation expectations after the 10-year T-note breakeven rate rose to a 2-week high.

The dollar index (DXY00 +0.19%) this morning is up +0.179 (+0.19%) at a new 1-1/2 month high. EUR/USD (^EURUSD) is down -0.0013 (-0.12%) at a 1-1/2 month o=low. USD/JPY (^USDJPY) is down -0.23 (-0.21%). Wednesday's closes: Dollar Index +0.532 (+0.56%), EUR/USD -0.0097 (-0.86%), USD/JPY +1.05 (+0.96%). The dollar index on Wednesday climbed to a 1-1/2 month high and closed higher on the Apr 26-27 FOMC minutes showing that Fed members saw a June interest rate hike as "likely" if the economy warranted. The dollar index was also boosted by the rally in USD/JPY to a 2-week high.

June WTI crude oil (CLM16 -1.87%) this morning is down -88 cents (-1.83%). June gasoline (RBM16 -1.95%) is down -0.0347 (-2.10%). Wednesday's closes: CLM6 -0.12 (-0.25%), RBM6 +0.0148 (+0.91%). Jun crude oil and gasoline on Wednesday settled mixed. Crude oil found support on supply concerns as ongoing wildfires in Canada and production losses in Nigeria are taking out at least 2.0 million bpd of global oil production and on reduced U.S. crude output as U.S. oil production in the week ended May 13 fell for a tenth week as output dropped -0.1% to a 1-1/2 year low of 8.791 million bpd. Crude oil was supported by the rally in the dollar index to a 1-1/2 month high and by the unexpected +1.31 million bbl build in weekly EIA U.S. crude inventories, more than expectations for a -3.5 million bbl draw.

Disclosure: None.