Morning Call For March 1, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 +0.88%) are up +0.74% and European stocks are up +1.04% at a 3-1/2 week high on expectations that global central banks will increase stimulus to spur economic growth. New York Fed President Dudley said that he is "somewhat less confident" that inflation will reach the Fed's target as "downside risks have crept up." His comments signal the Fed may wait further before they raise interest rates again. European stocks also found support after the Eurozone Jan unemployment rate unexpectedly fell to the lowest in more than 4 years. Global stocks shrugged off the negative Chinese economic data that showed the China Feb manufacturing PMI contracted at its steepest pace in 7 years. Asian stocks settled higher: Japan +0.37%, Hong Kong +1.55%, China +1.68%, Taiwan +0.89%, Australia +0.85%, Singapore +0.60%, South Korea closed for holiday, India +3.38%. Asian markets reacted positively to Monday's action from the PBOC to cut banks' reserve requirement ratios that was done after Asian markets closed on Monday.

The dollar index (DXY00 +0.04%) is up +0.04% at a 3-1/2 week high. EUR/USD ^EURUSD) is up +0.01%. USD/JPY (^USDJPY)is up +0.37%.

Jun T-note prices (ZNM16 -0.10%) are down -2 ticks.

New York Fed President Dudley said that he is "somewhat less confident" that inflation will reach the Fed's 2.0% target over time as "downside risks have crept up." He added that a continuing decline in energy, commodity prices may signal "greater and more persistent" deflationary pressure in the global economy.

The Eurozone Jan unemployment rate unexpectedly fell -0.1 to 10.3%, stronger than expectations of unch at 10.4% and the lowest in 4-1/3 years.

The China Feb manufacturing PMI unexpectedly fell -0.4 to 49.0, weaker than expectations of unch at 49.4 and matched Nov 2011 as the steepest pace of contraction in 7 years.

U.S. STOCK PREVIEW

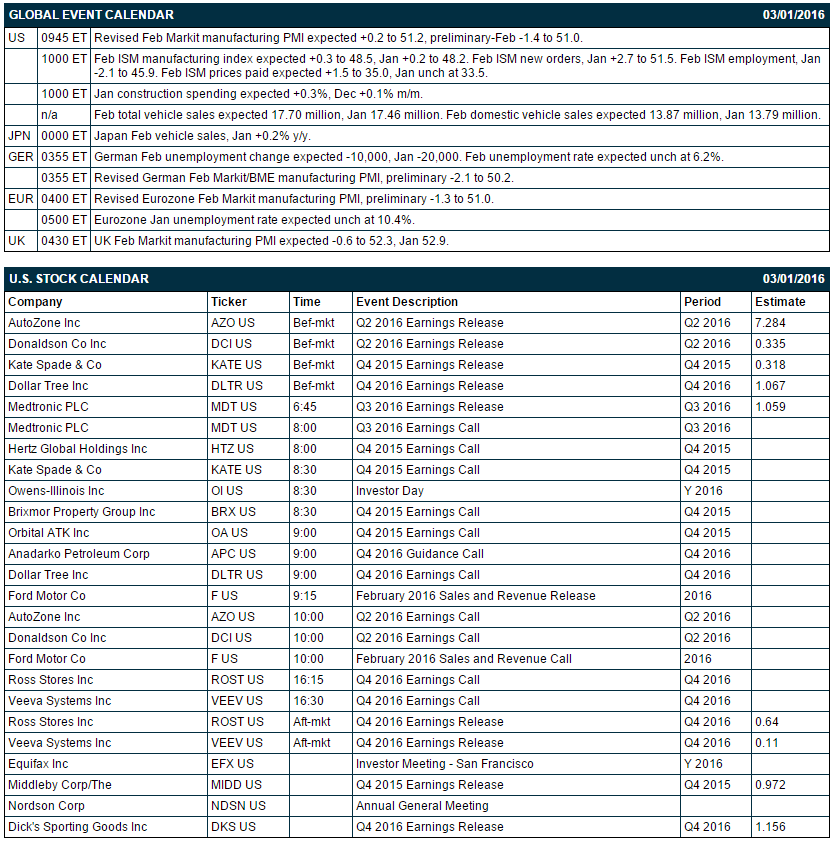

Key U.S. news today includes: (1) revised-Feb Markit U.S. manufacturing PMI (expected +0.2 to 51.2, preliminary-Feb -1.4 to 51.0), (2) Feb ISM manufacturing index (expected +0.3 to 48.5, Jan +0.2 to 48.2) (3) Jan construction spending (expected +0.4%, Dec +0.1% m/m), and (4) Feb total vehicle sales (expected 17.70 million, Jan 17.46 million).

There are 4 of the S&P 500 companies that report earnings today: AutoZone (consensus $7.28), Dollar Tree (1.07), Medtronic (1.06), Ross Stores (0.64).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: BMO Capital Markets Global Metals and Mining Conference on Mon-Tue, J.P. Morgan Global High Yield & Leveraged Finance Conference on Mon-Tue, Morgan Stanley Technology Media & Technology Conference on Mon-Thu, Barclays Power & Utility Credit Conference on Tue, Goldman Sachs Media & Telecom Conference on Tue, Canaccord Genuity Musculoskeletal Conference on Tue, JMP Securities Technology Conference on Tue, Longbow Research Basic Materials Investor Conference on Tue, Pacific Crest Securities Emerging Technology Summit on Tue-Wed, UBS Natural Gas & Electric Utilities Conference on Wed, Bank of America Merrill Lynch Global Agriculture and Chemicals Conference on Wed-Thu, Bank of America Refining Conference on Thu, Citi Asset Management, Broker Dealer & Exchanges Investor Conference on Thu, Gabelli & Company Waste & Environmental Services Conference on Thu, Simmons Energy Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Walgreens Boots Alliance (WBA -0.79%) was upgraded to 'Buy' from 'Neutral' at Mizhuho Securities USA with a target price of $95.

Signet Jewelers (SIG +9.35%) was upgraded to 'Buy' from 'Neutral' at CL King with a 12-month price target of $127.

Bank of America (BAC -1.42%) and Citigroup (C -1.65%) were both cut to 'Neutral' from 'Overweight' at Atlantic Equities.

Marathon Oil (MRO +2.24%) slid over 5% in pre-market trading after it said it intends to offer 135 million shares of common stock.

American Public Education (APEI +3.63%) jumped over 12% in after-hours trading after reported Q4 adjusted EPS of 75 cents, well above consensus of 54 cents.

Hertz Global Holdings (HTZ +2.78%) rose nearly 2% in after-hours trading after it reported Q4 adjusted EPS of 5 cents, better than consensus of 4 cents.

Crocs (CROX +0.20%) lowered guidance on Q1 revenue to $260 million-$270 million, below consensus of $270.8 million.

Qualys (QLYS -0.56%) climbed over 3% in after-hours trading after it announced that it will replace Hangar in the S&P SmallCap 600 Index.

Aegion (AEGN -1.20%) reported Q4 adjusted EPS continuing operations of 36 cents, better than consensus of 35 cents, although Q4 revenue of $330.7 million was below consensus of $341.7 million.

Halozyme Therapeutics (HALO -1.45%) rallied nearly 9% in after-hours trading after it reported Q4 revenue of $52.2 million, higher than consensus of $44.7 million.

Sykes Enterprises (SYKE +0.46%) slid nearly 2% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $1.73-$1.83, below consensus of $1.85.

Diplomat Pharmacy (DPLO +1.48%) plunged 16% in after-hours trading after it lowered guidance on fiscal 2016 EPS to 84 cents-89 cents, below consensus of $1.00.

PTC Therapeutics (PTCT -0.13%) dropped 2% in after-hours trading after it reported a Q4 adjusted loss of -$150 a share, wider than consensus of a loss of -$1.24.

TubeMogul (TUBE +3.46%) gained nearly 5% in after-hours trading after it raised guidance on 2016 revenue to $220 million-$228 million, above consensus of $213.8 million.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 +0.88%) this morning are up +14.25 points (+0.74%). Monday's closes: S&P 500 -0.81%, Dow Jones -0.74%, Nasdaq -0.81%. The S&P 500 on Monday closed lower on weak U.S. economic reports that included the unexpected -2.5% m/m drop in U.S. Jan pending home sales (weaker than expectations of +0.5% m/m and the largest decline in 2 years) and the -8.0 point decline in the Feb Chicago PMI to 47.6 (weaker than expectations of -3.1 to 52.5). Stocks saw early strength after the PBOC lowered the Chinese bank reserve requirement ratio by -50 bp to 17.0%, which should provide some extra stimulus to the Chinese economy.

Jun 10-year T-notes (ZNM16 -0.10%) this morning are down -2 ticks. Monday's closes: TYM6 +4.50, FVM6 +3.25. Jun T-notes on Monday closed higher on the weaker-than-expected U.S. economic reports and on carryover support from a rally in German bunds to a 10-1/4 month high on expectations for the ECB to expand stimulus after Eurozone Feb CPI fell by the most in a year.

The dollar index (DXY00 +0.04%) this morning is up +0.042 (+0.04%) at a 3-1/2 week high. EUR/USD (^EURUSD) is up +0.0001 (+0.01%). USD/JPY (^USDJPY) is up +0.42 (+0.37%). Monday's closes: Dollar Index +0.063 (+0.06%), EUR/USD -0.0061 (-0.56%), USD/JPY -1.31 (-1.15%). The dollar index on Monday rose to a 3-week high and closed higher on weakness in the Chinese yuan which fell to a 3-week low against the dollar after the PBOC cut the bank reserve requirement ratio by 50 bp. In addition, EUR/USD fell to a 1-month low after Eurozone Feb CPI unexpectedly fell -0.2% y/y, weaker than expectations of unch y/y which bolsters the case for the ECB to expand at its meeting next week.

Apr WTI crude (CLJ16 +1.69%) this morning is up +42 cents (+1.24%) and Apr gasoline (RBJ16 -0.29%) is down -0.0061 (-0.46%). Monday's closes: CLJ6 +0.97 (+2.96%), RBJ6 +0.0263 (+2.03%). Apr crude oil and gasoline on Monday closed higher on hopes for stronger Chinese energy demand after the PBOC cut the bank reserve ratio. Crude oil prices also received a boost from expectations for lower U.S. oil production after last Friday's news from Baker Hughes that the number of active U.S. oil rigs fell by another -13 rigs to a 6-year low of 400, the 10th straight weekly decline.

Disclosure: None.