Morning Call For June 29, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 +0.53%) are up +0.54% and European stocks are up +2.44% on speculation central banks will provide measures to mitigate the damage done by the UK's decision to leave the European Union. Fed Governor Powell said late yesterday that global risks have shifted further to the downside, which may merit a reassessing of monetary policy. Energy producing stocks are moving up and leading the overall market higher as the price of crude oil (CLQ16 +0.79%) climbs +1.15%. Crude prices moved higher after API data late yesterday showed U.S. crude inventories fell by -3.86million bbl last week. Asian stocks settled higher: Japan +1.59%, Hong Kong +1.31%, China +0.65%, Taiwan +0.95%, Australia +0.77%, Singapore +1.31%, South Korea +0.93%, India +0.81%. China's Shanghai Composite rallied to a 3-week high led by gains in drug makers and industrial and consumer-staple companies.

The dollar index (DXY00 -0.34%) is down -0.33%. EUR/USD (^EURUSD) is up +0.24%. USD/JPY (^USDJPY) is down -0.05%.

Sep T-note prices (ZNU16 -0.01%) are down -2 ticks.

Speaking Tuesday evening to the Chicago Council on Global Affairs, Fed Governor Powell said that global risks have shifted further to the downside as "the Brexit vote has the potential to create new headwinds for economies around the world, including our own."

Eurozone Jun economic confidence unexpectedly fell -0.2 to 104.4, weaker than expectations of no change at 104.7.

U.S. STOCK PREVIEW

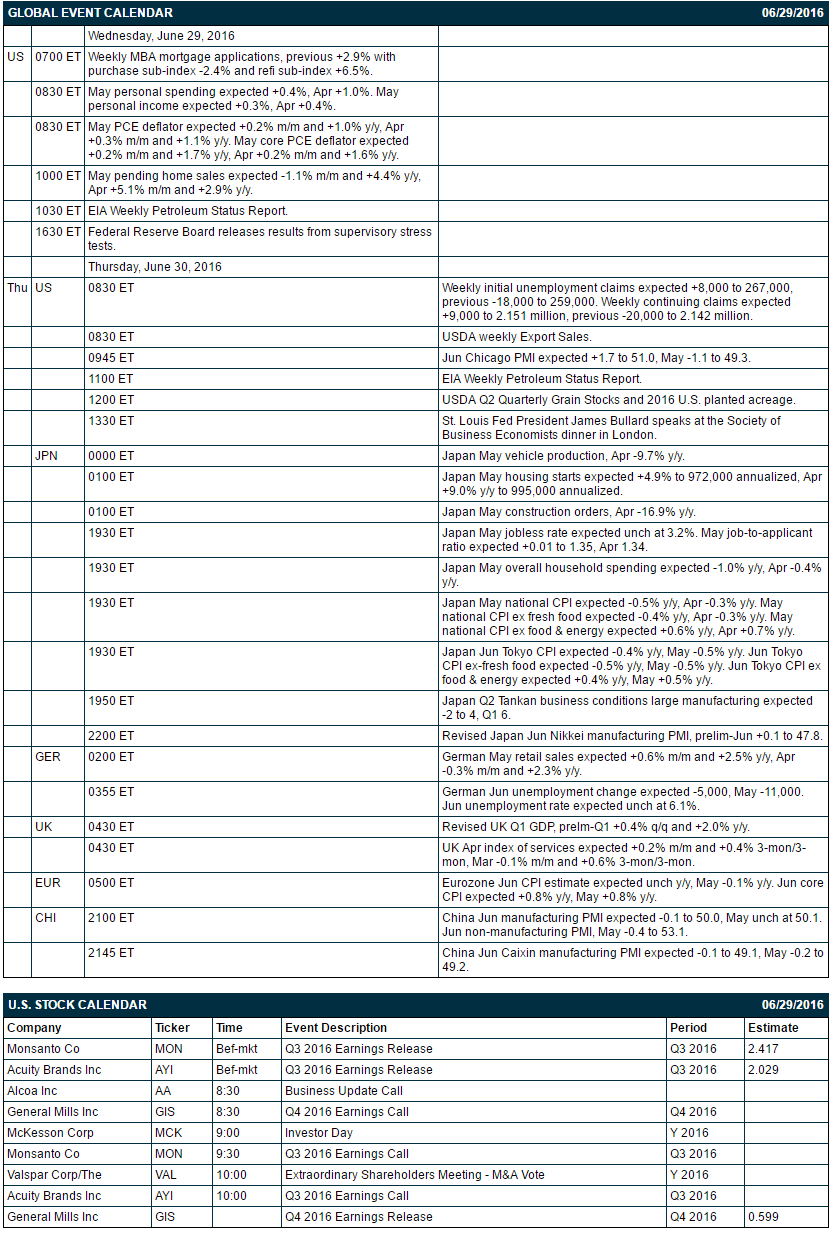

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +2.9% with purchase sub-index -2.4% and refi sub-index +6.5%), (2) May personal spending (expected +0.4%, Apr +1.0%) and May personal income (expected +0.3%, Apr +0.4%), (3) May PCE deflator (expected +0.2% m/m and +1.0% y/y, Apr +0.3% m/m and +1.1% y/y) and May core PCE deflator (expected +0.2% m/m and +1.7% y/y, Apr +0.2% m/m and +1.6% y/y), (4) May pending home sales (expected -1.1% m/m and +4.4% y/y, Apr +5.1% m/m and +2.9% y/y), (5) Federal Reserve Board releases results from supervisory stress tests, and (6) EIA Weekly Petroleum Status Report.

There are 3 of the Russell 1000 companies report earnings today: Monsanto (consensus $2.42), Acuity Brands (2.03), General Mills (0.60).

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: J.P. Morgan Inaugural Energy Equity Investor Conference on Mon-Wed.

OVERNIGHT U.S. STOCK MOVERS

Chicago Bridge & Iron (CBI +2.91%) was rated a new 'Buy' at MKM Partners with a 12-month price target of $46.

Autoliv (ALV +2.48%) slid over 6% in pre-market trading after it confirmed that Toyota had recalled some its cars that involved the company's airbags.

Symantex (SYMC +0.90%) was upgraded to 'Hold' from 'Sell' at Evercore ISI.

Nike (NKE +2.31%) fell nearly 4% in pre-market trading after it reported Q4 revenue of $8.24 billion, less than consensus of $8.28 billion, and said Q4 worldwide futures orders ex-FX were up 11%, below consensus of +13%.

CalAmp (CAMP +3.07%) fell -0.5% in after-hours trading after it said it sees Q2 revenue of $90 million-$95 million, below consensus of $96.5 million.

Neurocrine Biosciences (NBIX +5.00%) was rated a new 'Buy' at HC Wainwright & Co. LLC with a target price of $80.

A Schulman (SHLM -2.53%) declined over 1% in after-hours trading after it filed a lawsuit versus sellers of Citadel Plastics, saying it identified quality reporting issues affecting certain product lines at two Lucent Polymer manufacturing facilities in Evansville, IN.

Eclipse Resources (ECR +3.53%) dropped 5% in after-hours trading after it started an underwritten public offering of 37.5 million shares of common stock.

Aerovironment (AVAV +0.32%) slid over 3% in after-hours trading after t said it sees fiscal 2017 revenue of $260 million-$280 million, below consensus of $286.4 million.

Esperion Therapeutics (ESPR +8.30%) plunged over 20% in after-hours trading after the company said its experimental drug 'Bempedoic acid' may not be able to win FDA approval based solely on its ability to cut cholesterol, which raises concern it may take 6 or more years for the drug to reach the U.S. market.

Hutchinson Technology (HTCH -0.27%) fell 4% in after-hours trading after it said the FTC has not indicated when Hutchinson's merger with Headway Technologies will be approved.

Anthera Pharmaceuticals (ANTH +2.68%) fell nearly 7% in after-hours trading after it said data from "Bright-SC" study of blisibmod for IgA nephropathy failed to meet the primary endpoint at 24 weeks.

KemPharm (KMPH +6.63%) jumped over 16% in after-hours trading after it reported positive Phase 1 results in a trial of its Prodrug of Hydromorphone KP511.

MARKET COMMENTS

September E-mini S&Ps (ESU16 +0.53%) this morning are up +11.00 points (+0.54%). Tuesday's closes: S&P 500 +1.78%, Dow Jones +1.57%, Nasdaq +2.13%. The S&P 500 on Tuesday closed higher on short-covering in global equity markets following the sharp 2-day sell-off after Thursday's Brexit vote. Stocks were also supported by the upward revision in U.S. Q1 GDP to +1.1% from +0.8% and by the +5.6 point increase in U.S. June consumer confidence to 98.0, stronger than expectations of +0.9 to 93.5 and an 8-month high.

Sep 10-year T-note prices (ZNU16 -0.01%) this morning are down -2 ticks. Tuesday's closes: TYU6 -1.00. FVU6 -0.50. Sep T-notes on Tuesday closed lower on reduced safe-haven demand with the recovery in global equity markets and on the stronger-than-expected U.S. Q1 GDP and Jun consumer confidence reports. T-notes recovered from their worst levels after the Jun Richmond Fed manufacturing index contracted at the steepest pace in 3-1/3 years.

The dollar index (DXY00 -0.34%) this morning is down -0.313 (-0.33%). EUR/USD (^EURUSD) is up +0.0027 (+0.24%). USD/JPY (^USDJPY) is down-0.05 (-0.05%). Tuesday's closes: Dollar Index -0.404 (-0.42%), EUR/USD +0.0040 (+0.36%), USD/JPY +0.75 (+0.74%). The dollar index on Tuesday closed lower on the rebound in GBP/USD and EUR/USD after the recent sell-off on Brexit concerns. The dollar recovered from its worst levels after U.S. Jun consumer confidence rose to an 8-month high.

Aug WTI crude oil (CLQ16 +0.79%) this morning is up +55 cents (+1.15%). Aug gasoline (RBQ16 +0.26%) is up +0.0092 (+0.61%). Tuesday's closes: CLQ6 +1.78 (+3.84%), RBQ6 +0.0341 (+2.29%). Aug crude oil and gasoline on Tuesday closed sharply higher on a weaker dollar, a rebound in global equity markets, and expectations for Wednesday's weekly EIA crude inventories to fall -2.5 million bbl.

Disclosure: None.