Morning Call For June 23, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 +0.27%) are up +0.21% and European stocks are up +1.19% at a 3-week high on optimism that Greece can strike a deal with creditors along with signs that global economic growth is picking up. European leaders gave Greece 48 hours to make a final offer to satisfy creditors and Greek Prime Minister Tsipras said that negotiations with creditors will continue until they achieve a "total and viable solution." That helped lift Greece's ASE Stock Index +4.08% and pushed the Greek 10-year bond yield down -56 bp to a 2-week low of 10.60%. The Eurozone Jun Markit composite PMI rose more than expected to its highest since the data series began in 2012. Asian stocks closed higher: Japan +1.87%, Hong Kong +0.93%, China +2.19%, Taiwan +0.53%, Australia +1.32%, Singapore +0.74%, South Korea +1.41%, India +0.27%. Japan's Nikkei Stock Index climbed to a new 15-year high as a weaker yen boosted exporters and China's Shanghai Composite recovered from a 5-week low and closed higher after the China Jun HSBC flash PMI rose more than expected.

Commodity prices are mixed. Aug crude oil (CLQ15 -0.36%) is down -0.45%, Aug gasoline (RBQ15 -0.52%) is down -0.66%. Metals prices are mixed. Aug gold (GCQ15 -0.28%) is down -0.12%. Jul copper (HGN15 +1.42%) is up +1.15%. Agricultural prices are higher with Jul corn up +0.49% at a 1-1/2 week high and Jul soybeans up +0.13% at a 2-1/2 month high as heavy overnight rains in the Midwest flooded fields. The National Weather Service said that parts of the Midwest received more than 6 times the normal rainfall in the week through Monday.

The dollar index (DXY00 +0.84%) is up +0.73%. EUR/USD (^EURUSD) is down -1.07%. USD/JPY (^USDJPY) is up +0.27%.

Sep T-note prices (ZNU15 -0.16%) are down -6.5 ticks.

The China Jun HSBC flash manufacturing PMI rose +0.4 to 49.6, stronger than expectations of +0.2 to 49.4.

The Jun Markit composite PMI unexpectedly rose +0.5 to 54.1, stronger than expectations of -0.1 to 53.5 and the highest since the data series began in 2012.

U.S. STOCK PREVIEW

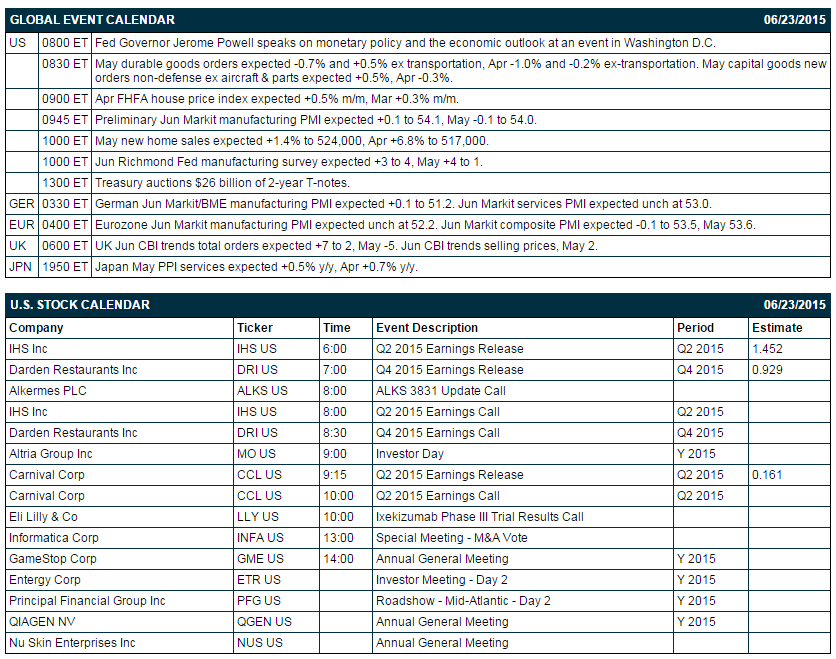

Key U.S. news today includes: (1) May durable goods orders (expected -0.7% and +0.5% ex-transportation after April's -1.0% and -0.2% ex-transportation), (2) Apr FHFA house price index (expected +0.5% m/m after March's +0.3% m/m), (3) preliminary-June Markit U.S. manufacturing PMI (expected +0.1 to 54.1 after May's -0.1 to 54.0), (4) May new home sales (expected +1.4% to 524,000 after April's +6.8% to 517,000), (5) Jun Richmond Fed manufacturing index (expected +3 to 4 after May's +4 to 1), and (6) the Treasury's auction of $26 billion of 2-year T-notes.

There are 3 of the Russell 1000 companies that report earnings today: Darden Restaurants (consensus $0.93), IHS (1.45), and Carnival (0.16).

U.S. IPO's scheduled to price today include: Ritter Pharmaceuticals (RTTR), GasLog Partners (GLOP), ClearBridge American Energy (CBA).

Equity conferences during the remainder of this week include: Global Hunter Securities Energy Conference on Tue-Wed, Jefferies Global Consumer Conference on Tue-Wed, Oppenheimer Consumer Conference on Tue-Wed, 3rd Annual Mobile Pharma Summit on Wed, and Sanford C. Bernstein Media Summit on Wed.

OVERNIGHT U.S. STOCK MOVERS

Darden Restaurants (DRI +0.74%) reported Q4 EPS of $1.08, stronger than consensus of 93 cents, and then raised guidance on fiscal 2016 adjusted EPS to $3.05-$3.20, well above consensus of $2.88.

American Airlines (AAL +3.54%) was downgraded to 'Equal Weight' from 'Overweight' at Morgan Stanley.

BlackBerry (BBRY +3.25%) reported a Q1 EPS los of -5 cents, a wider loss than consensus of -3 cents.

Newmont Mining (NEM -2.84%) was reinstated with an 'Outperform' at Credit Suisse with a price target of $30.

GrubHub (GRUB -1.05%) was initiated with a 'Buy' at Topeka with a price target of $44.

AMC Networks (AMCX +1.65%) was downgraded to 'Hold' from 'Buy' at Topeka.

Team Health (TMH +0.76%) was upgraded to 'Overweight' from 'Sector Weight' at KeyBanc.

AT&T (T +0.14%) was upgraded to 'Buy' from 'Neutral' at UBS.

Transocean Ltd. (RIG +1.74%) is up nearly 2% in pre-market trading after it said it received about $109 million of new contracts since its last report

Coca-Cola reported a 16.7% stake in Monster Beverage (MNST -0.16%) .

Wexford Capital reported a 19.03% stake in Famous Dave's (DAVE -1.67%) .

Green Dot (GDOT +0.39%) surged over 20% in after-hours trading after it announced that it had entered into a new, long-term agreement with Walmart.

D. E. Shaw reported a 5% passive stake in Allison Transmission (ALSN +0.36%) .

MARKET COMMENTS

September E-mini S&Ps (ESU15 +0.27%) this morning are up +4/50 points (+0.21%). Monday's closes: S&P 500 +0.61%, Dow Jones +0.58%, Nasdaq +0.68%. The S&P 500 on Monday rose to a 1-week high and settled higher on hopes that a Greek deal may be close and on the +5.1% increase in U.S. May existing home sales to 5.35 million, stronger than expectations of +4.4% to 5.26 million and the most in 5-1/2 years.

Sep 10-year T-notes (ZNU15 -0.16%) this morning are down -6.5 ticks. TYU5 -24.00, FVU5 -11.50. Sep T-notes on Monday closed lower on the stronger-than-expected U.S. existing home sales report of +4.4% to a 5-1/2 year high of 5.26 million units and reduced safe-haven demand with the rally in the U.S. stock market and reduced worries about Greece.

The dollar index (DXY00 +0.84%) this morning is up +0.688 (+0.73%). EUR/USD (^EURUSD) is down -0.0121 (-1.07%). USD/JPY (^USDJPY) is up +0.33 (+0.27%). Dollar Index +0.244 (+0.26%), EUR/USD -0.00095 (-0.08%), USD/JPY +0.696 (+0.57%). The dollar index on Monday closed higher on the larger-than-expected increase in U.S. May existing home sales. However, EUR/USD received support from optimism that a deal to unlock bailout funds for Greece might be close after European Commission President Juncker said that "we'll achieve an agreement with Greece this week."

Aug WTI crude oil (CLQ15 -0.36%) this morning is down -27 cents (-0.45%). Aug gasoline (RBQ15 -0.52%) is down -0.0131 (-0.66%). CLQ5 +0.41 (+0.68%), RBQ5 -0.0168 (-0.83%). Aug crude oil and gasoline on Monday settled mixed. Negative factors included the stronger dollar and the statement from Libya's state-run National Oil Corp. that Libya may double its crude production to 800,000 bpd by next month. Aug crude found support on expectations that Wednesday's weekly EIA data will show that crude inventories fell -1.5 million bbl, the eighth straight weekly decline.

Disclosure: None.