Morning Call For June 21, 2016

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU16 +0.47%) are up +0.48% and European stocks are up +0.83% at a 1-week high ahead of this morning's testimony to the Senate Banking Committee by Fed Chair Yellen and by a speech to the European Parliament by ECB President Draghi. European stocks also received a boost from an unexpected jump in the German Jun ZEW survey expectations of economic growth to a 10-month high. The British pound climbed to a 5-1/2 month high against the dollar as polls show the UK campaign to remain in the European Union are gaining ground before Thursday's referendum. Asian stocks settled mixed: Japan +1.28%, Hong Kong +0.77%, China -0.35%, Taiwan +0.68%, Australia +0.33%, Singapore -0.41%, South Korea +0.07%, India -0.20%. Japan's Nikkei Stock Index moved up to a 1-week high as exporters rallied after USD/JPY strengthened.

The dollar index (DXY00 +0.02%) is down -0.05% at a 1-1/2 month low. EUR/USD (^EURUSD) is up +0.01%. USD/JPY (^USDJPY) is up +0.67%.

Sep T-note prices (ZNU16 -0.12%) are down -3 ticks.

The German Jun ZEW survey expectations of economic growth unexpectedly rose +12.8 to 19.2, stronger than expectations of -1.6 to 4.8 and the highest in 10 months.

U.S. STOCK PREVIEW

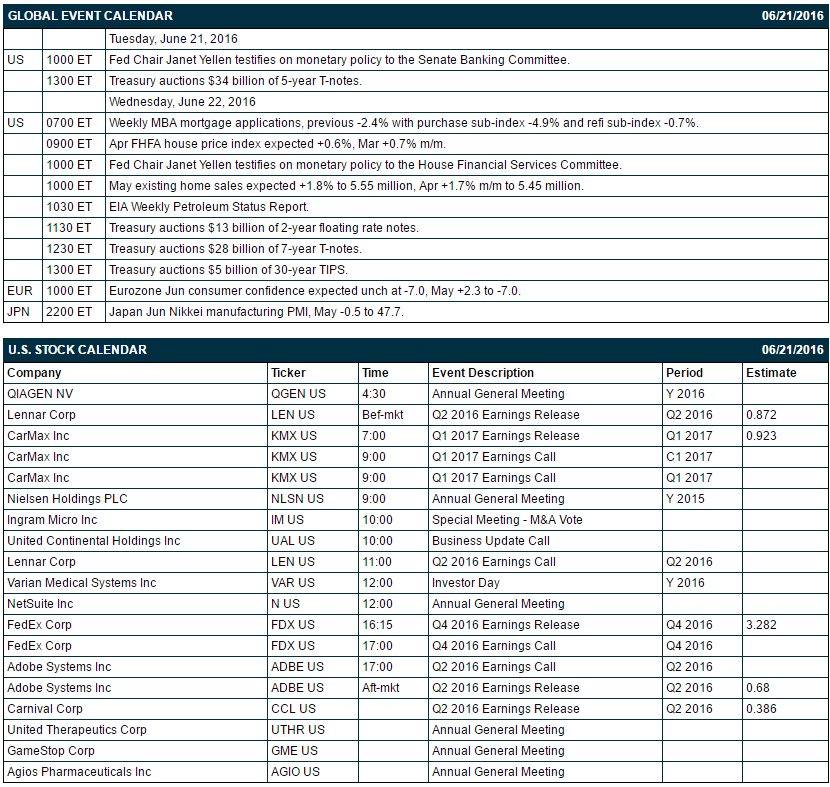

Key U.S. news today includes: (1) Fed Chair Janet Yellen testifies on monetary policy to the Senate Banking Committee, and (2) the Treasury's auction of $34 billion of 5-year T-notes.

There are 5 of the Russell 1000 companies that report earnings today: FedEx (consensus $3.28), Lennar (0.87), CarMax (0.92), Adobe (0.68), Carnival (0.39).

U.S. IPO's scheduled to price today: Selecta Biosciences (SELB), Tactile Systems Technology (TCMD)

Equity conferences this week include: Questex Sensors Expo & Conference on Tue, Real Estate Investment World Asia 2016 on Tue, Wells Fargo Convergence & Connectivity Symposium on Tue, Jefferies Consumer Conference on Tue-Wed, Wells Fargo West Coast Energy Conference on Tue-Wed, Panagora Pharma - Mobile Pharma Summit on Tue-Wed, Bernstein Global Future of Media & Telecommunications Summit on Wed, Oppenheimer Global Consumer Conference on Wed, Citigroup Insurance Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Signature Bank/New York (SBNY +0.95%) was upgraded to 'Strong Buy' from 'Outperform' at Raymond James with a 12-month price target of $162.

Abbott Laboratories (ABT +0.96%) was upgraded to 'Buy' from 'Hold' at Edward Jones.

Imperva (IMPV +0.27%) rallied over 9% in after-hours trading after Elliott Associates disclosed a 9.8% stake in Imperva and said it began a dialogue with management and board regarding strategic and operational opportunities.

Knight Transportation (KNX +3.53%) was downgraded to 'Neutral' from 'Buy' at Bank of America/Merrill Lynch.

Prologis (PLD +0.06%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Kirby Corp. (KEX +0.90%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

CNOOC Ltd. (CEO +2.55%) was upgraded to 'Buy' from 'Neutral' at UBS.

Paratek Pharmaceuticals (PRTK -2.59%) slid over 2% in after-hours trading after it proposed an offering of 3.75 million shares of common stock.

Sunrun (RUN +2.66%) gained over 1% in after-hours trading after it was rated a new 'Outperform' at Oppenheimer,

American Superconductor (AMSC +1.21%) was rated a new 'Outperform' at Oppenheimer with an 18-month price target of $12.

Opko Health (OPK +1.55%) rose nearly 4% in after-hours trading after a FDA approved-drugs website indicated approval for Opko's Rayaldee drug came on June 17.

Werner (WERN +1.36%) dropped over 9% in after-hours trading after it warned that Q2 EPS may be only 21 cents-35 cents, below consensus of 40 cents, due to "sluggish" freight market conditions, driver pay and contractor cost increases.

Scynexis (SCYX +6.85%) tumbled over 11% in after-hours trading after it announced it will launch a public offering of common stock and warrants.

MARKET COMMENTS

September E-mini S&Ps (ESU16 +0.47%) this morning are up +10.00 points (+0.48%). Monday's closes: S&P 500 +0.58%, Dow Jones +0.73%, Nasdaq +0.59%. The S&P 500 on Monday rallied to a 1-week high and closed higher on carryover support from a sharp rally in European stocks as Brexit concerns eased after the latest polls showed that Britons will vote to remain in the European Union at Thursday's referendum. Stocks were also boosted by strength in mining stocks and energy producers after copper rallied +2.1% and the price of crude oil climbed 2.9% to a 1-week high.

Sep 10-year T-note prices (ZNU16 -0.12%) this morning are down -3 ticks. Monday's closes: TYU6 -1300, FVU6 -6.25. Sep T-notes gapped lower Monday to a 1-week low and closed lower on reduced safe-haven demand for T-notes as stocks rallied sharply as the latest polls showed Britons favored remaining in the EU. T-notes were also undercut by slack demand for the Treasury's $26 billion 2-year T-note auction that had a 2.72 bid-to-cover ratio, below the 12-auction average of 3.01.

The dollar index (DXY00 +0.02%) this morning is down -0.046 (-0.05%) at a 1-1/2 month low. EUR/USD (^EURUSD) is up +0.0001 (+0.01%). USD/JPY (^USDJPY) is up +0.70 (+0.67%). Monday's closes: Dollar Index -0.595 (-0.63%), EUR/USD +0.0037 (+0.33%), USD/JPY -0.22 (-0.21%). The dollar index on Monday fell to a 1-week low and closed lower on an easing of Brexit concerns, which lifted EUR/USD to a 1-week high and GBP/USD to a 2-1/2 week high. The dollar index was also undercut by cautiousness ahead of Tuesday's testimony by Fed Chair Yellen to the Senate Banking Committee on monetary policy.

July WTI crude oil (CLN16 -1.13%) this morning is down -54 cents (-1.09%). July gasoline (RBN16 -1.60%) is down -0.0227 (-1.43%). Monday's closes: CLN6 +1.39 (+2.90%), RBN6 +0.0774 (+5.14%). Jul crude oil and gasoline on Monday rallied to 1-week highs and closed higher. Crude oil prices were boosted by the fall in the dollar index to a 1-week low and a report by the Joint Organizations Data Initiative saying that Saudi Arabian Apr crude exports fell to a 6-month low of 7.44 million bpd.

Disclosure: None.