Morning Call For June 18, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 +0.23%) are up +0.28% although European stocks are down -0.53% at a 4-month low as Eurozone finance ministers gather to work on an agreement for as much as 7.2 billion euros in bailout funds for Greece. European stocks rebounded from their worst levels after the Kathimerini newspaper reported that the European Union Commission and the ECB were working on the draft of a possible statement on debt relief to be used if Greece and its creditors reach an agreement. Asian stocks closed mostly lower: Japan -1.13%, Hong Kong -0.22%, China -3.67%, Taiwan +0.31%, Australia -1.26%, Singapore -0.77%, South Korea +0.24%, India +1.06%. Japan's Nikkei Stock Index fell to a 4-week low, dragged down by weakness in Japanese exporters, as the yen rose to a 1-week high against the dollar.

Commodity prices are higher as the dollar weakened. Jul crude oil (CLN15 +1.39%) is up +1.25%, Jul gasoline (RBN15 +0.44%) is up +0.44%. Metals prices are stronger. Aug gold (GCQ15 +1.92%) is up +1.58% at a 2-week high after the Fed signaled on Wednesday that the pace of policy tightening will be gradual. Jul copper (HGN15 +0.77%) is up +0.65%. Agricultural prices are mixed.

The dollar index (DXY00 -0.62%) is down -0.52% at a 1-month low after the FOMC on Wednesday cut its longer-term projections for interest rates. EUR/USD (^EURUSD) is up +0.51% at a 1-month high. USD/JPY (^USDJPY) is down -0.60% at a 1-week low.

Sep T-note prices (ZNU15 +0.17%) are up +6.5 ticks at a 2-week high on positive carryover from Wednesday's dovish post-FOMC statement.

The Kathimerini newspaper reported that the EU Commission and the ECB are working on the draft of a possible statement on debt relief to be used if Greece and its creditors reach an agreement, citing an unidentified EU official. The official said that the draft could be a renewal of the Nov 2012 Eurozone commitment to debt relief.

U.S. STOCK PREVIEW

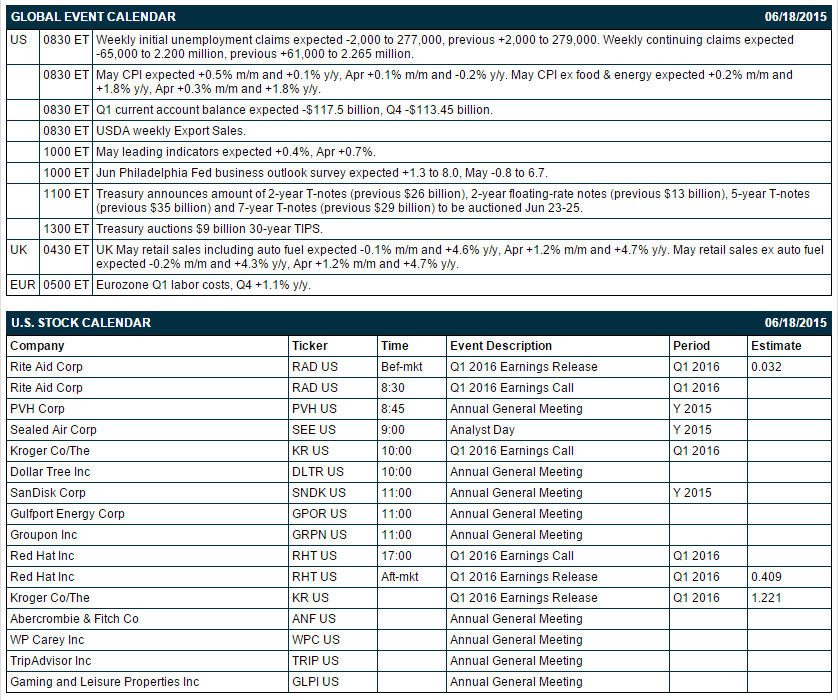

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -2,000 to 277,000 after last week's +2,000 to 279,000) and continuing claims (expected -65,000 to 2.200 million after last week's +61,000 to 2.265 million), (2) May CPI (expected +0.5% m/m and +0.1% y/y after April's +0.1% m/m and -0.2% y/y) and May core CPI (expected +0.2% m/m and +1.8% y/y after April's +0.3% m/m and +1.8% y/y), (3) Q1 current account balance (expected -$117.5 billion after Q4's -$113.45 billion), (4) May leading indicators (expected +0.4% after April's +0.7%), (5) June Philadelphia Fed business outlook survey (expected +1.3 to 8.0 after May's -0.8 to 6.7), and (6) the Treasury's auction of $9 billion 30-year TIPS.

There are 3 of the Russell 1000 companies that report earnings today: Rite Aid (consensus $0.03), Red Hat (0.41), Kroger (1.22).

U.S. IPO's scheduled to price today include: 8Point3 Energy Partners (CAFD), Celyad (CYAD), MINDBODY (MB), Fogo De Chao (FOGO), Ritter Pharmaceuticals (RTTR).

Equity conferences during the remainder of this week include: Goldman Sachs dotCommerce Day on Thu, JP Morgan Oil & Gas Forum on Thu, Leerink Health Care Services Conference on Thu, Telsey Advisory Group Advertising Trends Symposium on Thu.

OVERNIGHT U.S. STOCK MOVERS

Juniper (JNPR -0.07%) was upgraded to 'Outperform' from 'Neutral' at Wedbush.

Crown Castle (CCI -0.40%) was initiated with a 'Buy' at BTIG with a $95 price target.

Harley-Davidson (HOG +3.56%) was upgraded to 'Buy' from 'Neutral' at UBS.

Carter's (CRI +0.76%) was downgraded to 'Neutral' from 'Buy' at Sterne Agee CRT.

Hyatt (H -0.30%) was initiated with a 'Buy' at Brean Capital with a price target of $68.

Southwest Airlines (LUV -0.21%) was downgraded to 'Underweight' from 'Overweight' at Barclays.

AMC Entertainment (AMC -1.62%) was upgraded to 'Buy' from 'Neutral' at B. Riley.

Barron's contends that shares of FedEx (FDX -2.96%) are less expensive than UPS and could gain 35%.

BioMarin Pharmaceutical (BMRN +2.06%) climbed over 5% in after-hours trading after it announced positive results of a Phase 2 proof-of-concept and dose finding study of its drug Vosoritide in children with achondroplasia.

CVS Health (CVS +0.63%) was initiated with an 'Outperform' at Oppenheimer with a price target of $119.

Cerner (CERN +0.44%) was initiated with an 'Outperform' at Oppenheimer with a price target of $89.

Pier 1 Imports (PIR -1.15%) reported Q1 EPS of 8 cents, right on consensus, although Q1 revenue of $432.0 million was below consensus of $434.53 million.

Jabil Circuit (JBL -1.06%) dropped over 7% in after-hours trading after it reported Q3 EPS of 37 cents, weaker than consensus of 49 cents.

Oracle (ORCL +0.60%) slumped over 5% in after-hours trading after it reported Q4 EPS of 78 cents, below consensus of 87 cents.

MARKET COMMENTS

September E-mini S&Ps (ESU15 +0.23%) this morning are up +5.75 points (+0.28%). Wednesday's closes: S&P 500 +0.20%, Dow Jones +0.17%, Nasdaq +0.29%. The S&P 500 on Wednesday closed slightly higher as the FOMC lowered its 2016 and 2017 federal funds rate projections and Fed Chair Yellen’s said that the pace of job gains has picked up and the labor market improved. On the negative side, however, the FOMC cut in its 2015 U.S. GDP estimate to 1.8%-2.0% from a March forecast of 2.3%-2.7% and the FOMC kept its 2015 year-end fed funds rate estimate unchanged at 0.625%.

Sep 10-year T-notes (ZNU15 +0.17%) this morning are up +6.5 ticks at a 2-week high. Wednesday's closes: TYU5 +8.50, FVU5 +8.25. Sep T-notes on Wednesday posted a 2-week high and closed higher as the FOMC cut in its 2015 U.S. GDP estimate and cut its 2016 and 2017 fed funds rate projections, which signals a slower pace to Fed tightening.

The dollar index (DXY00 -0.62%) this morning is down -0.486 (-0.52%) at a 1-month low. EUR/USD (^EURUSD) is up +0.0058 (+0.51%) at a 1-month high. USD/JPY (^USDJPY) is down -0.74 (-0.60%) at a 1-week low. Wednesday's closes: Dollar Index -0.703 (-0.74%), EUR/USD +0.00892 (+0.79%), USD/JPY +0.07 (+0.06%). The dollar index on Wednesday closed lower on the FOMC’s cut in its 2015 U.S. 2015 GDP estimate and the FOMC’s cut in its 2016 and 2017 fed funds rate projections, a sign that they will be slow to raise interest rates.

July WTI crude oil (CLN15 +1.39%) this morning is up +75 cents (+1.25%). July gasoline (RBN15 +0.44%) is up +0.0092 (+0.44%). Wednesday's closes: CLN5 -0.11 (-0.18%), RBN5 -0.0285 (-1.34%). Jul crude oil and gasoline on Wednesday closed lower on the -1.5 point decline in the U.S. refinery capacity rate to 93.1%, a sign of weaker refinery crude demand, and the +460,000 bbl increase in weekly EIA gasoline inventories, more than expectations for a -800,000 bbl draw.

Disclosure: None.