Morning Call For July 1, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 +0.71%) are up +0.86% and European stocks are up +2.43% on signs that Greece was ready to accept some creditors' proposals to end the impasse over a bailout. In a letter dated Jun 30 to its creditors, Greek Prime Minister Tsipras offered to accept proposals from the creditors with changes. Optimism over a possible end to the Greek debt stalemate was muted after German Finance Minister Schaeuble said Greece has provided "no basis for talking about any serious measures" to break the deadlock. Asian stocks closed mixed: Japan +0.46%, Hong Kong closed for holiday, China -5.23%, Taiwan +0.56%, Australia +1.04%, Singapore +0.42%, South Korea +1.11%, India +0.86%. Japan's Nikkei Stock Index closed higher on signs of increased economic optimism after the Japan Q2 Tankan large manufacturing business conditions unexpectedly improved. China’s Shanghai Composite fell over 5% as margin traders continued to unwind losing stock positions and after Chinese manufacturing activity stagnated last month.

Commodity prices are mostly lower. Aug crude oil (CLQ15 -1.41%) is down -1.50%, Aug gasoline (RBQ15 -1.22%) is down -1.14%. Metals prices are mixed. Aug gold (GCQ15 -0.03%) is down -0.03%. Sep copper (HGU15 +0.19%) is up +0.19%. Agricultural prices are mixed, although Dec corn is up +0.29% at a new 6-month high.

The dollar index (DXY00 +0.37%) is up +0.40%. EUR/USD (^EURUSD) is down -0.32%. USD/JPY (^USDJPY) is up +0.33%.

Sep T-note prices (ZNU15 -0.41%) are down -19.5 ticks as optimism a deal for a Greek bailout can be reached undercut the safe-haven demand of government debt.

St. Louis Fed President Bullard said a September interest rate rise is still "very much in play," and that he doesn't see a "big impact" on the U.S. from the Greek crisis. He added that "the risk of contagion to the rest of Europe from Greece is low because of the ECB's quantitative easing program, which can be adjusted if necessary to keep volatility low and interest rates low in Europe."

The China Jun manufacturing PMI was unchanged at 50.2, weaker than expectations of +0.2 to 50.4.

The Japan Q2 Tankan large manufacturing business conditions unexpectedly rose +3 to 15, better than expectations of no change at 12 and the highest since Q1 of 2014.

U.S. STOCK PREVIEW

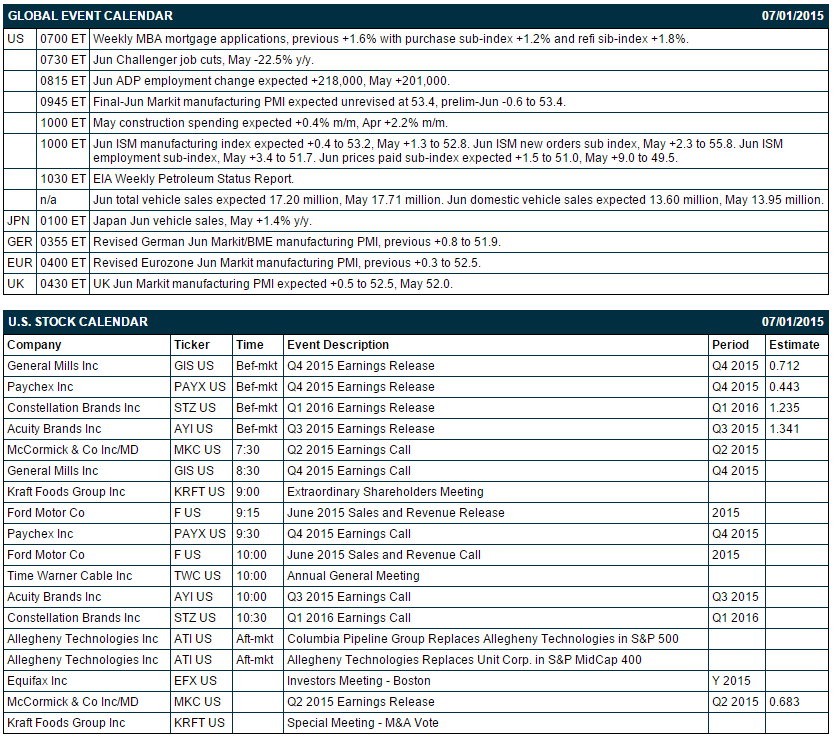

Key U.S. news today includes: (1) weekly MBA mortgage applications (last week +1.6% with purchase sub-index +1.2% and refi sib-index +1.8%), (2) Jun Challenger job cuts (May was -22.5% y/y), (3) Jun ADP employment change (expected +218,000 after May's +201,000), (4) final-Jun Markit manufacturing PMI (expected unrevised at 53.4 after prelim-June's -0.6 to 53.4), (5) May construction spending (expected +0.4% m/m after April's +2.2% m/m), (6) Jun ISM manufacturing index (expected +0.3 to 53.1 after May's +1.3 to 52.8), and (7) Jun total vehicle sales (expected 17.20 million after May's 17.71 million).

There are 5 of the Russell 1000 companies that report earnings today: General Mills (consensus $0.71), Paychex (0.44), Constellation Brands (1.24), Acuity Brands (1.34), McCormick & Co (0.68).

U.S. IPO's scheduled to price today include: NephroGenex (NRX).NovaBay Pharmaceuticals (NBY).

Equity conferences during the remainder of this week: none.

OVERNIGHT U.S. STOCK MOVERS

General Mills (GIS -0.61%) reported Q4 EPS of 75 cents, better than consensus of 71 cents.

McCormick (MKC +0.99%) reported Q2 adjusted EPS of 75 cents, higher than consensus of 68 cents, although Q2 revenue of $1.02 billion was below consensus of $1.04 billion.

ConAgra (CAG +0.67%) was upgraded to 'Neutral' from 'Underperform' at BofA/Merrill Lynch.

ACE Limited (ACE +0.08%) will acquire Chubb (CB +0.50%) for $28.3 billion in cash and stock.

Starbucks (SBUX +0.13%) was downgraded to 'Buy' from 'Conviction Buy' at Goldman Sachs.

Buffalo Wild Wings (BWLD +0.55%) was initiated with a 'Buy' at Goldman Sachs with a $195 price target.

Cheesecake Factory (CAKE +0.66%) was initiated with a 'Sell' at Goldman Sachs with a $51 price target.

Columbia Pipeline Group (CPGX) will replace Allegheny Technologies (ATI -2.49%) in the S&P 500 as of today's close.

Credit Suisse (CS unch) was upgraded to 'Overweight' from 'Equal Weight' at Morgan Stanley.

Adidas (ADDYY -0.81%) was upgraded to 'Buy' from 'Neutral' at UBS.

Carl Westcott raised the stake in Comstock Resources (CRK -0.89%) to 7.41% from 5.8%.

Boeing (BA -0.01%) was awarded a $358.94 million government contract for the manufacture and delivery of nine United States Navy Full-Rate Production Lot II P-8A aircraft, 16 USN FRP Lot III P-8A aircraft, and four Royal Australian Air Force FRP Lot III P-8A aircraft to the U.S. Navy and the Government of Australia.

Zillow Group (Z -0.07%) was initiated with a 'Buy' at Guggenheim with a price target of $120.

Splunk (SPLK +2.29%) was initiated with an 'Outperform' at Raymond James with a price target of $80.

GrubHub (GRUB +2.28%) was initiated with a 'Buy' at Guggenheim with a price target of $45.

MARKET COMMENTS

September E-mini S&Ps (ESU15 +0.71%) this morning are up +17.75 points (+0.86%). Tuesday's closes: S&P 500 +0.27%, Dow Jones +0.13%, Nasdaq +0.39%. The S&P 500 on Tuesday closed higher on the +6.8 point increase in U.S. Jun consumer confidence to 101.4, stronger than expectations of +2.0 to 97.4. However, U.S. stocks continued to be undercut by European stocks, which fell to a new 1-week low on the lack of any resolution of the Greek crisis before the bailout ended last night.

Sep 10-year T-notes (ZNU15 -0.41%) this morning are down -19.5 ticks. Tuesday's closes: TYU5 -1.00, FVU5 -1.25. Sep T-notes Tuesday settled slightly lower on the larger-than-expected increase in U.S. Jun consumer confidence and on the rebound in stocks, which reduced safe-haven demand for T-notes.

The dollar index (DXY00 +0.37%) this morning is up +0.386 (+0.40%). EUR/USD (^EURUSD) is down -0.0036 (-0.32%). USD/JPY (^USDJPY) is up +0.40 (+0.33%). Tuesday's closes: Dollar Index +0.735 (+0.78%), EUR/USD -0.00966 (-0.86%), USD/JPY -0.052 (-0.04%). The dollar index on Tuesday closed higher on the larger-than-expected increase in U.S. Jun consumer confidence and on weakness in EUR/USD as Greece's bailout program ended and as Greece defaulted on its payment to the IMF.

Aug WTI crude oil (CLQ15 -1.41%) this morning is down -89 cents (-1.50%). Aug gasoline (RBQ15 -1.22%) is down -0.0233 (-1.14%). Tuesday's closes: CLQ5 +1.14 (+1.95%), RBQ5 +0.0431 (+2.15%). Aug crude oil and gasoline prices on Tuesday closed higher on expectations that Wednesday's weekly EIA crude inventories will drop -2.5 million bbl, the ninth consecutive weekly decline. The main bearish factor was news that OPEC Jun crude production rose +744,000 bpd to 32.134 million bpd, the most in 2-3/4 years.

Disclosure: None.