Morning Call For Friday, Nov. 18

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.05%) are down -0.13% and European stocks are down -0.72%. A +0.07% increase in the dollar index (DXY00 +0.10%) to a new 13-1/2 year high has undercut commodity prices and is leading commodity and raw-material producing stocks lower. The likelihood of a Fed rate hike next month has also increased and is deepening a sell-off in government bond markets as the U.S. 10-year T-note yield climbed to a 10-1/2 month high of 2.33% after St. Louis Fed President Bullard said he is "leaning towards" supporting a rate increase at next month's FOMC meeting. Asian stocks settled mixed: Japan +0.59%, Hong Kong +0.37%, China -0.49%, Taiwan +0.15%, Australia +0.39%, Singapore +0.89%, South Korea -0.10%, India -0.30%. Japan's Nikkei Stock Index rose to a 10-1/4 month high, led by a rally in exporter stocks, after USD/JPY climbed to a 5-1/2 month high.

The dollar index (DXY00 +0.10%) is up +0.07% at a new 13-1/2 year high. EUR/USD (^EURUSD) is down -0.04% at an 11-1/2 month low after ECB President Draghi said the Eurozone economy "remains highly reliant on continued monetary support". USD/JPY (^USDJPY) is up +0.04% at a 5-1/2 month high.

Dec 10-year T-note prices (ZNZ16 -0.10%) are down -8.5 ticks at a 10-1/2 month nearest-futures low after St. Louis Fed President Bullard said he is "leaning towards" supporting a rate increase at the Dec FOMC meeting.

St. Louis Fed President Bullard (voter) said he is "leaning towards" supporting a rate increase in December.

ECB President Draghi said "even if there are many encouraging trends in the Eurozone economy, the recovery remains highly reliant on continued monetary support" as "we do not yet see a consistent strengthening of underlying price dynamics."

German Oct PPI of +0.7% m/m and -0.4% y/y was stronger than expectations of +0.2% m/m and -0.9% y/y with the +0.7% m/m gain the largest monthly increase in 5-1/2 years.

U.S. STOCK PREVIEW

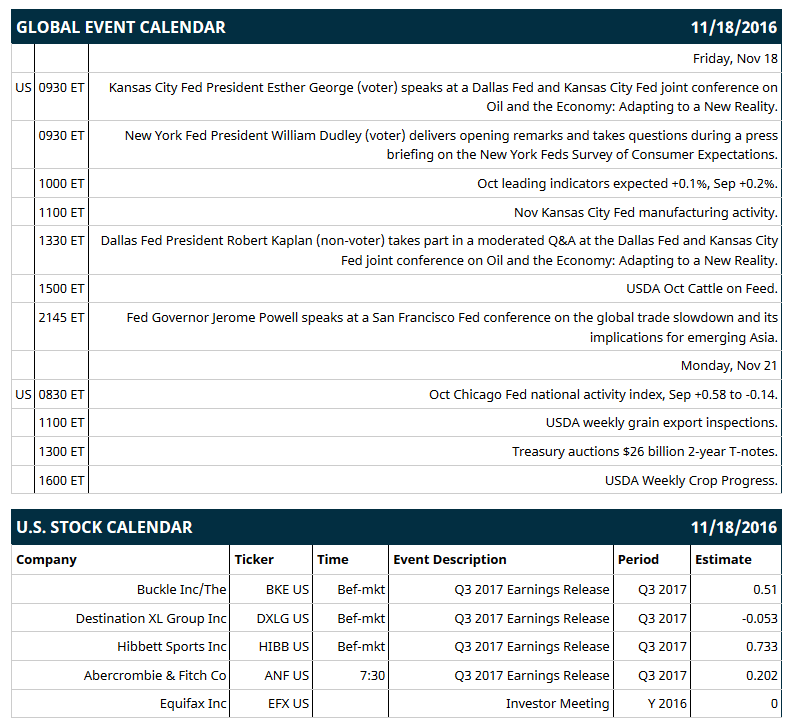

Key U.S. news today includes: (1) Kansas City Fed President Esther George (voter) speaks at a Dallas Fed and Kansas City Fed joint conference on “Oil and the Economy: Adapting to a New Reality,” (2) New York Fed President William Dudley (voter) delivers opening remarks and takes questions during a press briefing on the New York Fed’s Survey of Consumer Expectations, (3) Oct leading indicators (expected +0.1%, Sep +0.2%), (4) Nov Kansas City Fed manufacturing activity, (5) Dallas Fed President Robert Kaplan (non-voter) takes part in a moderated Q&A at the Dallas Fed and Kansas City Fed joint conference on “Oil and the Economy: Adapting to a New Reality,” (6) Fed Governor Jerome Powell speaks at a San Francisco Fed conference on the global trade slowdown and its implications for emerging Asia, (7) USDA Oct Cattle on Feed.

S&P 500 earnings reports today include: Foot Locker (consensus $1.11).

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: Morgan Stanley European Technology, Media & Telecom Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Wells Fargo (WFC +1.57%) was downgraded to 'Underperform' from 'Market Perform' at BMO Capital Markets.

Goldman Sachs Group (GS +1.63%) was upgraded to 'Outperform' from 'Neutral' at Macquarie Research with a 12-month target price of $245.

Salesforce.com (CRM +2.56%) rallied over 5% in pre-market trading after it reported Q3 adjusted EPS of 24 cents, above consensus of 21 cents, and said it sees Q4 revenue between $2.267 billion-$2.277 billion, higher than consensus of $2.24 billion.

Marvell Technology Group Ltd (MRVL -0.52%) jumped over 6% in after-hours trading after it reported Q3 adjusted EPS of 20 cents, well above consensus of 12 cents, and said it sees Q4 adjusted EPS between 17 cents-21 cents, higher than consensus of 13 cents.

The Gap (GPS +0.92%) fell over 8% in pre-market trading after it reported Q3 comparable sales were down -3%.

Ross Stores (ROST +2.62%) rallied over 3% in after-hours trading after it reported Q3 EPS of 62 cents, higher than consensus of 56 cents and raised guidance on full-year EPS to $2.78-$2.81 from an August 18 view of $2.69-$2.75.

Applied Materials (AMAT +2.37%) lost almost 4% in after-hours trading after it said Q4 new orders fell -16% q/q and backlog fell -7% q/q to $4.58 billion.

SolarCity (SCTY +2.87%) gained nearly 2% in after-hours trading after Tesla shareholders overwhelmingly approved the merger with SolarCIty by an 85% vote.

Nuance Communications (NUAN +0.71%) rose over 1% in after-hours trading after it reported Q4 adjusted EPS of 41 cents, higher than consensus of 39 cents.

Williams-Sonoma (WSM +3.29%) fell 4% in after-hours trading after it reported Q3 net revenue of $1.25 billion, below consensus of $1.26 billion.

Sportsman's Warehouse Holdings (SPWH +0.37%) climbed over 1% in after-hours trading after it raised its view on 2016 revenue to $789 million-$794 million, above consensus of $788.1 million.

Post Holdings (POST +2.64%) gained almost 2% in after-hours trading after it reported Q4 adjusted EPS of 61 cents, higher than consensus of 44 cents.

Synutra International (SYUT +2.27%) surged over 20% in after-hours trading after it agreed to a merger pact to go private with Beams Power Investment.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 +0.05%) this morning are down -2.75 points (-0.13%). Thursday's closes: S&P 500 +0.47%, Dow Jones +0.19%, Nasdaq +0.72%. The S&P 500 on Thursday climbed to a 2-3/4 month high and settled higher on upbeat comments from Fed Chair Yellen that showed her confidence in the U.S. economy when she said “the economy is making very good progress toward our goals." There were also positive U.S. economic reports with the unexpected -19,000 decline in U.S. weekly initial unemployment claims to a 43-year low of 235,000 (stronger than expectations of +3,000 to 257,000) and the +25.5% surge in U.S. Oct housing starts to 1.323 million (stronger than expectations of +10.4% to 1.156 million and the most in 9 years).

Dec 10-year T-notes (ZNZ16 -0.10%) this morning are down -8.5 ticks a a fresh 10-1/2 month nearest-futures low. Thursday's closes: TYZ6 -12.50, FVZ6 -5.25. Dec 10-year T-notes on Thursday fell to a 10-1/2 month nearest-futures low and settled lower on comments from Fed Chair Yellen who said "the economy is making very good progress toward our goals" and that she sees a rate hike "relatively soon." T-notes were also undercut by the stronger-than-expected U.S. Oct housing starts report that climbed to a 9-year high and the unexpected decline in U.S. weekly jobless claims to a 43-year low.

The dollar index (DXY00 +0.10%) this morning is up +0.070 (+0.07%) at a new 13-1/2 year high. EUR/USD (^EURUSD) is down -0.0004 (-0.04%) at an 11-1/2 month low. USD/JPY (^USDJPY) is up +0.04 (+0.04%) at a 5-1/2 month high. Thursday's closes: Dollar index +0.480 (+0.48%), EUR/USD -0.0065 (-0.61%), USD/JPY +1.04 (+0.95%). The dollar index on Thursday climbed to a new 13-1/2 year high and closed higher on comments from Fed Chair Yellen who said a rate hike "could well become appropriate relatively soon" and by the unexpected decline in weekly jobless claims to a 43-year low, which bolsters the case for Fed interest rate increase.

Dec crude oil (CLZ16 +0.68%) prices this morning are up +15 cents (+0.33%) and Dec gasoline (RBZ16 +0.38%) is up +0.0021 9+0.16%). Thursday's closes: Dec crude -0.15 (-0.33%), Dec gasoline +0.0165 (+1.25%). Dec crude oil and gasoline on Thursday settled mixed. Crude oil prices were boosted by comments from Saudi Minister of Energy and Industry Khalid Al-Falih who said after meeting with Russian Energy Minister Novak in Doha that he's "optimistic" a deal will be concluded between oil producers to stabilize world oil markets. Crude oil prices were undercut by the rally in the dollar index to a fresh 13-1/2 year high.

(Click on image to enlarge)

Disclosure: None.