Morning Call For February 4, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.36%) this morning are down -0.16% and European stocks are down -0.36% as a drop in crude oil undercuts energy producers and leads the overall market lower. Equity losses were limited after the PBOC cut banks' reserve ratio by 50 bp to 19.50%. European stocks also found support from stronger-than-expected Eurozone Dec retail sales and from an upward revision to the Eurozone Jan composite PMI to a 6-month high. Asian stocks closed mixed: Japan +1.98%, Hong Kong +0.51%, China -1.04%, Taiwan +0.69%, Australia +1.23%, Singapore +0.28%, South Korea +0.49%, India -0.40%. Chinese stocks closed lower after a gauge of services activity last month slowed to the weakest pace in 6 months, although Chinese stocks have yet to react to the reserve ratio cut by the PBOC, which was done after Chinese equity markets had closed. Commodity prices are mixed. Mar crude oil (CLH15 -3.02%) is down -2.96% and Mar gasoline (RBH15 -2.29%) is down -2.45%. Apr gold (GCJ15 +0.60%) is up +0.51%. Mar copper (HGH15 +0.35%) is up +0.41% to a 2-week high after China lowered banks' reserve ratios, which may spur economic growth. Agriculture prices are mixed. The dollar index (DXY00 +0.09%) is up +0.19%. EUR/USD (^EURUSD) is down -0.24%. USD/JPY (^USDJPY) is down-0.09%. Mar T-note prices (ZNH15 unch) are unchanged.

In an attempt to add liquidity to the economy, the Peoples Bank of China (PBOC) lowered the reserve ratio that banks must set aside as reserves by 50 bp to 19.50%, effective Feb 5.

Eurozone Dec retail sales rose +0.3% m/m and +2.8% y/y, better than expectations of unch m/m and +2.0% y/y with the +2.8% y/y gain the largest annual increase in 7-3/4 years.

The Eurozone Jan Markit composite PMI was revised upward to 52.6 from the originally reported 52.2, the fastest pace of expansion in 6 months.

The German Jan Markit services PMI was revised upward to 54.0 from the originally reported 52.7.

The UK Jan Lloyds business barometer rose 4 to 49, the best level in 4 months.

The UK Jan Markit/CIPS services PMI rose +1.4 to 57.2, better than expectations of +0.5 to 56.3.

The China Jan HSBC services PMI fell -1.6 to 51.8, the slowest pace of expansion in 6 months.

Japan Dec real cash earnings fell -1.4% y/y, the eighteenth consecutive month that earnings have contracted.

U.S. STOCK PREVIEW

Today’s Jan ADP employment report is expected to show a gain of +220,000, exceeding the +200,000 mark for the fifth consecutive month. Today’s Jan ISM non-manufacturing index is expected to show a -0.1 point decline to 56.4, adding to the -2.3 point decline to 56.5 seen in December.

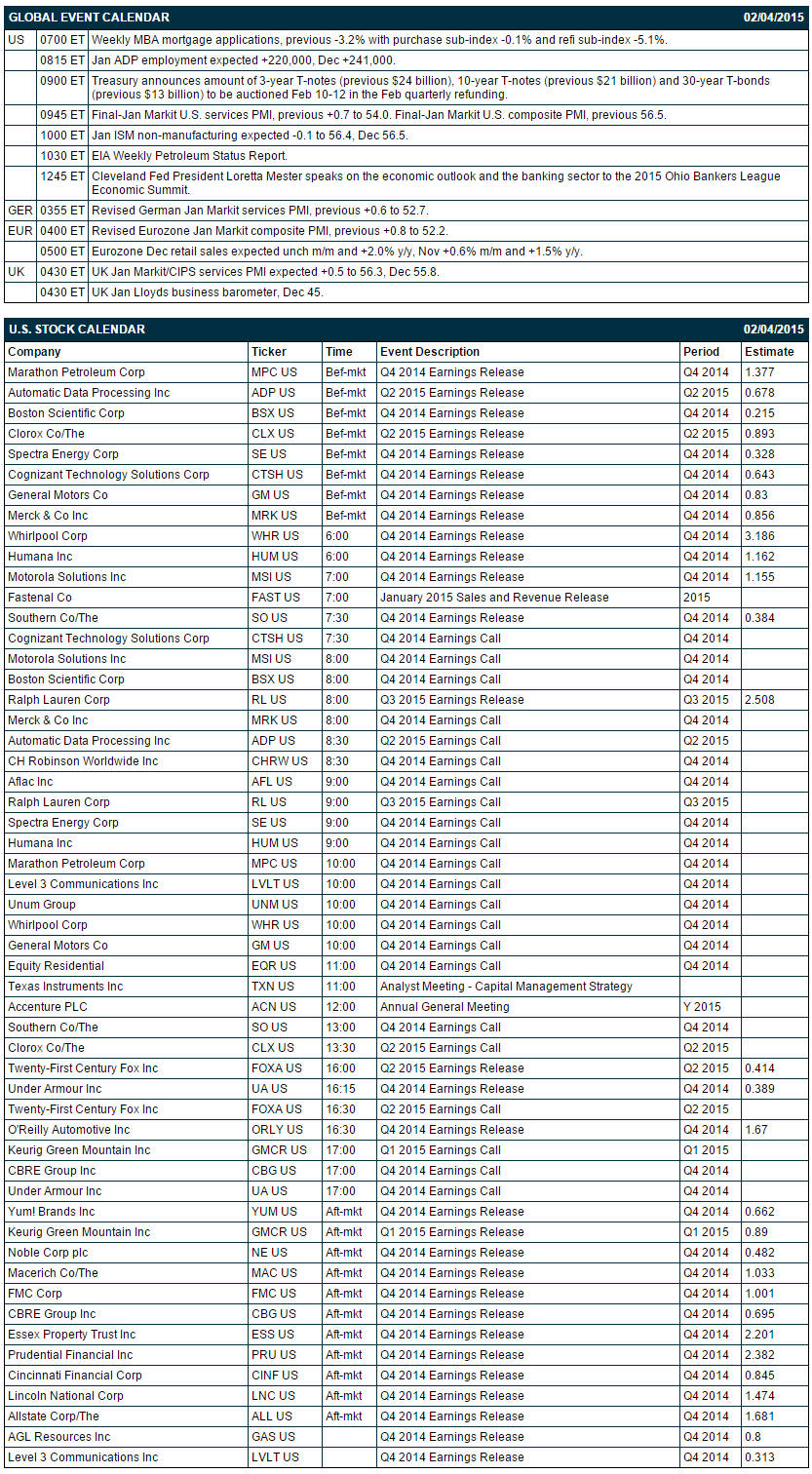

There are 54 of the S&P 500 companies that report earnings today: Marathon Petroleum (consensus $1.38), Automatic Data Processing (0.68), Boston Scientific Corp (0.22), Clorox (0.89), Spectra Energy (0.33), Cognizant Technology Solutions (0.64), General Motors (0.83), Merck & Co (0.86), Whirlpool Corp (3.19), Humana (1.16). Equity conferences this week include: Media Insights & Engagement Conference on Tue-Thu, Cowen and Company Aerospace/Defense Conference & Transport Forum on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Humana (HUM +1.78%) reported Q4 EPS of $1.09, below consensus of $1.16.

Massachusetts Financial reported a 5.9% passive stake in Franklin Resources (BEN +2.39%) .

FDA approved Pfizer's (PFE +1.17%) Ibrance drug for postmenopausal women with breast cancer.

Wabash (WNC +6.19%) reported Q4 EPS of 27 cents, highe than consensus of 24 cents.

Silgan Holdings (SLGN +1.27%) reported Q4 adjusted EPS of 58 cents, above consensus of 56 cents.

C.H. Robinson (CHRW +2.44%) reported Q4 EPS of 77 cents, higher than consensus of 76 cents.

Franklin Mutual reported a 5.7% passive stake in Symantec (SYMC +2.13%) , a 5.9% passive stake in Hospira (HSP +0.47%) , and a 5.3% passive stake in CIT Group (CIT +2.90%) .

Arthur J. Gallagher (AJG +1.04%) reported Q4 adjusted EPS of 56 cents, more than consensus of 54 cents.

Disney (DIS +2.36%) rose over 4% in after-hours trading after it reported Q1 EPS of $1.27, much better than consensus of $1.07.

Edwards Lifesciences (EW +1.21%) jumped 4% in after--hours trading after it reported Q4 EPS pf $1.06, better than consensus of 95 cents.

Take-Two (TTWO -0.50%) climbed over 5% in after-hours trading after it reported Q3 EPS of $1.87, well above consensus of $1.52, and hen raised guidance on fiscal 2015 EPS $1.65-$1.75, higher than consensus of $1.38.

Wynn Resorts (WYNN +4.05%) slid 5% in after-hours trading after it reported Q4 adjusted EPS of $1.20, below consensus of $1.43.

Gilead (GILD +0.93%) reported Q4 EPS of $2.43, more than consensus of $2.22, and then announced a 43 cent dividend and a $15 billion share buyback program.

Aflac (AFL +1.58%) reported Q1 operating EPS of $1.29, right on consensus, with Q1 revenue of $5.51 billion, above consensus of $5.48 billion.

Unum Group (UNM +2.94%) reported Q4 adjusted EPS of 90 cents, higher than consensus of 88 cents.

Chipotle (CMG +1.98%) reported Q4 EPS of $3.84, better than consensus of $3.79.

Fiserv (FISV +1.43%) reported Q4 adjusted EPS of 89 cents, right on consensus, although Q4 adjusted revenue of $1.23 billion was below consensus of $1.32 billion.

Macy's M raised guidance on fiscal 2014 EPS outlook to $4.35-$4.37 from $4.25-$4.35, higher than consensus of $4.35.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.36%) this morning are down -3.25 points (-0.16%). The S&P 500 index on Tuesday closed higher: S&P 500 +1.44%, Dow Jones +1.76%, Nasdaq +0.97%. Supportive factors included (1) a rally in energy producers after crude oil climbed to a 2-week high, (2) increased M&A activity after the WSJ reported that Office Depot is an advanced merger talks with Staples, and (3) reduced concern that Greece will default on its debt after the Greek government backed off on a plan to write down its debt.

Mar 10-year T-notes (ZNH15 unch) this morning are unch. Mar 10-year T-note futures prices on Tuesday closed lower. Closes: TYH5 -27.50, FVH5-15.50. Bearish factors included (1) reduced safe-haven demand for T-notes after Greece's government backed down from its call for a debt write down, and (2) increased inflation expectations as a jump in crude to a 2-week high boosted the U.S. 10-year breakeven inflation rate to a 4-week high.

The dollar index (DXY00 +0.09%) this morning is up +0.182 (+0.19%). EUR/USD (^EURUSD) is down -0.0028 (-0.24%). USD/JPY (^USDJPY) is down-0.10 (-0.09%). The dollar index on Tuesday fell to a 1-week low and closed lower: Dollar index -0.904 (-0.96%), EUR/USD +0.01369 (+1.21%), USD/JPY -0.025 (-0.02%). Bearish factors included (1) the biggest drop in U.S. Dec factory orders in 4 months, which may prompt the Fed to delay interest rate hikes, and (2) strength in EUR/USD which climbed to a 1-week high as Greek sovereign debt concerns eased after Greek Finance Minister Varoufakis outlined plans to swap some Greek debt owned by the ECB and the European Financial Stability Facility for new securities that would allow Greece to avoid imposing a haircut on creditors.

Mar WTI crude oil (CLH15 -3.02%) this morning is down -$1.57 a barrel (-2.96%) and Mar gasoline (RBH15 -2.29%) is down -0.0392 (-2.45%). Mar crude oil and Mar gasoline on Tuesday closed sharply higher with Mar crude at a 1-month high and Mar gasoline at a 1-1/4 month high: CLH5 +3.48 (+7.02%), RBH5 +0.0567 (+3.67%). Bullish factors included (1) the fall in the dollar index to a 1-week low, (2) concern that gasoline production will decline as a strike by U.S. oil refinery workers that account for 10% of U.S. refining capacity entered its third day.

Disclosure: None.