Morning Call For February 13, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.12%) this morning are up +0.17% at a record high and European stocks are up +0.83% at a 6-1/2 year high after German Q4 GDP expanded +0.7% q/q, more than twice as much as forecast. Also, optimism has increased over Greek debt talks after government officials taking part in Greece's debt negotiations said both sides are signaling willingness to compromise. That sent the yield on Greece's 10-year bond falling to a 2-week low of 9.15% and fueled gains in Italian, Spanish and Portuguese government bonds. Asian stocks closed mostly higher: Japan -0.37%, Hong Kong +1.07%, China +0.78%, Taiwan +0.35%, Australia +2.33%, Singapore +0.21%, South Korea +0.83%, India +1.01%. China's Shanghai Stock Index rose to a 1-week high on signs of stronger credit growth after China Jan new yuan loans rose by the most in 5-1/2 years. Commodity prices are mostly higher. Mar crude oil (CLH15 +1.19%) is up +1.46% and Mar gasoline (RBH15 +0.45%) is up +1.07%. Apr gold (GCJ15 +0.31%) is up +0.28%. Mar copper (HGH15 -0.04%) is up +0.17% at a 1-month high. Agriculture prices are higher. The dollar index (DXY00 +0.16%) is down -0.01%. EUR/USD (^EURUSD) is up +0.09%. USD/JPY (^USDJPY) is down -0.18%. Mar T-note prices (ZNH15 -0.15%) are down -6 ticks.

German Q4 GDP rose +0.7% q/q and +1.6% y/y (nsa), better than expectations of +0.3% q/q and +1.2% y/y (nsa).

The German Jan wholesale price index fell -0.4% m/m, the fourth straight monthly decline, and fell -2.6% y/y, the largest annual decrease in 5 years.

Eurozone Q4 GDP rose +0.3% q/q and +0.9% y/y, better than expectations of +0.2% q/q and +0.8% y/y.

UK Dec construction output rose +0.4% m/m, less than expectations of +2.7% m/m, and on an annual basis rose +5.5% y/y, right on expectations.

China Jan new yuan loans totaled 1.47 trillion yuan, more than expectations of 1.35 trillion yuan and the most in 5-1/2 years.

U.S. STOCK PREVIEW

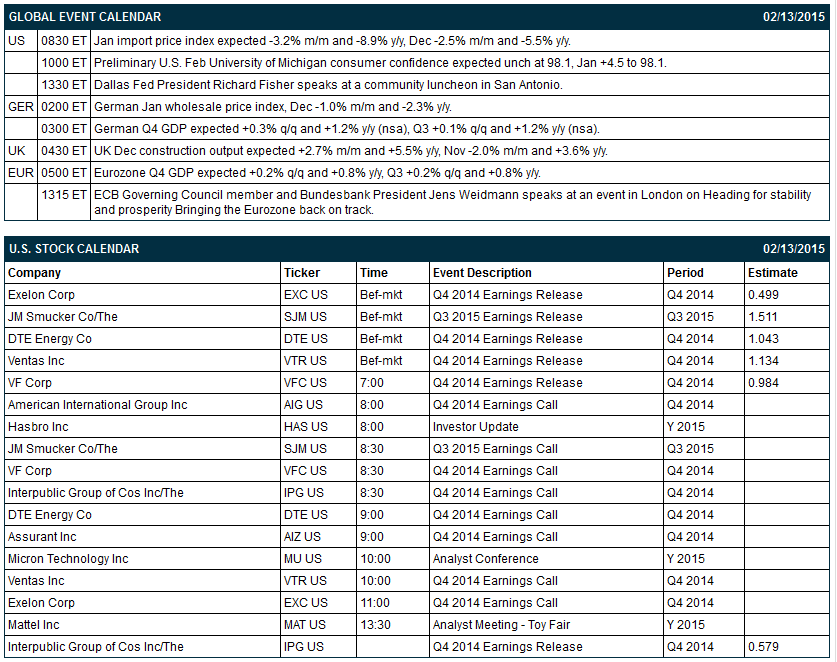

Today’s preliminary-Feb U.S. consumer confidence index from the University of Michigan is expected to show a +0.1 point increase to 98.2, adding to January’s sharp +4.5 point increase to an 11-year high of 98.1. Today’s Jan U.S. import price index is expected to fall sharply by -3.2% m/m and -8.9% y/y, which would be even weaker than December’s report of -2.5% m/m and -5.5% y/y. There are 6 of the S&P 500 companies that report earnings today: Excelon (consensus $0.50), JM Smucker (1.51), DTE Energy (1.04), Ventas (1.13), VF Corp (0.98), Interpublic (0.58). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

CBS (CBS +1.80%) gained nearly 4% in pre-market trading after it reported Q4 EPS of 77 cents, more than consensus of 76 cents.

King Digital (KING +4.24%) soared over 15% in after-hours trading after it reported Q4 adjusted EPS of 57 cents, well aboove consensus of 47 cents.

Campbell Soup (CPB -0.23%) slid 4% in after-hours trading after it lowered guidance on fiscal 2015 EPS outlook to $2.32-$2.38, less than consensus of $2.45.

ConAgra (CAG +0.69%) fell 3% in after-hours trading after it lowered guidance on fiscal 2015 EPS to $2.13-$2.18, below consensus of $2.26.

Boyd Gaming (BYD +4.36%) reported Q4 adjusted EPS of 0 cents, better than consensus of a -4 cent loss.

Regal Entertainment (RGC +0.14%) reported Q4 EPS of 30 cents, above consensus of 29 cents.

Shutterfly (SFLY +0.92%) reported Q4 adjusted EPS of $2.57, more than consensus of $2.51.

Kraft Foods (KRFT +1.69%) reported Q4 EPS ex-items of 75 cents, higher than consensus of 73 cents.

DaVita (DVA +0.58%) reported Q4 continuing operations EPS of 96 cents, better than consensus of 89 cents.

AIG (AIG +0.38%) fell over 2% in after-hours trading after it reported Q4 EPS of 97 cents, below consensus of $1.05.

Groupon (GRPN -1.58%) reported Q4 adjusted EPS of 6 cents, twice as much as consensus of 3 cents.

Columbia Sportswear (COLM +3.91%) jumped over 5% in after-hours trading after it reported Q4 EPS of 79 cents, higher than consensus of 67 cents, and then raised guidance on fiscal 2015 EPS to $2.10-$2.20, above consensus of $2.07.

American Equity (AEL +0.56%) reported Q4 EPS of 63 cents, better than consensus of 54 cents.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.12%) this morning are up +3.50 points (+0.17%) at a new record high. The S&P 500 index on Thursday jumped to a 6-week high and closed higher: S&P 500 +0.96%, Dow Jones +0.62%, Nasdaq +1.18%. Bullish factors included (1) reduced geopolitical risks in Eastern Europe after Russian President Putin said that a cease-fire had been agreed to in Ukraine, and (2) speculation that Greece was making progress on debt talks with its creditors, which eased Greek default concerns. Negatives for stocks include (1) the +24,000 increase in U.S. weekly jobless claims, more than expectations of +9,000, and (2) the +0.2% increase in U.S. Jan retail sales ex autos and gasoline, less than expectations of +0.4%.

Mar 10-year T-notes (ZNH15 -0.15%) this morning are down -6 ticks. Mar 10-year T-note futures prices on Thursday recovered from a 5-week low and closed higher. Closes: TYH5 unch, FVH5 unch. Bullish factors included (1) the larger-than-expected increase in U.S. weekly jobless claims, and (2) the weaker-than-expected U.S. Jan retail sales. T-notes had opened lower on reduced safe-haven demand after geopolitical risks eased in Eastern Europe when a cease-fire was agreed upon in Ukraine.

The dollar index (DXY00 +0.16%) this morning is down -0.01%. EUR/USD (^EURUSD) is up +0.09%. USD/JPY (^USDJPY) is down -0.18%. The dollar index on Thursday closed lower: Dollar index -0.891 (-0.94%), EUR/USD +0.00688 (+0.61%), USD/JPY -1.334 (-1.11%). Bearish factors included (1) the larger than expected increase in U.S, weekly jobless claims and the larger-than-expected decline in U.S. Jan retail sales, which may prompt the Fed to delay interest rate hikes, and (2) weakness in USD/JPY as the yen rallied on speculation the BOJ may not boost stimulus after people familiar with the talks said that BOJ policy makers view further monetary easing as a counterproductive step for now.

Mar WTI crude oil (CLH15 +1.19%)this morning is up +75 cents (+1.46%) and Mar gasoline (RBH15 +0.45%) is up +0.0171 (+1.07%). Mar crude oil and Mar gasoline on Thursday closed higher: CLH5 +2.37 (+4.85%), RBH5 +0.0523 (+3.39%). Bullish factors included (1) the weaker dollar, (2 the rally in the S&P 500 to a 6-week high, which bolsters optimism in the economic outlook and energy demand, and (3) concern that the ongoing strike by United Steelworkers union who represent employees at more than 200 refineries with 10% of U.S. refining output will start to curtail gasoline and distillate production.

Click on the picture to enlarge

Disclosure: None.