Morning Call For April 29, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.25%) this morning are down -0.12% before U.S. Q1 GDP data and the FOMC decision. European stocks are up +0.07% as they fluctuate between minor gains and losses. Weakness in European stocks was muted after the Eurozone Apr business climate indicator unexpectedly rose +0.09 to 0.32, an 11-month high. Asian stocks closed mostly lower: Japan closed for holiday, Hong Kong -0.15%, China +0.01%, Taiwan -1.03%, Australia -1.85%, Singapore -0.23%, South Korea -0.19%, India -0.62%.

Commodity prices are mostly lower. Jun crude oil (CLM15 -0.63%) is down -0.51% and Jun gasoline (RBM15 -0.78%) is down -0.61% ahead of today's EIA data that is expected to show crude inventories rose +2.5 million bbl to a new record high Metals prices are weaker. Jun gold (GCM15 -0.54%) is down -0.58% and May copper (HGK15 -0.50%) is down -0.36%. Agriculture prices are mixed.

The dollar index (DXY00 -0.18%) is down -0.14% to a 1-1/2 month low on speculation the FOMC will signal that it will delay an interest rate increase. EUR/USD (^EURUSD) is up +0.14% at a 3-week high after a gauge of Eurozone business confidence rose to an 11-month high. USD/JPY (^USDJPY) is up +0.32%. GBP/USD rose +0.17% to a 1-3/4 month high on speculation the BOE may soon tighten monetary policy after UK Apr nationwide house prices rose a more-than-expected +1.0% m/m, the most in 10 months.

Jun T-note prices (ZNM15 -0.28%) are down -7.5 ticks at a 2-week low on negative carry-over from a slide in German bund prices to a 1-1/4 month low. The 10-year German bund yield jumped 8 bp to a 1-1/4 month high of 0.249% on weak demand for Germany's 5-year note auction that received only 3.649 billion euros of bids, short of its 4 billion-euro sales goal.

The ECB raised the amount of Emergency Liquidity Assistance to the Bank of Greece by +1.4 billion euros to 76.9 billion euros. Data from the Bank of Greece show Greek Mar bank deposits by businesses and households fell -1.4% m/m to 138.6 billion euros, the sixth consecutive month of outflows and the lowest since Jan 2005.

U.S. STOCK PREVIEW

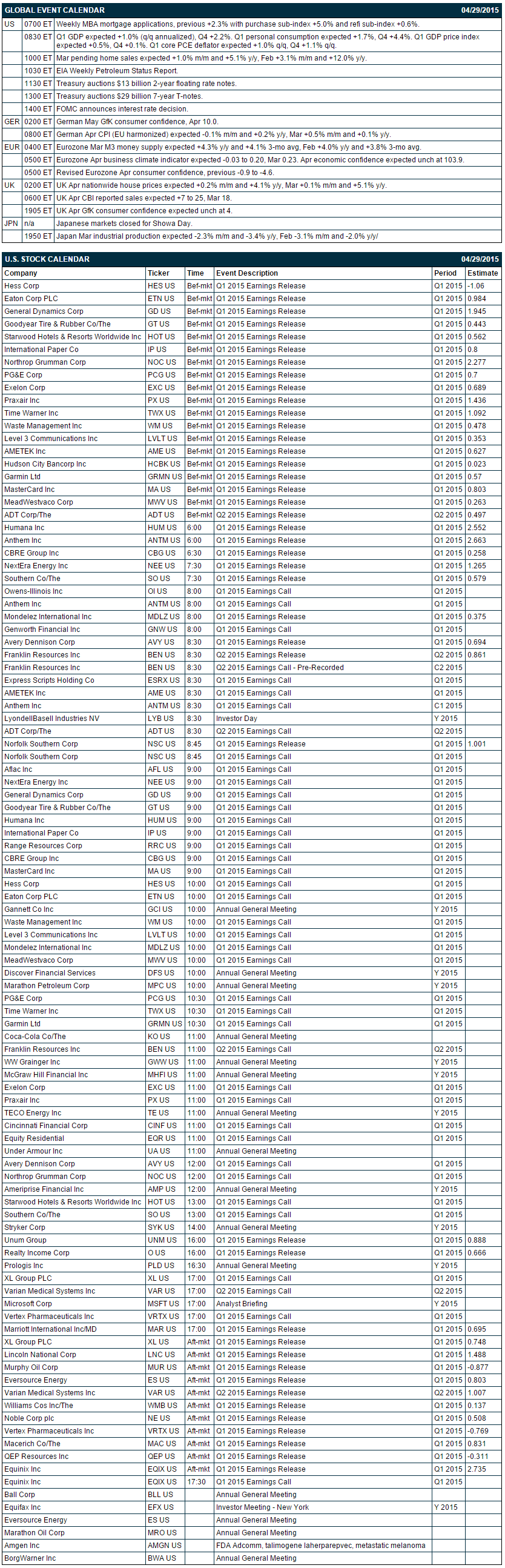

Key U.S. reports today include: (1) the 2-day FOMC meeting that ends today (rates expected unchanged), (2) weekly MBA mortgage applications (previous +2.3% with purchase sub-index +5.0% and refi sub-index +0.6%), (3) Q1 GDP (expected +1.0% q/q annualized after Q4's +2.2%), (4) March pending home sales (expected +1.0% m/m after Feb's +3.1% m/m), and (5) the Treasury's sale of $13 billion of 2-year floating rate notes and $29 billion of 7-year T-notes.

There are 42 of the S&P 500 companies that report earnings today with notable reports including: MasterCard (consensus $0.80), Time Warner (1.09), Waste Management (0.48), Williams Companies (0.14), Humana (2.55), NextEra Energy (1.27), Murphy Oil (-0.88).

U.S. IPO's scheduled to price today include: Black Stone Minerals (BSM), and Viondvax Pharmaceuticals (BVXV). IPOs that are scheduled to trade today include: Enviva Partners (EVA), and Springleaf Holdings (LEAF).

Equity conferences this week include: Milken Institute Global Conference on Mon-Wed.

OVERNIGHT U.S. STOCK MOVERS

Humana (HUM +0.55%) reported Q1 EPS of $2.47, below consensus of $2.55.

U.S. Steel (X +1.98%) slid 7% in after-hours trading after it reported an unexpected Q1 adjusted EPS loss of -7 cents, well below consensus of a 12 cent profit.

Aflac (AFL +0.62%) reported Q1 EPS with-items of $1.51, below consensus of $1.54.

Willis Group (WSH +0.53%) reported Q1 EPS of $1.26, weaker than consensus of $1.39.

Owens-Illinois (OI +2.36%) reported Q1 EPS of 44 cents, above consensus of 42 cents, but Q1 revenue of $1.40 billion was below consensus of $1.42 billion.

Panera Bread (PNRA +0.42%) reported Q1 EPS ex-items of $1.41, below consensus of $1.44.

Tempur Sealy (TPX +0.43%) reported Q1 adjusted EPS of 55 cents, higher than consensus of 48 cents.

Western Digital (WDC -1.01%) reported Q3 EPS of $1.87, less than consensus of $1.89.

Wynn Resorts (WYNN +1.28%) reported Q1 adjusted EPS of 70 cents, well below consensus of $1.33.

Kraft Foods (KRFT +0.01%) reported Q1 un-adjusted EPS of 72 cents, weaker than consensus of 81 cents.

Smart & Final Stores (SFS +0.90%) reported Q1 adjusted EPS of 10 cents, better than consensus of 9 cents.

GoPro (GPRO +4.05%) jumped 11% in after-hours trading after it reported Q1 EPS of 24 cents, above consensus of 18 cents.

Buffalo Wild Wings (BWLD +2.54%) reported Q1 EPS of $1.52, weaker than consensus of $1.63.

Edison International (EIX +1.07%) reported Q1 EPS of 90 cents, higher than consensus of 79 cents.

Akamai (AKAM -1.26%) reported Q1 EPS of 61 cents, right on consensus, and Q1 revenue of $527 million was slightly ahead of consensus at $526.18 million.

Express Scripts (ESRX +0.76%) reported Q1 adjusted EPS of $1.10, right on conensus $1.10, although Q1 revenue of $24.90 billion was better than consensus of $24.34 billion.

Total System (TSS +0.42%) reported Q1 adjusted continuing operating EPS of 54 cents, better than consensus of 46 cents.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.25%) this morning are down -2.50 points (-0.12%). Tuesday's closes: S&P 500 +0.28%, Dow Jones +0.40%, Nasdaq-0.22%. The S&P 500 on Tuesday closed higher on the stronger-than-expected +0.9% m/m increase in the Feb S&P CaseShiller composite-20 home price index and strength in health-care stocks after Merck boosted its earnings guidance. The stock market was able to shake off the unexpected -6.2point decline in U.S. Apr consumer confidence index from the Conference Board to a 4-month low of 95.2.

Jun 10-year T-notes (ZNM15 -0.28%) this morning are down -7.5 ticks to a fresh 2-week low. Tuesday's closes: TYM5 -11.50, FVM5 -5.50. Jun 10-year T-notes on Tuesday closed lower on supply pressures during this week's T-note auction package and on the larger-than-expected increase in Feb S&P CaseShiller home price index. T-notes received support from the decline in the U.S. Apr consumer confidence index to a 4-month low.

The dollar index (DXY00 -0.18%) this morning is down -0.131 (-0.14%) to a 1-1/2 month low. EUR/USD (^EURUSD) is up +0.0015 (+0.14%) to a 3-week high. USD/JPY (^USDJPY) is up +0.38 (+0.32%). Tuesday's closes: Dollar Index -0.673 (-0.70%), EUR/USD +0.00904 (+0.83%), USD/JPY -0.175(-0.15%). The dollar index on Tuesday fell to a 1-3/4 month low on ideas that the FOMC at the conclusion of its meeting on Wednesday may signal that it will wait longer to raise interest rates due to the soft U.S. economy. USD/EUR saw continued weakness as the euro continued to get a boost from Monday's news that Greek Prime Minister Tsipras is being more aggressive in seeking a bailout deal with the Eurozone.

Jun WTI crude oil (CLM15 -0.63%) this morning is down -29 cents (-0.51%) and Jun gasoline (RBM15 -0.78%) is down -0.0121 (-0.61%). Tuesday's closes: CLM5 +0.07 (+0.12%), RBM5 -0.0144 (-0.72%). June crude oil and gasoline prices on Tuesday settled mixed with crude oil seeing weakness on expectations for Wednesday's EIA report to show a +2.5 million bbl increase in U.S. crude oil inventories to a new record high.

Disclosure: None.