Morning Call For April 28, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 -0.78%) are down -0.75% and European stocks are down -1.63%, both at 1-week lows, as global stocks slid after the BOJ refrained from expanding stimulus measures. Global government bond prices moved higher and the dollar index tumbled to a 2-week low. Stocks moved off of their worst levels on an increase in M&A activity after Abbott Laboratories agreed to buy St. Jude Medical for about $25 billion. Asian stocks settled mostly lower: Japan -3.61%, Hong Kong +0.12%, China -0.27%, Taiwan -1.04%, Australia +0.73%, Singapore -0.43%, South Korea -0.97%, India -1.77%.

The dollar index (DXY00 -0.55%) is down -0.58% at a 2-week low. EUR/USD (^EURUSD) is up +0.21%. USD/JPY (^USDJPY) is down sharply by 3.01% at a 1-week low.

Jun T-note prices (ZNM16 +0.16%) are up +5.5 ticks at a 1-week high.

The BOJ unexpectedly maintained their 80 trillion-yen target for expanding the monetary base, kept the -0.1% negative rate on a portion of the cash that banks keep at the BOJ, and postponed their time frame for reaching a 2.0% inflation target to sometime in fiscal 2017, the fourth delay in a year. BOJ Governor Kuroda said that the BOJ needs time to gauge the impact of its negative-rate policy program.

Eurozone Apr economic confidence rose +0.9 to 103.9, stronger than expectations of +0.4 to 103.4.

The Japan Mar national CPI fell -0.1% y/y, weaker than expectations of 0.0% and the lowest in 2-3/4 years.

U.S. STOCK PREVIEW

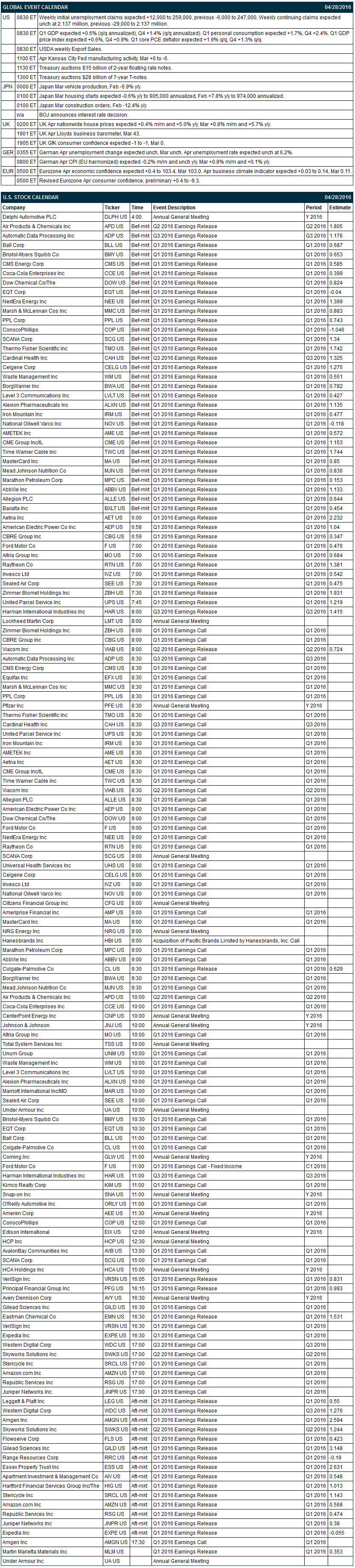

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +12,000 to 259,000, previous -6,000 to 247,000) and continuing claims (expected unch at 2.137 million, previous -29,000 to 2.137 million), (2) Q1 GDP (expected +0.6%, Q4 +1.4%), (3) Kansas City Fed manufacturing activity (Mar +6 to -6), and (4) the Treasury's auction of $15 billion of 2-year floating rate notes and $28 billion of 7-year T-notes.

There are 63 of the S&P 500 companies that report earnings today with notable reports including: Amazon.com (consensus $0.57), MasterCard ($0.85), UPS (1.22), Coca-Cola (0.40), ConocoPhillips (-1.05), Waste Management (0.55), CME Group (1.15), Abbvie (1.13), Ford (0.48), Amgen (2.59).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: none.

OVERNIGHT U.S. STOCK MOVERS

O'Reilly Automotive (ORLY +0.19%) fell over 3% in after-hours trading after it reported Q1 EPS of $2.59, better than consensus of $2.49, but said its sees Q2 EPS of $2.54-$2.64, below consensus of $2.77.

Facebook (FB +0.12%) jumped over 8% in pre-market trading after it reported Q1 adjusted EPS of 77 cents, well above consensus of 63 cents.

PayPal Holdings (PYPL +0.70%) rose nearly 2% in after-hours trading after it reported Q1 net revenue of $2.54 billion, higher than consensus of $2.50 billion.

Marriott International (MAR +2.51%) gained almost 2% in after-hours trading after it reported Q1 adjusted EPS of 87 cents, better than consensus of 84 cents.

Rent-A-Center (RCII +1.35%) dropped nearly 5% in after-hours trading after it reported Q1 revenue of $835.7 million, weaker than consensus of $851.2 million, and said Q1 consolidated same store sales fell -2.5%, weaker than consensus of a +0.4% gain.

Dolby Laboratories (DLB -0.42%) climbed 7% in after-hours trading after it reported Q2 adjusted EPS of 82 cents, well above consensus of 61 cents.

First Solar (FSLR +1.29%) dropped over 6% in after-hours trading after CEO Jim Hughes stepped down.

Xilinx (XLNX +0.85%) slid over 2% in after-hours trading after it forecast "low" single-digit growth in EPS for fiscal year 2017, below consensus of 9% growth.

MicroStrategy (MSTR +0.07%) fell over 8% in after-hours trading after it reported Q1 EPS of $1.24, well below consensus of $2.06.

Callaway Golf (ELY -0.85%) rose nearly 3% in after-hours trading after it reported Q1 non-GAAP EPS of 48 cents, above consensus of 37 cents.

On Assignment (ASGN -6.99%) climbed 8% in after-hours trading after it reported Q1 adjusted EPS continuing operations of 66 cents, higher than consensus of 60 cents, and said it sees Q2 revenue of $592 million-$602 million, above consensus of $588.6 million.

Synergy Pharmaceuticals (SGYP -0.83%) dropped nearly 4% in after-hours trading after CFO Gary Sender resigned for personal reasons, effective April 30.

RingCentral (RNG +1.56%) gained over 7% in after-hours trading after it reported Q1 adjusted EPS of 1 cent, higher than consensus of breakeven.

OSI Systems (OSIS -2.79%) tumbled nearly 10% in after-hours trading after it reported Q3 adjusted EPS of 64 cents, below consensus of 67 cents, and then said it sees Q4 adjusted EPS of 45 cents-70 cents, weaker than consensus of $1.38.

Silicon Graphics International (SGI +0.29%) slumped over 17% in after-hours trading after it lowered guidance on fiscal year EPS to 3 cents from a prior view of 25 cents-35 cents, well below consensus of 23 cents.

Aeterna Zentaris (AEZS -2.40%) jumped over 10% in after-hours trading after it said it acquired the exclusive right to promote the Apifiny prostate cancer blood test in the U.S. under a co-marketing pact with Armune BioScience.

MARKET COMMENTS

June E-mini S&Ps (ESM16 -0.78%) this morning are down -15.75 points (-0.75%) at a 1-week low. Wednesday's closes: S&P 500 +0.17%, Dow Jones +0.28%, Nasdaq -0.82%. The S&P 500 on Wednesday closed higher on the +1.4% m/m and +2.9% y/y increase in U.S. Mar pending home sales (stronger than expectations of +0.5% m/m and +0.8% y/y) and on the FOMC's post-meeting statement in which policy makers reiterated that they will raise interest rates at a "gradual" pace. Stocks were undercut by weakness in technology stocks after Apple tumbled by more than -6% when it forecast below-consensus Q3 revenue due to waning demand for its iPhone.

June 10-year T-note prices (ZNM16 +0.16%) this morning are up +5.5 ticks at a 1-week high. Wednesday's closes: TYM6 +19.50, FVM6 +9.75. Jun T-notes on Wednesday closed higher on increased safe-haven demand with the sell-off in stocks and on the Fed's reiteration that rate hikes will be "gradual."

The dollar index (DXY00 -0.55%) this morning is down -0.546 (-0.58%) at a 2-week low. EUR/USD (^EURUSD) is up +0.0024 (+0.21%). USD/JPY (^USDJPY) is down -3.36 (-3.01%) at a 1-week low. Wednesday's closes: Dollar Index -0.186 (-0.20%), EUR/USD +0.0025 (+0.22%), USD/JPY +0.15 (+0.13%). The dollar index on Wednesday closed lower on the Fed's assurance that any rate hikes will be "gradual" and on strength in EUR/USD after German May GfK consumer confidence unexpectedly rose to an 8-month high.

June WTI crude oil (CLM16 -0.42%) this morning is down -2 cents (-0.04%). June gasoline (RBM16 -1.12%) is down -0.0154 (-0.97%). Wednesday's closes: CLM6 +1.29 (+2.93%), RBM6 +0.0193 (+1.97%). Jun crude and gasoline on Wednesday closed higher with Jun crude at a 5-3/4 month high and Jun gasoline at a 4-1/2 month high. Crude oil prices were boosted by a weaker dollar and by the -0.2% fall in U.S. crude production in the week of Apr 22 to 8.938 million bpd, a 1-1/2 year low. Crude oil prices were undercut by the +1.75 million bbl increase in crude supplies at Cushing and by the unexpected +1.61 million bbl build in EIA gasoline stockpiles, more than expectations for a -1.0 million bbl decline.

(Click on image to enlarge)

Disclosure: None.