Morning Call For April 26, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 +0.12%) are up +0.12% and European stocks are up +0.22% ahead of the start of the 2-day FOMC meeting that begins today. The market is not expecting any increase in interest rates at this meeting but will be looking for clues as when to the Fed may be considering another hike in rates. Energy producers are stronger as crude oil (CLM16 +1.01%) is up +0.89% and GBP/USD is up +0.52% at a 2-1/2 month high on speculation that Britain will vote to remain in the EU following the June 23 referendum. Asian stocks settled mixed: Japan -0.49%, Hong Kong +0.48%, China +0.61%, Taiwan +0.25%, Australia -0.30%, Singapore -0.19%, South Korea +0.32%, India +1.28%.

The dollar index (DXY00 -0.25%) is down -0.26%. EUR/USD (^EURUSD) is up +0.12%. USD/JPY (^USDJPY) is down -0.26%.

Jun T-note prices (ZNM16 -0.04%) are down -2.5 ticks at a 4-week low.

U.S. STOCK PREVIEW

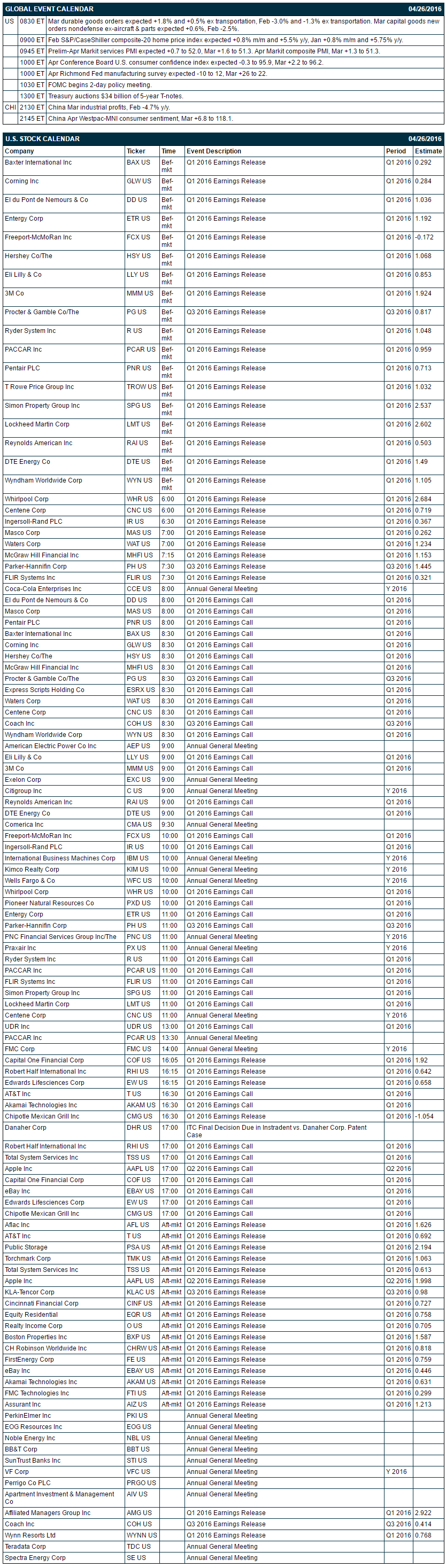

Key U.S. news today includes: (1) Mar durable goods orders (expected +1.8% and +0.5% ex transportation, Feb -3.0% and -1.3% ex transportation), (2) Feb S&P/CaseShiller composite-20 home price index (expected +0.8% m/m and +5.5% y/y, Jan +0.8% m/m and +5.75% y/y), (3) prelim-Apr Markit services PMI (expected +0.7 to 52.0, Mar +1.6 to 51.3), (4) Apr Conference Board U.S. consumer confidence index (expected -0.3 to 95.9, Mar +2.2 to 96.2), (5) Apr Richmond Fed manufacturing survey (expected -10 to 12, Mar +26 to 22), (6) first day of the 2-day FOMC meeting, and (7) the Treasury's auction of $34 billion of 5-year T-notes.

There are 50 of the S&P 500 companies that report earnings today with notable reports including: Apple (consensus 2.00), eBay (0.45), Capital One (1.92), Procter & Gamble (0.82), AT&T (0.69), Chipotle (-1.05),

U.S. IPO's scheduled to price today: Yintech Investment Holdings (YIN), Red Rock Investments (RRR).

Equity conferences this week include: Nomura Retail and Restaurants Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

NXP Semiconductors (NXPI -1.24%) climbed over 2% in pre-market trading after it reported Q1 adjusted EPS of $1.14, higher than consensu sof $1.11.

Pioneer National Resources (PXD +0.23%) gained almost 3% in after-hours trading after it said it sees 2016 production growth of 12%, higher than a previous estimate of 10%.

Chemtura (CHMT +0.14%) was upgraded to 'Buy' from 'Hold' at BB&T Capital Markets with a 12-month price target of $37.

Spark Energy (SPKE -2.06%) was rated a new 'Outperform' at FBR Capital Markets with a 12-month price target of $27.

Express Scripts Holdings (ESRX +0.23%) fell over 2% in after-hour trading after it reported Q1 adjusted EPS of $1.22, right on consensus, but Q1 revenue of $24.8 billion was less than consensus of $25.2 billion.

Office Depot (ODP -1.13%) reported Q1 adjusted EPS of 10 cents, below consensus of 12 cents.

Ethan Allen Interiors (ETH -0.06%) rallied nearly 4% in after-hours trading after it reported Q3 adjusted EPS of 34 cents, better than consensus of 31 cents,

Canadian National Railway (CNI -1.05%) slipped nearly 5% in after-hours trading after it cut its full-year forecast and said it sees carloads down 4%-5%y/y.

Sanmina (SANM +0.82%) rose over 5% in after-hours trading after it reported Q2 non-GAP EPS of 63 cents, higher than consensus of 57 cents.

Artana Therapeutics (PETX -4.29%) climbed over 15% in after-hours trading after it entered into a licensing agreement with Eli Lilly's Elanco animal health unit.

Nabors Industries (NBR -4.34%) fell nearly 5% in after-hours trading after it reported Q1 operating revenue of $597.6 million, less than consensus of $633.4 million and said it sees margins deteriorating, particularly in the lower 48 U.S. states.

Knowles (KN -8.89%) surged over 20% in after-hours trading after it reported Q1 adjusted EPS of 8 cents, more than double consensus of 3 cents, and said it sees Q2 adjusted EPS of 8 cents-14 cents, above consensus of 8 cents.

Container Store Group (TCS -8.04%) jumped over 20% in after-hours trading after it reported Q4 adjusted EPS of 20 cents, right on consensus, but said comparable sales were up +0.2%, better than expectations of a -3.6% decline.

Ballard Power Systems (BLDP -2.11%) rallied over 15% in after-hours trading after it delivered a prototype PEM (proton exchange membrane) fuel cell propulsion modules to Boeing's Insitu unit for use in the ScanEagle unmanned aerial vehicle.

MARKET COMMENTS

June E-mini S&Ps (ESM16 +0.12%) this morning are up +2.50 points (+0.12%). Monday's closes: S&P 500 -0.18%, Dow Jones -0.15%, Nasdaq unchanged. The S&P 500 on Monday closed lower on negative carryover from a slide in European stocks after a gauge of German investor confidence unexpectedly declined. Stocks were also undercut by the unexpected -1.5% decline in U.S. Mar new home sales to 511,000 (weaker than expectations of +1.6% to 520,000).

June 10-year T-note prices (ZNM16 -0.04%) this morning are down -2.5 ticks at a 4-week low. Monday's closes: TYM6 -3.00, FVM6 -1.50. Jun T-notes on Monday fell to a 3-1/2 week low and closed lower on supply overhang amidst this week's $103 billion T-note auction package, the rise in the 10-year T-note breakeven inflation expectations rate to an 8-1/2 month high, and negative carryover from a fall in German bund prices to a 5-week low.

The dollar index (DXY00 -0.25%) this morning is down -0.251 (-0.26%). EUR/USD (^EURUSD) is up +0.0014 (+0.12%). USD/JPY (^USDJPY) is down-0.29 (-0.26%). Monday's closes: Dollar Index -0.274 (-0.29%), EUR/USD +0.0046 (+0.41%), USD/JPY -0.59 (-0.53%). The dollar index on Monday closed lower on weakness in USD/JPY as a slide in stocks boosted the safe-haven demand for the yen. The dollar was also hurt by strength in GBP/USD, which climbed to a 2-1/4 month high on increased hopes for Britain to remain within the EU ahead of June's referendum.

June WTI crude oil (CLM16 +1.01%) this morning is up +38 cents (+0.89%). June gasoline (RBM16 +0.88%) is up +0.0119 (+0.78%). Monday's closes: CLM6 -1.09 (-2.49%), RBM6 -0.0170 (-1.10%). Jun crude and gasoline on Monday closed lower on concern that the global crude oil glut will persist after Saudi Aramco said it will complete expansion of its Shaybah oilfield next month to boost its output capacity to 1.0 million bpd from 750,000 bpd currently. In addition, Iranian Oil Minister Zanganeh said Iran's oil production has increased by +1.0 million bpd since Jan and will continue to increase until Iran's pre-sanctions oil market share is regained.

Disclosure: None.