Morning Call For April 17, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.67%) this morning are down -0.67%% and European stocks are down -1.70% at a 3-week low after Chinese stock futures plunged over 5% in after-hours trading on news that China's Securities Regulatory Commission (CSRC) will ban margin financing for over-the-counter (OTC) stock trading. The CSRC also expanded the number of Chinese stocks available for short selling to 1,100. Asian stocks closed mostly lower: Japan -1.70%, Hong Kong -0.31%, China +2.20%, Taiwan -0.89%, Australia -1.17%, Singapore -0.18%, South Korea -0.06%, India -0.78%. China's Shanghai Composite Stock Index surged to a new 7-year high as new funds flow into Chinese stocks. Data from China Securities Depository and Clearing Co. show Chinese investors have opened a record 10.8 million new stock accounts this year, more than the total number for all of 2012 and 2013 combined. Japan's Nikkei Stock Index fell to a 1-1/2 week low, led by weakness in exporters, after the yen climbed to a 3-week high against the dollar.

Commodity prices are mixed. May crude oil (CLK15 -0.97%) is down -0.69% and May gasoline (RBK15 -0.72%) is down -0.48%. Metals prices are higher as the dollar weakens. Jun gold (GCM15 +0.54%) is up +0.53%. May copper (HGK15 +0.02%) is up +0.29% at a 1-1/2 week high. Copper prices also found support on signs of reduced Chinese supplies after weekly Shanghai copper inventories fell -9,940 MT to 230,835 MT, a 1-1/2 month low. Agriculture prices are lower.

The dollar index (DXY00 -0.10%) is down -0.20% at a 1-1/2 week low as recent U.S. economic data point to signs of slowing momentum in the economy that dim the prospects for a near-term Fed interest rate increase. EUR/USD (^EURUSD) is up +0.45% at a 1-week high. USD/JPY (^USDJPY) is down-0.24% at a 3-week low. The British pound rose +0.55% to a 4-week high against the dollar on signs of strength in the UK labor market after the UK Mar claimant count rate fell for the 29th consecutive month to 772,400, the lowest since 1975.

Jun T-note prices (ZNM15 +0.14%) are up +6.5 ticks at a 1-1/2 week high on carry-over support from a rally in German bunds as the 10-year bund yield fell to an all-time low of 0.049%.

U.S. STOCK PREVIEW

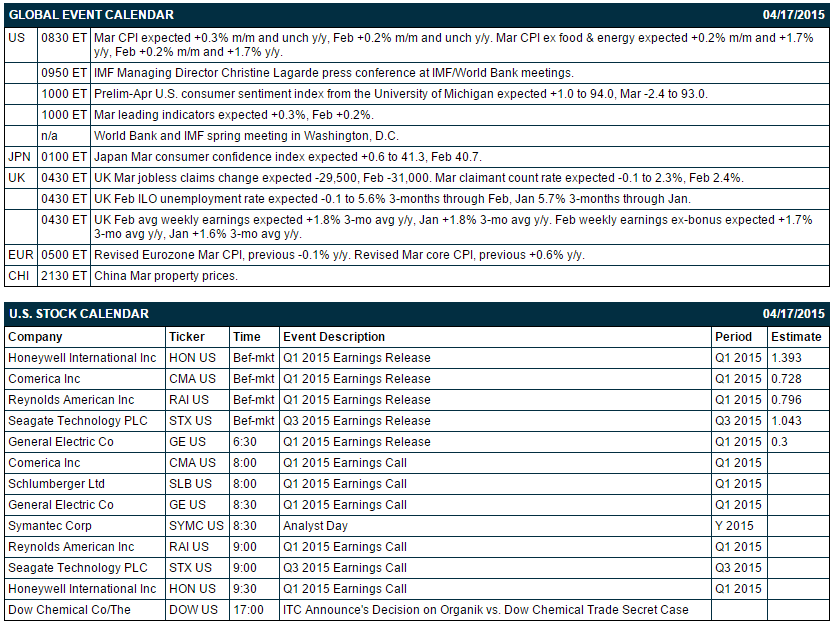

Key U.S. news today includes (1) Mar CPI (expected to match Feb's unchanged y/y) and Mar core CPI (expected unchanged at +1.7% y/y), (2) the preliminary-Apr U.S. consumer sentiment index from the University of Michigan (expected +1.0 to 94.0 after March's -2.4 to 93.0), (3) Mar leading indicators (expected +0.3% after Feb's +0.2%), (4) the second day of the 2-day G-20 meeting, and (5) IMF Managing Director Christine Lagarde's press conference at IMF/World Bank meetings in Washington.

There are 5 of the S&P 500 companies that report earnings today: GE (consensus $0.30), Honeywell (1.39), Comerica (0.73), Seagate (1.04), Reynolds American (0.80).

U.S. IPO's scheduled to price or trade today: none.

There are no equity conferences during the remainder of this week.

OVERNIGHT U.S. STOCK MOVERS

Advanced Micro Devices (AMD +6.30%) slumped 12% in pre-market trading after it reported a Q1 adjusted EPS loss of -9 cents, a bigger loss than consensus of -5 cents.

Honeywell (HON +0.13%) reported Q1 EPS of $1.41, more than consensus of $1.39.

Reynolds American (RAI +0.20%) reported Q1 EPS of 86 cents, higher than consensus of 80 cents.

General Electric (GE -0.66%) reported Q1 EPS of 31 cents, better than consensus of 30 cents.

Goldman Sachs (GS -0.44%) looks like a buy, Barron's says in its 'Barron's Take' column.

Discover (DFS +0.80%) announced a $2.2 billion share repurchase plan and raised its dividend to 28 cents from 24 cents per share.

Ulta Salon (ULTA +0.39%) was upgraded to 'Buy' from 'Neutral' at Nomura.

Celanese (CE +0.71%) reported Q1 adjusted EPS of $1.72, much better than consensus of $1.31.

Crown Holdings (CCK -0.51%) reported Q1 adjusted EPS of 53 cents, better than consensus of 52 cents.

Cytec Industries (CYT -1.12%) rose over 2% in after-hours trading after it reported Q1 adjusted EPS of 82 cents, higher than consensus of 73 cents.

Mattel (MAT -0.39%) gained over 6% in after-hours trading after it reported a Q1 adjusted EPS loss of -8 cents, a smaller loss than consensus of -9cents.

Schlumberger (SLB -0.12%) gained over 1% in pre-market trading after it reported Q1 EPS of $1.06, well above consensus of 91 cents, and said it will cut an additional 11,000 jobs.

American Express (AXP +1.45%) reported Q1 EPS of $1.48, better than consensus of $1.37.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.67%) this morning are down -14.00 points (-0.67%). Thursday's closes: S&P 500 -0.08%, Dow Jones -0.04%, Nasdaq-0.13%. The stock market on Thursday closed slightly lower due to the weaker-than-expected U.S. economic reports as initial claims rose +12,000, March housing starts rose by only +2.0% (vs expectations of +15.9%), and March building permits fell by -5.7% to a 6-month low. The stock market was also undercut by increased Greek default worries as the 10-year Greek bond yield surged to a new 2-year high of 13.04%.

Jun 10-year T-notes (ZNM15 +0.14%) this morning are up +6.5 ticks at a 1-1/2 week high. Thursday's closes: TYM5 +8.00, FVM5 +5.50. Jun 10-year T-notes on Thursday closed higher on the lower close in the stock market and the weaker-than-expected initial unemployment claims and March housing starts/permits reports.

The dollar index (DXY00 -0.10%) this morning is down -0.191 (-0.20% at a 1-1/2 week low. EUR/USD (^EURUSD) is up +0.0048 (+0.45%) at a 1-week high. USD/JPY (^USDJPY) is down -0.29 (-0.24%) at a 3-week low. Thursday's closes: Dollar Index -0.904 (-0.92%), EUR/USD +0.0077 (+0.72%), USD/JPY -0.14 (-0.12%). The dollar index on Thursday closed with a fairly sharp loss due to the weaker-than-expected U.S. economic data.

May WTI crude oil (CLK15 -0.97%) this morning is down -39 cents (-0.69%). May gasoline (RBK15 -0.72%) is down -0.0093 (-0.48%). Thursday's closes: CLK5 +0.32 (+0.57%), RBK5 +0.0015 (+0.08%). May crude oil and gasoline prices continued higher with May crude posting a 3-1/2 month high and May gasoline posting a 1-1/2 month high. Crude oil rallied on continued hopes that U.S. oil production will stop rising and on concern about the crisis in Yemen after Al-Qaeda militants seized Yemen's al-Rain international airport. Crude oil was undercut early by news that Saudi Arabia in March boosted its oil production by +658,600 bpd to 10.294 million bpd.

Disclosure: None.