'Maxing' Long VIX Exposure?

With the VIX trading at historic lows, many investors are looking for ways to gain exposure to potential VIX upside. Choosing the duration of a VIX instrument may be as important a decision as choosing between futures, options, or regulated products to gain exposure. We can use an example with VIX options to explore why the duration decision is so important.

VIX options are European style, cash settled contracts. That means you cannot exercise your option before the end of the contract and that all gains will be paid in cash at expiration. Ultimately, you cannot own the underlying VIX index. The European style of a VIX option and the inability to exercise your option before expiration are both important to note because the VIX has historically been a mean-reverting metric. If the market gets spooked due to, say, a geopolitical surprise, the VIX index may spike from a rush of investors buying puts on the S&P 500. However, markets normally quiet down after the information gets digested and markets start to focus on other things. So while the VIX may currently have a high spot level, market participants may (justifiably) assume the VIX will move back towards normal once equities stabilize.

Let's say you had purchased a 3 month call on the VIX, with a strike price of 20, a couple days before China announced they were devaluing their currency in the second half of 2015. It could seem like great foresight on your part-your strike was at 20 and the level of the VIX shot up to over 40 after the news. You would expect the price for your option to be 20 (40 spot - 20 strike) or higher, a killing for what you paid for it. When you log on to your account and notice the bid for your option is significantly less, you feel shortchanged. Under an American style option, you could exercise the call, which contractually allows you to purchase shares of the underlying at a price of $20, and you could immediately sell at the market price. However, since you can't force that valuation to happen now, you will have to hope the current level of fear persists for 3 more months, in which case you would in fact be paid the full spread over the strike. Unfortunately, historical probability would suggest this is unlikely, so other market participants aren't going to bet on this happening; hence the low bid. As shown in Figure 1, the futures curve on 8/24/2015 shows the expected future value of the VIX index converged closer to the long-term VIX average than the then current 40.7 spot level of the VIX.

Figure 1. Source: Bloomberg

VIX Futures Curve on 8/24/2015

The shape of the futures curve is for good reason. Figure 2 shows that out of the 53 times VIX has spiked to higher than 20 since 2010, it has only stayed above that level for more than 20 trading days five times. So if you own a call option with a strike of 20 that expires more than 20 trading days out, historically, even when the level of the VIX is greater than your option strike, your option will expire in the money less than 10% of the time.

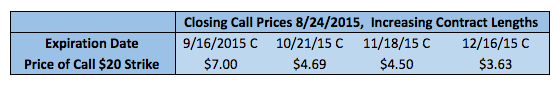

Figure 2. Source: CBOE, REX Shares

If you had instead purchased a shorter-term call on the VIX, the market would have priced in a much higher chance that VIX would stay near the spot level. As you can see in Figure 3, the price of a ~3 week 20-strike call on 8/24/2015 was $7.00 a contract, while the ~3 month 20-strike call that you owned only traded at $4.50 a contract. If the call expiration was less than a day away, the price would have been closer to 20. In summary, when VIX spikes well over its average, spot VIX values become poorer predictors of future VIX values the further your time horizon expands.

Figure 3. Source: Bloomberg

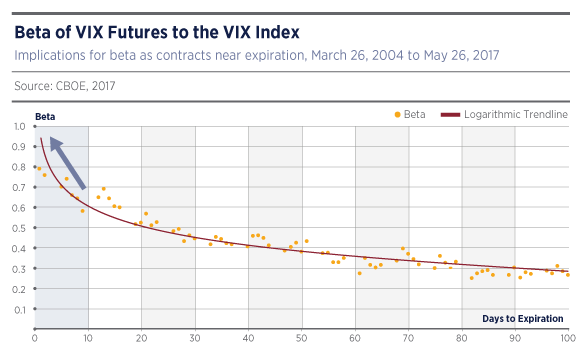

Rolling long-term calls or futures may indeed cost less in terms of roll yield than rolling shorter term contracts, but as discussed, you might not have the beta to VIX you expect over the whole period. CBOE's empirical research states: "The addition of weekly expirations to standard monthly futures and options expirations offers volatility exposures that more precisely track the performance of the VIX Index. The closer VIX futures and options are to expiration, the more closely they generally track the VIX Index."

Our REX VolMAXX Long Weekly Futures Strategy ETF (NYSEMKT:VMAX) was designed to bring shorter-term exposure to VIX index movements in an attempt to improve sensitivity and avoid some of the issues presented by longer duration exposure. The next time you look to put on long VIX exposure in your portfolio, consider how the duration of that investment may ultimately impact the underlying sensitivity to movements in the VIX.

Disclaimer: Performance is based on the net asset value returns from November 30, 2016 to June 12, 2017.The market price return for GHS is 18.99% for the same period.The net asset value return from ...

more