Maximum Flexibility

SOME SIGNS OF LIFE

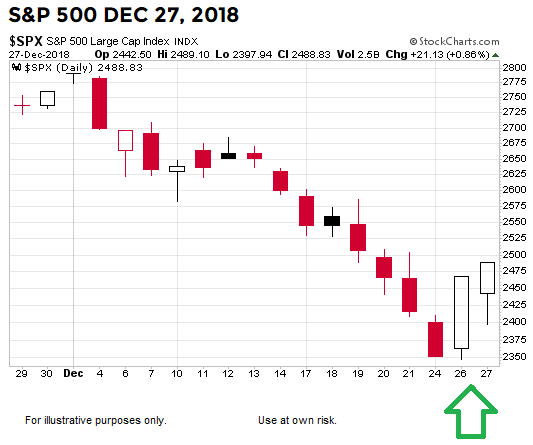

It is too early to read too much into the last two days, but we can acknowledge some observable signs of what could be the early stages of an attempt to form a lasting bottom.

Wednesday’s massive, rare, and impressive candle was followed by a 91 point intraday reversal in the S&P 500 today. We have been saying in order to consider migrating from a defensive/principal-protection posture to a more balanced stance, we need the market to show us something. The last two sessions provide evidence of some improvement on the risk-taking relative to risk-aversion front.

BONDS: A FAILED BREAKOUT?

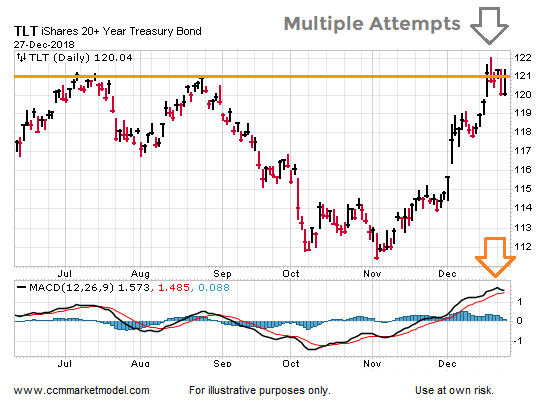

Given the S&P 500 remained in an oversold position, we purposely added a relatively small percentage stake to defensive bonds, knowing a rally in stocks could be coming soon. In a short-term narrative that aligns well with the S&P 500’s improvement in the last two days, bonds (TLT) could possibly be in the process of experiencing a failed bullish breakout. If the breakout indeed fails, which is still to be determined, TLT could see increased selling pressure in the days ahead. Therefore, we reduced our exposure to TLT before Thursday’s close.

TLT was up over 1.00% intraday Thursday (doing well when stocks were getting hammered) and looking like it was going to print a convincing breakout. When stocks staged the impressive intraday rally, TLT moved to more of a “this breakout could be failing” look and closed with a tiny gain of 0.02%.

MAY MOVE TO A MORE BALANCED APPROACH

If the S&P 500 can stay out of free-fall mode and can continue to show signs of what looks like a possible bottoming process, the model will have us move to a more balanced approach in the short run. If we can add a nominal amount of equity exposure, it will allow us to have modest exposure to both sides of the equation (growth and defensive). The market’s profile has sustained so much damage that cash will remain a fairly substantial part of the equation until the data improves.

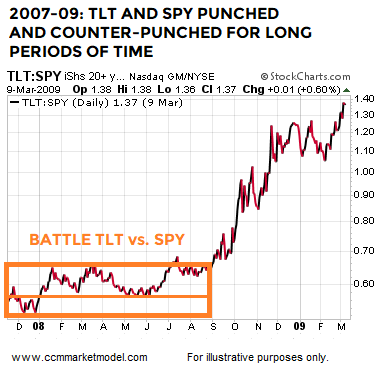

This weekend’s video will outline the rationale for having a cash/bond/stock mix and why it would allow us to be more flexible and patient in the weeks and months ahead. It is possible stocks and bonds will alternate between periods of leadership; that could be true in a devastating bear market scenario (see example below) or a “stocks are trying to form a lasting bottom” scenario. Once things calm down a bit, the model prefers to be in a more neutral vs. one-sided stance. The stock market still needs to show additional signs of improvement (TBD).

GETTING TO THE RIGHT PLACE CAN BE MESSY

Corrections, bear markets, and the process of forming a lasting bottom can all lead to frustrating volatility and whipsaws. The recent 2018 plunge could lead to much lower lows in stocks or a bottoming formation. In either case, a period of sideways confusion and consolidation could be coming in the weeks/months ahead. A mixed cash/bond/stock allocation could help us be patient, allowing the market to digest the recent plunge before deciding which way the next trending period will break.

This weekend’s video will provide numerous “hang in there during the messy period” examples that occured in bear markets and sharp corrections. Messy periods are often followed by much cleaner periods marked by stronger trends, along with a sharp reduction in whipsaws, frustration, aggravation and trading frequency. For example, whipsaws (bad trades) were common during the bottoming process in 2011. Eventually, the frustration was followed by a “forget the whipsaws” gain of over 97%. This too will pass. The market will decide how, which way, and when.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more